Curve Finance: Few factors to consider before you leap into any CRV trade

- CRV’s worth has rallied by over 100% for the reason that yr began.

- Patrons can not help any additional worth rally, as bullish sentiment weakens.

The value of Curve Finance’s CRV token has seen a big improve, doubling in worth for the reason that starting of the present bull cycle. Exchanging palms at $1.08 at press time, the alt’s worth has risen by 107% within the final 30 days, knowledge from CoinMarketCap confirmed.

Learn Curve Finance’s [CRV] Value Prediction 2023-24

As CRV’s worth rallied, its day by day buying and selling quantity grew as effectively. Per knowledge from Santiment, within the final month, CRV’s day by day buying and selling quantity has elevated by 200%. The surge in day by day buying and selling quantity over the last 30 days hinted on the elevated utility of the altcoin.

Sharks and whales see issues in another way

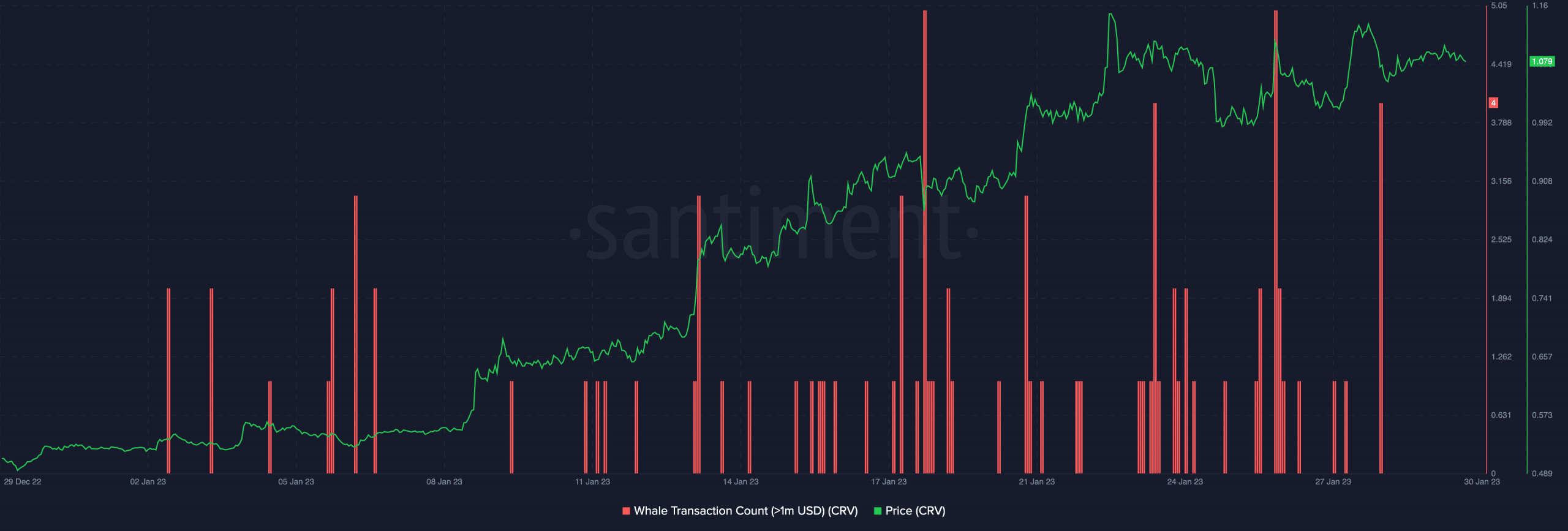

The numerous surge in CRV’s worth within the final month led to a leap within the day by day rely of whale transactions exceeding $1 million. A rise in whale transactions for a cryptocurrency is often seen as a bullish indicator and an indication of a robust perception in continued worth development.

Supply: Santiment

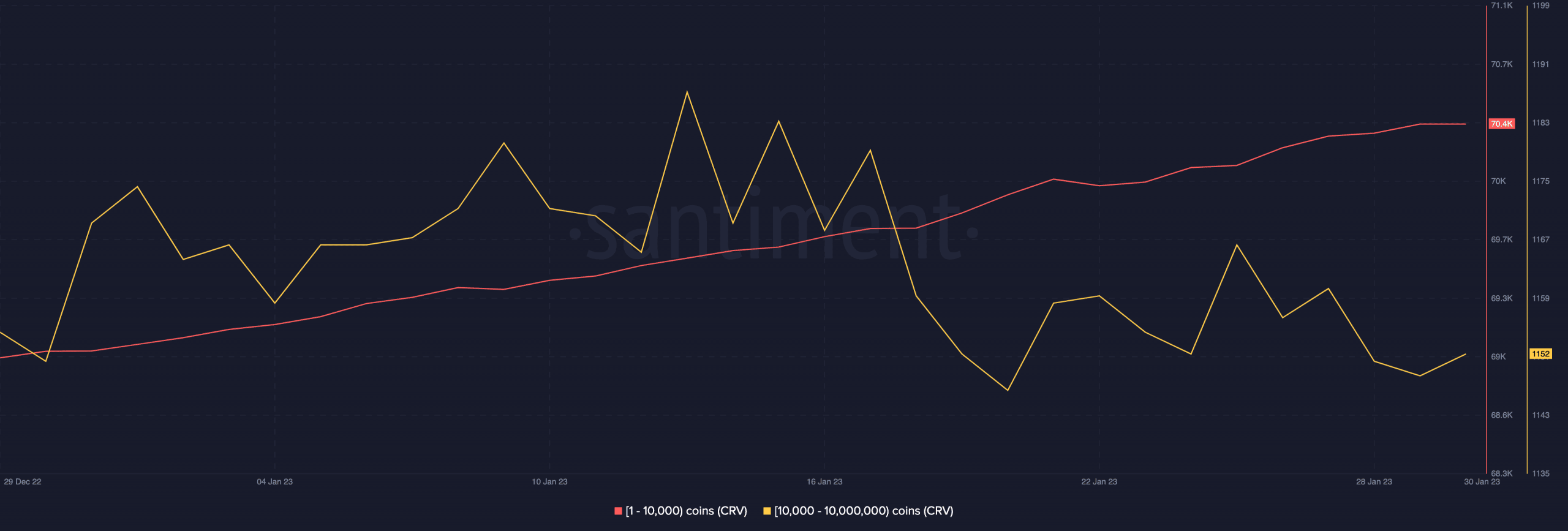

An evaluation of CRV’s provide distribution confirmed that the current worth surge was primarily fueled by CRV token holders within the 1 to 10,000 vary. This group elevated their token accumulation, inflicting their rely to rise by 2% within the final month.

Alternatively, greater stakeholders that maintain between 10,000 to 10,000,000 CRV tokens lowered their holdings through the interval underneath assessment. Per knowledge from Santiment, at press time, this cohort held 12.53% of CRV’s circulating provide. A month in the past, they held 13.23%.

Supply: Santiment

Nearer than you would possibly assume

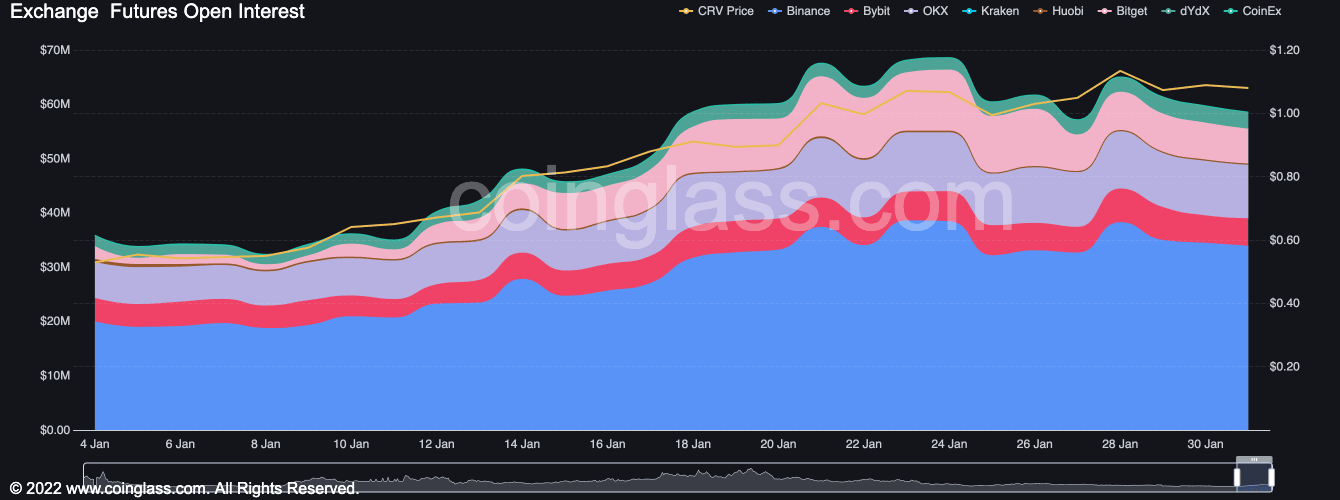

In accordance with knowledge from Coinglass, CRV’s Open Curiosity has been on a decline previously seven days. At $58.56 million on the time of writing, CRV’s Open Curiosity has fallen by 15% within the final week.

Is your portfolio inexperienced? Take a look at the CRV Revenue Calculator

A decline in a crypto asset’s Open Curiosity usually signifies that fewer contracts for future trades have been purchased or bought for that cryptocurrency.

It could possibly point out a lower in market demand and investor curiosity. A worth disadvantage usually follows this declining demand.

Supply: Coinglass

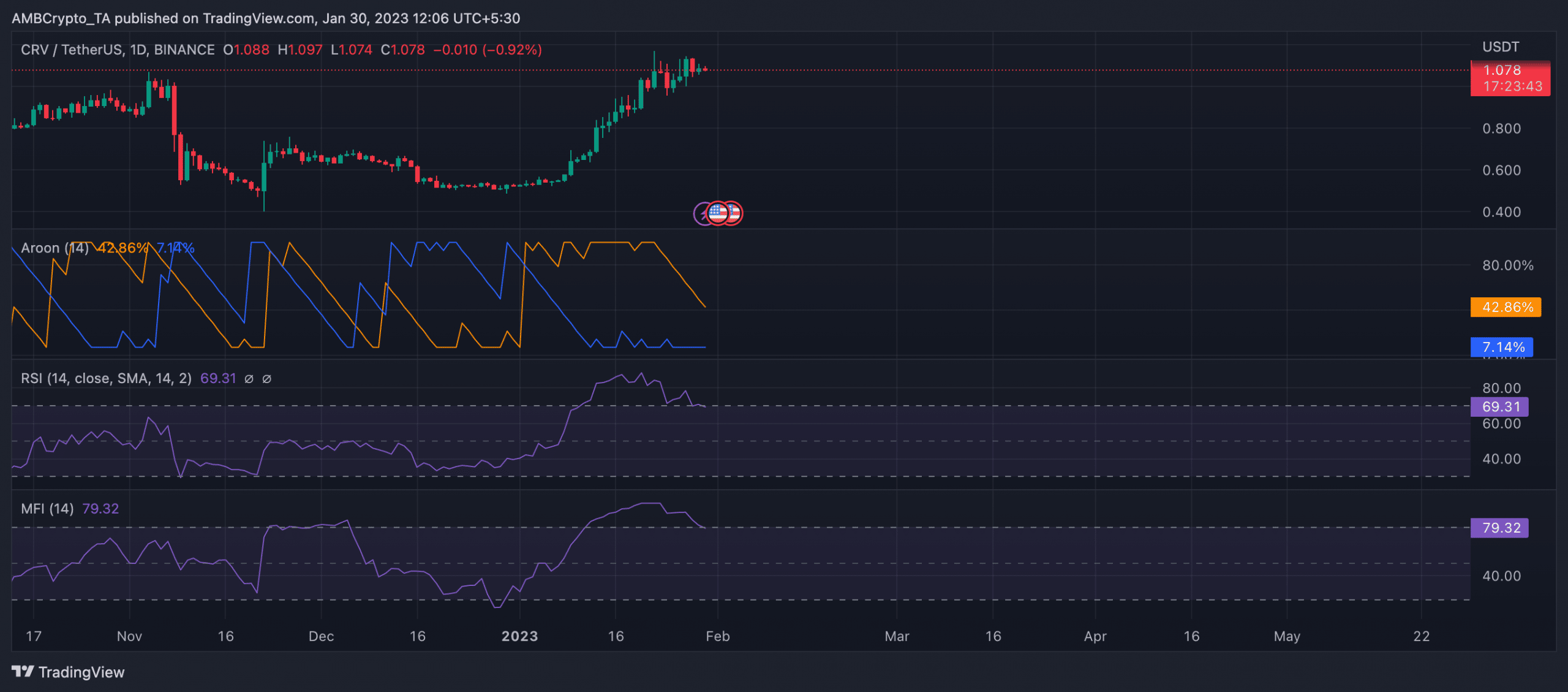

An extra evaluation of CRV’s worth motion on a day by day chart revealed that key indicators Relative Power Index (RSI) and Cash Move Index (MFI), have been pegged at overbought highs.

These positions are generally marked by consumers’ exhaustion as they discover it onerous to provoke any additional worth rallies. At press time, the RSI was 69.31, whereas the MFI was 79.32.

Whereas many is perhaps led to imagine that the rising worth was conclusive proof that bullish sentiment lingered out there, a take a look at the Aroon indicator confirmed that the bullish development out there had weakened severely.

At press time, the Aroon Up line was in a downtrend at 42.86%. The Aroon indicator measures the energy of an uptrend by figuring out how current the newest excessive was reached.

When the Aroon Up line is near 100, it exhibits a robust uptrend. Alternatively, if it’s near zero, the uptrend is weak and will point out a possible development reversal.

Supply: CRV/USDT on TradingView