Why Is The Bitcoin Price Up Today?

After the Bitcoin value reached a three-month low of $24.835 final week, the bulls presently appear to be gaining the higher hand once more. The BTC value has continued its upward development within the final 24 hours and has risen by 1.6% to presently $26,795. At one level, BTC had already hit $27,203 earlier than a corrective transfer occurred.

Why Is Bitcoin Up At the moment?

As at all times, one can solely speculate in regards to the the reason why the Bitcoin value is rising. However due to the submitting by BlackRock, the world’s largest asset supervisor, for a Bitcoin Spot ETF within the US, bullish sentiment has returned to the market. A Bitcoin Spot ETF is predicted to open the flood gates for institutional traders.

As NewsBTC reported, the historical past of the primary gold ETF within the US in 2004 may very well be an indicator of the bullish influence that the approval of a spot ETF may have. The gold ETF has been instrumental within the adoption of gold by establishments. Inside eight years of the primary ETF, the worth of gold greater than quadrupled.

Principally, the US Securities and Change Fee has 240 days (about eight months) to determine on the appliance. Nevertheless, David Attley, CEO of Bitcoin Journal, asserted yesterday that he had heard a compelling argument that the BlackRock Bitcoin ETF may very well be permitted shortly (“days to weeks”).

This information could have had as constructive an influence in the marketplace as yesterday’s information that Constancy might also quickly apply for a Bitcoin Spot ETF alongside the strains of BlackRock. Clearly, crypto Twitter has turn into far more bullish on account of the BlackRock information.

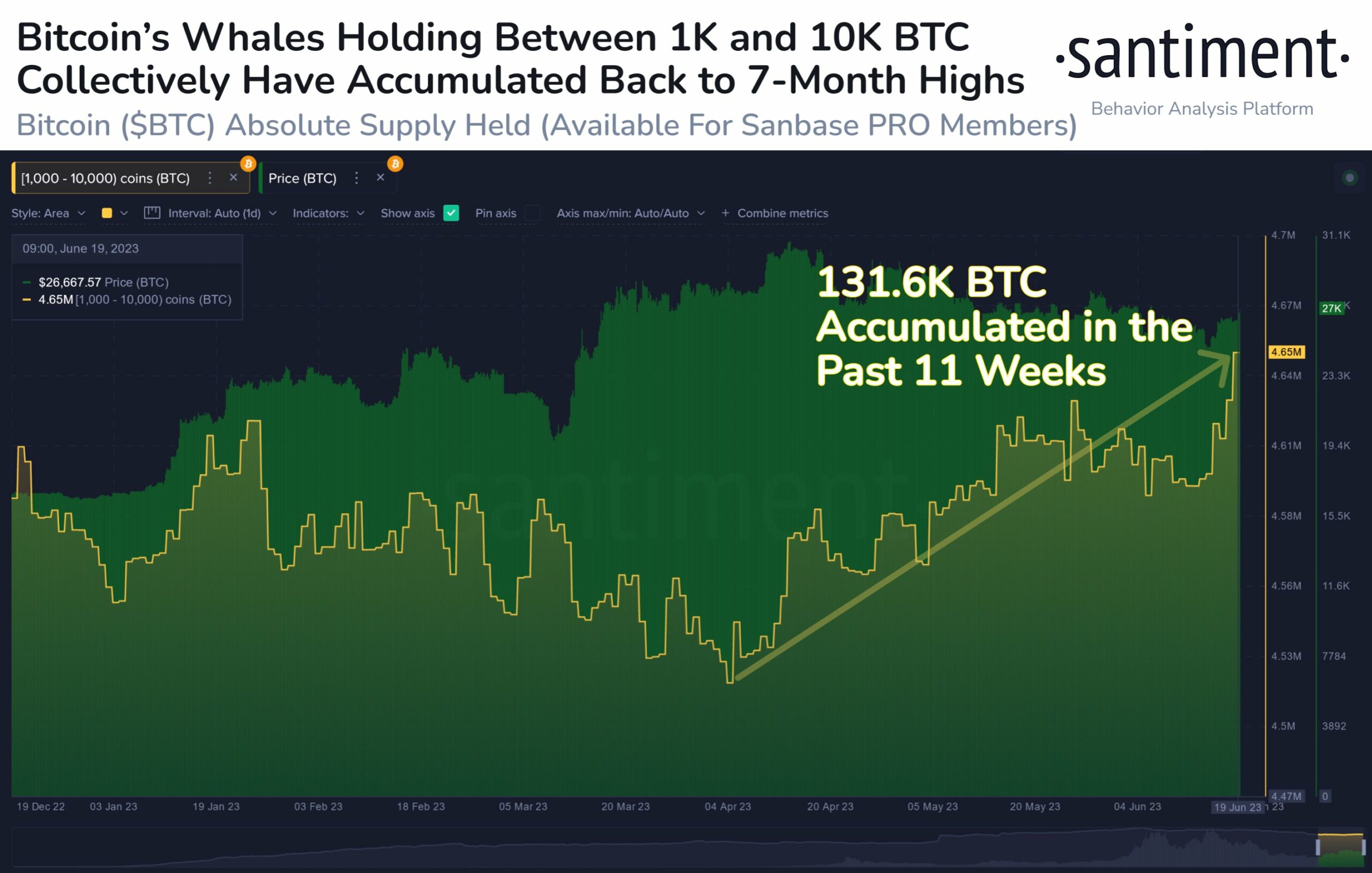

And huge traders in BTC, so-called whales, have additionally turned bullish on the main cryptocurrency for fairly a while. As reported by on-chain knowledge analytics service Santiment, whales have been busy over the previous two months as the group watched the worth fall.

“Now again above $27k as soon as once more, it’s removed from coincidence that wallets holding 1K to 10K $BTC have gathered a mixed $3.5B for the reason that first week of April,” Santiment states.

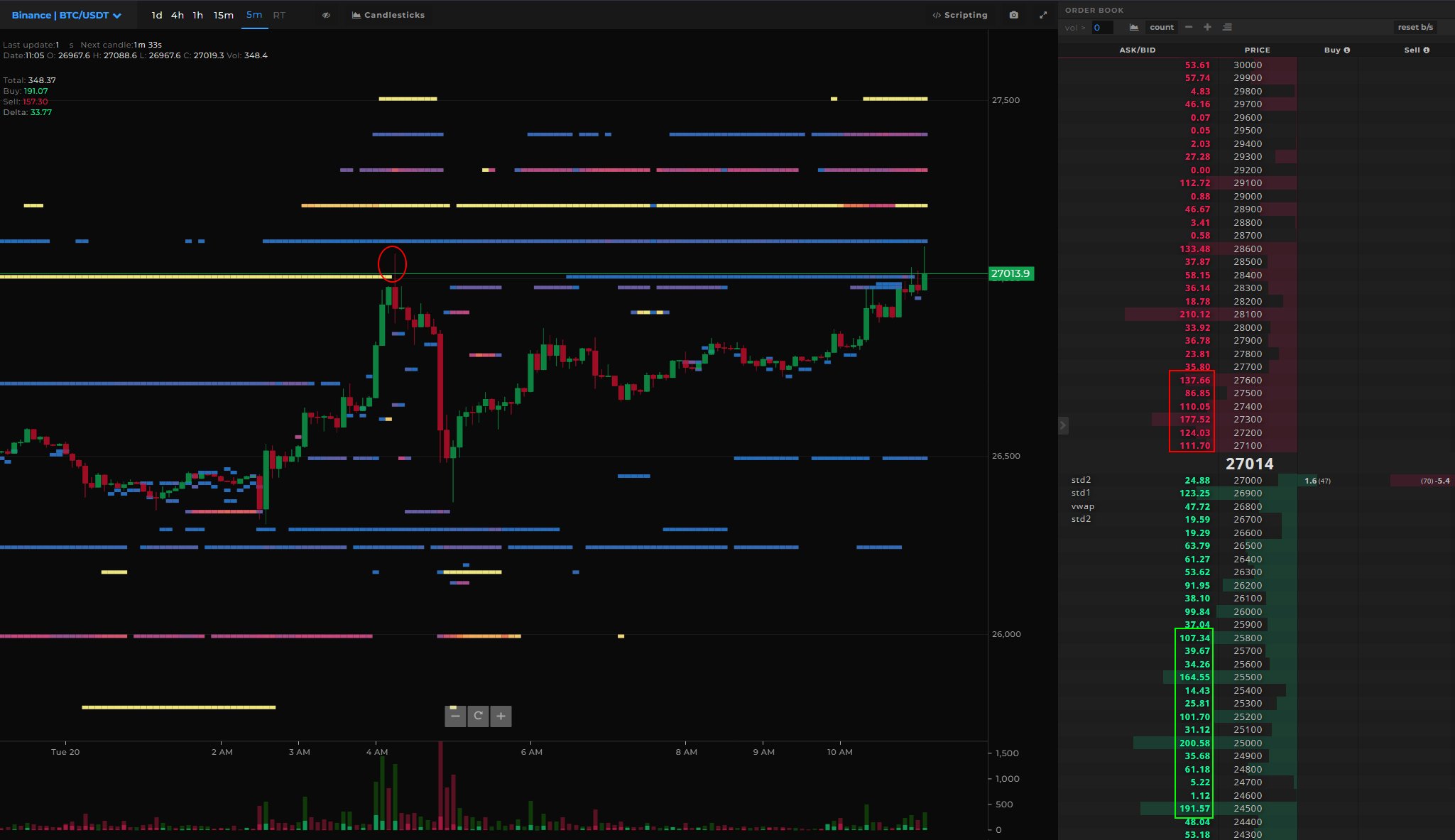

Intraday dealer @52Skew makes an identical remark with regard to BTC perp CVD buckets & delta orders: “Whales largely driving value nonetheless, longs aped on this bounce, shorts nonetheless twaping on each bounce.”

Furthermore, the dealer noticed in the previous few hours that there was loads of demand within the spot market on Binance, the most important crypto alternate. In response to him, spot shopping for is an indication of a sustained rally, so ideally spot shopping for must persist.

By way of the Binance open curiosity and funding, Skew states that many shorts are chasing the worth after the longs have been squeezed earlier.

Outlook For H2 2023

One other bullish influence in the marketplace may very well be the technical chart outlook for the second half of the 12 months. As Aksel Kibar, Chartered Market Technician (CMT), writes through Twitter, BTC may very well be on the verge of a breakout from the correction that has been happening since mid-April:

Appears to be like like now we have a sound downward sloping channel on $BTCUSD with the higher boundary performing as short-term resistance at 27K. Breakout from the channel can full the prevailing pullback to the bigger scale H&S backside reversal.

At press time, the Bitcoin value noticed a slight correctional transfer and was buying and selling at $26,795.

Featured picture from iStock, chart from TradingView.com