How They Are Made And What’s Special To Attract Bitcoiners

Solely Casey Rodarmor, the creator of this set of requirements, will not be joyful to name these items NFT. He thinks the time period has grow to be stigmatized, so he refers to those issues as “digital artwork.” Whether or not you name it “digital artwork” or “ordinal NFT,” they use “ordinal principle” to mark and monitor these “inscriptions,” that’s, knowledge/content material embedded within the blockchain.

The so-called “ordinal quantity” is a quantity that describes a particular place inside a sequence (e.g., “first,” “second”). And right here, “ordinal quantity” refers back to the UTXO (unspent transaction output) of a particular Satoshi (satoshi, the smallest unit of Bitcoin). This Satoshi “accommodates” an inscription, which is the content material of NFT, which will be textual content, footage, HTML recordsdata, and even MP3 (music recordsdata); and the ordinal quantity marks this Satoshi with the inscription as a particular transaction, So customers can find and monitor them. Surprisingly, such a sorting system for Satoshi was proposed as early as 2012.

Since its launch in January, greater than 1,000 digital artworks have been immortalized on the Bitcoin blockchain. These inscriptions embody screenshots from Twitter, a burgeoning assortment of NFTs, an advert for Keet.io software program, and even an 8-pixel online game (like a clone of the standard shooter Doom you can play within the ordinal block explorer).

Along with these trivial however enjoyable footage, video video games, and extra, ordinal NFTs can be used as tamper-resistant, censorship-resistant storage for delicate data.

Not like earlier NFTs based mostly on the Bitcoin blockchain, ordinal NFTs don’t use Bitcoin’s OP_RETURN output (this opcode additionally permits customers to retailer arbitrary knowledge on the chain). As an alternative, it makes use of the transaction witness (witness knowledge) subject of the Bitcoin block and tapscript (the scripting operate that appeared due to the Taproot improve in 2021).

Ordinal NFTs are native to Bitcoin, so it doesn’t require a brand new blockchain nor a brand new token. And it additionally shops the whole content material of the NFT on the chain, in contrast to different NFT requirements that solely put a hyperlink on the chain.

This innovation has unlocked new software situations for block area (at the least lowered the boundaries to entry). Naturally, this has some miners hoping that ordinal NFTs will additional drive demand for block area and generate larger charge income, however not everyone seems to be proud of the innovation – some within the Bittheism camp I believe that is at finest a trivial gadget, and at worst an assault on Bitcoin.

Counterparty, RarePepes, and the Return of Bitcoin NFTs

Earlier than we dive into ordinal NFTs, let’s take a second to take a look at previous makes an attempt to mint NFTs on Bitcoin.

Anyway, NFT did originate from Bitcoin. There have been buying and selling playing cards and “Pepe the Frog” on Bitcoin lengthy earlier than the prime punks and floppy-eyed monkeys on the Ethereum and Solana chains grew to become movie star toys. Pei is the one with the large eyes and the unhappy expression.)

NFTs first appeared in 2015 on Counterparty, a blockchain community that makes use of Bitcoin’s OP_RETURN output to make non-homogeneous belongings. After OP_RETURN was launched in March 2014, Robby Dermody, Adam Krellenstein, and Ouziel Slama launched Counterparty in November. In 2015, the primary set of NFTs on this platform appeared, a card change recreation much like “Magic-the-Gathering” known as “Spells of Genesis.”

Visitors Jam, the actual explosion of Counterparty, got here after the launch of 1774 NFTs of the Frog Pepe Change Card collection. Collectors use the Counterparty pockets to maintain these NFTs, and Counterparty makes use of the OP_RETURN output to anchor the index of those NFTs to the Bitcoin blockchain. The dimensions of the information that may be hooked up to the OP_RETURN output is proscribed to 80 bytes, which is simply sufficient for the Counterparty to place the outline, identify, and amount of the NFT.

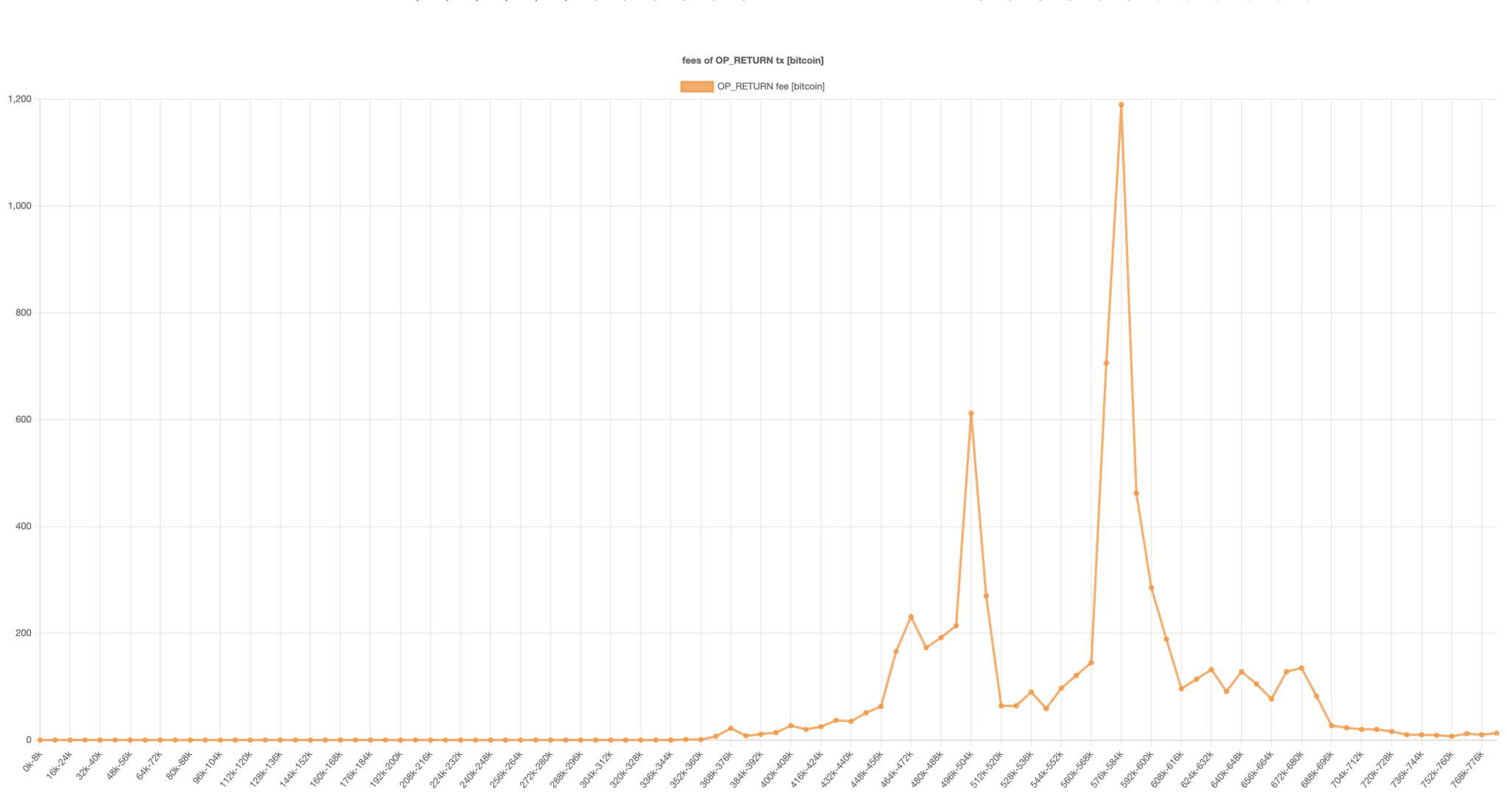

The quantity of OP_RETURN transactions peaked in late 2018, bottomed out within the spring of 2019, after which pale away in 2020 with the exits of OMNI (the platform the place Tether initially issued USDT) and Counterparty. 2019 ~ 2020 can also be the time when USDT migrated to Ethereum, and early NFT initiatives on Ethereum emerged.

The picture above raises a powerful query for ordinal NFTs which are nonetheless of their infancy: Will ordinal NFTs comply with of their footsteps? Or can it have a larger affect?

What are Ordinal NFTs?

Persevering with from the earlier guide, let’s check out a number of primary modules of ordinal NFT:

- The witness knowledge subject of the transaction is the place the information and content material of the NFT are saved.

- Inscription: It’s the most important physique of NFT – the precise content material placed on the Bitcoin blockchain, and NFT represents the possession of those contents. The inscription might be engraved within the witness knowledge subject of the transaction’s enter, and the NFT might be given to the primary satoshi of the primary output of the transaction. You’ll additionally see individuals seek advice from inscriptions as “digital paintings/serial NFTs”—these three phrases can already be used synonymously.

- Envelope: The inscription might be saved (throughout the witness knowledge) in what Rodarmor calls the “envelope,” which contains the OP_IF and OP_FALSE opcodes. Similar to OP_RETURN, these opcodes ship directions to the Bitcoin blockchain. Within the “envelope” utilization, OP_IF holds the information being imprinted, and OP_FALSE ensures that the information isn’t truly executed and pushed onto the stack (so, whereas some cultists are panicking, in actuality, The total node doesn’t have to course of and confirm the inscription, it solely must course of and confirm the UTXO set, and NFT is free in it).

- Ordinal: The mathematical principle of numerical ordering, used right here to establish particular person satoshis as “digital paintings” (aka “ordinal NFT”). The ordinal quantity defines the primary satoshi of the primary output of a transaction as an NFT; as soon as marked, this satoshi can change fingers and be traded like every other NFT.

Not like counterpart NFTs (solely 80 bytes on-chain), ordinal NFTs haven’t any measurement restrict, restricted solely by the 4MB measurement of the transaction witness knowledge subject. So, in case your recordsdata are sufficiently big, you might theoretically mint a single order NFT that would fill a whole Bitcoin block with simply its textual content.

The Tapscript led to by the Taproot improve, and the transaction witness knowledge subject introduced by the Segregated Witness improve enable all of this to be mixed.

After the remoted witness improve in 2017, the signatures of Bitcoin transactions will be moved from the “ScriptSig” subject to the witness knowledge subject, and the information on this subject won’t be included within the transaction Merkle tree. of the block and is positioned solely in a separate space (therefore its identify, “Segregated Witness”).

Segregated Witness expands the block measurement restrict since not one of the knowledge within the witness knowledge subject takes up the 1 MB that Bitcoin initially allotted to blocks. Because of this, the Segregated Witness improve introduces a brand new methodology of measuring block sizes known as “block weights.” The info positioned within the witness knowledge subject might be “heavier” than the information positioned within the preliminary block area, which is gentle.” Subsequently, it’s cheaper to retailer knowledge within the witness knowledge subject of a separate witness transaction than with in-block knowledge storage. That is known as “witness knowledge discounting” and is essential to performing standard NFTs.

One other key’s upgrading Taproot. Regardless of introducing a reduction on witness knowledge, Segregated Witness nonetheless limits the quantity of knowledge a single transaction can embody within the witness knowledge subject. The Taproot improve relaxes these necessities, eradicating the restriction solely, so you might theoretically use the whole block area to write down an NFT of as much as 4MB of content material.

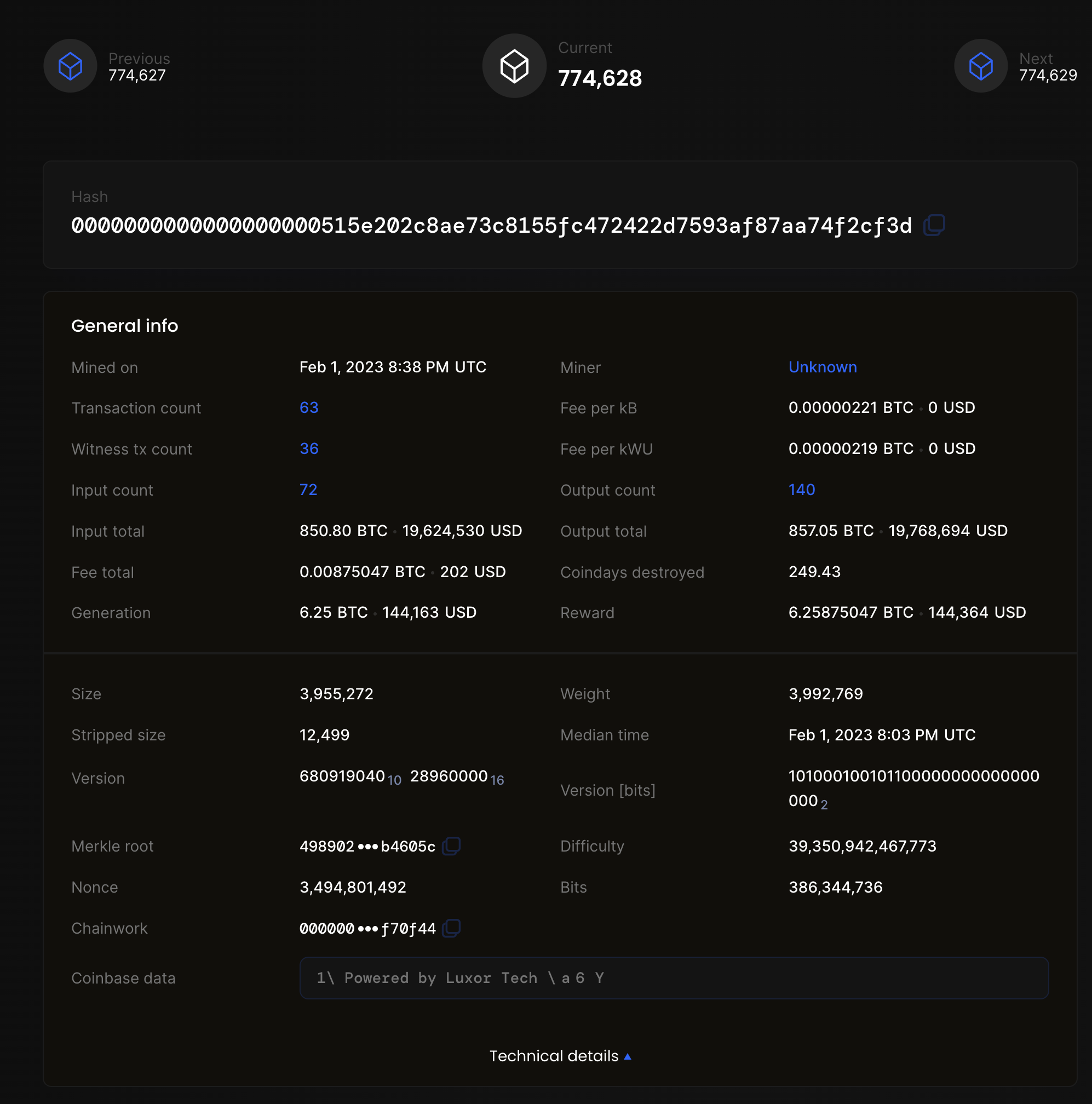

The most important block ever, NFT has credited 3.94 MB, whole block measurement of three.96 MB

What Ordinal NFTs Imply for Bitcoin Miners?

Ordinal NFTs have grow to be a scorching subject amongst Bitcoiners, though their creators have tried to keep away from controversy by calling them “digital artwork.”

There are mainly two camps. Those that help it argue that Bitcoin’s block area is a free market; should you pays the transaction charge, you should use the block area, regardless of how massive or what the transaction accommodates. The opposing occasion claims that NFTs are all scams and can take up block area. These junk transactions will crowd out extra significant financial transactions (similar to extraordinary transfers); bandwidth necessities.

Ordinal NFTs have additionally entered the bigger debate over Bitcoin’s safety price range. Proponents argue that this new software will drive demand for block area, which is nice for the way forward for Bitcoin as its block reward ultimately drops to zero. Naturally, miners are additionally within the debate about block area and charges, which as soon as accounted for 30% of their whole revenue, however now, in good instances, solely account for 3%.

There are simply over 1,000 ordinal NFTs in circulation proper now, in order that they haven’t achieved parabolic progress in transaction charge charges.

That mentioned, each Bitcoin transaction charges and block sizes did improve considerably within the final two days of January, however a few of the improve could also be on account of a 3% drop in Bitcoin’s hash fee from its all-time excessive, which is The time to provide a block is longer, which ends up in an extended time for transactions to enter a block and better dealing with charges. However with out the inscription craze for ordinal NFTs, we possible wouldn’t see will increase in transaction charges and block sizes.

Ordinal NFTs most probably won’t improve transaction charges. After all, they will result in larger charges, however not in the best way you assume. In any case, a block stuffed with digital paintings may theoretically carry fewer charges than a block full of standard Bitcoin transactions, because of the SegWit low cost.

However suppose sufficient customers begin minting ordinal NFTs. In that case, they’ll compete fiercely with extraordinary transactions for block area, and customers who broadcast extraordinary transactions might want to improve their dealing with charges to get their transactions packaged. On this method, miners could prioritize packing as many extraordinary transactions as doable as a result of they pay larger charges per their knowledge, so the extra extraordinary transactions they pack, the upper the charge revenue.

Subsequently, even when ordinal NFT will generate upward strain on dealing with charges, miners could prioritize packaging extra extraordinary transactions to generate larger dealing with charges.

Shortage

Transaction charges couldn’t be miners’ most important revenue supply, however slightly the invention of uncommon Satoshi.

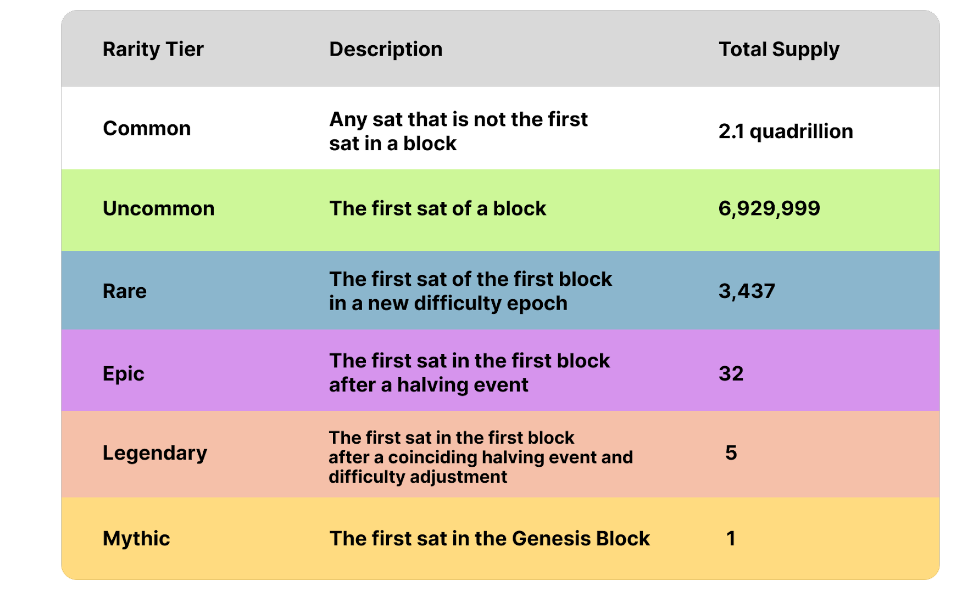

Casey Rodarmot presents a graph illustrating the rarity of varied satoshis in a weblog publish on ordinal quantity principle. The self-regulating occasions of Bitcoin’s proof of labor, notably the issue adjustment occasion and the halving occasion of the issuance fee, are the main focus of this taxonomy. As an example, the primary Satoshi within the first block following a halving of the problem fee might be labeled as “Epic” Satoshi; if there’s a marketplace for such Satoshi, such Satoshi may be offered to collectors for a better value.

The desk seems to be like this:

When such a collectible market exists, miners could make some huge cash promoting that Satoshi to collectors. This shortage is, in fact, based mostly purely on the idea that such a market would come up. However with all the pieces from monkeys, rocks, and even chickens discovering their collectors within the frenzy of NFT transactions, think about some Bitcoiners leaping in, chasing satoshi’s first of the brand new halving, the primary new satoshi of the issue cycle can also be not shocking.

As soon as such a collectible market exists, miners could make some huge cash promoting such Satoshi to collectors. After all, this shortage is solely based mostly on the idea that such a market will come up. However with all the pieces from monkeys to rocks, to even chickens discovering their collectors within the frenzy of NFT transactions, think about some Bitcoiners leaping on the bandwagon, chasing the primary satoshis of a brand new halving cycle, the brand new first satoshi of the issue cycle is no surprise both.

Ordinal NFTs: Anomaly?

Casey Rodarmor’s innovation has solely been round for a couple of month and has already grow to be essentially the most controversial subject in Bitcoin circles this 12 months.

The opposition is so robust that Bitcoin Core contributor Luke Dashjr has written a crude filter for node operators’ retweets), though the efficacy and affect of this device are unsure. OP_FALSE signifies that the inscription knowledge doesn’t have to be verified, and the pruning node won’t save the witness knowledge of the transaction in any respect.

There are additionally individuals on the opposite aspect, and many individuals — together with Bittheists and extraordinary cryptocurrency lovers — are enthusiastic about this new method of minting NFTs. Along with pictures and collectibles, ordinal NFTs can be used to publish delicate paperwork that may profit from everlasting, censorship-resistant storage and replication. Bitcoin customers can curate an “immutable library” by inscribing ordinal NFTs to borrow the phrases of Galaxy Digital’s Brandon Bailey.

For miners, this innovation can result in elevated transaction charges sooner or later, open extra revenue streams for miners (mining uncommon Satoshi), and even generate “miner extractable worth (MEV).”

Regardless, ordinal NFTs usually are not going away. The one query is how a lot affect they’ll have and whether or not inscription will be capable of create the NFT craze that Ethereum and different blockchains have.

DISCLAIMER: The Info on this web site is supplied as basic market commentary and doesn’t represent funding recommendation. We encourage you to do your personal analysis earlier than investing.