XRP investors can gain profits in Q4, but here’s the caveat for traders going long

- XRP witnessed a spike in social dominance, which may result in a value pump

- Nevertheless, sentiment towards XRP remained adverse

On 3 December, crypto analytics agency Santiment tweeted that Ripple’s [XRP] social dominance witnessed spikes over the previous couple of days. This spike may lead to short-term constructive value motion within the close to future. Nevertheless, the coin could be susceptible to a fast sell-off if costs do soar.

🗣️ #XRPNetwork, #Stellar, & #Status are all presently on the highest trending checklist in #crypto Friday. These belongings are all comparatively even on the day, which implies pump likelihood is increased than normal. However look ahead to a fast sell-off in the event that they do whereas trending. https://t.co/puOnDyvhJp pic.twitter.com/wu3k5syQLw

— Santiment (@santimentfeed) December 2, 2022

Learn Ripple’s [XRP] Worth Prediction 2023-2024

One other issue to think about could be XRP’s progress in social mentions, which grew by 67.1% over the past week, in line with LunarCrush. Regardless of the spike in mentions and dominance, the sentiment towards XRP remained adverse.

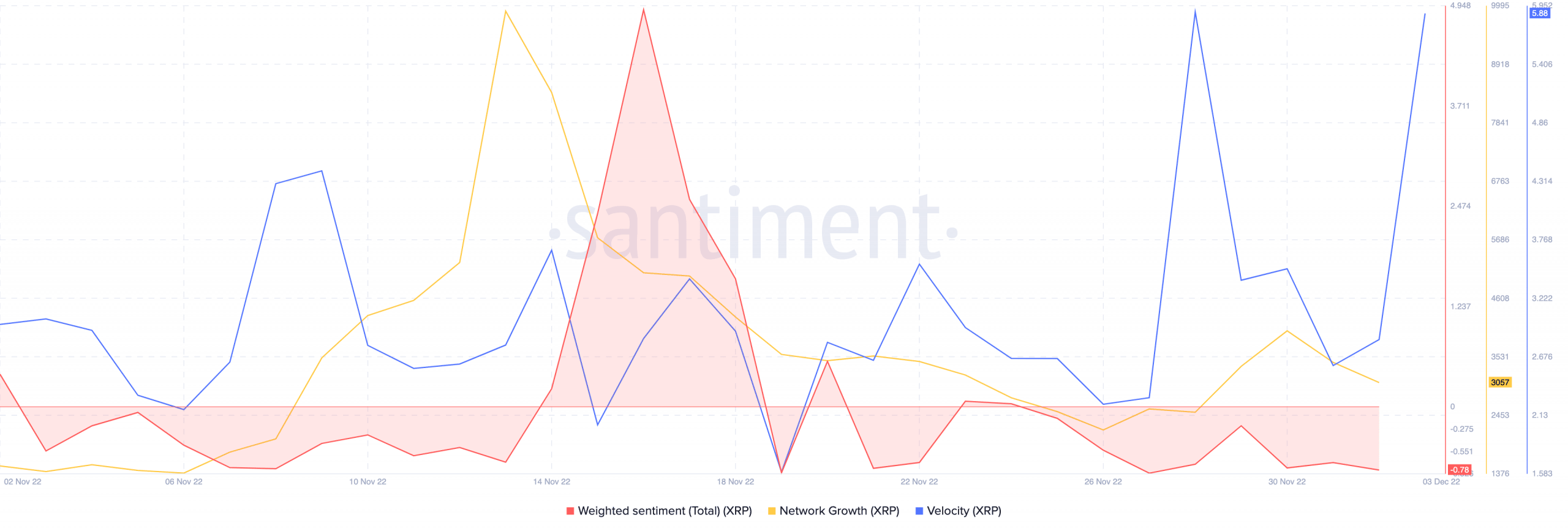

XRP’s weighted sentiment declined over the previous couple of days as nicely, indicating that the crypto neighborhood’s general outlook in direction of XRP was adverse. Moreover, XRP’s community progress additionally witnessed an enormous decline. This indicated that the variety of addresses transferring XRP for the primary time had diminished.

Nevertheless, the coin’s velocity noticed an enormous spike, implying that the frequency with which XRP had been transferring throughout exchanges had elevated.

Supply: Santiment

XRP income within the brief time period

One purpose for the rise in transactions might be the rising Market Worth to Realized Worth (MVRV) ratio of XRP. A rising MVRV ratio indicated that, on the time of writing, if most of holders have been to promote their holdings, they’d take away some revenue.

The declining Lengthy/Brief distinction line showcased that short-term holders would revenue off the commerce if merchants bought on this market. Nevertheless, long-term holders must look ahead to an extended interval to expertise some positive aspects.

Supply: Santiment

On the time of writing, XRP was buying and selling at $0.390 and. Its value had risen by 19.3% since 14 November and remained between $0.41 and $0.371 after 25 November.

The Relative Power Index (RSI), which was at 44.13, indicated that the momentum was nonetheless with the sellers regardless of XRP’s momentary uptick. Nevertheless, the Chaikin Cash Circulation (CMF) witnessed a spike and was at 0.13. Thus, the cash stream indicated that there was energy available in the market.

Supply: TradingView