Here’s the Most Bullish Signal Now Flashing for Bitcoin and Crypto Markets, According to Analyst Justin Bennett

A preferred crypto strategist says that one chart might foreshadow bullish continuations for Bitcoin (BTC) and the remainder of the crypto markets.

Analyst Justin Bennett tells his 110,600 Twitter followers that the Tether dominance chart (USDT.D) is on the verge of violating the diagonal help that has saved the metric in an uptrend since November 2021.

Merchants usually control the USDT.D chart because it reveals how a lot of the crypto market cap is comprised of stablecoin Tether (USDT). A bearish USDT.D chart is historically interpreted as bullish for Bitcoin and crypto because it signifies that merchants are parting with their stablecoins to take danger.

Says Bennett,

“Essentially the most bullish sign proper now for crypto is the Tether dominance chart, in my view.

This strikes inversely to crypto and is at present breaking down.

Unconfirmed as of now. Weekly shut can be key.”

At time of writing, the USDT.D chart stands at 6.88%, under Bennett’s trendline of round 7%.

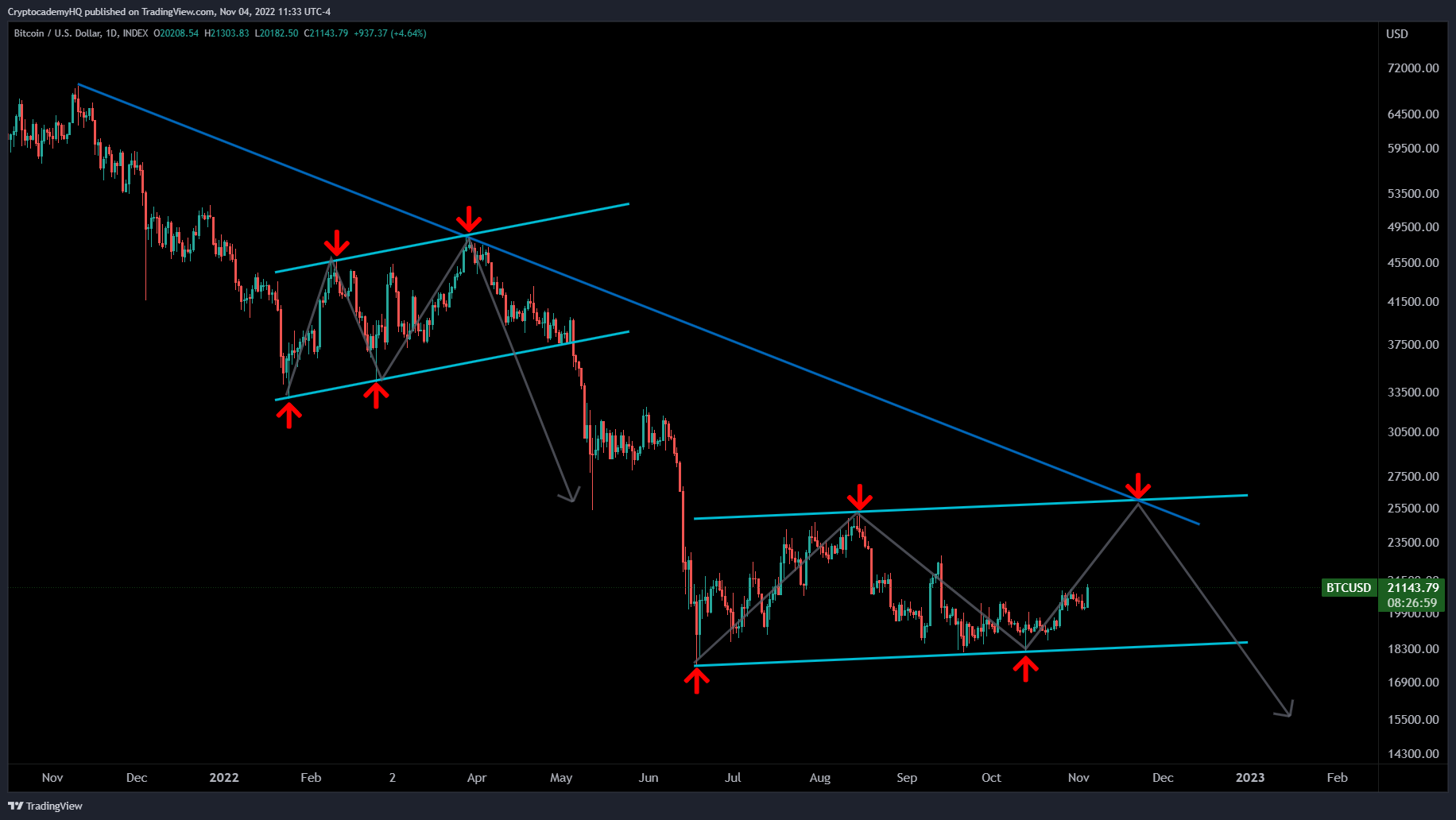

Because the USDT.D chart flash indicators of probably ending its one-year uptrend, Bennett says Bitcoin is able to rally towards his goal of $26,000 by December.

“A $26,000 BTC peak remains to be on the desk…

Nonetheless, just a few issues must happen, together with Bitcoin getting above $22,800 and the DXY (US greenback index) closing under 109.30 [points] subsequent week, amongst different issues.

There aren’t any simple duties right here.”

At time of writing, Bitcoin is altering arms for $21,211, flat on the day.

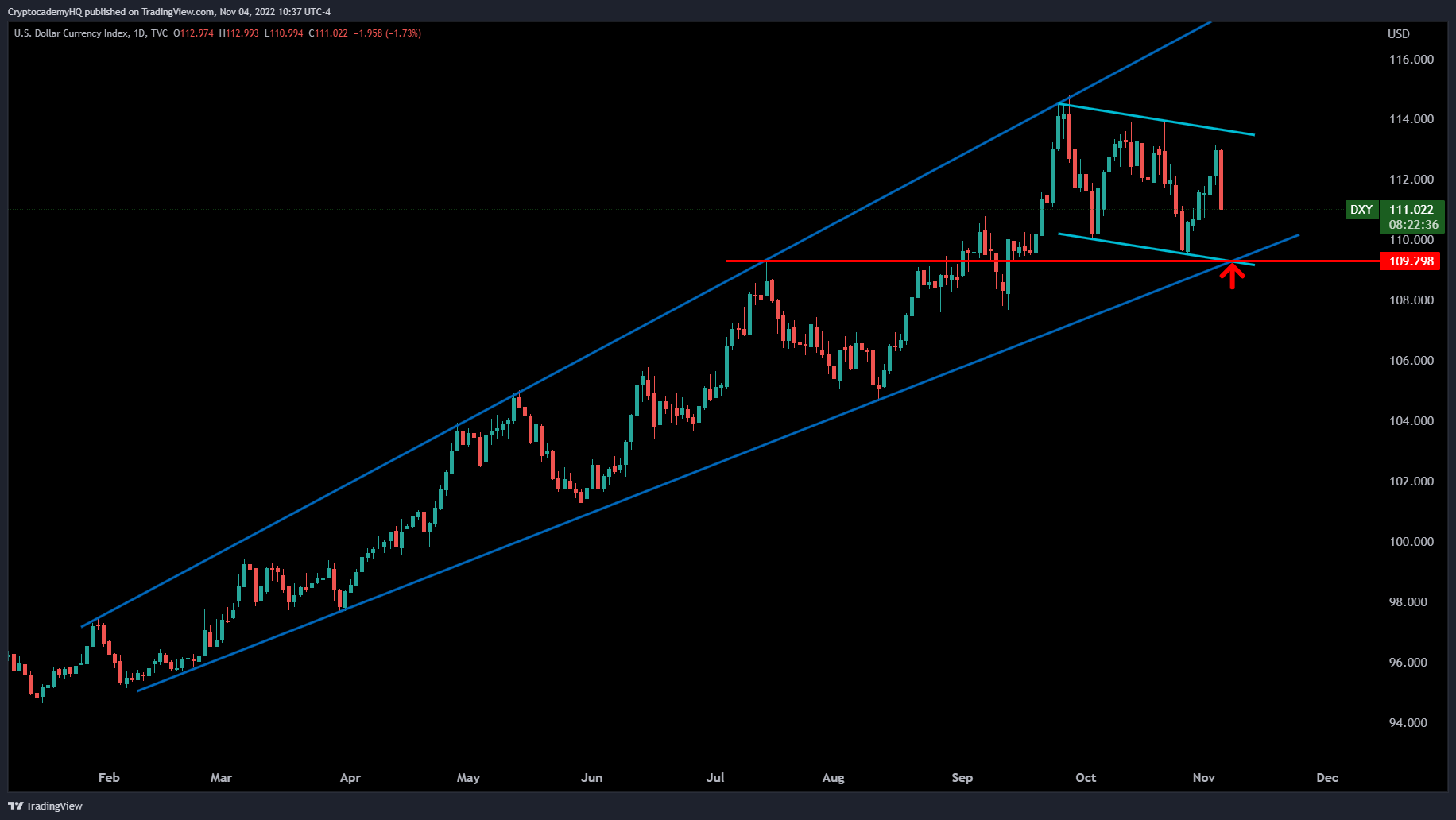

Bennett additionally explains why he believes the 109.30 degree for the DXY could possibly be key for a sustained crypto rally.

“I can’t stress sufficient how vital 109.30 can be for the DXY subsequent week.

The confluence there may be huge.

2022 development line, descending channel help, and key month-to-month degree.

Shut under = prolonged crypto rally.

Bounce aggressively = crypto pullback.”

Much like the USDT.D metric, merchants additionally observe the efficiency of the DXY as a plummeting index means that buyers are leaving the security of the US greenback to build up danger belongings like Bitcoin and crypto.

At time of writing, the DXY is at 110.78 factors.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Featured Picture: Shutterstock/Tithi Luadthong