XRP traders need to watch out for this bearish order block from May

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion

- XRP kinds yet one more vary after breaking above the earlier one in September

- Will the vary highs see a breakout or a rejection for XRP?

XRP noticed optimistic sentiment available in the market in September, however was unable to match that momentum in October. The SEC’s lawsuit in opposition to Ripple Labs appeared to lean in favour of the defendants. Coinbase filed an amicus brief in favor of Ripple Labs, Inc. Help gathered for Ripple as CEO Brad Garlinghouse tweeted that a number of entities have submitted amici briefs.

Right here’s AMBCrypto’s Value Prediction for XRP in 2022-23

There appeared to be hypothesis that exchanges that had delisted XRP previously may be able to re-list the coin as soon as extra. In flip, speculators would possibly discover a cause to flip to bullish on XRP.

Right here is why the vary highs might supply a shorting alternative

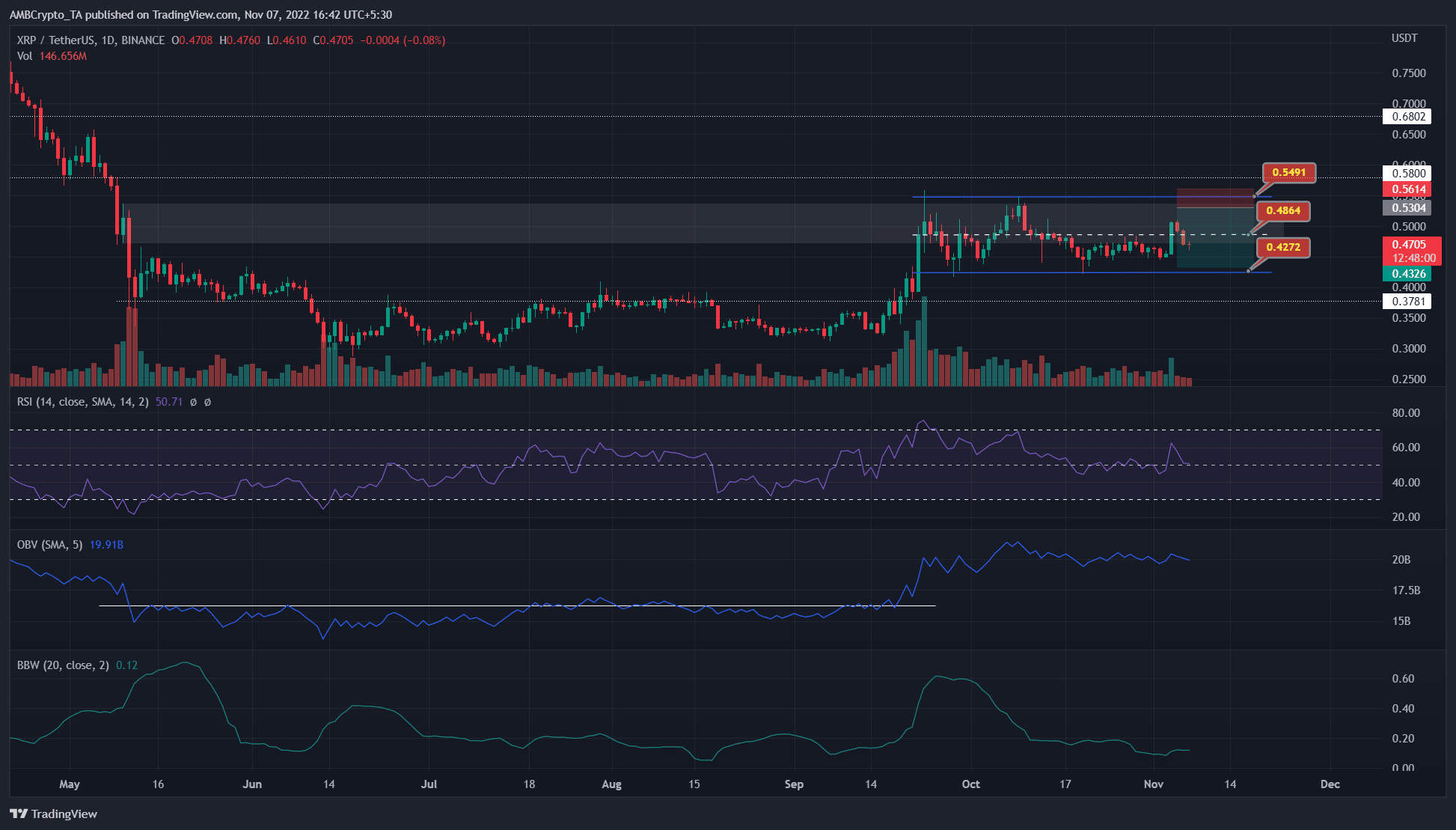

Supply: XRP/USDT on TradingView

XRP has traded inside a spread from mid-September. This vary (blue) prolonged from $0.42 to $0.55, with the mid-range worth at $0.48. In Could, the value noticed a quick bounce earlier than persevering with its prior downtrend. This bounce shaped a bearish order block. Furthermore, this area had confluence with the psychological $0.5-level of resistance.

Therefore, any bullish advances previous $0.5 could possibly be tough for the bulls to tug off. The OBV noticed a breakout previous an area resistance (white) in September. The previous month noticed a flat OBV as soon as extra as shopping for and promoting volumes had been balanced. The Bollinger Bands width indicator was in decline too. This highlighted the truth that there was lowered volatility seen on the every day timeframe.

Larger timeframe merchants can look to purchase a revisit to the vary lows, and look to quick the asset because it approaches $0.55. Invalidation of this concept could be a breakout and retest above $0.55.

The funding charge is again in optimistic territory as bulls regain confidence

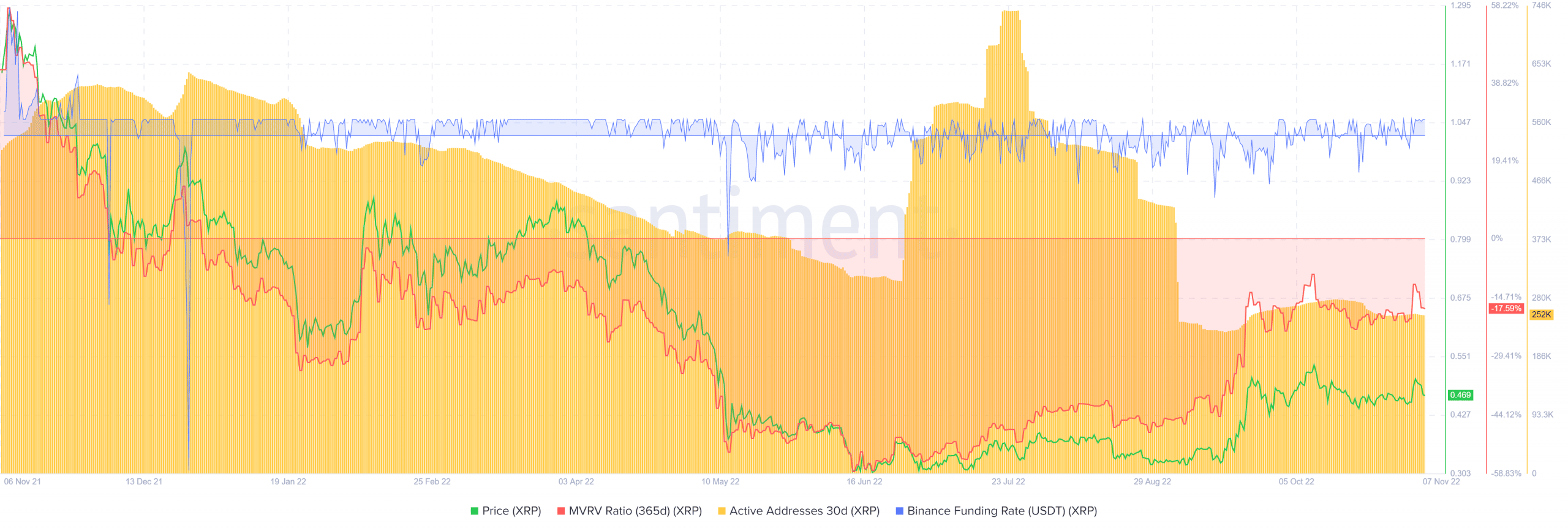

Supply: Santiment

The on-chain metrics didn’t paint a very bullish image for XRP both. The MVRV (365-day) ratio has picked up considerably from the lows it set in June, nevertheless.

Even so, the metric revealed that XRP holders of the previous 12 months had been at a loss total. The lows registered in mid-June match the lows set in December 2018 nearly precisely. May this point out {that a} long-term backside has been shaped?

The 30-day energetic handle depend has been on a decline too. The optimistic funding charge confirmed that speculators have been bullishly positioned in latest days.

The previous couple of days have seen XRP bulls face rejection on the $0.5-bearish order block. Coinglass data confirmed that the previous 24 hours noticed solely 46.7% of the lengthy positions being bullish. A bounce from the mid-range in the direction of $0.54 can be utilized to safe earnings by the bulls and in addition to evaluate taking quick positions.