How To Invest With Little Money in 2024: A Step-by-Step Guide

Between rising inflation, stagnating wages, and ever-increasing dwelling prices, financial savings are arduous to make and may be even more durable to take care of. That’s the place investing is available in.

An funding journey can begin with as little as $1. All you want is a need to be taught and a cool head in your shoulders. Every part else can include time—and energy. Right here’s a step-by-step information on the best way to make investments even for those who don’t have some huge cash.

Please do not forget that this text doesn’t represent funding recommendation. All the time DYOR earlier than making any monetary choices.

Step 1: Perceive the Fundamentals of Investing

Beginning your funding journey doesn’t require having a hefty checking account. It’s about making sensible decisions with what you could have. In the case of investing with restricted funds, data is your most respected asset.

Earlier than diving into any funding, understanding the fundamentals is essential. This implies getting acquainted with phrases like shares, bonds, ETFs (exchange-traded funds), and mutual funds. A stable basis in these areas may also help you make knowledgeable choices and set lifelike monetary objectives.

One other key to investing on a funds is consistency and persistence. Beginning small doesn’t imply staying small. By frequently contributing to your investments, even in small quantities, you leverage the facility of compound curiosity, which may flip modest financial savings into important sums over time.

Keep away from frequent pitfalls similar to chasing excessive returns with out understanding the dangers of investing in stylish property with out doing all your homework. Keep in mind, each investor’s journey begins with a single step, and with the proper strategy, even the smallest step can result in substantial development. Keep knowledgeable, keep disciplined, and watch your funding portfolio develop, one greenback at a time.

Step 2: Put together to Make investments

This step may be accomplished each earlier than and through your funding journey—it’s nice observe for everybody who needs to be sensible about their funds, which begins with efficient budgeting and saving.

Step one to unlocking funding alternatives is to handle your present funds correctly. This implies scrutinizing your earnings and bills to determine the place you’ll be able to in the reduction of and save. Many discover success by adopting the 50/30/20 rule—allocating 50% of earnings to requirements, 30% to needs, and 20% to financial savings and investments. This straightforward but efficient technique may also help in systematically setting apart funds for funding functions.

Equally essential is the institution of an emergency fund earlier than taking the funding plunge. Life’s unpredictability calls for a monetary cushion, sometimes overlaying 3–6 months’ value of dwelling bills, to deal with unexpected circumstances with out derailing your funding journey. This fund acts as a monetary security internet, making certain that you simply don’t need to liquidate investments prematurely, which may be counterproductive to your funding objectives.

Step 3: Begin Small

There are various other ways to start out investing with little cash. Investing doesn’t at all times begin within the high-stakes world of the inventory market; typically, it begins with a easy, safe basis like a high-yield financial savings account. These accounts are a wonderful start line for brand spanking new traders, providing a risk-free technique to develop financial savings at charges larger than conventional financial institution accounts. Particularly for these not but able to navigate the complexities of the inventory market or particular person shares, a high-yield financial savings account generally is a stepping stone that gives a style of passive earnings via accrued curiosity.

Micro-investing apps, tailor-made for these with out substantial capital, symbolize one other accessible entry level into the world of funding. These platforms demystify the method, enabling customers to take a position minimal quantities—typically simply the spare change from transactions—into a various array of funding choices, together with ETFs and fractional shares of particular person shares. By doing so, they not solely provide a sensible introduction to funding but additionally assist in regularly constructing a portfolio in sync with the person’s danger tolerance. Apps like Acorns and Stash stand out by making funding extremely approachable, merging the convenience of saving with the expansion potential of investing.

Transitioning from saving to investing can appear daunting, however Dividend Reinvestment Plans (DRIPs) and Direct Inventory Buy Plans (DSPPs) clean this path. Each enable traders to start out small, straight buying shares or fractional shares from main firms. DRIPs, particularly, provide a option to mechanically reinvest dividends acquired again into further shares, harnessing the facility of compounding to develop investments over time. This strategy not solely cultivates an funding behavior but additionally offers direct publicity to the inventory market’s potential returns with out the necessity for substantial preliminary funding.

Energetic Investing vs. Passive Investing

For a first-time investor specializing in constructing their retirement financial savings or rising a small preliminary sum, it may be actually essential to grasp the variations between lively and passive investing. Energetic investing entails hands-on administration, with traders or their monetary advisors making particular choices about shopping for or promoting shares, bonds, or different securities based mostly on market evaluation. This strategy goals to outperform the market common and requires a great deal of analysis, market data, and, usually, larger charges for managed funds.

On the flip facet, passive investing is about setting a long-term technique and sticking to it, minimizing the quantity of shopping for and promoting. This usually entails investing in index funds or ETFs that observe a market index, just like the S&P 500. The fantastic thing about passive investing, particularly for these simply beginning out with restricted funds, lies in its decrease prices and the facility of compounding curiosity over time. On-line banks and numerous platforms now provide easy accessibility to some of these investments, permitting for month-to-month contributions out of your account to steadily develop your portfolio.

Step 4: Discover Different Low-Value Funding Alternatives

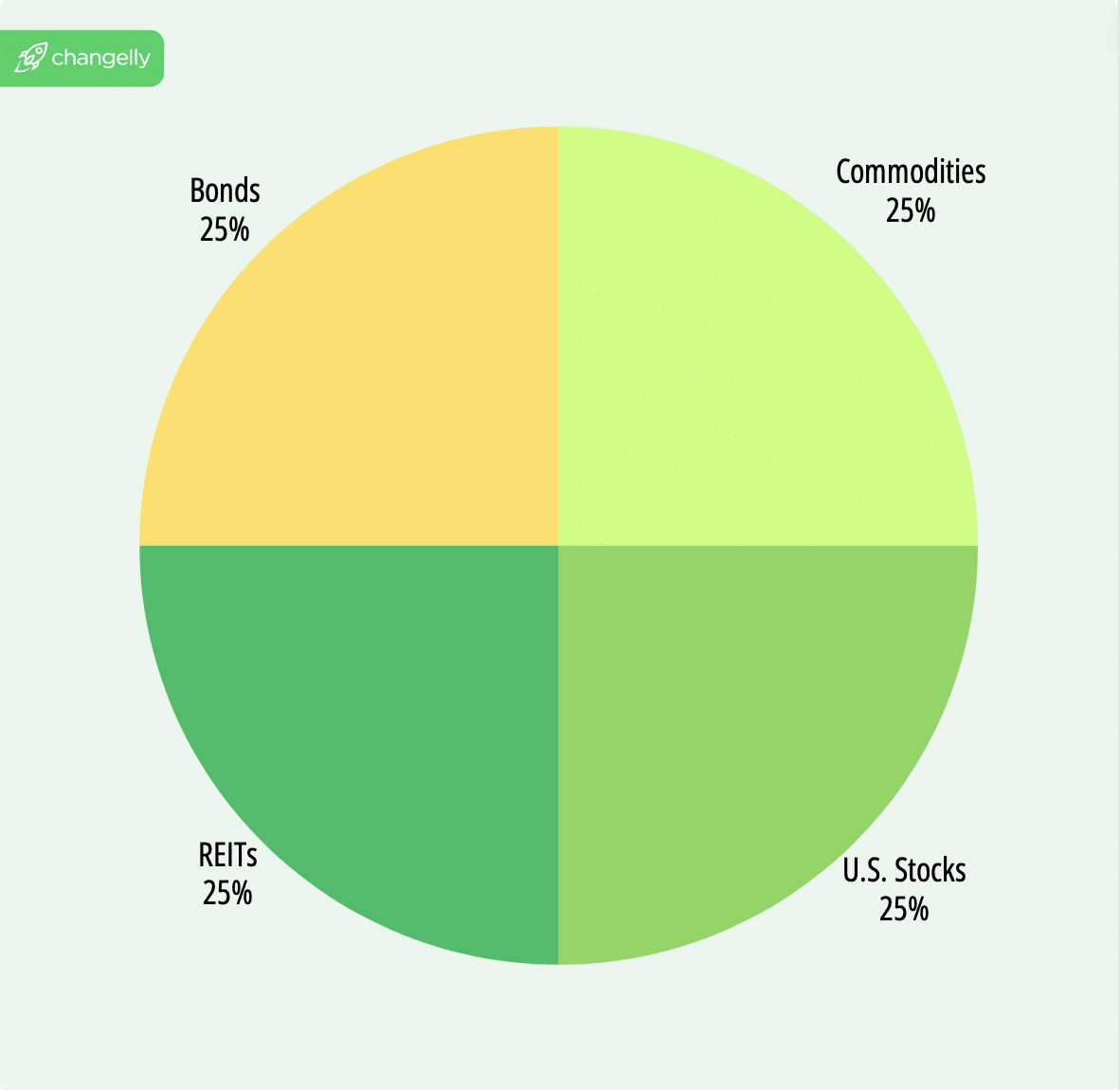

Some of the essential guidelines of funding is that so as to reduce your dangers, you must construct a diversified portfolio. The final method to do that is to spend money on a balanced mixture of high- and low-risk property, in addition to property belonging to completely different industries.

A great start line is index funds and ETFs (exchange-traded funds). These funding automobiles are celebrated for his or her means to supply diversification at a comparatively low value, an important consider constructing a resilient funding technique. By pooling cash from quite a few traders, index funds and ETFs spend money on a variety of property, from particular person firms to whole sectors, mirroring the efficiency of specified indices.

This broad publicity considerably mitigates the chance related to investing in single shares, aligning properly with the investing objectives of these searching for a extra conservative entry into the market. Monetary advisors usually advocate these choices to shoppers on the lookout for an funding technique that balances development potential with danger administration, all with out the necessity for a considerable minimal funding.

On the opposite finish of the spectrum lies the dynamic world of cryptocurrency. Investing in digital currencies like Bitcoin and Ethereum has turn into more and more accessible, with platforms permitting transactions with as little as the quantity linked to a debit card buy. This low entry barrier permits traders to discover the cryptocurrency market with out committing massive sums, making it an intriguing funding automobile for these prepared to navigate its volatility.

Whereas the potential for a excessive annual return attracts many to this frontier, it’s accompanied by a degree of danger and worth fluctuation far better than extra conventional investments like index funds or retirement accounts. Monetary planners usually stress the significance of understanding these dangers and rewards, advising that cryptocurrency ought to complement, not dominate, a diversified portfolio designed to fulfill long-term investing objectives, together with particular person retirement planning.

Step 5: Develop Methods for Rising Your Funding

Rising your funding doesn’t simply contain selecting the best sorts of investments or shopping for a single share; it’s about making strategic funding choices that take into account your whole monetary scenario, together with managing high-interest debt and pupil loans.

There are sensible methods designed that will help you navigate market fluctuations and construct a sturdy nest egg over time. With cautious planning and a give attention to long-term objectives, these methods may be instrumental in crafting a diversified portfolio that meets minimal funding necessities and aligns along with your investing journey, setting a stable basis for monetary safety by retirement age. Listed here are a few of them.

Greenback-cost averaging is a technique employed by traders seeking to reduce the impression of market fluctuations on the acquisition of property, like shares of inventory. By persistently investing a set amount of cash over common intervals—whatever the share worth—traders can keep away from dangerous makes an attempt to time the market.

This strategy means you would possibly purchase extra shares when costs are low and fewer when costs are excessive, averaging out the price of your investments over time. This technique is especially useful to newbies with a long-term horizon as a result of it will possibly assist in constructing a nest egg for retirement age with out the necessity to monitor the complete market consistently.

Reinvesting dividends is one other highly effective technique to boost your investing journey. When firms pay dividends to shareholders, as a substitute of taking these funds as money, you’ll be able to select to reinvest them to buy further shares. As you successfully earn dividends in your reinvested dividends, this strategy can considerably compound your funding development over time. That is notably advantageous in employer-sponsored retirement plans or any long-term funding account, the place the purpose is to develop the funding considerably by the point you attain retirement age.

These strategies assist mitigate dangers related to market volatility, improve the expansion potential of your investments, and, in the end, safe a wholesome monetary standing by the point you attain retirement age. Beginning on this path as early as doable, even with small quantities, could make a big distinction in the long term, permitting you to navigate your investing journey with confidence.

Frequent Funding Errors to Keep away from

It doesn’t matter what your funding plan or technique is, there are some frequent errors that may stand between you and success. Listed here are a few of them.

- Investing With out Understanding: Leaping into investments with out a clear grasp of how they work is akin to setting sail with out a map. Whether or not it’s shares, actual property funding trusts (REITs), or every other automobile, a stable understanding is a should. Take the time to do analysis to make sure that every funding aligns along with your objectives and danger tolerance.

- Making an attempt to Time the Market: Many traders suppose they will predict market highs and lows, however this technique usually results in missed alternatives. As a substitute of attempting to outsmart the market, take into account dependable funding methods like dollar-cost averaging, the place investing common quantities over time can mitigate the impression of volatility.

- Lack of Diversification: Placing all of your eggs in a single basket is dangerous. Diversification—spreading your investments throughout numerous property like shares, bonds, and actual property funding trusts—can cut back danger. Keep in mind, a diversified portfolio can embody investments throughout completely different sectors, geographical places, and asset courses.

- Forgetting the Lengthy-Time period Perspective: It’s straightforward to get caught up in short-term fluctuations and lose sight of your long-term investing objectives. Remember the fact that constructing wealth is a marathon, not a dash. Adjusting your portfolio in response to short-term market actions may be detrimental to your long-term targets.

- Blindly Trusting Monetary Professionals. There are numerous “advisors” on-line that promise to construct you a worthwhile portfolio for a small price, and even without cost. Don’t belief these individuals blindly—there’s a actually excessive probability it’s a rip-off. Moreover, be cautious of individuals posting their funding concepts and plans on-line, particularly in the event that they promise excessive returns.

Easy methods to Make investments With Little or No Cash: Conclusion

Though it’s a lot simpler to start out investing when you have already got sizable financial savings in your accounts, it isn’t inconceivable to take a position if you don’t have some huge cash. No matter your present monetary standing, funding may also help you develop your funds and give you a security internet.

Keep in mind, profitable investing isn’t just about making 1000’s of {dollars}; it’s about making sensible, knowledgeable choices that develop your wealth steadily over time, whatever the dimension of your brokerage accounts.

FAQ

Easy methods to spend money on actual property with little cash?

Investing in actual property with little cash might sound difficult, however it’s totally doable via inventive methods. One accessible route is thru Actual Property Funding Trusts (REITs), which let you spend money on actual property with out shopping for bodily properties. Crowdfunding platforms are another choice, as they allow people to pool their sources collectively to spend money on bigger actual property tasks.

How can newbies spend money on shares with little cash?

Freshmen can begin investing in shares with little cash by leveraging platforms that provide fractional shares, permitting you to purchase parts of a single share at a time. This strategy makes it simpler to spend money on high-value shares with out the necessity for a big upfront funding. Moreover, beginning with low-cost index funds or ETFs generally is a sensible option to diversify your portfolio with a minimal preliminary funding.

How can taxes have an effect on funding choices?

Relying in your tax bracket, the returns from sure investments could also be considerably impacted by taxes. Think about tax-efficient investments and accounts, like Roth IRAs or 401(ok)s, particularly for those who’re in a better tax bracket. Consulting with a monetary advisor may also help navigate these waters, making certain your funding choices are each growth-oriented and tax-smart.

Disclaimer: Please be aware that the contents of this text usually are not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native laws earlier than committing to an funding.