Bull Flag Pattern: An Overview

intermediate

Studying the way to determine and use the bull flag sample is important for anybody trying to up their buying and selling recreation. It lets you spot a continuation of optimistic value motion, which, in flip, enables you to make quite a lot of revenue.

Nonetheless, patterns like bull flags are nice not just for making a revenue but in addition for gaining a greater understanding of the market as a complete. On this article, we are going to talk about what the bull flag patterns are, the way to determine them, and the way to commerce with them. Let’s go!

What Is a Bull Flag Sample?

A bull flag is a chart sample typically utilized in technical evaluation and buying and selling to determine a bullish continuation. It happens when a inventory or different safety trades in a sideways vary after an advance after which breaks out above the resistance degree, creating a powerful uptrend.

To place it merely, a bull flag sample alerts that though there could also be a brief setback, a optimistic value development is prone to proceed.

The bullish flag sample is the direct reverse of the bear flag. Whereas the previous reveals a continuation of optimistic value motion, the bearish flag sample alerts the method of a downtrend. Bear flags have the identical construction as bull flags — the flagpole and the flag itself — however are inverted. Learn extra about them right here.

Wanna see extra content material like this? Subscribe to Changelly’s e-newsletter to get weekly crypto information round-ups, value predictions, and knowledge on the most recent traits instantly in your inbox!

Keep on prime of crypto traits

Subscribe to our e-newsletter to get the most recent crypto information in your inbox

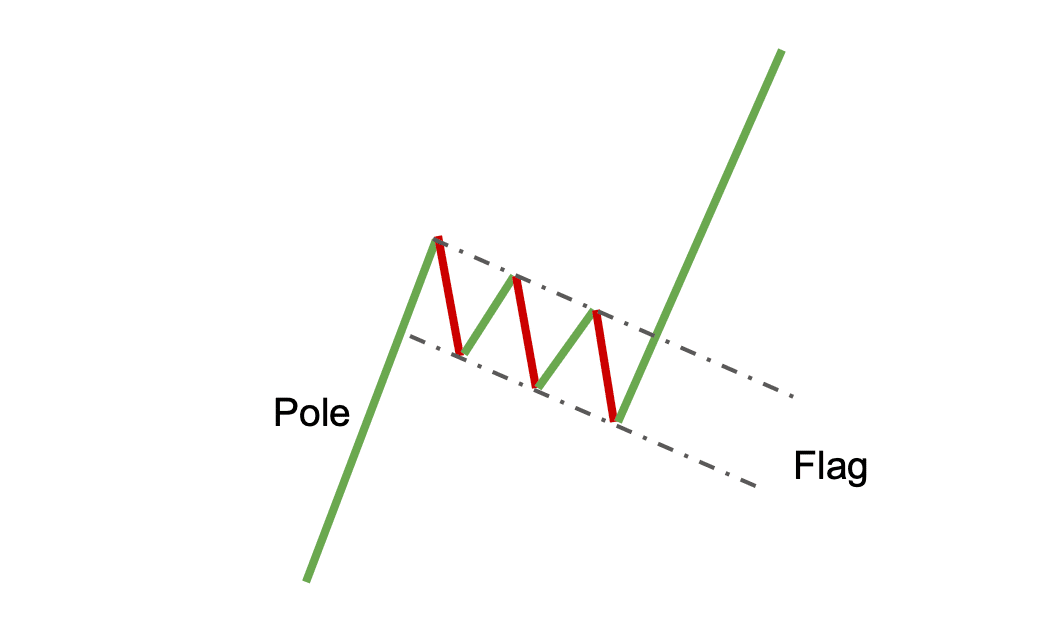

How you can Determine Bull Flag Patterns

Step one in figuring out the bullish flag sample is to acknowledge an upward development (i.e., the flagpole).

To ensure that it to be a bullish flag sample, this flagpole must be adopted by the flag — a downward sloping consolidation interval. It’s normally made up of smaller back-and-forth value strikes with repeatedly decrease highs.

After a interval of consolidation, merchants will search for a breakout above the earlier highs. This alerts that the upward development continues and that merchants can enter lengthy positions.

It could appear that one can determine flag chart patterns with out breaking a sweat, however they’re really fairly tough. Pay shut consideration to all of the alerts and attempt to watch for the affirmation of the bullish development earlier than making any buying and selling choices in the event you’re not an skilled dealer but.

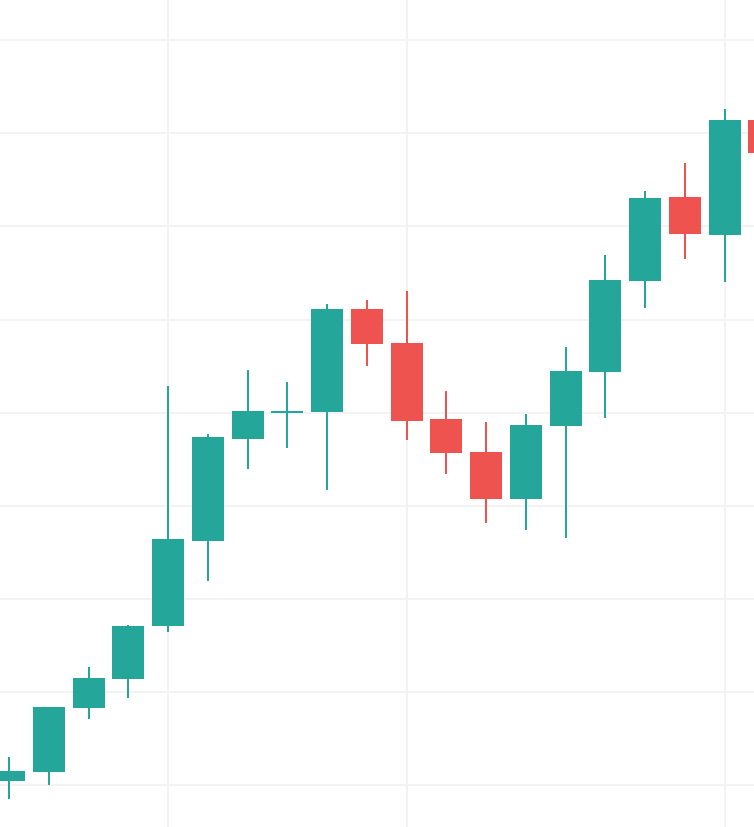

Instance

Right here’s an instance of a easy bull flag chart continuation sample.

It’s a fragment of the BTCUSD value chart from the start of August 2021. It reveals a transparent flagpole, a flag, and the next uptrend. The worth consolidated for a short time however managed to start rising once more, finishing the bull flag sample.

Bull Flag vs Flat High Breakout

One widespread query merchants have is whether or not the bull flag sample is similar because the flat prime breakout. The reply to this query isn’t any, they don’t seem to be the identical. Whereas each patterns can sign bullish continuation, the important thing distinction between them is that the bull flag has decrease highs, whereas the flat prime breakout has equal highs.

How you can Commerce a Bull Flag Chart Sample

Now that we have now mentioned the character of the bull flag sample and methods to determine it, let’s discuss how we will commerce it. There are two principal methods to commerce the bull flag sample: shopping for the breakout or shopping for the pullback.

Shopping for the breakout signifies that merchants will enter lengthy positions when the worth breaks out above the resistance degree. A stop-loss order must be positioned beneath the consolidation degree to guard in opposition to a false breakout.

Shopping for the pullback signifies that merchants will enter lengthy positions when the worth retraces and exams the earlier highs. A stop-loss order must be positioned beneath the lows of the pullback to guard in opposition to an additional decline.

Listed below are some further ideas for buying and selling bull flag patterns:

- It’s essential to attend for a transparent breakout earlier than getting into a commerce. A false breakout can result in losses.

- Place a stop-loss order beneath the consolidation degree or the lows of the pullback. It will assist to guard in opposition to a decline.

- Take income when the worth reaches the measured transfer goal. That is the minimal value goal for the sample, and it may be calculated by measuring the peak of the flagpole and including it to the breakout level.

Professionals and Cons of Bull Flag Patterns

Like all chart patterns, the bull flag has its professionals and cons.

Professionals:

- The bull flag can sign a continuation of an uptrend.

- It gives clear value targets.

- One can simply determine this sample.

Cons:

- False breakouts can happen.

- It requires persistence to attend for a transparent breakout.

To attenuate the prospect of dropping cash to a false breakout, make use of instruments akin to buying and selling indicators and attempt to be affected person.

Usually, it will be higher to attend for clearly manifested alerts than going all in on the first signal of a continuation sample. Sure, you would possibly lose out on some extra revenue, however no less than you’ll reduce the danger of dropping your preliminary funding. Don’t fall for FOMO, do your personal analysis, and research the market to maximise your revenue whereas buying and selling. Good luck!

Disclaimer: Please notice that the contents of this text are usually not monetary or investing recommendation. The data supplied on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.