Binance’s Bitcoin liquidity for TUSD surges 250%

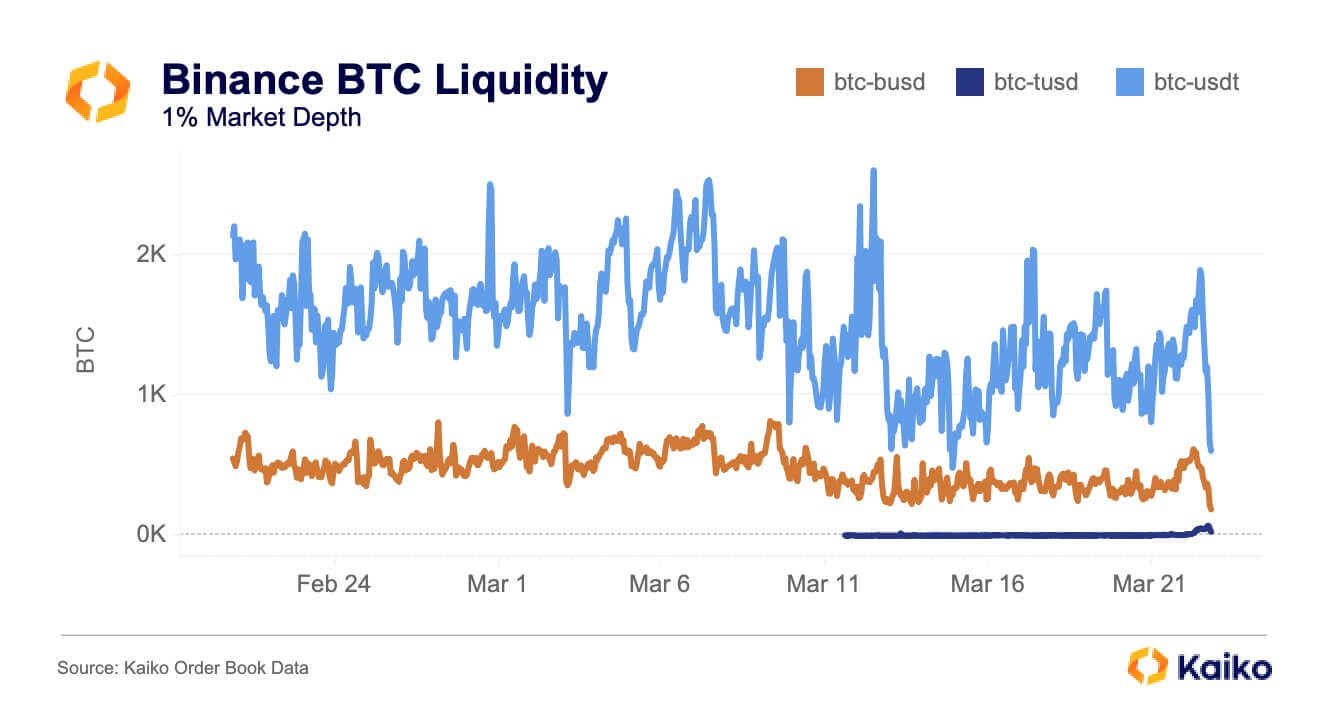

Binance’s Bitcoin (BTC) liquidity for its TrueUSD (TUSD) rose greater than 250% on March 22 after it phased out its zero-fee buying and selling for different stablecoins.

Kaiko Knowledge researcher Riyad Carey highlighted that the change’s BTC liquidity for Binance USD (BUSD) and Tether’s USDT declined by 60% and 70%, respectively.

In the meantime, the change’s liquidity for TUSD elevated to 29 BTC from 9 BTC inside just a few hours.

On March 15, Binance introduced it was transferring the zero-fee BTC buying and selling function from BUSD to TUSD on March 22. On the time, CEO Changpeng ‘CZ’ Zhao blamed the regulatory upheaval the opposite stablecoins confronted for the agency’s resolution.

Will this resolution have an effect on Binance’s market share?

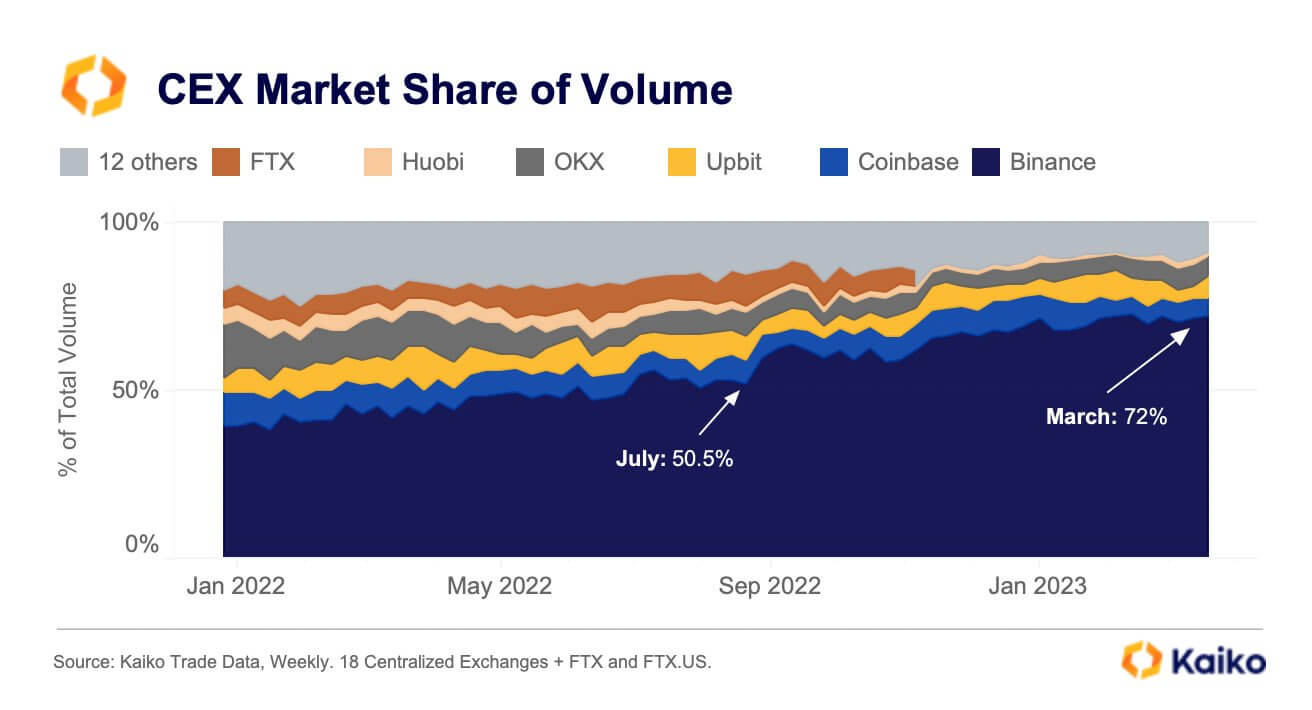

Kaiko’s director of analysis, Clara Medalie, highlighted the function the zero-trading price possibility performed in enhancing Binance’s market share.

In accordance with Medalie, the free buying and selling possibility helped Binance acquire a further 20% of the market because it was launched in July 2022. On the time, Binance managed solely 50.5% of the market; nonetheless, the change’s market management elevated to 72% following FTX’s collapse in November 2022.

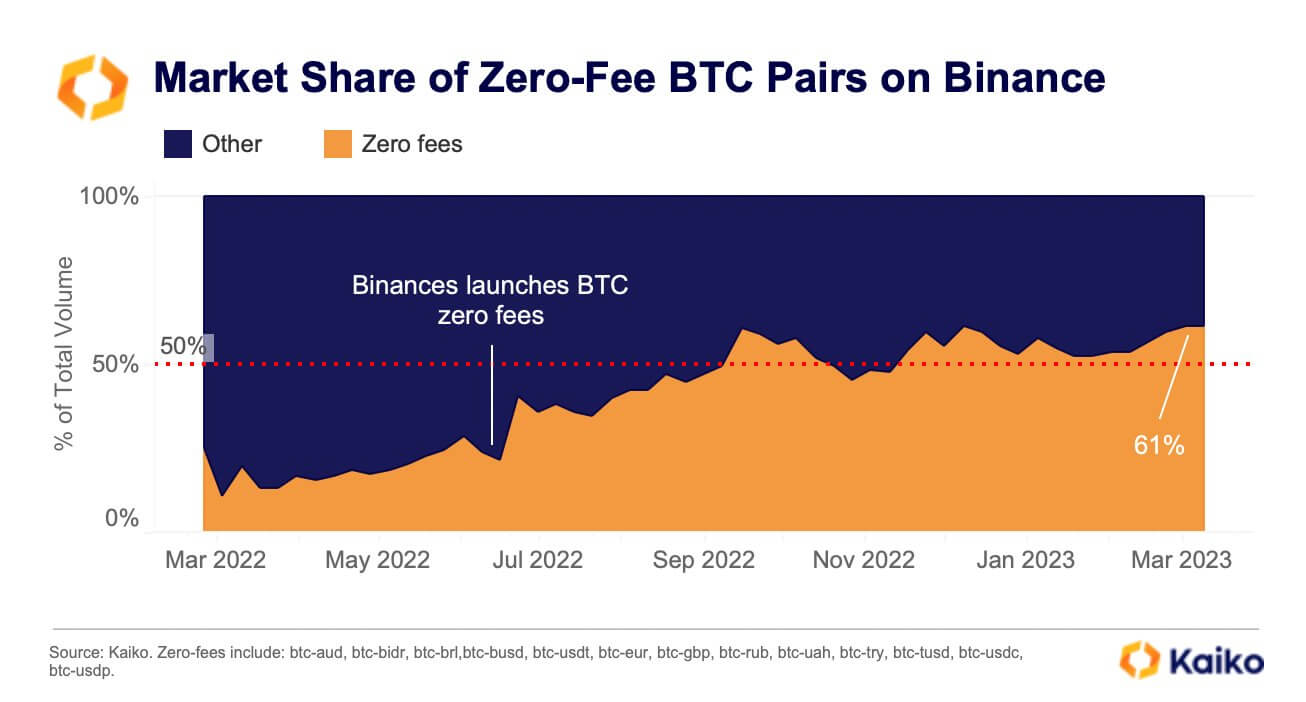

Extra info from Kaiko identified that the zero-trading possibility accounted for 61% of the overall quantity on Binance as of the earlier week.

Binance customers drawn to the change due to its zero-fee function may depart for different rival platforms, Medalie famous.

TUSD retains rising

Binance’s resolution would enormously profit TUSD — rising as a big winner from its rivals’ latest debacle.

Carey added that Binance’s resolution confirmed that it had made an obvious transfer to advertise TUSD because the successor to BUSD.

Because the crackdown on BUSD, TUSD has seen its circulating provide double to over $2 billion and turn out to be the second-largest stablecoin on the Tron community. Throughout the interval, Binance minted extra TUSD stablecoin and added new buying and selling pairs for the asset.

In the meantime, Protos’ researcher Bennett Tomlin pointed out that TUSD is likely one of the weirdest stablecoins within the crypto market. In accordance with the researcher, TUSD has some undisclosed relations with Justin Solar, and bankrupt Alameda Analysis was additionally a lead investor within the asset.