BTC pushes toward the highs of a two-month range, will the bulls be repelled?

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

- Bitcoin has crept upward to a two-month vary excessive, and a reversal was extra probably than a breakout

- A transfer greater to $20k and above wants $17.8k flipped to help

All through January, the USDT Dominance metric has been pressured decrease from 8.79% to eight.12% at press time. This represented a 7% drop and signified crypto market contributors had been keen to purchase crypto with their stablecoins. This defined the positive aspects Bitcoin and lots of altcoins witnessed over the previous week.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

The low realized volatility for Bitcoin meant an explosive transfer may very well be across the nook. Such a transfer may catch many merchants offside. A every day session shut above $17.8k could be step one for a push previous the $20k space.

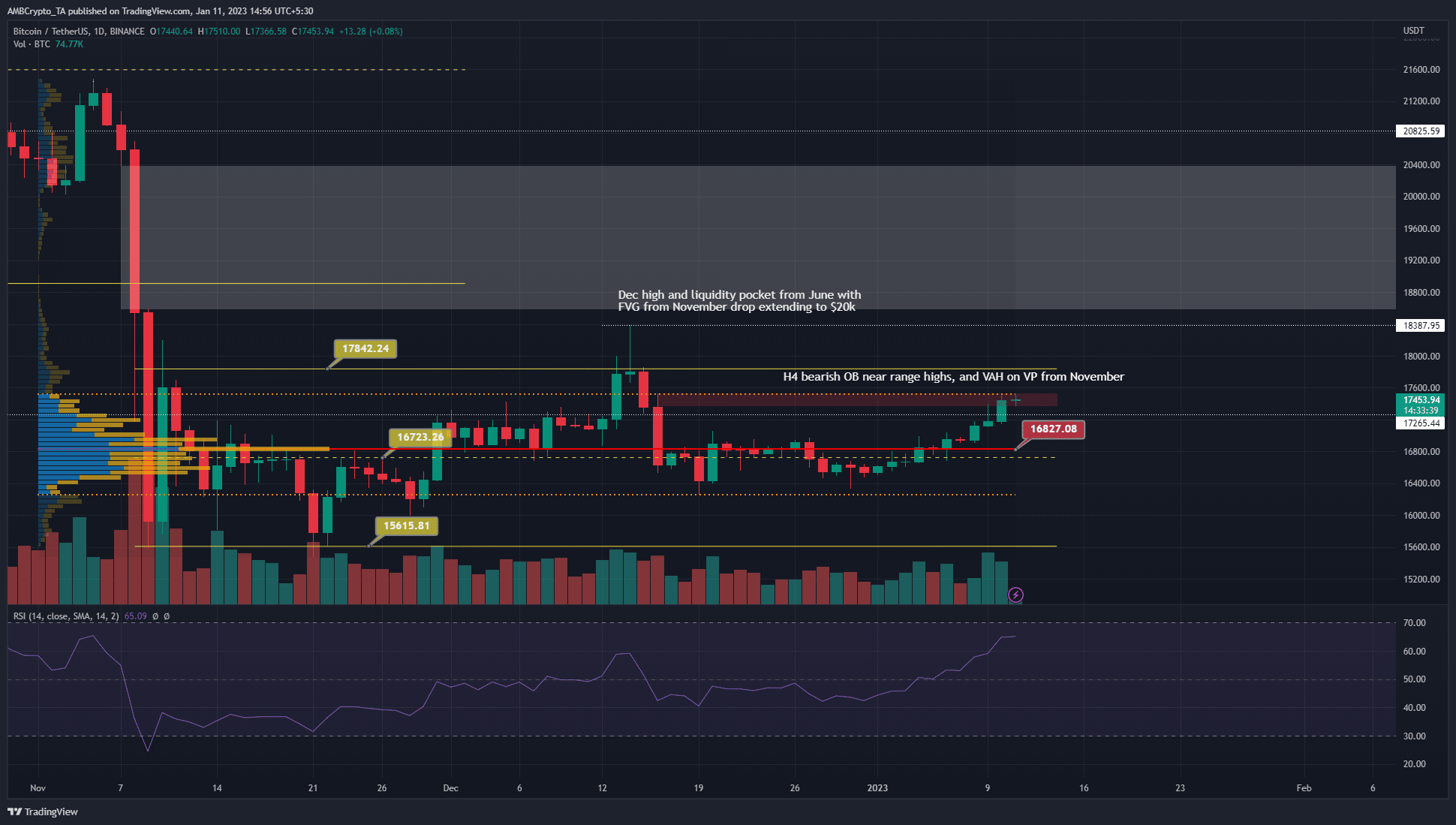

The Mounted Vary Quantity Profile highlighted some vital ranges for BTC

Supply: BTC/USDT on TradingView

The Mounted Vary Quantity Profile was plotted from 1 November to the day of writing and confirmed the Worth Space Excessive at $17,50. The Level of Management was at $16,827 and the Worth Space Low was at $16,260. The VAL has already been revered as help in mid-December.

On 8 January, Bitcoin rose above the $17k mark and the RSI additionally confirmed sturdy bullish momentum previously few days. Nevertheless, buying and selling quantity was not excessive and remained close to the typical of the previous two months’ every day quantity. This might change ought to BTC breakout previous the vary excessive.

Are your holdings in Revenue? Examine the BTC Revenue Calculator

The world demarcated by the purple field confirmed a bearish order block on the four-hour chart that prolonged upward to $17,531. This was near the VAH, which lent it extra significance.

A every day session shut above $17.6k may see BTC attain for the vary highs and even push as excessive because the December excessive. Nevertheless, a breakout would want BTC to shut a every day session above the vary excessive at $17.8k.

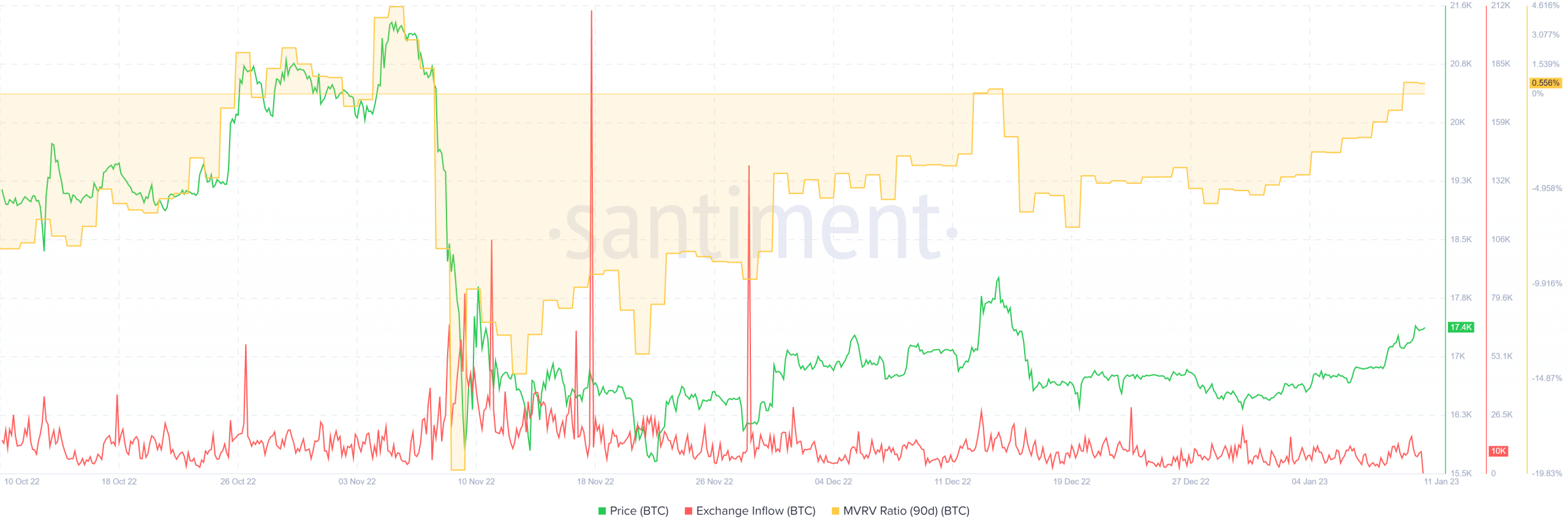

The MVRV ratio tiptoes again into optimistic territory

Supply: Santiment

Santiment knowledge confirmed the 90-day MVRV ratio climbed again into optimistic territory. The final time this occurred was in early November, earlier than the large wave of promoting that adopted the FTX implosion.

Moreover, it remained to be seen the place precisely holders will look to take revenue as BTC climbs greater, however the $17.8k and $18.4k ranges are value watching.

Supply: Coinalyze

In latest days, the Open Curiosity additionally climbed alongside the worth to point out bullish sentiment on the decrease timeframes. This might see a transfer above the vary highs, however warning was nonetheless warranted.

Moreover, identical to in mid-December, the worth may transfer to $18k to pressure brief place liquidation, acquire liquidity and reverse again into the vary. Such a reversal may see the $15.8k mark revisited as nicely.

A real breakout previous $17.8k would probably push to $20k and better, given the inefficiency seen there on the charts primarily based on the nosedive from early November.