Here’s why Polkadot investors should be cautious with current sideway structure

- Polkadot (DOT) may fall to $4.376.

- An increase above $4.695 will invalidate the forecast.

Polkadot (DOT) has been in a downtrend since mid-August. From its mid-August excessive of $9.6, it fell to $4.5, on the time of publication. That’s a drop in worth of about 50%, and it seems prefer it may break via one other help stage.

DOT has been buying and selling sideways for the previous 5 days, fluctuating between $4.695 and $4.376, nevertheless it may fall beneath that vary if help at $4.376 fails to carry.

Learn Polkadot (DOT) value prediction 2023-24

Help at $4.486: Can it maintain?

Supply: DOT/USDT on TradingView

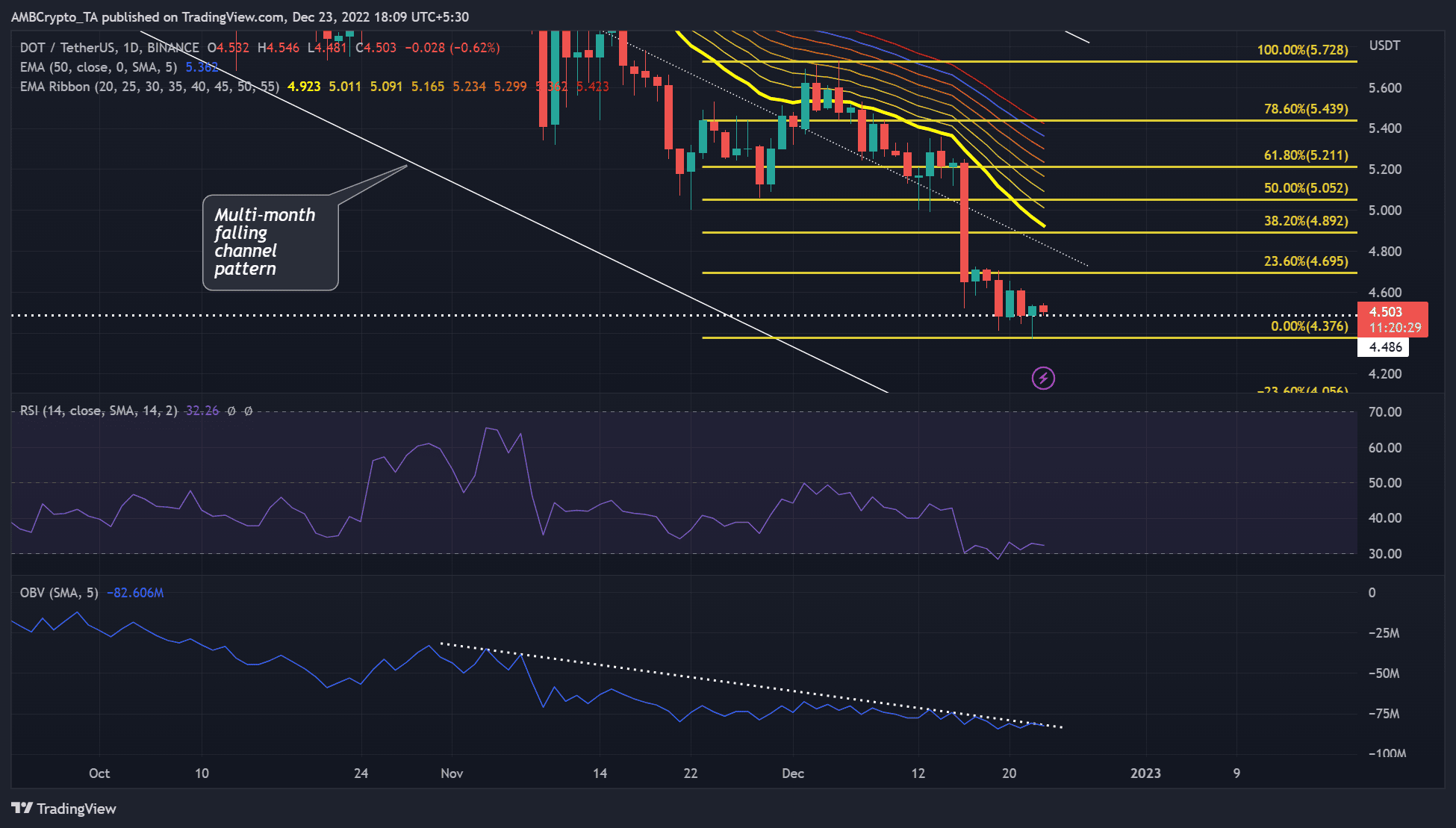

Polkadot’s downtrend since mid-August has shaped a multi-month falling channel. It has damaged via a number of help ranges. Primarily based on technical indicators, it may break via one other one earlier than the Christmas weekend.

Specifically, the RSI recovered barely from the oversold space however moved sideways. It suggests that purchasing stress elevated, however sellers provided as a lot resistance, leading to a impartial market. However, the RSI was at 32, deep within the decrease vary, indicating that sellers nonetheless have the higher hand.

The on-balance quantity (OBV) has additionally steadily declined since November. Subsequently, DOT may proceed to commerce throughout the present sideways construction or fall beneath it. If sellers have the higher hand, the value may break the present help at $4.486 and attain $4.376.

Such a downward transfer may assist traders promote excessive and purchase again cheaply when DOT reaches $4.376. Nevertheless, this chance comes with an unattractive risk-reward (RR) ratio.

How many Polkadot (DOT) are you able to get for $1?

A break above the higher boundary of the buying and selling vary at $4.695 would invalidate the above bearish bias. Nevertheless, DOT bulls might want to overcome the fast bearish order block at $4.602 to maneuver above the higher vary boundary.

The upside transfer will permit DOT to give attention to the EMA Ribbon stage at $4.923.

Traders’ outlook remained bearish regardless of the current enhance in growth exercise

Supply: Santiment

The DOT’s weighted sentiment remained damaging for many of December. On the time of publication, it slipped even deeper into the damaging territory. This implies that traders remained extraordinarily pessimistic concerning the asset.

Apparently, the regular enhance in growth exercise solely drove the DOT value greater round 13-15 December, when sentiment improved barely. Might the current damaging sentiment enhance and growth exercise enhance negate the constructive outlook for DOT’s value?