Polygon’s continual disruption could influence MATIC’s Q1: Here’s how

- Polygon collaborated with a finance large in tokenizing property.

- Whereas NFT curiosity surged, MATIC may additionally stay bullish in Q1.

As a part of its plans to develop its impression within the crypto sector, Polygon [MATIC] secured a partnership with Hamilton Lane per its $2.1 billion tokenization flagship fund. In October 2022, the funding agency announced that it deliberate on tokenizing three of its funds, together with its digital asset accomplice Securitize.

Learn Polygon’s [MATIC] Worth Prediction 2023-2024

Now, particular person traders can entry the fund through the Polygon community. In accordance with Polygon’s co-founder, Sandeep Nailwal, the event has the potential to drive the venture’s DeFi development whereas admitting that institutional liquidity was a welcome growth.

Hamilton Lane @hamiltonlane, $890bn Monetary Large is tokenizing their $2.1B flagship fund on @0xPolygon!

Innovation on institutional liquidity is the subsequent frontier for development in Defi.

Liquidity @0xPolygonDeFi about to 🚀.

Come and construct #OnPolygon https://t.co/eSRjjVRRtv

— Sandeep | Polygon 💜 Prime 3 by impression (@sandeepnailwal) January 31, 2023

Providing alternative in abundance

Colin Butler, Polygon’s international head of institutional capital, commented on the matter. Particulars from the official weblog put up revealed how Butler’s remark revolved round democratizing blockchain sensible purposes and monetary alternative. He stated,

“The tokenization of personal funds is a large leap ahead for traders and fund managers–a broader pool of traders enticed by higher alternative and disintermediation.”

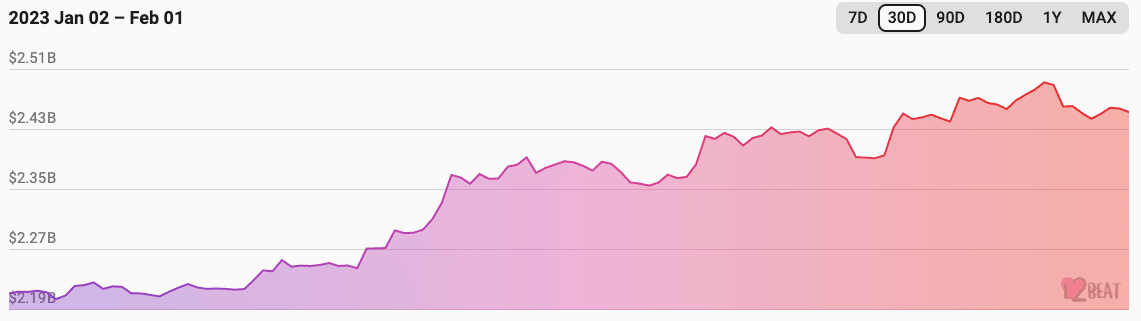

This headway comes after the web3 initiatives recorded large strides concerning its community. Apparently, the Polygon Whole Worth Locked (TVL) has been on a constant enhance since January. The TVL takes into consideration a venture’s market capitalization and deposits it into the protocol.

In accordance with L2Beat, the Polygon TVL was price $2.9 billion at press time. Thus, plenty of customers have been capable of bridge property between Polygon and Ethereum [ETH]. This has been with the assistance of Polygon’s Proof-of-Stake (PoS) validators.

Supply: L2Beat

In addition to the tokenization fund and TVL hike, Polygon has been performing exceptionally within the NFT market. A couple of days again, it hit an spectacular landmark on the NFT market OpenSea.

As well as, one other market, Rarible, tweeted that the Polygon Ape Yacht Membership was its group market of the earlier week.

.@PolygonApeYC is our Neighborhood Market of the Week!

Discover this assortment of 10,000 distinctive apes with 185 attributes on the @0xPolygon blockchain. Unlock entry to a enjoyable group and funky aidrops!

Go discover! 👇https://t.co/tlN4ofJ67F

— Rarible (@rarible) January 31, 2023

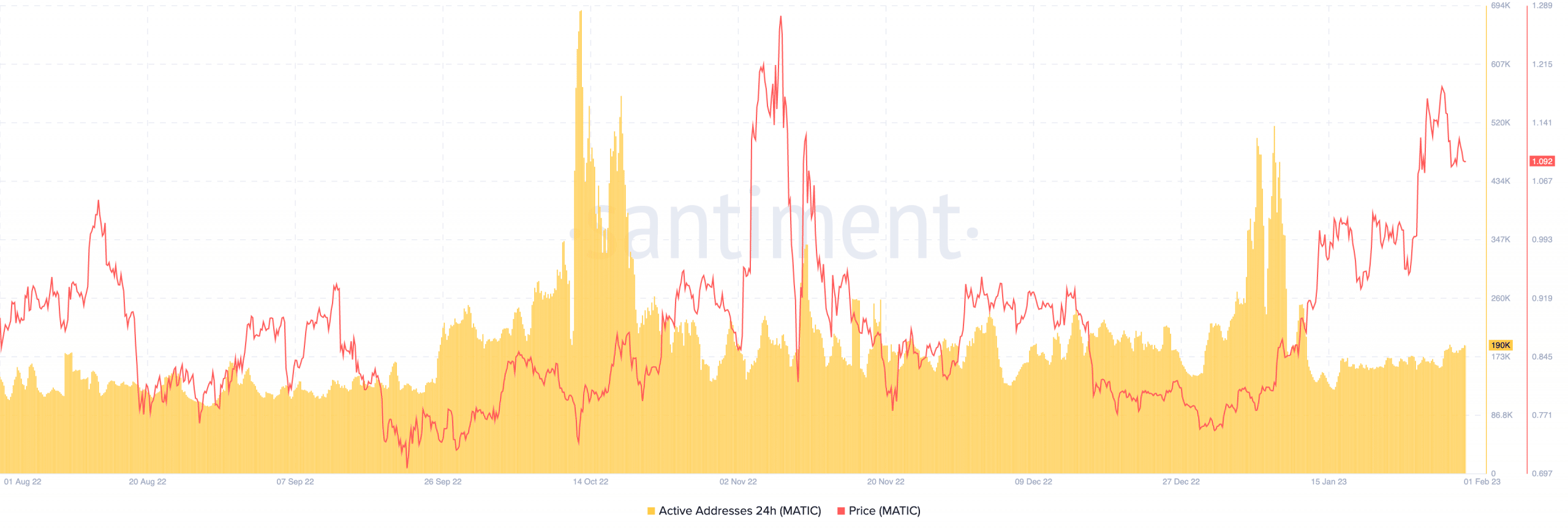

This was one other affirmation that the OpenSea milestone was no fluke. Santiment knowledge confirmed that crypto customers have sustained the momentum of transacting on the Polygon community. On the time of writing, active addresses on Polygon had elevated to 189,000 as MATIC exchanged palms at $1.09.

Supply: Santiment

Reasonable or not, right here’s MATIC’s market cap in BTC’s phrases

MATIC to carry the bull in Q1?

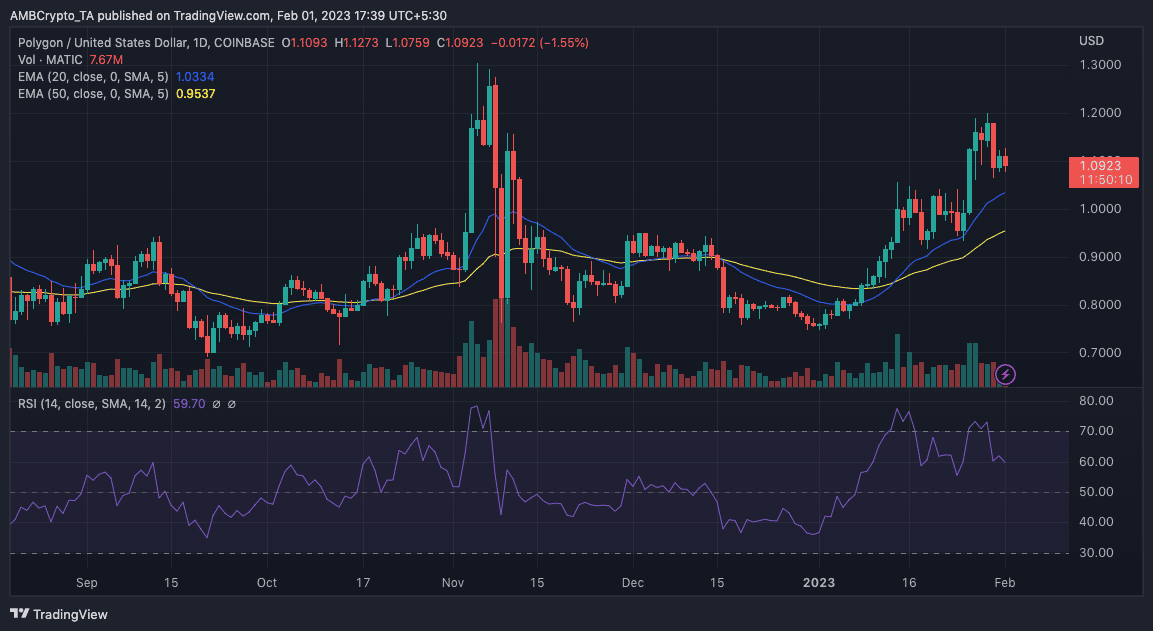

Per value motion, the Relative Power Index (RSI) confirmed that MATIC’s momentum had reversed to the overbought area. At 59.70. Nevertheless, it was far above the oversold area, indicating that MATIC bulls have been nonetheless sustaining the shopping for momentum.

In a case the place the shopping for energy supersedes promote strain, the MATIC may stay within the rally area within the first quarter. Indications from the Exponential Shifting Common (EMA) additionally aligned with a short-term inexperienced degree because the 20 EMA (blue) was above the 50.

Supply: TradingView