Tripple top pattern explained

newbie

Candlestick patterns are an integral a part of buying and selling and technical evaluation — and the crypto market is not any exception. Though it’s usually extra unstable than its conventional counterparts, the identical guidelines apply right here, too.

On this article, we’ll check out the Triple High reversal chart sample, its significance, and methods to identify it and commerce round it. Let’s dive in!

What Is the Triple High Bearish Reversal Chart Sample?

A triple prime chart sample is a bearish candlestick sample that happens on the finish of an uptrend.

- Bearish: a market characterised by falling/downward value motion.

- Candlestick: a kind of chart that shows an asset’s opening, closing, and excessive and low costs for a predetermined interval.

- Uptrend: an total constructive/upwards value motion.

Because it signifies a change from an asset’s value going as much as happening, it’s thought of a bearish reversal sample.

The triple prime sample is the alternative of the triple backside sample, which indicators the alternative — a falling value reversing and going up, the start of a bullish development after a downtrend.

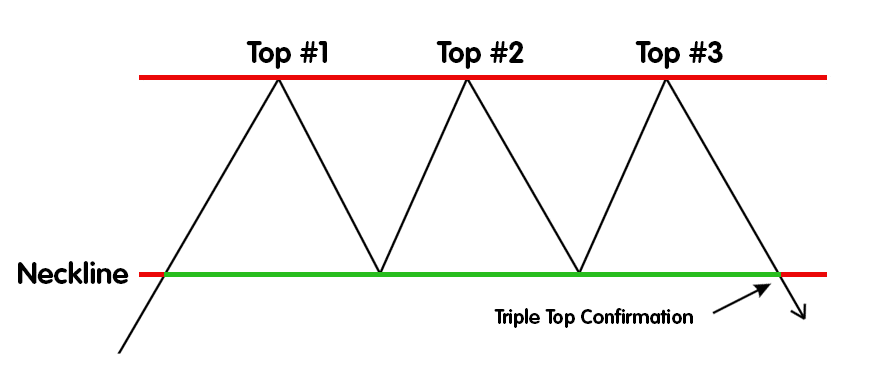

Instance of a Triple High Sample

Right here’s what a triple prime sample appears like.

The higher line, the one drawn throughout the peaks of the chart sample, is known as the horizontal resistance.

How a Triple High Works

A triple prime sample consists of a number of completely different parts:

- An uptrend: An asset’s value needs to be going up for the triple prime sample to start out.

- Three peaks: The worth of an asset ought to try to interrupt by way of the resistance 3 times and fail, creating three “mountain tops.”

- A neckline: When an asset’s value reverses after the primary two peaks, it ought to hit the help line, which, when damaged, will signify the uptrend reversal.

- Horizontal resistance: The development line that shows the resistance space, the value degree that an asset’s value can’t overcome.

The triple prime chart sample happens when patrons lose their energy as they’re unable to interrupt by way of the resistance line.

There may be additionally a double prime chart sample — it provides the identical sign, albeit a weaker one. Three consecutive failures to cross over the resistance value degree make patrons hesitant and anxious, drastically decreasing the chance of the continuation of bullish sentiment.

Tips on how to Spot a Triple High Sample

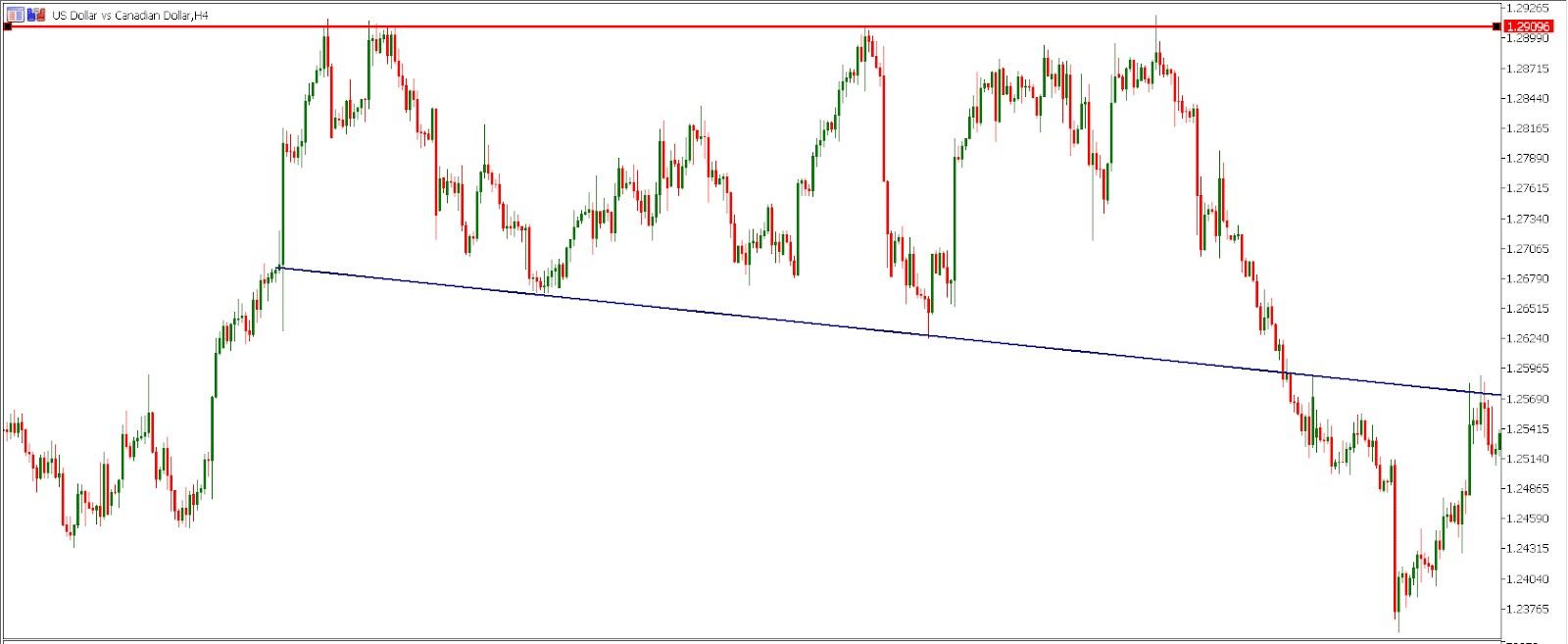

When searching for triple prime chart patterns out within the wild, don’t get too hung up on the peaks: they’re not often completely equal in actuality. The horizontal resistance and the neckline are often a bit slanted.

The three most important elements of the triple prime chart sample are the preliminary uptrend, the insurmountable resistance, and the next downtrend. Nonetheless, how do you see it earlier than the downtrend — and even all three peaks — seem?

Right here’s an instance of a triple prime sample for the USD/CAD pair. Discover how there are smaller peaks in between the large ones, and the neckline/resistance degree each aren’t completely horizontal.

When making an attempt to establish triple prime chart patterns earlier than they’re absolutely shaped, be cautious of blending them up with double tops. We are going to speak about entry factors within the subsequent part, however for now, it is very important notice that buying and selling triple tops earlier than the neckline is damaged might be dangerous. Nonetheless, it’s best to look out for the peaks after the uptrend and be able to react.

Buying and selling Triple High Patterns

As triple prime (and equally, triple backside) patterns are fairly uncommon, they are often laborious to identify and to commerce. Listed below are some recommendations on the right way to do it in probably the most environment friendly approach.

In terms of entry factors, most specialists advocate coming into triple prime trades solely after the value breaks by way of the resistance — as in, when a candle closes under the neckline.

You may enter proper on the breakthrough, however this entry level isn’t the most secure as a result of the asset can doubtlessly shoot up in value shortly after. Another choice is coming into because the asset retests the damaged neckline — as in, its value approaches the earlier resistance degree.

Both approach, your quick place setup shall be considerably related. In an effort to reduce threat, you will have to position a stop-loss above the neckline and set a value goal equal to the space between the tops and the neckline.

Errors to Keep away from When Buying and selling the Triple High Chart Sample

Triple prime patterns might be fairly laborious to commerce. The primary mistake you may make is coming into a commerce too shortly — whereas it’s potential in some instances, it is extremely dangerous. Keep away from opening a brief place earlier than the sample is confirmed by way of the breakthrough.

Nonetheless, coming into too late can be a mistake — at that time, promoting stress will improve by an excessive amount of and trigger the value to stagnate and even rise once more. Discovering the proper entry level isn’t simple, however we advocate utilizing cease losses to safeguard your self and take a look at the waters.

Early trades — ones earlier than the breakdown — might be potential if the buying and selling quantity for the third peak is noticeably smaller than that of the opposite ones. This means that patrons have misplaced their steam.

Tips on how to Inform When the Triple High Chart Sample Will Fail

Because the triple tops might be unreliable, one ought to know some early indicators that may inform us the sample will fail. Listed below are the 2 commonest ones.

Increased Highs

If peaks get progressively greater, meaning patrons are regaining their energy, and we’re unlikely to see any accomplished reversal chart patterns.

Buying and selling Quantity at Peaks and Lows

If the buying and selling quantity on the third peak is extremely excessive, or at the least considerably greater than that of the opposite peaks, it signifies that purchasing stress remains to be sturdy. Moreover, the identical goes for the underside factors: if buying and selling quantity is greater on the second low level than the primary one, extra patrons who’re able to push again towards the bearish sentiment have joined the market.

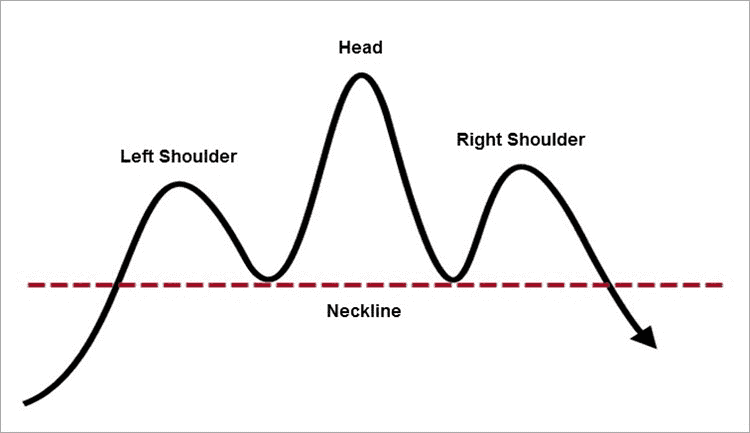

Triple High vs Head and Shoulders Sample

These two patterns are alike and may yield related outcomes. Head and shoulders, which is a bearish reversal sample, additionally consists of three peaks. Nonetheless, it has one essential distinction: its peaks are uneven, with the center one being taller than the opposite two (therefore, the sample’s identify).

The triple prime is taken into account a extra predictable chart sample: it indicators a potential reversal from the second peak. Head and shoulders, however, nonetheless provides bulls some hope throughout its second peak. Because of this, it finally ends up being extra sudden.

Disclaimer: Please notice that the contents of this text usually are not monetary or investing recommendation. The data supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.