Ethereum Drops To $1,300, What’s Next For ETH Price?

Ethereum has been following the final development within the crypto market, giving again its revenue obtained over the previous week. The cryptocurrency was shifting in tandem with Bitcoin and huge cryptocurrencies, however now ETH’s value is reacting to new financial information printed in the USA.

On the time of writing, Ethereum trades at $1,300 with a 2% loss and sideways motion within the final week. Different cryptocurrencies within the prime 10 by market capitalization document related value motion apart from XRP. This token is displaying power towards the development and continues to knock on earnings over the identical interval.

Ethereum Inbound For One other Sideways Week

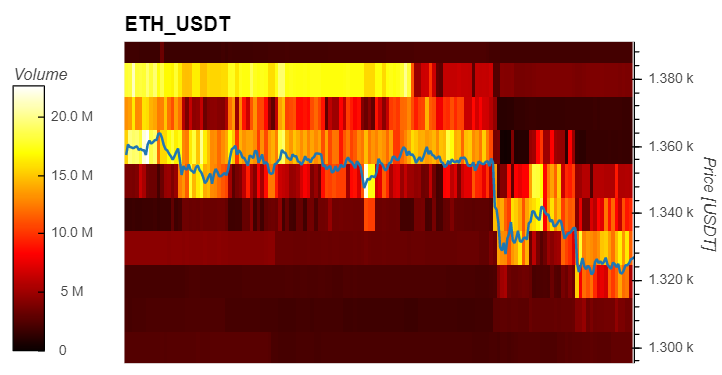

Information from Materials Indicators (MI) exhibits that Ethereum is seeing some bids at its present ranges. This might sign a short-term rally into earlier resistance ranges neat $1,340 with potential for $1,400.

As seen within the chart beneath, the Ethereum value has reacted comparatively properly to the current value motion with bid (purchase) liquidity coming in at in the present day’s low. This has supported the value of ETH permitting it to bounce into the realm of round $1,340.

Earlier in the present day, the second cryptocurrency by market cap was experiencing a spike in promoting from all traders, from retail to whales. Nonetheless, the promoting has been mitigated in current hours with giant gamers with bid orders of as a lot as $100,000 shopping for into Ethereum’s value motion.

These gamers purchased over $800 million in ETH on brief timeframes and would possibly be capable to maintain ETH for some time. Nonetheless, ETH’s value motion may be in jeopardy because the market heads into the weekend.

For Ethereum and Bitcoin, $1,200 and $18,500 are key ranges to forestall a recent leg down into the yearly lows. In response to a pseudonym dealer, so long as these ranges maintain, the cryptocurrency will maintain the road with extra days of sideways motion. The dealer said:

The second $18.5K or $20.5K (for Bitcoin) provides in we’ll probably see it adopted by a giant transfer. Chop chop and extra chop till then. CPI on Wednesday might change it up a bit however as we communicate we’re again to the center of the vary.

Ethereum And Bitcoin Poised For Incoming Volatility

On the latter, the upcoming Client Worth Index (CPI) print for September and in the present day’s information on the U.S. financial system present that macroeconomic forces are nonetheless in management. Thus far, the financial information has been optimistic and has even surpassed professional expectations.

That is detrimental for Bitcoin, Ethereum, and world markets as a result of it alerts that the U.S. Federal Reserve (Fed) can sustain and even flip up the strain to decelerate inflation metrics. In that sense, subsequent week’s CPI print may very well be one of many key occasions for ETH, BTC, and your complete business.

Speaking concerning the potential for the Fed to take a much less aggressive stance, and pivot its financial coverage, Keith Alan from Materials Indicators wrote:

A FED pivot isn’t probably with out one thing of main significance taking place. The #FED desires to see consecutive months of declining CPI and growing unemployment.