What Is Value Investing? Exploring the Timeless Investment Strategy – Cryptocurrency News & Trading Tips – Crypto Blog by Changelly

On the earth of investing, there are a mess of methods and approaches that buyers can take. Nevertheless, worth investing has stood the take a look at of time and is taken into account one of the vital dependable and confirmed strategies for reaching long-term monetary success. Many famend buyers, together with Warren Buffett, have attributed their fortunes to worth investing.

Hello! My identify is Zifa, and immediately, I’ll be your information to worth investing. In case you’re fascinated with studying extra about this technique and the way it can assist you obtain your monetary objectives, hold studying to find its key ideas and methods.

What Is Worth Investing?

Worth investing is a technique utilized by many profitable buyers to determine shares which are buying and selling beneath their intrinsic values. The idea relies on the precept of shopping for shares at a reduction to their true value and holding onto them till their value displays their actual worth.

In essence, worth buyers search out corporations which are presently undervalued by the market, usually because of momentary setbacks or market fluctuations, and consider that these shares have the potential to extend in worth over time. They totally analyze the corporate’s financials, administration workforce, aggressive benefits, and {industry} outlook to find out whether or not a inventory is really undervalued.

The objective of worth investing is to purchase these undervalued shares and patiently anticipate the market to acknowledge their true value, resulting in potential earnings when the inventory value finally rises to replicate their intrinsic values. This strategy contrasts with different funding methods that will contain shopping for high-growth shares no matter their present value or following market developments.

Intrinsic Worth and Worth Investing

Intrinsic worth, within the context of worth investing, refers back to the precise value of an organization’s inventory or enterprise, relatively than its market value. It’s based mostly on the underlying fundamentals of the corporate, corresponding to its monetary well being, profitability, development prospects, and the worth of its property. This strategy to investing focuses on discovering corporations which are buying and selling at a reduction to their intrinsic worth, within the perception that their true value will likely be acknowledged by the market over time.

To find out the intrinsic worth of an organization, buyers use elementary evaluation, which includes analyzing the corporate’s monetary statements, debt ranges, profitability, and future development prospects. This evaluation seems to be at key metrics corresponding to earnings, income, money move, and return on fairness to gauge the corporate’s monetary well being and potential for future development. Moreover, buyers will contemplate the corporate’s aggressive benefit, administration workforce, and {industry} prospects to get a holistic view of the enterprise. By estimating the corporate’s intrinsic worth based mostly on these components, buyers can determine alternatives to purchase undervalued shares and probably earn increased returns in the long term.

What makes an incredible worth inventory?

A fantastic worth inventory sometimes displays a low price-to-earnings (P/E) ratio, excessive dividend yield, sturdy steadiness sheet, and strong development prospects. These traits signify profitability, steady income, and dividend funds, making them enticing to buyers searching for long-term good points.

You will need to search for corporations with aggressive benefits and steady money flows. Aggressive benefits, corresponding to a powerful model or distinctive product providing, can maintain an organization’s profitability and distinguish it from rivals. Secure money flows present a cushion throughout financial downturns and reveal the corporate’s skill to generate constant returns for shareholders.

Moreover, figuring out potential worth traps is essential. Some shares might seem low cost however have underlying points that forestall them from realizing their true worth. Persistence is essential: it could take time for nice worth shares to unleash. Nevertheless, affected person buyers stand to achieve substantial returns when the corporate’s true worth is acknowledged by the market.

Learn additionally: Finest AI shares to take a position.

Why put money into worth shares?

Investing in worth shares affords quite a few advantages to buyers. One of many key benefits is the potential for important returns over the long run. Buyers usually have the chance to buy worth shares at a reduced value as a result of they’re generally undervalued by the market. Because the market finally acknowledges the true worth of those corporations, buyers can profit from substantial capital appreciation.

Moreover, worth shares sometimes exhibit decrease volatility in comparison with development shares, offering a extra steady funding choice. This may be notably interesting to buyers who’re searching for to attenuate danger and protect capital. Moreover, in instances of market downturns, worth shares have traditionally demonstrated resilience and the power to outperform development shares. This defensive nature of worth investing can shield buyers throughout turbulent market circumstances.

Furthermore, worth shares have proven important long-term development potential. That’s why they’re considered a horny choice for buyers with a horizon past short-term fluctuations. By specializing in corporations with sturdy fundamentals and strong financials, buyers can construct a portfolio with the potential to ship constant and sustainable development over time.

How Do I Determine Worth Shares to Put money into?

One frequent solution to determine worth shares is utilizing monetary ratios corresponding to P/E (price-to-earnings), P/B (price-to-book), and free money move.

Step 1: Search for shares with a low P/E ratio relative to their {industry} friends. A low P/E ratio means that the inventory could also be undervalued.

Step 2: Test the P/B ratio to see if the inventory is buying and selling beneath its e-book worth. A P/B ratio lower than 1 might point out an undervalued inventory.

Step 3: Analyze the corporate’s free money move—that’s, the money generated after accounting for capital expenditures. A constructive and growing free money move is an efficient signal of a wholesome and undervalued firm.

Buyers can use monetary information web sites like Bloomberg, CNBC, or Reuters for market information, analysis, and evaluation. Funding databases like Morningstar, Yahoo Finance, and Google Finance present inventory information and monetary ratios for evaluation. Firm monetary reviews obtainable on their investor relations web sites or the Securities and Alternate Fee (SEC) database supply in-depth monetary info for additional evaluation.

By using these assets and ratios, buyers can determine worth shares with the potential for long-term development.

Why Shares Change into Undervalued

Shares can turn out to be undervalued for numerous causes. Because it usually occurs, although, one man’s loss is one other man’s achieve, and savvy buyers can use it to probably capitalize.

Market Strikes and Herd Mentality

Herd mentality refers back to the tendency of buyers to comply with and mimic what a majority of others are doing out there. This conduct usually results in irrational decision-making. Shares can turn out to be undervalued when this collective conduct ends in extreme promoting. Buyers would possibly react en masse to market information, developments, and even rumors, inflicting a inventory’s value to plummet beneath its intrinsic worth. This phenomenon can create a discrepancy between an organization’s inventory value and its elementary value, providing worth buyers alternatives to purchase high quality shares at a reduction.

Market Crashes

Throughout market crashes or important downturns, a broad sell-off happens as buyers liquidate holdings for money, which ends up in widespread undervaluation. Pushed by panic and worry, these indiscriminate sell-offs usually disregard the basics of particular person corporations, leading to enticing shopping for alternatives for worth buyers who can determine high-quality shares at low costs.

Unnoticed and Unglamorous Shares

Some shares stay undervalued as a result of they belong to sectors or industries that lack pleasure or visibility. Regardless of having strong fundamentals and profitability, these corporations don’t entice a lot consideration from the investing public or media, so they’re traded beneath their precise value till a catalyst highlights their worth.

Profitable corporations that have been as soon as undervalued or unnoticed embody Amazon, which initially struggled however has since turn out to be a powerhouse in e-commerce and cloud computing. One other instance is Netflix, as soon as a DVD rental firm that has now turn out to be a frontrunner within the streaming {industry}.

Dangerous Information

An organization-specific piece of unhealthy information, corresponding to a authorized subject, administration scandal, or an earnings miss, can result in a pointy decline in inventory value. The market’s emotional response usually exaggerates the impression, undervaluing the inventory relative to its long-term prospects. Worth buyers can exploit these overreactions by analyzing the true impression of the information and investing in corporations whose underlying worth stays sturdy.

Cyclicality

Cyclicality refers back to the tendency of companies to expertise fluctuations of their efficiency and profitability over time. Since buyers usually react to those fluctuations, this may have a major impression on revenue ranges and inventory costs. Components corresponding to seasonality, shopper attitudes, and financial cycles contribute to this cyclicality. For instance, companies within the retail {industry} usually expertise increased gross sales throughout vacation seasons, whereas shopper attitudes and spending habits can fluctuate based mostly on numerous components corresponding to financial circumstances and developments.

By understanding these causes, worth buyers can higher determine shares which are undervalued because of market overreactions, neglected deserves, or cyclical developments.

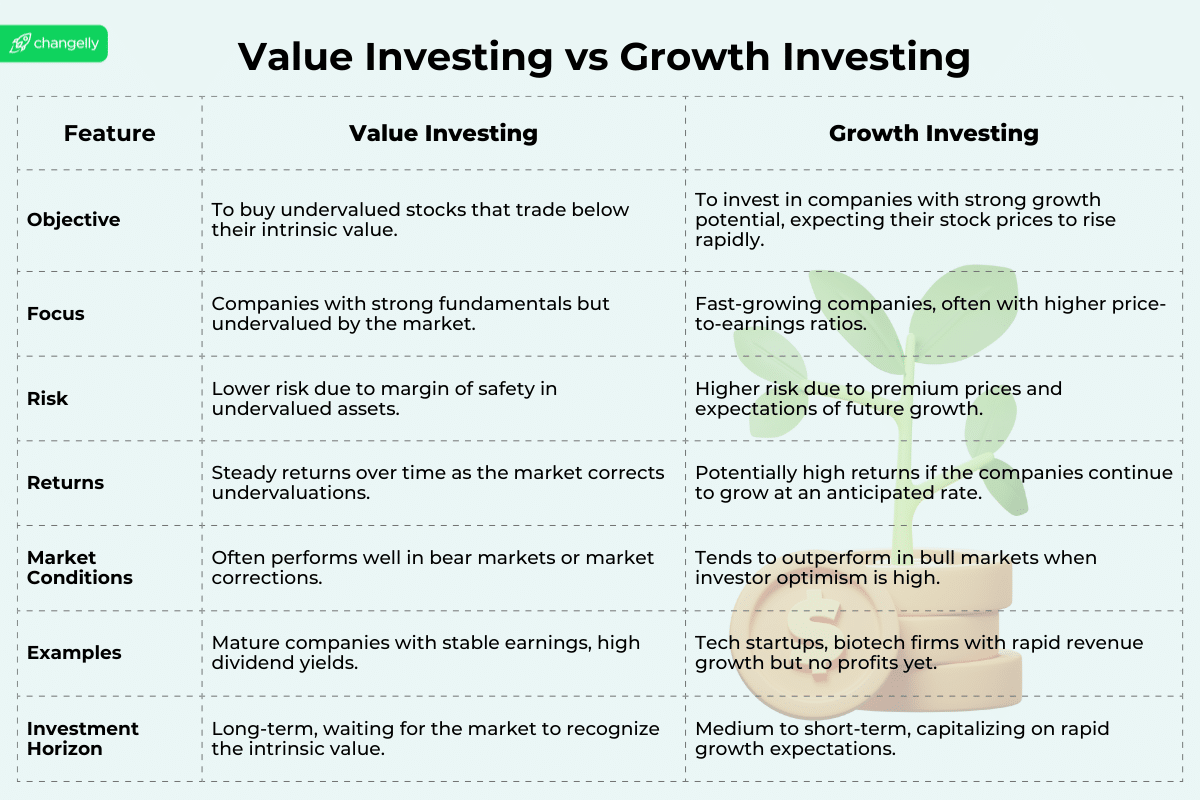

How is worth investing completely different from development investing?

Worth investing focuses on discovering shares which are undervalued based mostly on their intrinsic worth and potential for future development. The objective is to purchase low and promote excessive, so this technique emphasizes inventory pricing. Worth buyers sometimes have an extended time horizon and should prioritize dividend funds as a supply of revenue.

In distinction, development investing targets shares with excessive potential for future development, usually at increased valuations. This technique focuses on corporations with sturdy earnings development and should prioritize reinvesting earnings for future development relatively than paying dividends. Development buyers sometimes have a shorter time horizon and are prepared to pay a premium for high-growth shares.

Worth investing is related to decrease danger and decrease potential returns, whereas development investing is related to increased danger and better potential returns. Worth investing tends to outperform throughout market downturns, whereas development investing tends to outperform throughout financial expansions.

Worth vs. development investing: Which is best?

An investor’s danger tolerance strongly influences their determination to decide on both worth or development investing. These with a decrease danger tolerance might favor worth investing, whereas these with the next danger tolerance might lean in the direction of development investing. Balancing a portfolio with a mix of worth and development shares can present diversification and probably mitigate danger. In the end, the selection between worth and development investing relies on an investor’s particular monetary objectives, time horizon, and danger tolerance.

Worth Investing Methods

Insider Shopping for and Promoting

Monitoring insider shopping for and promoting actions can present useful insights into an organization’s potential future efficiency. Insider shopping for, the place firm executives and administrators buy shares of their very own corporations, can sign their confidence within the firm’s future prospects. Conversely, insider promoting would possibly increase pink flags, though it’s vital to contemplate the context, as gross sales might be motivated by private monetary wants relatively than pessimism in regards to the firm’s future. Buyers use this info to gauge the interior sentiment in the direction of the corporate’s valuation and future development potential.

Analyze Monetary Reviews

A elementary facet of worth investing is the in-depth evaluation of an organization’s monetary reviews. Buyers scrutinize steadiness sheets, revenue statements, and money move statements to evaluate an organization’s monetary well being, profitability, debt ranges, and operational effectivity. Key metrics such because the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, debt-to-equity ratio, and free money move present insights into whether or not a inventory is undervalued. This evaluation helps buyers discover corporations buying and selling beneath their intrinsic worth because of momentary points or market overreactions.

Extra Well-liked Methods

- Dividend Yield Evaluation: Specializing in corporations that pay excessive dividends relative to their inventory value generally is a signal of undervaluation. This technique targets shares that not solely supply potential for capital appreciation but additionally present a gentle revenue stream.

- Margin of Security: This precept includes shopping for shares at a major low cost to their calculated intrinsic worth, providing a buffer in opposition to errors in valuation or unexpected market downturns. The margin of security helps shield the investor’s capital.

- Contrarian Investing: This technique includes going in opposition to prevailing market developments by shopping for shares which are presently out of favor with buyers however have sturdy fundamentals. Contrarian buyers search for alternatives the place the market’s adverse sentiment has led to an undervaluation of basically sound corporations.

- Guide Worth Comparability: Buyers might search for corporations buying and selling beneath their e-book worth, or internet asset worth, as an indicator of undervaluation. Shares buying and selling beneath e-book worth might symbolize a discount if the corporate’s property are undervalued by the market.

Dangers of Worth Investing

Worth investing is a technique that goals to determine undervalued shares with sturdy fundamentals, however like every funding strategy, it comes with its personal set of dangers and pitfalls. Understanding these dangers and the right way to mitigate them is essential for achievement in worth investing.

Falling into Worth Traps

Threat: Worth traps are shares that look like undervalued however have underlying issues that will forestall them from reaching their anticipated restoration. These can embody deteriorating enterprise fashions, aggressive disadvantages, or important modifications within the {industry}.

Mitigation: To keep away from worth traps, buyers ought to conduct thorough due diligence, trying past surface-level monetary metrics. Assess the corporate’s aggressive place, {industry} developments, and administration high quality. Repeatedly monitor your investments for any indicators of elementary decline.

Overreliance on Historic Knowledge

Threat: Relying solely on historic monetary figures with out contemplating the corporate’s present and future potential can lead buyers to make poor selections.

Mitigation: Whereas historic information is vital, buyers also needs to analyze present efficiency indicators and future development prospects. This contains understanding the corporate’s income streams, market potential, and any latest developments that might have an effect on its monetary well being.

Misinterpreting Monetary Efficiency

Threat: Extraordinary good points or losses can skew an organization’s monetary efficiency, main buyers to misjudge its true earnings potential.

Mitigation: Search for and regulate earnings to exclude one-time occasions or non-recurring good points and losses. This gives a clearer image of the corporate’s working efficiency and sustainability.

Ignoring the Limitations of Ratio Evaluation

Threat: Over-reliance on monetary ratios with out understanding their limitations can result in misinterpretation of an organization’s worth.

Mitigation: Use a complete set of ratios together with different evaluation strategies. Perceive the context behind the numbers, together with industry-specific components and financial circumstances, to make extra knowledgeable funding selections.

Investing in Overvalued Shares

Threat: Buyers might mistakenly purchase overvalued shares, pondering they’re undervalued, because of incomplete evaluation or misunderstanding of the corporate’s prospects.

Mitigation: Set up a transparent methodology for valuing corporations, incorporating each qualitative and quantitative components. Set strict standards for what constitutes undervaluation, and be disciplined about solely investing in shares that meet these standards.

Missing Portfolio Diversification

Threat: Concentrating investments in a couple of shares or a single sector will increase the danger of serious losses if these investments carry out poorly.

Mitigation: Diversify your portfolio throughout completely different sectors and industries to unfold the danger and cut back the impression of any single underperforming funding.

Yielding to Emotional Investing

Threat: Emotional decision-making, corresponding to worry of lacking out (FOMO) or panic promoting, can result in poor funding selections.

Mitigation: Develop and stick with a disciplined funding technique. Make selections based mostly on thorough evaluation and long-term views relatively than short-term market actions or feelings.

By being conscious of those dangers and implementing methods to mitigate them, worth buyers can enhance their probabilities of success. The bottom line is to keep up a disciplined strategy, conduct thorough analysis, and keep centered on the basics of the businesses through which you make investments.

Finest Practices for Implementing a Worth Investing Technique

Implementing a profitable worth investing technique requires cautious consideration of quite a lot of finest practices to make sure that the precise corporations are chosen and the precise strategy is taken. From understanding the basics of an organization to having endurance and self-discipline, the next headings define the most effective practices for implementing a worth investing technique.

Construct a Watchlist of Potential Investments

As you construct your watchlist of potential investments, contemplate corporations that won’t meet your present investing necessities however present promising potential. Search for worth performs which have sturdy development outlooks and could also be undervalued out there. Monitor their inventory costs and efficiency to determine shopping for alternatives when circumstances change. Regulate any key developments or modifications within the {industry} that might impression their development potential.

It’s vital to proceed monitoring the shares in your watchlist and be able to take motion if the state of affairs evolves. Search for corporations with sturdy fundamentals and a aggressive edge of their {industry}. Think about components corresponding to market developments, administration modifications, and potential catalysts that might drive their inventory value increased sooner or later.

Be proactive in researching and analyzing the businesses in your watchlist to determine potential shopping for alternatives. By intently monitoring their development outlook and inventory costs, you’ll be well-prepared to take motion when the time is true. Preserve updating your watchlist with new potential worth performs, and be able to seize alternatives as they come up.

Conduct Thorough Analysis and Evaluation

To conduct thorough analysis and evaluation for worth shares, it’s important to first perceive the qualities required for worth investing. This contains analyzing monetary statements to find out if the inventory is undervalued, assessing {industry} developments to determine potential alternatives, and evaluating firm efficiency to gauge its potential for development.

Analyzing monetary statements is essential in figuring out worth shares, because it gives insights into an organization’s profitability, money move, and total monetary well being. Moreover, finding out {industry} developments helps assess the potential for development and profitability inside a particular sector.

Conducting in-depth analysis and evaluation includes assessing aggressive benefits to grasp if an organization has a sustainable edge over its rivals, evaluating administration high quality to make sure competent management, and analyzing development prospects to find out the potential for long-term worth creation.

Monitor Your Investments Carefully

Monitoring the investments is crucial to make sure that you’re making knowledgeable selections about your portfolio. Preserve a detailed eye on the efficiency of your worth shares, usually checking for any modifications within the firm’s circumstances that might impression their worth. If a inventory not meets your funding parameters, don’t hesitate to shut it out and transfer on to a greater alternative.

Along with actively managing your present investments, it’s vital to maintain a watchlist of potential alternatives. Repeatedly monitor these shares for any modifications in inventory value or their development outlook. Staying on prime of market developments and the efficiency of your investments will show you how to make educated selections about the place to allocate your funds.

Rebalance Your Portfolio as Wanted

The composition of your portfolio naturally modifications over time because of market fluctuations and particular person asset efficiency, which may go away you chubby in sure positions if left unchecked. Over time, this may result in the next stage of danger than initially meant.

Rebalancing your portfolio includes adjusting your holdings to keep up a goal composition that aligns along with your danger tolerance and funding objectives. By promoting overperforming property and shopping for underperforming ones, you possibly can convey your portfolio again consistent with your unique targets. This not solely helps to handle danger but additionally ensures that your portfolio continues to replicate your required stage of diversification and asset allocation.

Who’re the 2 most well-known worth buyers?

Warren Buffett and Benjamin Graham are two of probably the most famend worth buyers on the planet.

Warren Buffett, sometimes called the “Oracle of Omaha,” is a broadly acclaimed American investor, enterprise magnate, and philanthropist. He’s the chairman and CEO of Berkshire Hathaway and is thought for his long-term, value-oriented strategy to investing. Buffett is a disciple of Benjamin Graham and has been vastly profitable in making use of Graham’s ideas to his funding technique. He’s additionally recognized for his emphasis on investing in corporations with sturdy aggressive benefits and strong administration groups.

Benjamin Graham, referred to as the “father of worth investing,” was a British-born American economist {and professional} investor who taught at Columbia Enterprise Faculty. His funding philosophy emphasised elementary evaluation and the seek for undervalued shares. Graham’s influential e-book The Clever Investor had an enduring impression on the funding neighborhood, laying the inspiration for worth investing and galvanizing a technology of profitable buyers, together with Warren Buffett.

Each Buffett and Graham had a major affect on worth investing, their profitable observe data solidifying their locations as two of probably the most revered figures within the funding world.

FAQ

What’s an instance of a worth funding?

An instance of a worth funding is buying a inventory within the inventory market that’s believed to be buying and selling beneath its intrinsic worth. As an illustration, if an organization’s present inventory value is considerably decrease than what you have got decided to be its honest value based mostly on thorough evaluation, this might symbolize a worth funding alternative. The important thing thought is to purchase shares for lower than what they’re value, permitting buyers to revenue when the market corrects the value discrepancy. This strategy requires diligent analysis to grasp the corporate’s fundamentals and be certain that the present inventory value certainly affords a reduction to its honest value, making it a horny purchase.

What’s Warren Buffett’s worth investing technique?

Warren Buffett is maybe the best-known worth investor, famend for his skill to choose shares which are undervalued by the market and maintain them as a part of his funding portfolio for lengthy intervals.

Buffett’s strategy to worth investing includes in search of corporations with sturdy fundamentals, together with constant earnings, sturdy model identification, and aggressive moats, which can be found at a value beneath their intrinsic worth. His technique emphasizes understanding the corporate’s enterprise mannequin and potential for sustained development, making investments based mostly on an intensive evaluation relatively than market developments. By adopting this disciplined strategy, Buffett achieved unparalleled success and have become a mannequin for worth buyers worldwide.

When does worth investing carry out finest?

Worth investing tends to carry out finest in environments the place the market begins to acknowledge the intrinsic worth of undervalued shares. This may usually happen within the aftermath of market corrections or bear markets when shares have been crushed down past their fundamentals. Worth shares, characterised by low price-to-earnings ratios and different frequent metrics of worth, can supply important upside as markets get better. Nevertheless, worth investing additionally requires endurance and a long-term perspective as a result of it could take time for the market to regulate. Whereas worth investing can outperform in numerous market circumstances, together with bull markets, it’s the rigorous choice course of, usually involving extra metrics past the standard monetary ratios, that permits worth buyers to determine shares with probably the most enticing return potential.

Is worth investing for me?

Whether or not worth investing is appropriate for you relies on your private finance objectives, danger tolerance, and funding philosophy. Worth investing is most aligned with long-term buyers who’re affected person and prepared to conduct intensive analysis to uncover shares buying and selling beneath their intrinsic worth. This strategy requires an intensive evaluation of economic statements, an understanding of funding types, and a dedication to holding investments by market volatility to appreciate their potential worth. In case you favor a hands-on strategy to managing your investments and have a long-term horizon, worth investing might be a rewarding technique. Nevertheless, it’s vital to contemplate your consolation stage with delving into monetary reviews and your willingness to attend until the market acknowledges the inventory’s true value.

Disclaimer: Please observe that the contents of this text should not monetary or investing recommendation. The data supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native laws earlier than committing to an funding.