Is Ethereum ready for a pivot as this ETH front sees renewed interest

- ETH noticed a rise within the demand for futures contracts, which can lead to rising volatility this week

- Although the metrics had been in favor of the bulls, ETH’s value noticed a bearish shift

Ethereum [ETH] dashed all hopes for a short-term rally as its efficiency final week was a disappointment. The king of altcoins dropped by 13% from mid-last week to its press time stage. Furthermore, current observations indicated that ETH may expertise extra volatility.

Learn Ethereum’s [ETH] Worth Prediction 2023-24

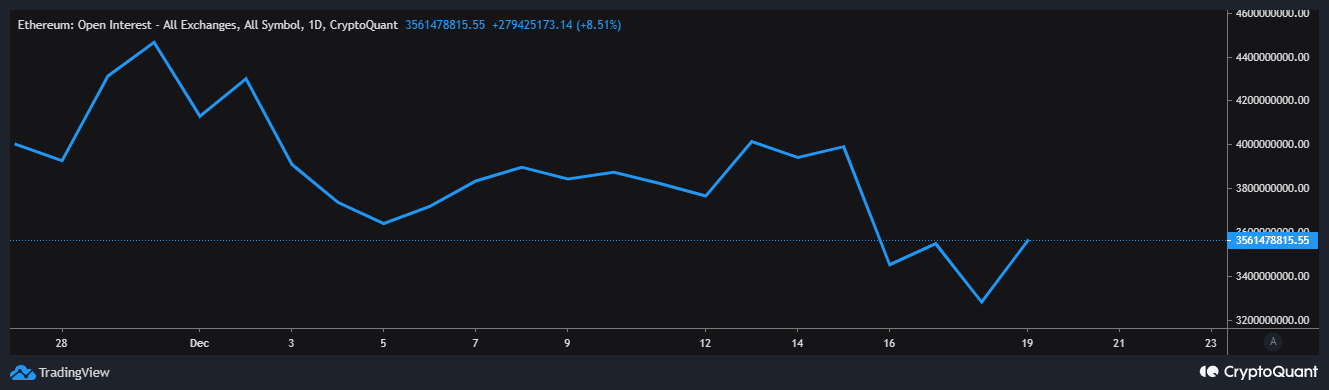

In keeping with the most recent alerts by Glassnode, the quantity of ETH provide final lively 5 to seven years lately hit a four-month excessive. Much more fascinating was a discovering, which revealed that Ethereum futures contracts’ open curiosity reportedly reached a brand new month-to-month excessive.

📈 #Ethereum $ETH Futures Contracts Open Curiosity simply reached a 1-month excessive of $47,993,283.71 on #Huobi

Earlier 1-month excessive of $47,896,498.52 was noticed on 18 December 2022

View metric:https://t.co/hFZ1PPd8fT pic.twitter.com/Llk60qIbQV

— glassnode alerts (@glassnodealerts) December 19, 2022

The rise within the demand for futures contracts might give technique to a rise within the cryptocurrency’s volatility this week. Nevertheless, these observations don’t essentially point out which route shall be in favor. Maybe a have a look at a few of ETH’s metrics might present a tough thought of what to anticipate.

Launching a bullish assault?

ETH’s open curiosity metric noticed a pointy uptick within the final 24 hours. This confirmed that the demand for the cryptocurrency was recovering.

Supply: CryptoQuant

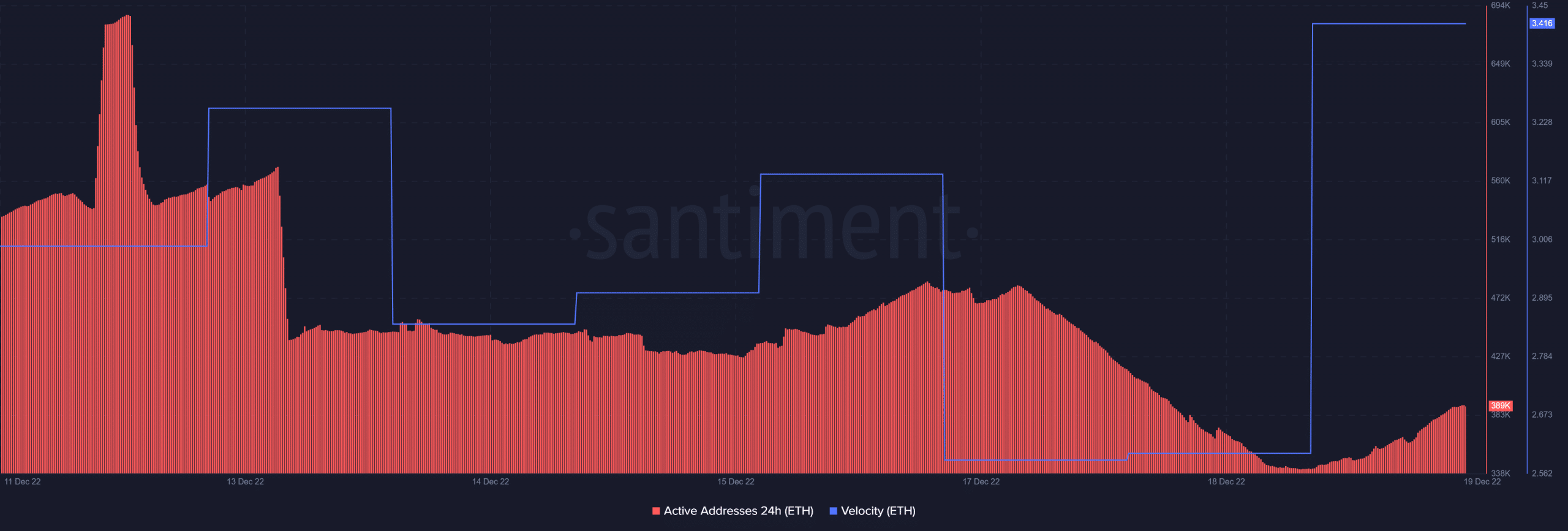

This uptick in open curiosity additionally mirrored a resurgence in deal with exercise. The 24-hour lively addresses metric skilled an uptick within the final 24 hours, confirming that the retail market noticed some exercise. This was additionally accompanied by a pointy uptick in velocity, thus creating the expectation that ETH may uphold greater volatility within the subsequent few days.

Supply: Santiment

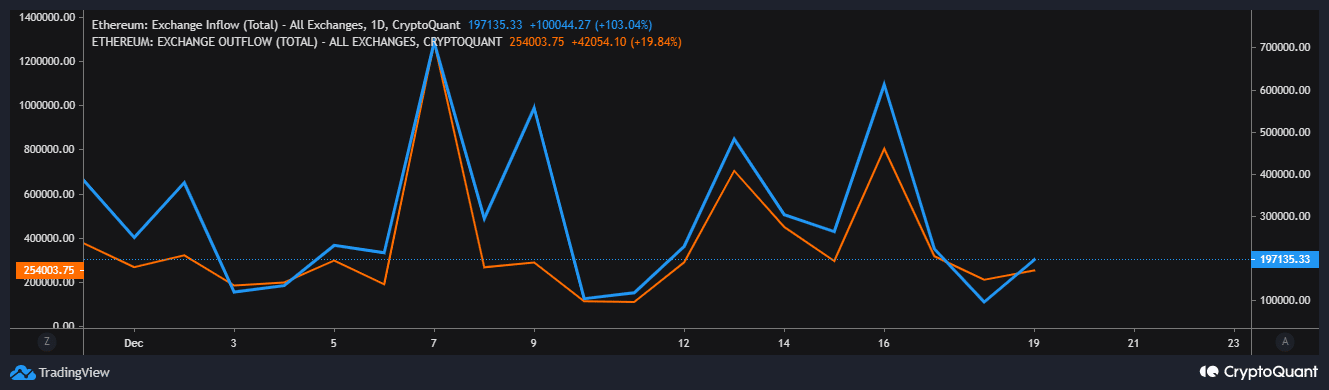

However what was the state of demand for ETH out there? A have a look at the coin’s trade flows revealed that it had greater trade outflows than inflows within the final 24 hours. However, ETH trade inflows had a better improve than the variety of trade outflows.

Supply: CryptoQuant

Whereas these metrics indicated a resurgence of demand, particularly of the bullish sort, additionally they revealed that the bears weren’t but completed with ETH. As of 19 December, its value motion noticed a drop in bearish momentum within the final three days after the sharp crash it skilled final week.

ETH bulls are placing up a good battle

Maybe the very best rationalization for the above observations was that the bulls had been making an attempt to make a comeback. This may occasionally clarify why the draw back slowed down and misplaced its momentum. Nevertheless, the prevailing bullish energy within the final two days was not sturdy sufficient to lend favor to the bulls.