Heavy speculative demand for Aptos in South Korea tied to hopes of…

- Debunking the rationale behind Aptos’ sudden rise to fame.

- Demand for APT slows down within the prevailing market circumstances.

Each as soon as in an extended whereas, a crypto challenge makes it into the checklist of the highest blockchain networks and quickly climbs up the ranks. Aptos is essentially the most notable challenge to attain this, however why has it quickly grow to be so standard?

Is your portfolio inexperienced? Try the Aptos Revenue Calculator

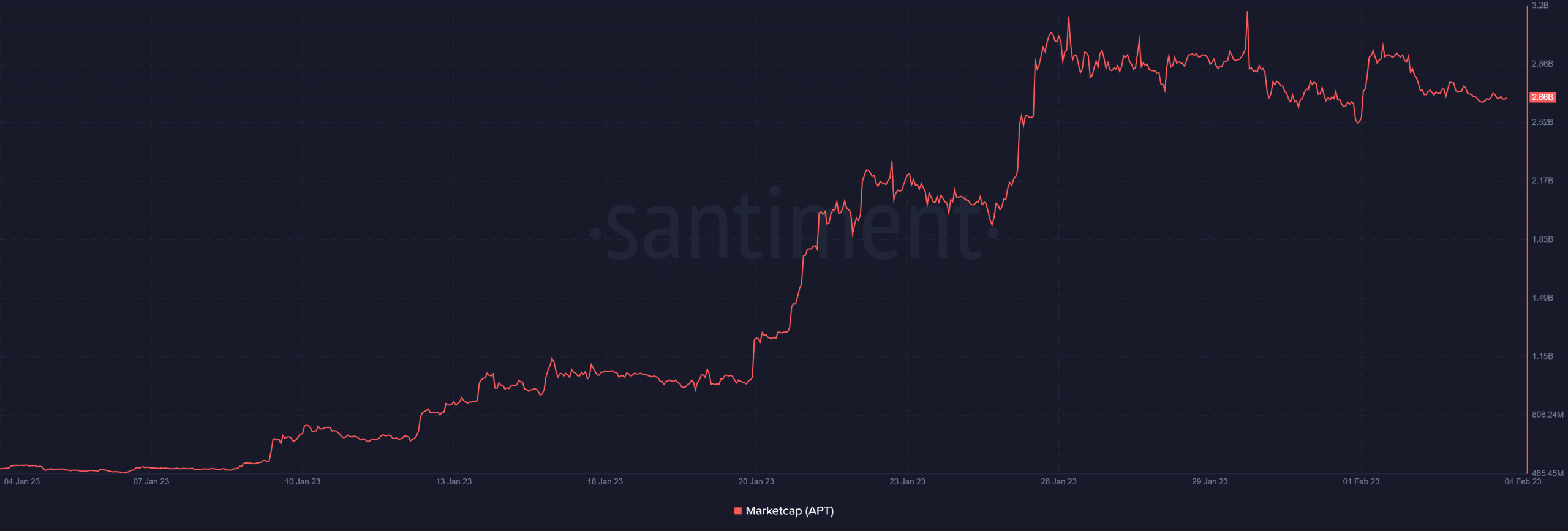

Aptos’ market capitalization was simply over $2.5 billion on the time of writing. For perspective, its market cap initially of 2023 was lower than $500 million, therefore it grew by barely over $2 billion throughout the final 5 weeks.

This development has earned it a spot within the prime 30 blockchain networks by market cap. An abnormally giant inflow of capital in such a brief interval, particularly for a lesser-known challenge.

There is no such thing as a official phrase out on why Aptos’s native cryptocurrency APT is experiencing such sturdy demand. Nevertheless, there are claims that Koreans have been calling the native coin “residence.”

The narrative behind that is that Koreans have been shopping for and holding APT hoping that it’s going to in the future be excessive sufficient to help an residence buy.

For these of you questioning why $APT is $17. Aptos is a meme coin in Korea.

The #1 asset class in Korea is actual property — extra particularly, Residences.

Retail is asking Aptos “residence” claiming individuals can in the future afford to buy an precise residence in the event that they maintain $APT.

— Alex Shin (@AlexShin) February 4, 2023

A chicken’s eye view

Earlier experiences indicated that there was sturdy shopping for strain coming from South Korea. Unsurprisingly, Aptos hails from Korea and has a robust neighborhood within the nation. The community simply concluded its first hackathon which was held in Seoul, the capital of South Korea.

.@Aptos_Network‘s Seoul Hackathon has come to a conclusion.

It was a pleasure assembly so many associates that flew in from around the globe and in addition the Korea-based groups which can be constructing tasks on Aptos!

See everybody on the subsequent hackathon.

Trace: prior to you assume

— Ferum (@ferumxyz) February 5, 2023

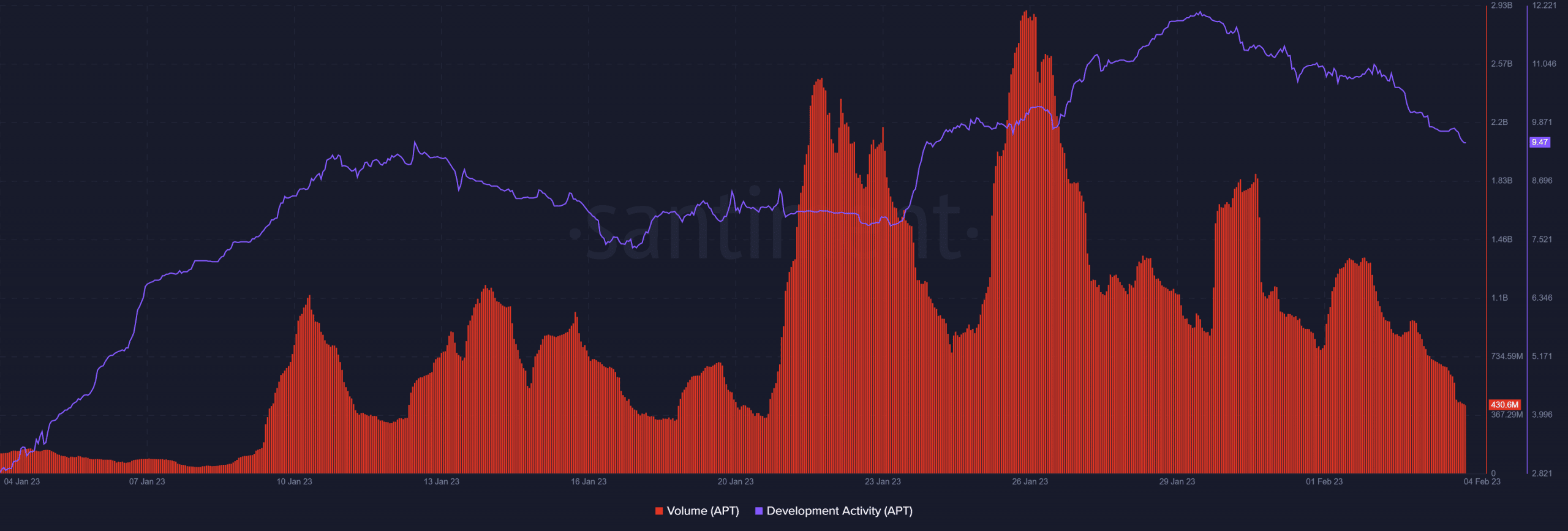

Moreover, Aptos skilled a surge in growth exercise for the reason that begin of January. Nevertheless, the event exercise dropped considerably throughout the previous few days of the hackathon.

Equally, it skilled a robust surge in quantity throughout the final 4 weeks, which then peaked within the final week of January.

Supply: Santiment

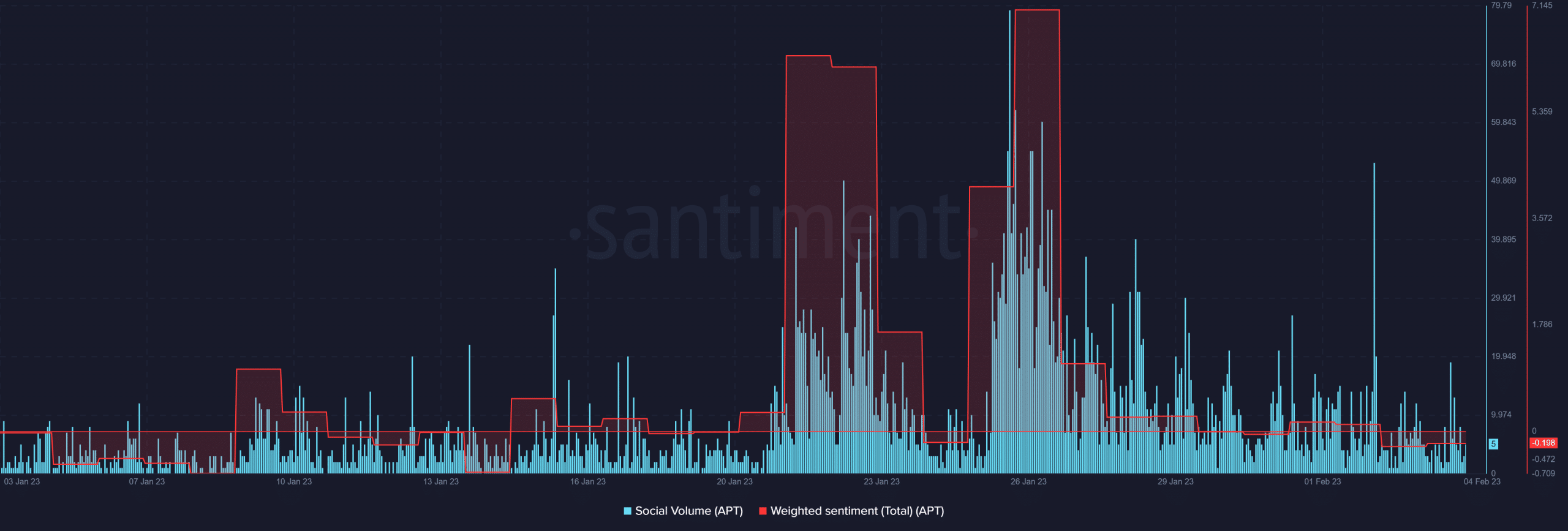

Can Aptos preserve this demand? Effectively, to date now we have seen a drop within the community’s social quantity. This coincides with decrease quantity, therefore visibility has been fading.

The weighted sentiment additionally tanked within the first 5 days of February, confirming that there’s now a bearish bias.

Supply: Santiment

The sentiment displays the market cap efficiency. The token’s market cap, at press time, was down by over $500 million throughout the final six days, therefore there was some promoting strain.

This implies the wave of demand as seen in January has come to its conclusion and profit-taking has been occurring as indicated by the market cap decline.

Supply: Santiment

The speed of outflow additionally means that many APT holders are opting to HODL fairly than promote. This is the reason the promoting strain noticed in the previous few days has not manifested as an enormous drop.

APT’s present efficiency seems consistent with the general crypto market efficiency even at its $15 press time worth.

Conclusion

A little bit of analysis reveals that there’s not a lot of a distinction that units Aptos other than different PoS networks. The important thing defining attribute is that it’s South Korean and it’s receiving a number of help from its residence market.