What Is Solana (SOL)?

What promising altcoin hasn’t been referred to as an “Ethereum killer” at this level? But, out of the myriad crypto tokens and cash showing (and promptly disappearing) yearly, just a few stand out. Solana is one among them.

Solana is understood for being a extremely environment friendly and practical sensible contract platform. The challenge’s native cryptocurrency, SOL, has been close to the highest of market capitalization rankings for fairly some time now and has grow to be a favourite amongst many crypto traders. However what makes Solana distinctive, and why has it garnered a lot consideration?

I’m Daria Morgen, a crypto fanatic who’s been immersed on this business since 2014. Through the years, I’ve seen many initiatives come and go, however I’ve all the time been drawn to trailblazers like Solana. It’s not simply their imaginative and prescient that pulls me in, however their relentless drive to truly perform transformative adjustments and enhancements within the crypto and blockchain sphere.

What Is Solana (SOL)?

Solana is a high-performance blockchain platform designed to assist scalable decentralized purposes (dApps) and cryptocurrencies. On the coronary heart of its ecosystem is SOL, the challenge’s native cryptocurrency. Not like many different blockchain networks that rely solely on the proof-of-work consensus mechanism, Solana employs a singular mixture of the well-known proof-of-stake and a extra distinctive proof-of-history algorithm.

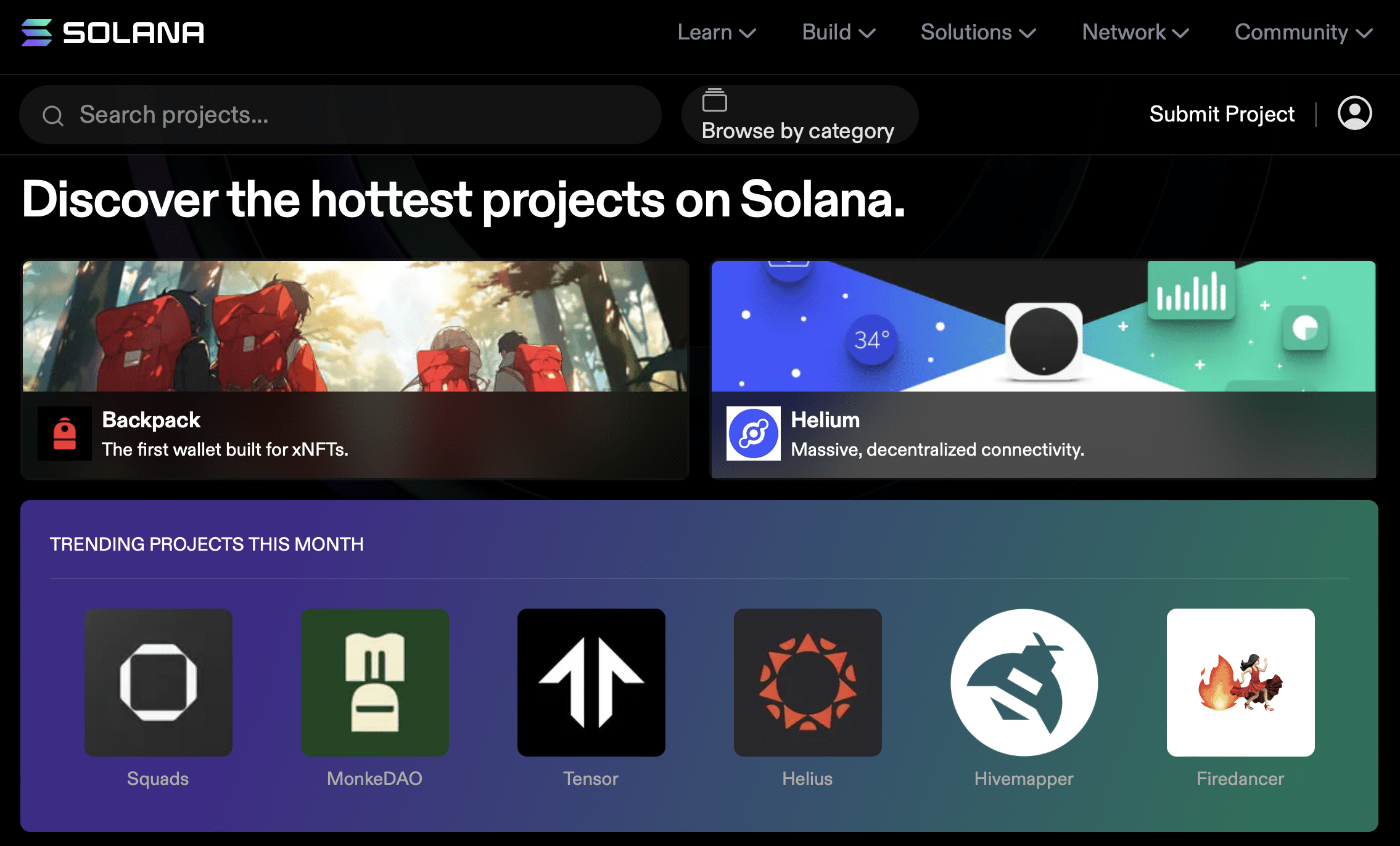

One of many greatest advantages of the Solana community is the big variety of various initiatives constructed on its blockchain. In that sense, it’s just like Ethereum – though the world’s second-biggest cryptocurrency naturally has a a lot greater ecosystem of apps and platforms constructed on it. Nonetheless, Solana has fairly a formidable catalog, and every of these initiatives represents yet one more use case for its cryptocurrency, SOL.

Listed below are a few of the initiatives constructed on Solana:

- HDOKI, an leisure ecosystem that gives crypto rewards

- Star Atlas, a fully-fledged technique recreation

- ALF Protocol, a Solana-based lending dApp

- Solanart, a zero-fee NFT market

The Historical past of Solana

Solana’s origin will be traced again to its white paper. It was printed again in 2017 by Anatoly Yakovenko, who then teamed up with Greg Fitzgerald to discovered Solana Labs. Solana was not launched and made out there to the general public till 2020 following its preliminary token allocation.

Whereas the remainder of the crypto business was battling with the “blockchain trilemma” of balancing transaction prices and speeds, safety, and scalability, Solana emerged as a promising answer. Recognizing the demand for quicker transaction speeds and decrease transaction charges, the Solana Basis laid the groundwork for what many declare to be one of the crucial scalable blockchains.

How Does Solana Work?

Solana is an extremely environment friendly blockchain: it has the capability to deal with hundreds of transactions in a fraction of a second, attaining unparalleled transaction throughput. This effectivity is achieved by way of utilizing a mixture of proof-of-history and proof-of-stake mechanisms.

The Solana community makes use of validator nodes to course of transactions, guaranteeing the integrity and safety of information. Validator nodes play a pivotal position within the proof-of-stake mechanism. They’re community contributors who run specialised software program, serving to safe the community by validating the order and validity of transactions.

- Position in Consensus. Validators leverage the historic data from PoH to attain consensus rapidly. They’re accountable for producing blocks and validating transactions.

- Staking. To grow to be a validator, a node should stake a certain quantity of SOL tokens. This acts as a safety deposit. The extra SOL tokens a validator stakes, the upper the prospect they’ve of being chosen to validate a block of transactions.

- Incentives. Validators earn rewards for validating and producing blocks. Nevertheless, they’ll lose their staked SOL in the event that they try and validate fraudulent transactions or act maliciously towards the community.

Identical to Ethereum, Solana’s sensible contract functionality permits it to host all kinds of various decentralized purposes, from decentralized exchanges (DEXs) to video games and non-fungible tokens (NFTs) marketplaces.

What Is Proof of Historical past?

Proof of historical past is a consensus algorithm that may be seen as a cryptographic timestamp that ensures the correct sequencing of occasions on the blockchain. It capabilities as a decentralized clock for the Solana blockchain, permitting for a synchronized and environment friendly system. This progressive methodology reduces the necessity for validators to speak excessively, leading to quicker transaction speeds.

What Makes Solana Distinctive?

Listed below are a few of the options that make Solana stand out and have boosted its recognition as each a blockchain community and a cryptocurrency.

- Excessive Throughput. Solana can course of hundreds of transactions per second, addressing the challenges many blockchains face with scalability.

- Decreased Transaction Prices. Leveraging its distinctive structure, Solana affords considerably decrease transaction charges in comparison with its opponents.

- Decentralized Community. Solana’s strong community of validators ensures a safe, decentralized blockchain, maintaining it immune to central factors of failure.

- Adoption. Platforms like Solana Pay and the NFT development have leveraged Solana’s infrastructure, additional solidifying its place out there.

Solana vs. Ethereum

Ethereum, one other titan within the crypto house, makes use of the standard proof-of-stake consensus algorithm. Solana’s distinctive method, significantly its incorporation of proof-of-history, affords:

- Quicker Transaction Occasions. Solana’s methodology drastically reduces transaction occasions in comparison with Ethereum.

- Decrease Transaction Prices. Ethereum’s fuel charges have been a big concern, whereas Solana affords lowered transaction prices.

- Scalability. Solana’s structure supplies an answer to the scalability points Ethereum has traditionally confronted.

Nevertheless, Ethereum’s longevity, bigger developer neighborhood, and early market presence give it a big place within the crypto business. It is usually essential to notice that the Ethereum blockchain community isn’t static – it retains on evolving. For instance, it’s turning into more and more scalable with the assistance of layer-2 options.

That stated, Solana’s co-founder Anatoly Yakovenko is extremely skeptical of the viability of L2 chains – he claims they break up the consumer base and create composability points. If you wish to be taught extra about his opinion on this matter in addition to his imaginative and prescient for Solana, you may hearken to his episode of the Lightspeed podcast on Spotify / Apple Podcasts.

Is Solana a Good Funding?

Like all cryptocurrencies, investing in Solana comes with dangers. Its fast progress, excessive market capitalization, and adoption by dApps and platforms like market makers signify its potential.

Solana has made a big affect on the world of blockchain and cryptocurrency. Its progressive method to transaction validation and sequencing units it aside from different gamers within the house. As with all new addition to their portfolio, potential traders ought to totally conduct their analysis, seek the advice of monetary consultants if needed, and ensure to know market dynamics earlier than making a call.

You may see our Solana worth prediction right here.

How To Purchase Solana

Buying SOL, the native crypto tokens of Solana, will be performed on quite a few centralized and decentralized exchanges – for instance, Changelly. Some platforms don’t supply direct Solana purchases – in that case, you may first buy a stablecoin like USD coin, after which change it for SOL. Earlier than shopping for, all the time make sure you’re utilizing a good change and think about transaction charges, which, given Solana’s structure, are sometimes aggressive.

FAQ

What’s Solana used for?

Solana is primarily used as a high-performance blockchain platform designed to assist decentralized purposes (dApps) and cryptocurrencies. Throughout the Solana ecosystem, builders can construct dApps, launch sensible contracts, and validate transactions effectively, fixing most of the scalability points which have been prevalent in blockchain expertise, comparable to these on the Bitcoin community.

What’s wrapped Solana?

Wrapped Solana refers to a illustration of the SOL token on different blockchains. On the earth of blockchain, “wrapping” a token means creating a brand new token on one other blockchain that represents and is backed 1:1 by the unique token.

Are you able to stake Solana?

Sure, you may stake Solana. By staking SOL tokens, customers can earn rewards whereas additionally contributing to the safety and stability of the Solana community. Staking entails locking up a certain quantity of SOL to assist the operations of the blockchain, significantly to validate transactions. The staked SOL acts as a type of collateral and, in return, stakers obtain rewards for his or her contribution to the community’s operations.

What language is Solana written in?

Solana is primarily written within the Rust programming language. Rust is understood for its efficiency and security, making it an excellent selection for blockchain platforms that require each pace and safety.

Disclaimer: Please word that the contents of this text usually are not monetary or investing recommendation. The data supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.