Chainlink [LINK] beats its contemporaries, thanks to dApp activity

- Chainlink scored the very best in attracting builders to construct on its community prior to now six months.

- LINK would possibly proceed its free fall, no matter its elevated staking exercise.

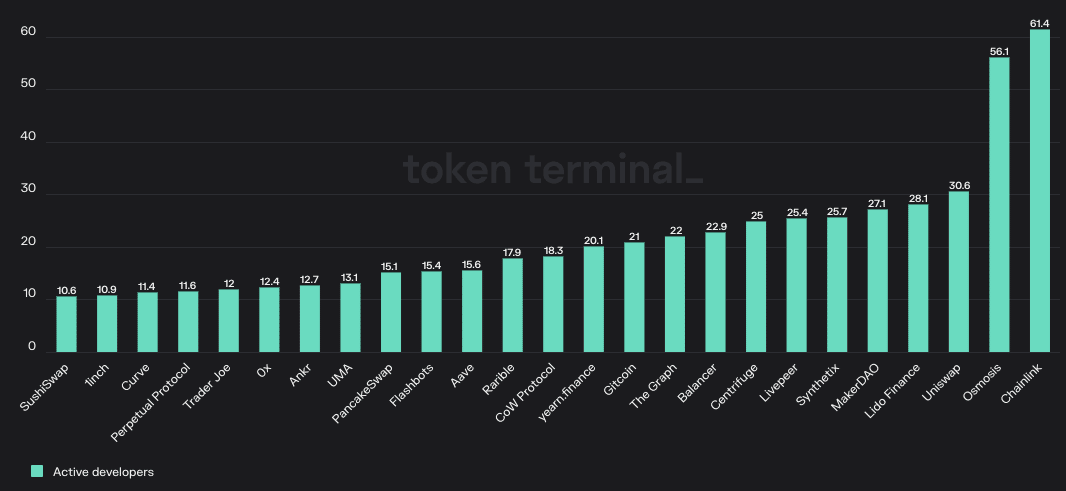

Decentralized oracle community Chainlink [LINK] topped the checklist of purposes when it comes to Decentralized Purposes (dApps) improvement over the past 180 days, information from Token Terminal disclosed.

In accordance with the knowledge from the platform, LINK’s lively builders primarily based on dApp improvement had been 61.4, beating the likes of Osmosis [OSMO] and Uniswap [UNI].

Supply: Token Terminal

Learn Chainlink’s [LINK] Value Prediction 2023-24

Chainlink undoubtedly deserved the feat, as evidenced by the quite a few partnerships and integrations it had inside the stated interval. Whereas this may very well be thought of a formidable efficiency, primarily because of the bear market, it had didn’t replicate on LINK’s value.

In accordance with CoinMarketCap, LINK’s 90-day efficiency had decreased by 28.08%. Furthermore, LINK was unable to change the pattern as the value slid by 4.32%.

How lengthy earlier than the bears depart energy?

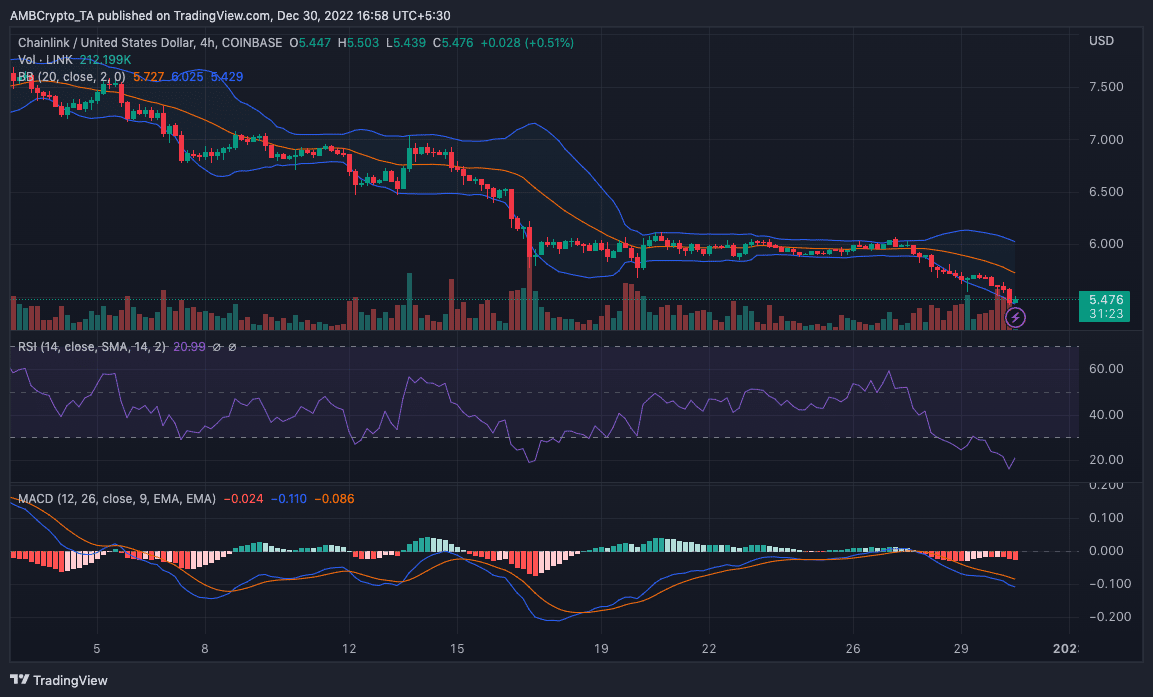

Indications derived from the four-hour chart confirmed that LINK had misplaced management to the bears. As revealed by the Relative Power Index (RSI), LINK was languishing within the oversold area. Because it was down at 20.99, it implied that pace and value motion change didn’t cross the underside swing check. Nonetheless, elevated shopping for momentum would possibly show sufficient to set off a reversal.

Per its volatility, LINK demonstrated excessive indicators of unpredictability. This was as a result of the Bollinger Bands (BB) left the low unstable area on 27 December. Moreso, the LINK value, at press time, trended in direction of the decrease bands. This has been steady for the reason that date talked about above, affirming the oversold situation revealed by the RSI.

With respect to the Shifting Common Convergence Divergence (MACD), LINK approached potential entry factors slightly than a bullish transfer for positive aspects. This was because of the promoting (orange) and shopping for (blue) remaining under the histogram. This indicated a bearish momentum whereas avoiding readability for purchase triggers. Within the interim, LlNK would possibly proceed decelerating.

Supply: TradingView

Nonetheless, hold the provision operating

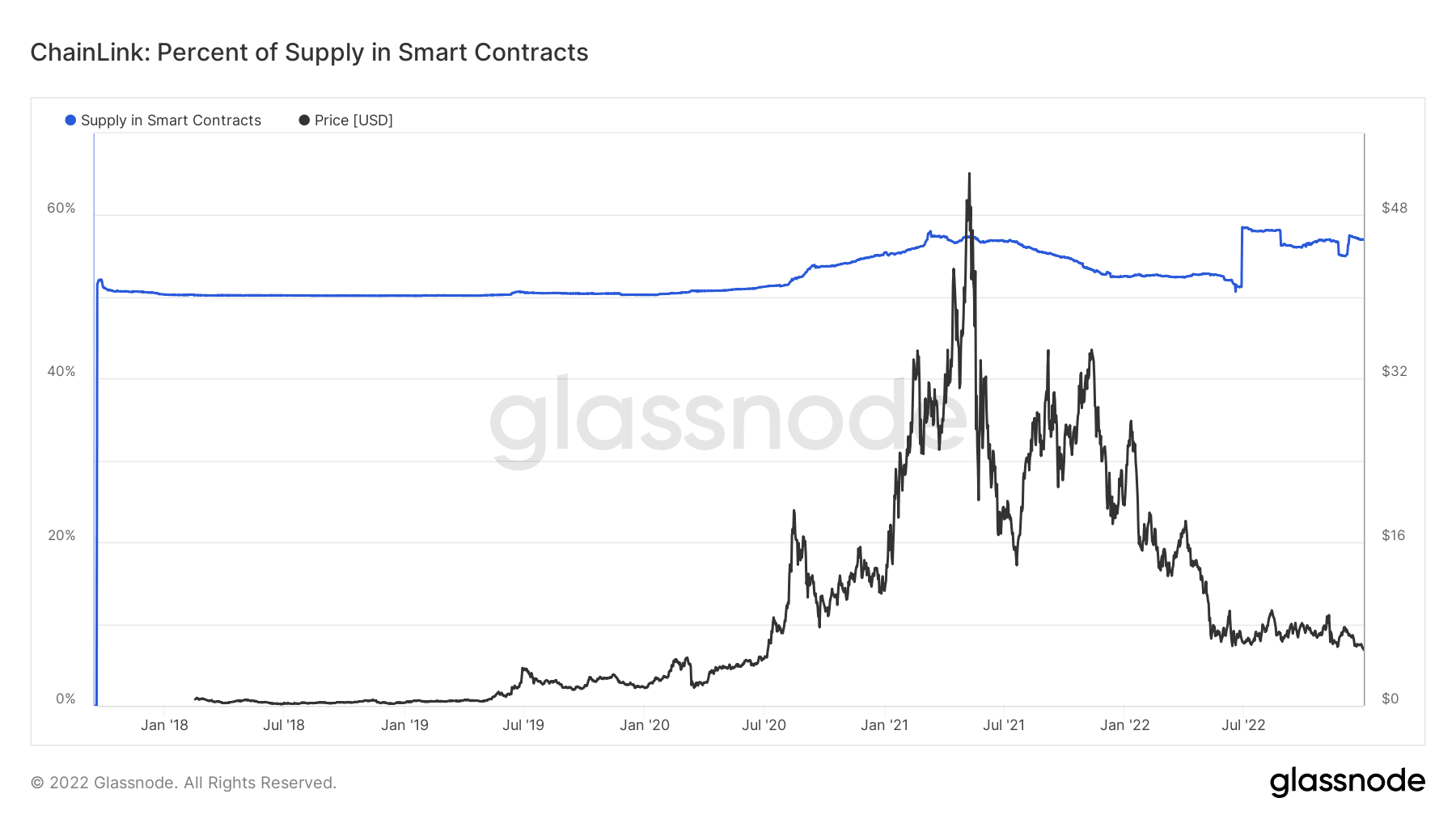

Based mostly on its on-chain information, Chainlink stored its good contracts’ affect in test. Glassnode’s information confirmed that LINK’s supply in smart contracts had recovered from the drop in June 2022. As of this writing, the provision was 57.04%. This meant that customers most well-liked to interact LINK in staking actions as an alternative of ready for an acceptable shopping for alternative.

Supply: Glassnode

Moreover, not a lot was taking place with LINK per exchange activity. At press time, Glassnode revealed that each alternate influx and outflow had been at low ranges.