VeChain: Investors looking for a safe bet have all the reasons to consider VET

VeChain [VET] currently managed to make its traders pleased as the value of VET surged by almost 8% during the last week. At press time, VET was trading at $0.02396 with a market capitalization of $1,737,838,130.

Although a lot of the credit score goes to the present bullish crypto market, a number of developments on the VeChain ecosystem might have contributed to this value surge.

____________________________________________________________________________________

Right here’s AMBCrypto’s Worth Prediction for VeChain [VET] for 2023-24

____________________________________________________________________________________

For example, the NFT supporting the primary Stock Monetization transaction was minted on the VeChainThor community. A press release was launched by Provide@ME and VeChain about the identical. This improvement is predicted to enhance money circulation and entry to working capital for the car manufacturing industries within the US, Italy, and Africa.

October was a tremendous month! Technically an important brick was laid with our #WebHooks that enables bi-directional #Blockchain communication with each backend. However there was extra …

This is our reflection on October:https://t.co/RfiW5UNncW#VeChain #VeFam 🎃 pic.twitter.com/GevQyKC58v

— vechain.vitality (@VeChainEnergy) October 31, 2022

Nonetheless, as we enter the ultimate months of 2022, what lies forward for VeChain traders? A have a look at VeChain’s metrics offered some readability to the state of affairs.

Traders ought to think about this

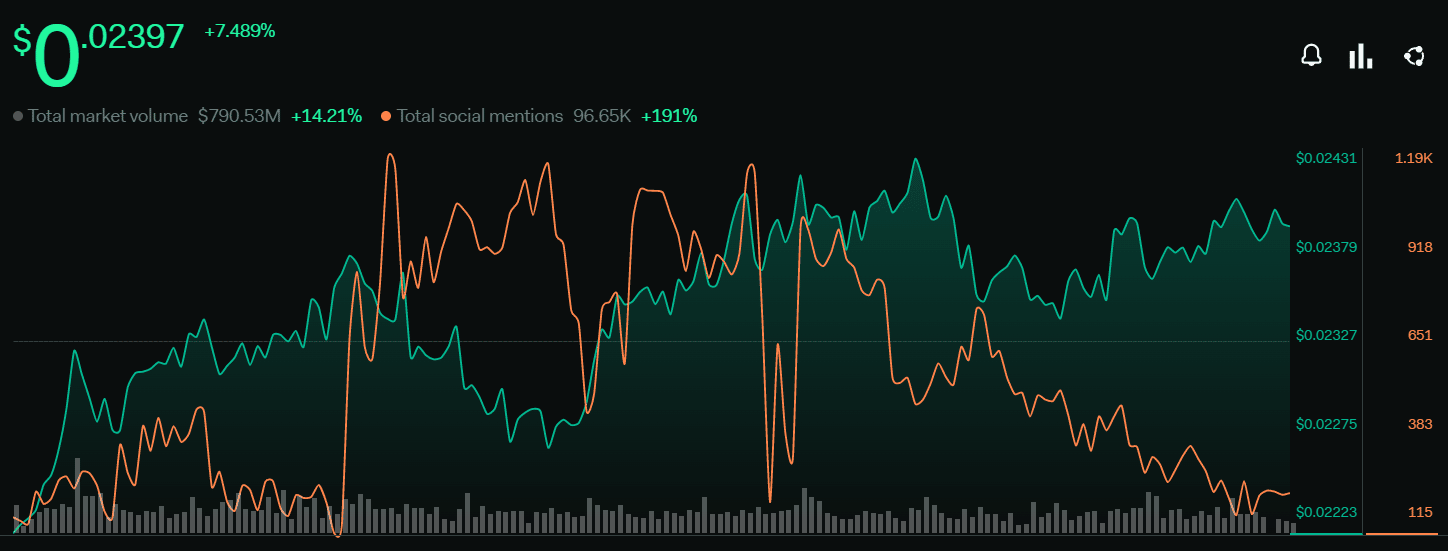

Although VET’s ecosystem was fairly heated due to the aforementioned developments, LunarCrush’s information revealed a unique state of affairs. VeChain’s social mentions decreased significantly over the previous few days. This indicated that the community was rising much less in style within the crypto neighborhood.

Supply: LunarCrush

A have a look at DefiLlama’s chart identified that regardless of marking a slight uptick, VET’s TVL was significantly down as in comparison with the final week. This might be thought of as a adverse sign. Nonetheless, the remainder of the metrics seemed fairly promising as they have been all in VET’s favor.

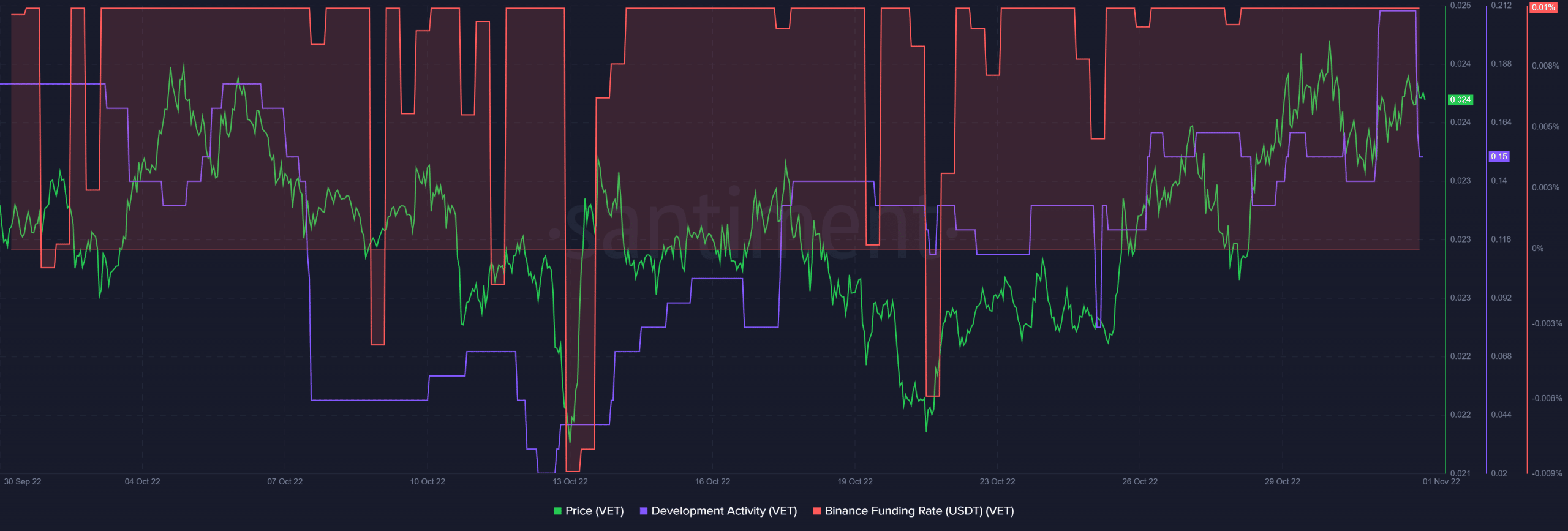

For example, VET’s improvement exercise elevated sharply during the last week. Furthermore, VeChain’s Binance funding fee was additionally persistently excessive. This indicated a rising curiosity from the derivatives market.

Supply: Santiment

Excellent news incoming

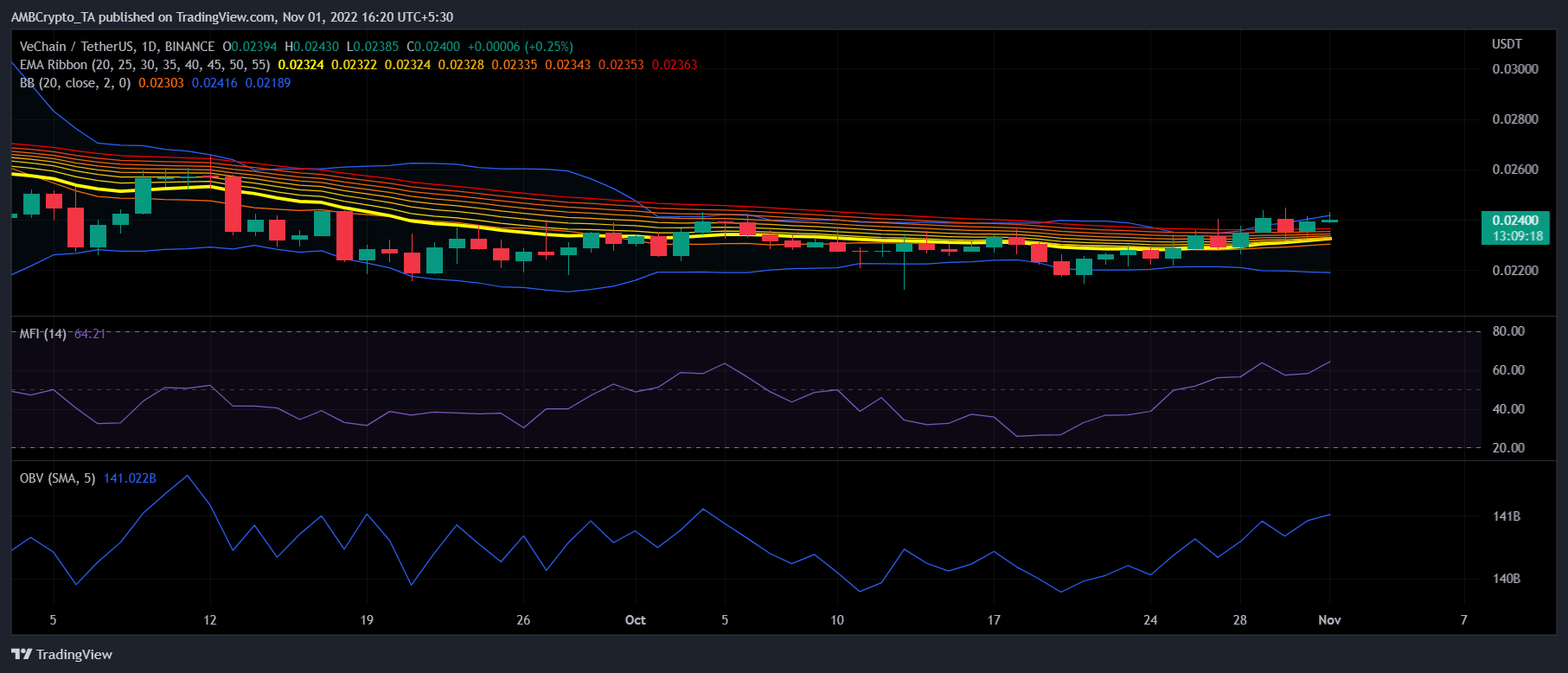

Like most different cryptocurrencies, indicators on VET’s day by day chart steered brighter days forward. The Cash Stream Index (MFI) and On Steadiness Quantity (OBV) each registered upticks. This might be thought of as a bullish signal.

Furthermore, the Exponential Shifting Common (EMA) Ribbon revealed that the bears’ benefit available in the market would possibly quickly come to an finish. The Bollinger Bands (BB) revealed that VET’s value was about to enter a excessive volatility zone. Due to this fact, contemplating all of the on-chain metrics, developments, and market indicators, VET traders can sit again and chill out as a continued value surge might be anticipated.

Supply: TradingView