Hedera’s funding rate, weighted sentiment were positive, is recovery likely?

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- HBAR may goal at a vital overhead resistance stage within the quick time period.

- Sentiment and Funding Price was optimistic, which may bolster its uptrend momentum.

Hedera [HBAR] posted over 20% good points on Saturday, 21 January, after Bitcoin [BTC] moved to the $23K zone. The uptrend momentum noticed HBAR attain a excessive of $0.0810. Nevertheless, correction occurred after BTC fell again to the $22K zone.

On the time of publication, HBAR’s worth was $0.0701, as BTC maintained its $22K stage. If BTC reclaims the $23K zone, HBAR may witness an upswing aimed toward this overhead resistance stage.

Learn Hedera [HBAR] Value Prediction 2023-24

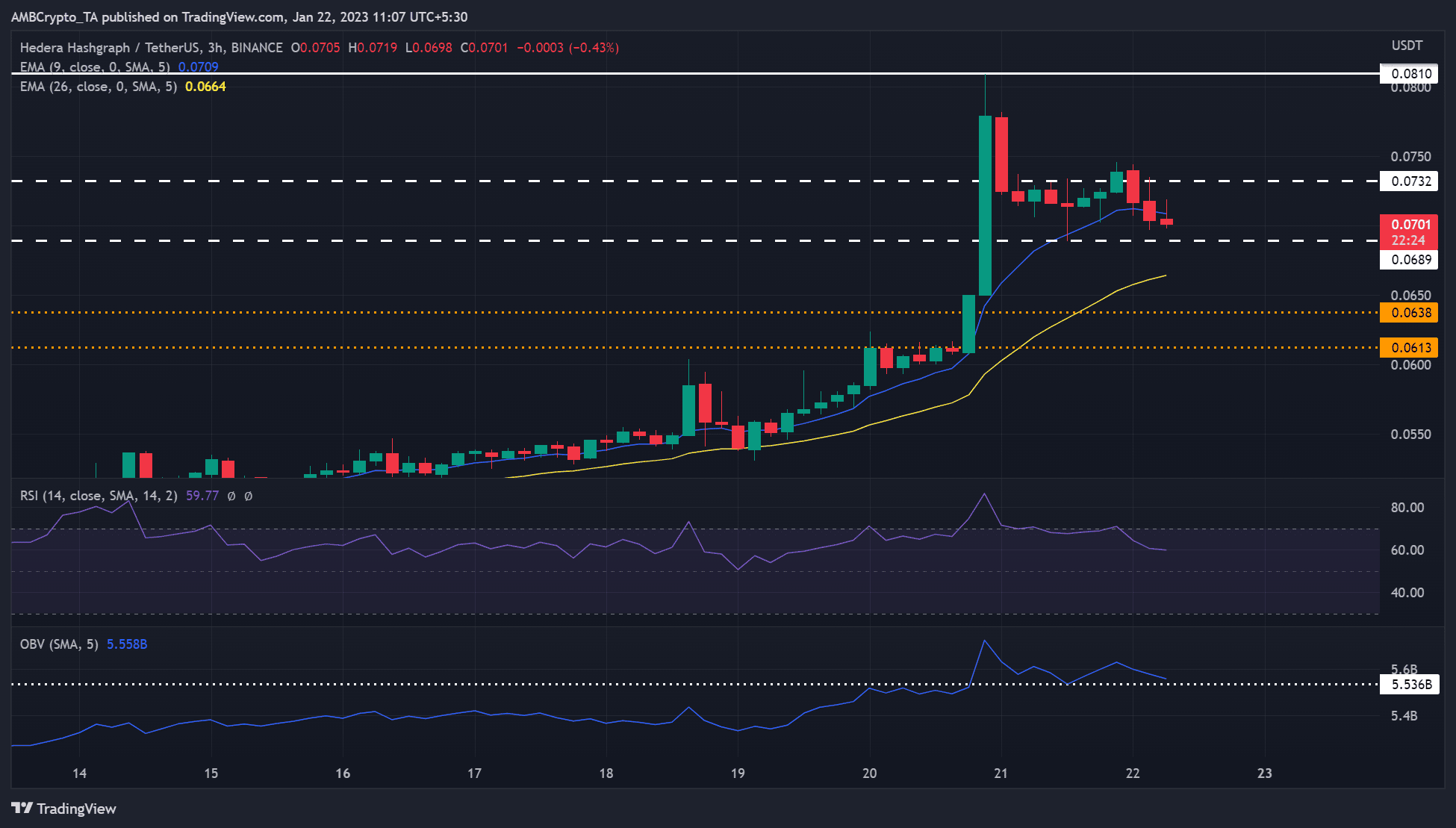

The overhead resistance stage at $0.0810

Supply: HBAR/USDT on TradingView

The three-hour chart confirmed a bullish HBAR with an RSI (Relative Power Index) of 59. The RSI had retreated from the overbought zone and rested on the 60 mark. It reveals shopping for strain declined barely.

Historic RSI patterns confirmed rejection on the 60 or 50 ranges. Subsequently, the RSI may bounce again from 60 or an equilibrium stage of fifty, initiating a restoration. It may set HBAR to retest or break above the $0.0732 stage and goal the overhead resistance at $0.0810.

Nevertheless, a break under $0.0689 would invalidate the above bullish bias. The downtrend may very well be checked by the 26-period EMA or the $0.0638 assist stage.

How a lot are 1,10,100 HBARs value immediately?

Subsequently, traders ought to look ahead to RSI and On Stability Quantity (OBV). An RSI rejection on the 60 or 50 ranges will denote a possible restoration. Nevertheless, an OBV drop under the $5.54B stage (white line) will undermine any uptrend momentum as a result of restricted buying and selling volumes.

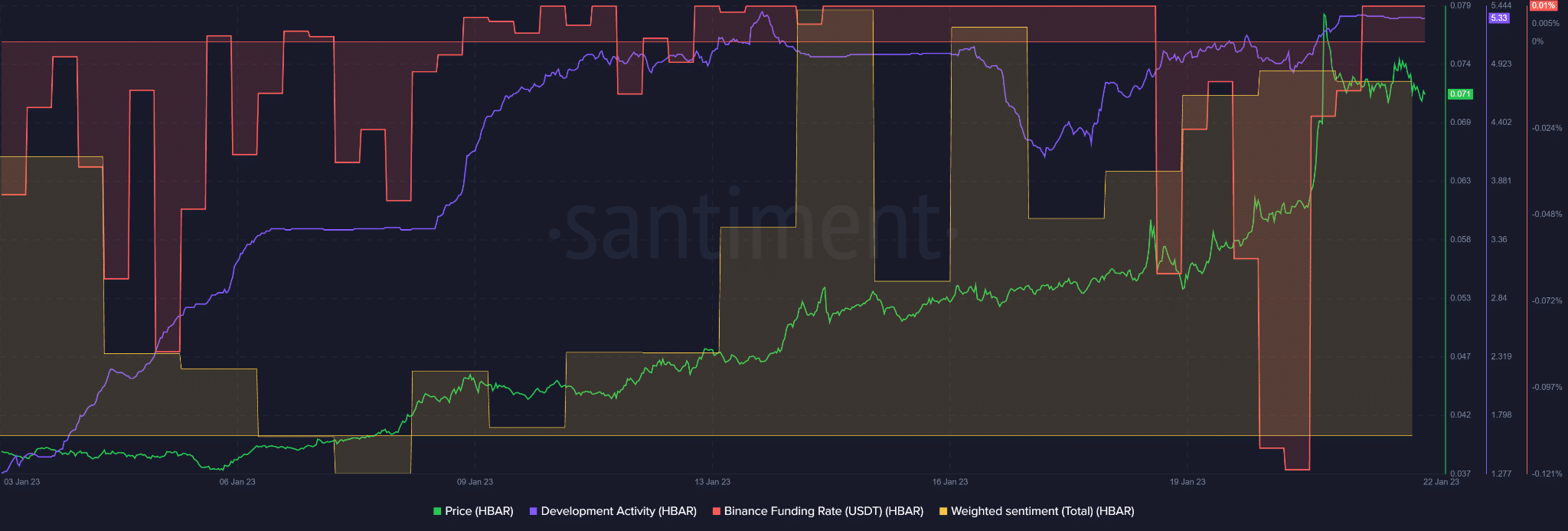

HBAR’s Funding Price and sentiment have been optimistic

Supply: Santiment

In keeping with Santiment, HBAR’s Funding Price and weighted sentiment have been optimistic, indicating the asset loved demand within the derivatives market whereas traders’ have been assured with it. This might increase the asset’s uptrend momentum.

The traders’ confidence may be partly attributed to HBAR’s spectacular improvement exercise development. Nevertheless, the event exercise was stagnant at press time.

Though the stagnation may have an effect on the HBAR’s sentiment and worth, BTC worth motion considerably impacts the asset’s efficiency. Subsequently, traders ought to monitor BTC to gauge HBAR’s doable pattern course.