Why Polkadot [DOT] is slated to dash for some more upside

Final week we noticed Polkadot’s native cryptocurrency DOT pull off its sharpest bullish pivot since July. It’s thus unsurprising that analysts would possibly anticipate or hope for an additional main rally particularly after it not too long ago retested its decrease vary.

Right here’s AMBCrypto’s value prediction for DOT

However are DOT rally expectations nonetheless grounded in actuality particularly given the continuing financial issues? Maybe a positive demand shift would possibly assist DOT’s continued upside.

Polkadot not too long ago introduced the launch of nomination swimming pools. However how does this have an effect on DOT’s demand?

Now that nomination swimming pools are stay, you’ll be able to stake natively and earn rewards with as little as 1 DOT!

Native, protocol-level nomination swimming pools symbolize a significant innovation within the broader blockchain trade, making staking accessible to all, even these with much less tokens. pic.twitter.com/YJjZkC0qDM

— Polkadot (@Polkadot) November 1, 2022

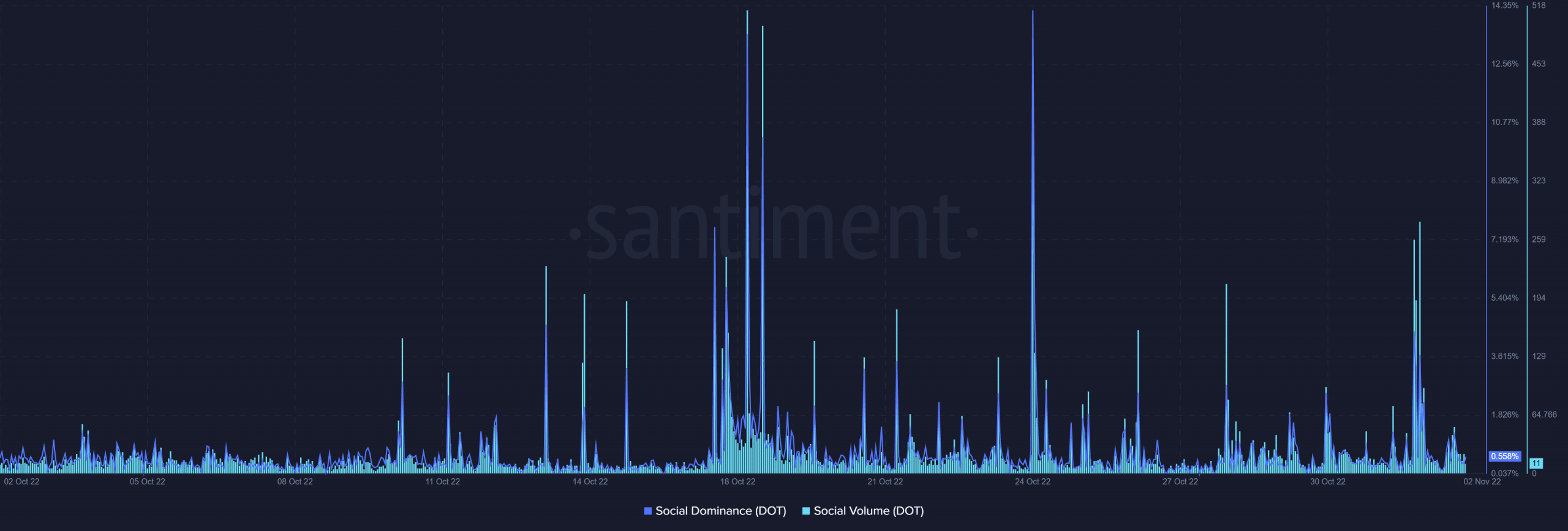

In keeping with Polkadot’s official announcement, the nomination swimming pools will enable DOT holders to stake and earn rewards. This incentive would possibly encourage extra demand for DOT. The cryptocurrency’s social dominance and social quantity registered a large uptick on the identical day of the announcement.

Supply: Santiment

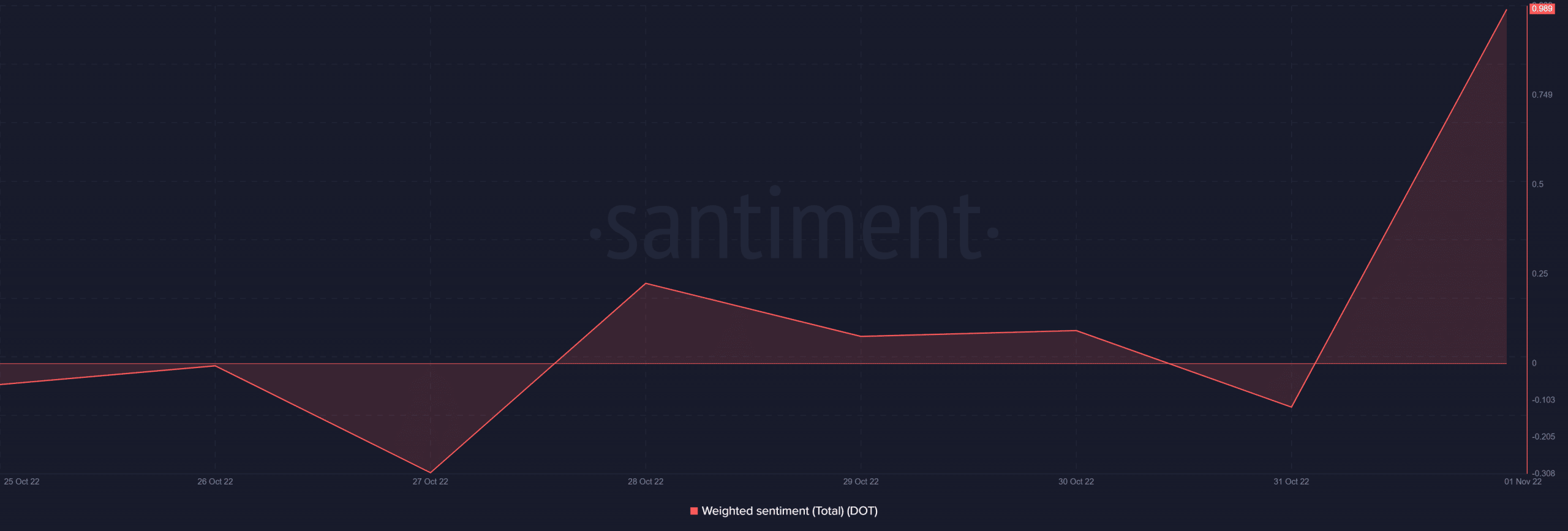

The social metrics increase appears to have steered the market in favor of the bulls. We additionally noticed a surge in DOT’s weighted sentiment to its highest weekly worth. This implies that traders’ curiosity is shortly flowing again and this would possibly result in extra upside within the subsequent few days.

Supply: Santiment

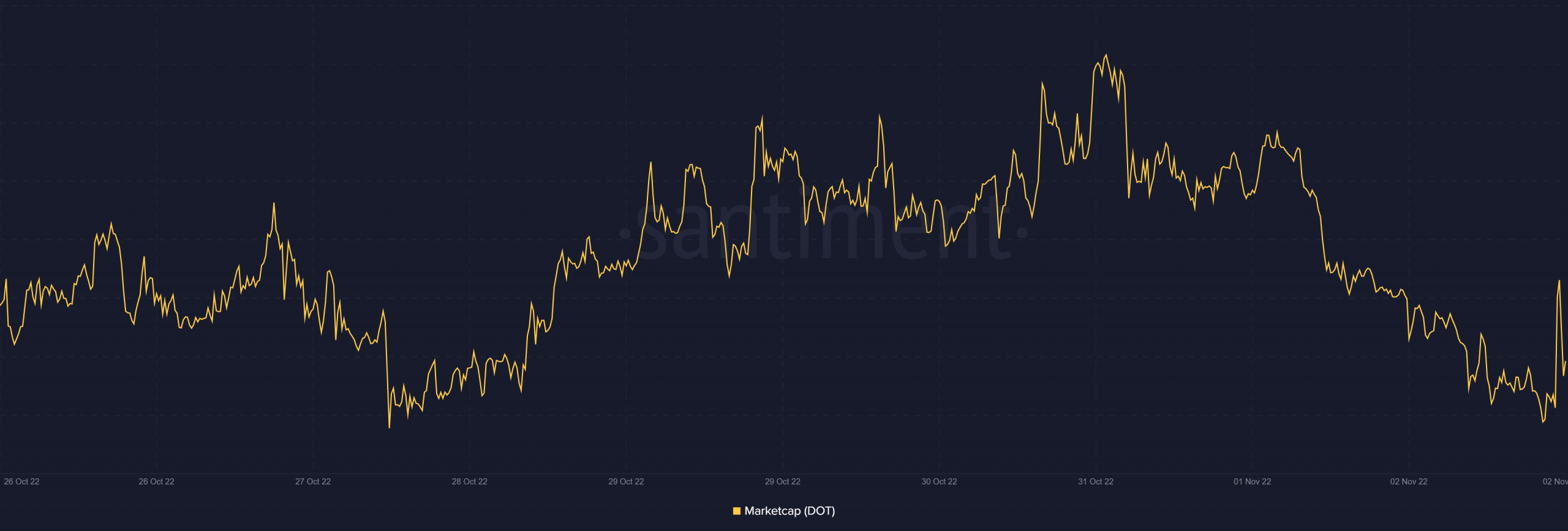

DOT’s market cap grew by over $186 million within the final 24 hours at press time because of the sentiment shift and liquidity flowing again into DOT. Effectively, this final result means that there was a robust accumulation within the final two days.

Supply: Santiment

DOT value motion

A fast have a look at DOT’s value motion reveals one more reason why the bulls need to come again so quickly. The cryptocurrency simply concluded a 17% rally after bouncing again from October lows through the end-of-October rally.

A little bit of a sell-off typically follows a large upside and DOT’s draw back within the final three days displays this expectation. Nonetheless, the draw back pulled again to the 50-day transferring common which frequently acts as a pivot level.

Supply: TradingView

As well as, the newest draw back has triggered a retest of the 50% RSI degree, one other indicator that traders typically use as a pivot zone.

The convergence of those indicators, plus the announcement in regards to the nomination swimming pools contribute to extra chance of a pivot. Whereas the chances of a bullish takeover stay excessive, you will need to notice that, at press time, the market was experiencing pre-FOMC jitters which can have affected DOT’s potential upside.