Yes, Uniswap [UNI] was king in 2022, but at what cost?

This 12 months, the cryptocurrency market noticed a big lower in worth, shedding over $1.4 trillion. This decline was on account of numerous points confronted by the {industry}, together with failed initiatives and a scarcity of liquidity.

The {industry} confronted a number of challenges, with plenty of distinguished gamers inside the ecosystem submitting for chapter, together with BlockFi, Celsius, Voyager, Three Arrows Capital, and, extra just lately, FTX and Alameda.

The decentralized finance (DeFi) vertical suffered an identical decline as general complete worth locked (TVL) – the entire worth of all property held inside a DeFi product – throughout all protocols plummeted by 77%. The trigger behind the decline in DeFi TVL just isn’t far-fetched.

A 35.51x hike on the playing cards if UNI hits ETH’s market cap?

In 2020, the U.S authorities applied stimulus packages that resulted in a rise within the provide of U.S {dollars}, resulting in greater demand and rising costs (inflation) in 2021.

Nonetheless, with a view to fight this rising inflation, the Federal Reserve raised rates of interest in 2022. This made borrowing cash dearer and inspired traders and shoppers to cut back spending.

Because of this, traders moved away from speculative property class (cryptocurrencies) to place their cash in risk-free yields on U.S treasuries. This led to a extreme decline within the worth of a number of crypto-assets, the yield on DeFi investments, and DeFi TVL typically.

Supply: DefiLlama

Uniswap’s numerous variations: A 2022 retrospective

Launched in 2018, Uniswap is a decentralized cryptocurrency buying and selling protocol whereby customers can commerce cryptocurrency property.

The unique model of the Uniswap protocol, generally known as Uniswap V1, was launched as a trial run to evaluate the effectiveness of the automated market maker (AMM) liquidity mannequin. In Might 2020, Uniswap V1 was changed by Uniswap V2, which launched quite a few enhancements and new options to the platform.

Uniswap V3, launched in Might 2021, shortly gained recognition in 2022 because it launched a sequence of vital upgrades to the DEX. This included concentrated liquidity, versatile transaction charges, and vary orders.

This sequence of upgrades launched by Uniswap V3 led to its speedy adoption, which brought on its TVL to develop considerably above the 2 earlier variations. As per information from DeFiLlama, Uniswap V3’s TVL of $2.45 billion represented a 74% share of complete TVL for Uniswap.

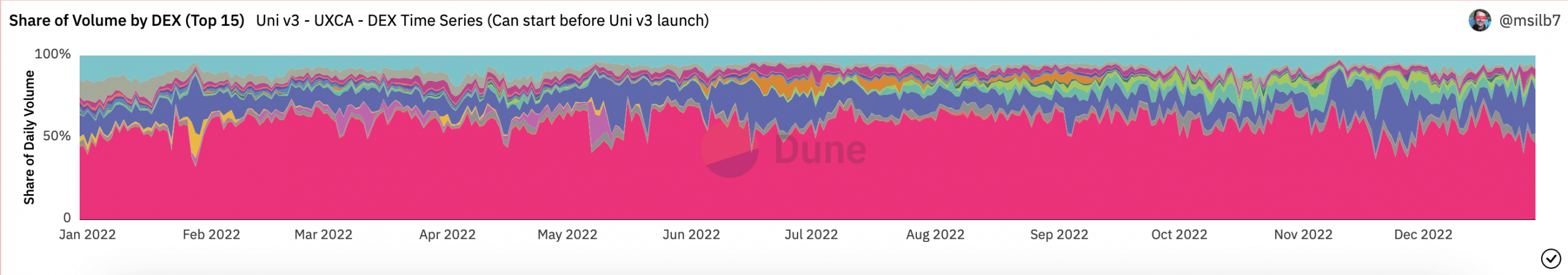

In 2022, Uniswap V3 shortly overshadowed DEXs that existed earlier than it as elevated utilization led to a progress in its share of the entire DEX buying and selling quantity.

What number of UNIs are you able to get for $1?

As of January 2022, Uniswap V3 held a 39.4% share of complete buying and selling quantity by DEXs, information from Dune Analytics revealed. By Might, its share of complete buying and selling quantity had peaked at 72%.

Curiously, Uniswap V3’s place was threatened through the FTX debacle as different DEXs noticed elevated utilization on account of traders’ flight from centralized exchanges to DEXs. Because of this, its share of complete DEX buying and selling quantity fell to the touch a low of 36.5% on 11 November. This was its lowest level all through the 12-month interval.

This rebounded not lengthy after and was noticed at 46.5% as of 29 December. On a year-to-date foundation, Uniswap V3’s share of the entire DEX buying and selling quantity grew by 27%.

Supply: Dune Analytics

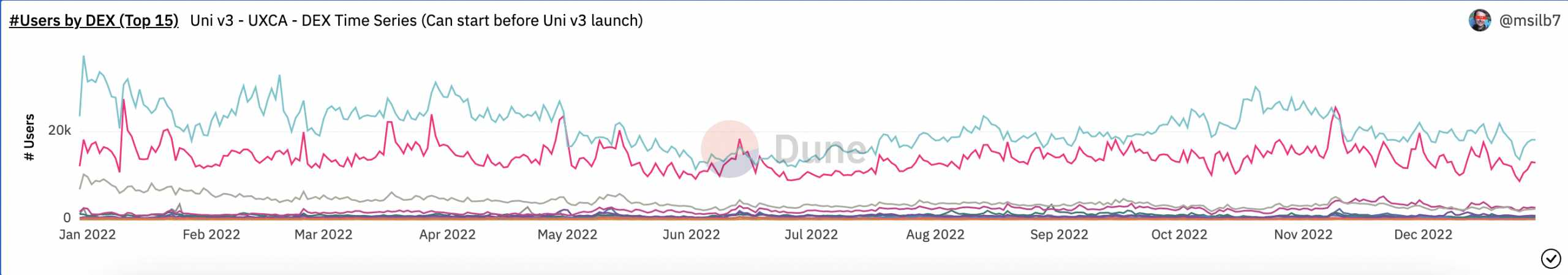

Uniswap V3’s excessive buying and selling quantity was attributable to the constant progress within the depend of its every day customers. As per information from Dune Analytics, the regular progress in every day person depend positioned it atop all different DEXs because the DEX with essentially the most on a regular basis customers.

When FTX collapsed, Uniswap v3 logged a every day excessive depend of 25,552 customers on 9 November. It noticed essentially the most inflow of customers from centralized exchanges amid the market turmoil brought on by the sudden FTX turmoil.

As of 29 December, Uniswap v3 had a every day person depend of 12,949.

Supply: Dune Analytics

Regardless of the numerous success recorded by its V3 deployment in 2022, Uniswap couldn’t escape the influence of the extreme bearishness that brought on many DeFi protocols to register a decline inside a 12-month interval.

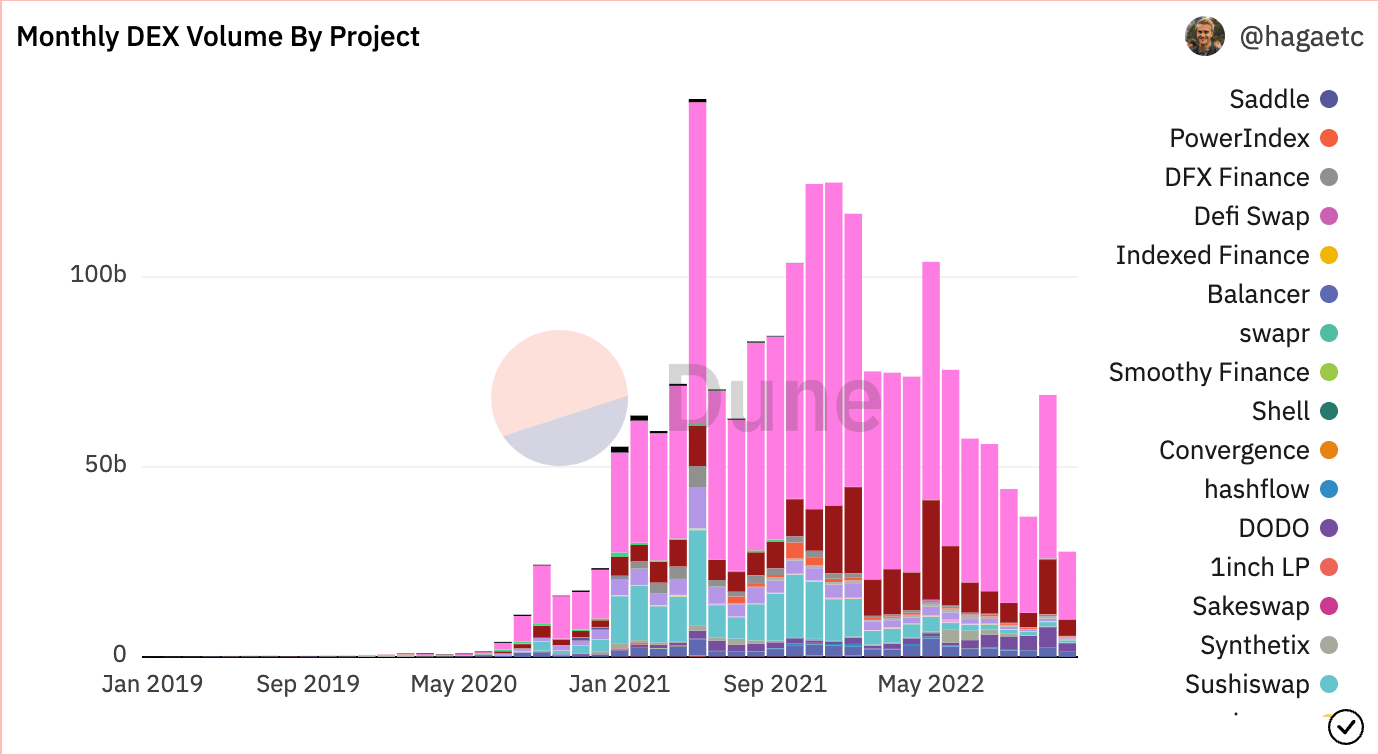

Uniswap’s month-to-month buying and selling quantity peaked in January when the DEX logged a buying and selling quantity of $71 billion. Nonetheless, this declined steadily to $17 billion by December.

Supply: Dune Analytics

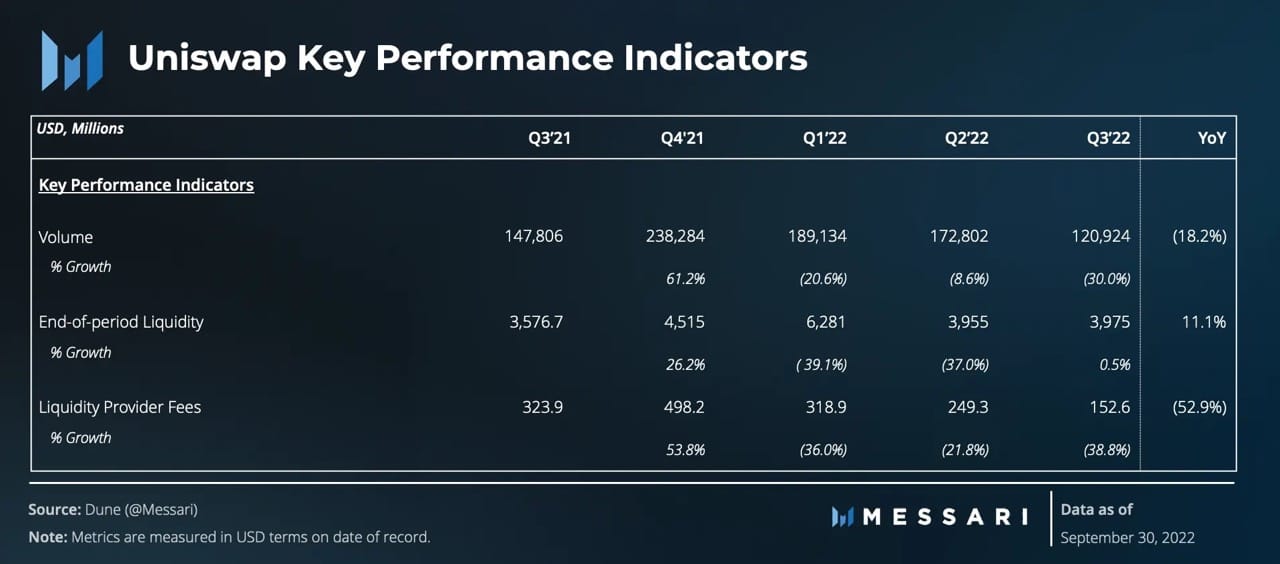

Uniswap: Key efficiency indicators in 2022

Uniswap noticed a steep decline in buying and selling quantity within the first three quarters of the 12 months. In line with information from Messari, the main DEX closed This autumn 2021 with a buying and selling quantity of $238.28 billion.

By the top of Q1 2022 when the bear market turned fully-fledged and traders started shifting capital to U.S treasury payments, Uniswap’s buying and selling quantity had fallen by 21%. It closed the quarter with a buying and selling quantity of $189 billion.

Issues didn’t get higher in Q2. Terra LUNA’s grave demise created a contagion that led to the collapse of a number of different gamers within the {industry}. Buying and selling quantity throughout DeFi protocols fell, and DeFi TVL declined additional. Uniswap closed Q2 with a buying and selling quantity of $172 billion, an 8% decline QoQ.

This was adopted by a good steeper decline of 30% in buying and selling quantity by the top of Q3, Messari reported.

Along with a fall in buying and selling quantity, equipped liquidity on Uniswap fell as nicely. With end-of-period liquidity of $3.9 billion by the top of Q3, this had fallen by over half of its worth for the reason that starting of the 12 months.

Likewise, charges paid to liquidity suppliers on Uniswap fell all year long.

Supply: Messari

UNI had a tricky time

UNI is a governance token for the Uniswap protocol, permitting holders to vote on adjustments to the protocol and take part in its decision-making processes. Additionally it is used as a utility token inside the Uniswap platform, permitting customers to entry sure options and providers.

In direction of the start of the 12 months, the token was buying and selling at $17.1, as per information from CoinMarketCap. This value stage remained UNI’s highest promoting value level through the 2022 bear market.

Exchanging arms at $5.01 on the time of writing, UNI’s worth appears to have declined by over 71% in 2022.

Supply: CoinMarketCap

Concluding ideas

Uniswap confronted a tough 12 months on account of a difficult macroeconomic surroundings, geopolitical uncertainty, and institutional liquidation. Though the DEX noticed a decline in buying and selling exercise through the 12 months, Uniswap strengthened its place within the crypto-industry by establishing an funding staff and an NFT market aggregator. These strikes have positioned the protocol to proceed to be a key participant within the crypto-economy.