What Ethereum Classic buyers need to keep an eye on before going long

Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought of funding recommendation.

- Ethereum Traditional [ETC] witnessed a loss of life cross on its EMAs, can the consumers cease the bleeding?

- The altcoin noticed an uptrend in its social volumes whereas the lengthy/quick ratio affirmed a bearish edge.

Ethereum Traditional [ETC] consumers revved up their efforts to shift the broader momentum of their favor from the $21 baseline. However the sellers popped in on the $26.5-resistance to undermine the shopping for potential.

Right here’s AMBCrypto’s worth prediction for Ethereum Traditional [ETC] for 2023-24

The ensuing bearish pull’s bearish engulfing candlestick orchestrated a streak of pink candles within the four-hour timeframe. The altcoin’s unstable decline can plateau within the excessive liquidity area.

At press time, the altcoin was buying and selling at $23.26, down by practically 7.27% within the final 24 hours.

Will the bears proceed to press for extra?

Supply: TradingView, ETC/USDT

From a comparatively long-term viewpoint, ETC has been in a decline section, as evidenced by its two-month trendline resistance (white, dashed). The coin misplaced practically half its worth after its mid-September reversal from the trendline resistance.

Whereas the $21-$22 vary exhibited its inclinations to supply dependable assist, ETC marked an ascending channel (yellow) development.

Over the previous few days, ETC broke into excessive volatility after observing a robust rejection of upper costs from the $26.5 ceiling. Thus, the sellers re-emerged to induce a detailed beneath the 20/5/200 EMA on the chart.

Going ahead, a sustained shut beneath the up-channel can place the coin for a continued draw back within the coming classes. An in depth beneath the $22.54 assist might improve the draw back possibilities.

The primary main assist stage, on this case, would lie within the $21 area, adopted by the $19.5 baseline. A probable bearish crossover of the 20 EMA with the 50 EMA would additional reaffirm the bearish edge.

In case the broader sentiment rekindles the shopping for stress, any quick recoveries would doubtless slam into the $26 ceiling earlier than the higher trendline of the up-channel.

Whereas it might be an extended shot given the press time situations, a detailed above these limitations would affirm a robust bearish invalidation.

Improved social volumes, however is it sufficient?

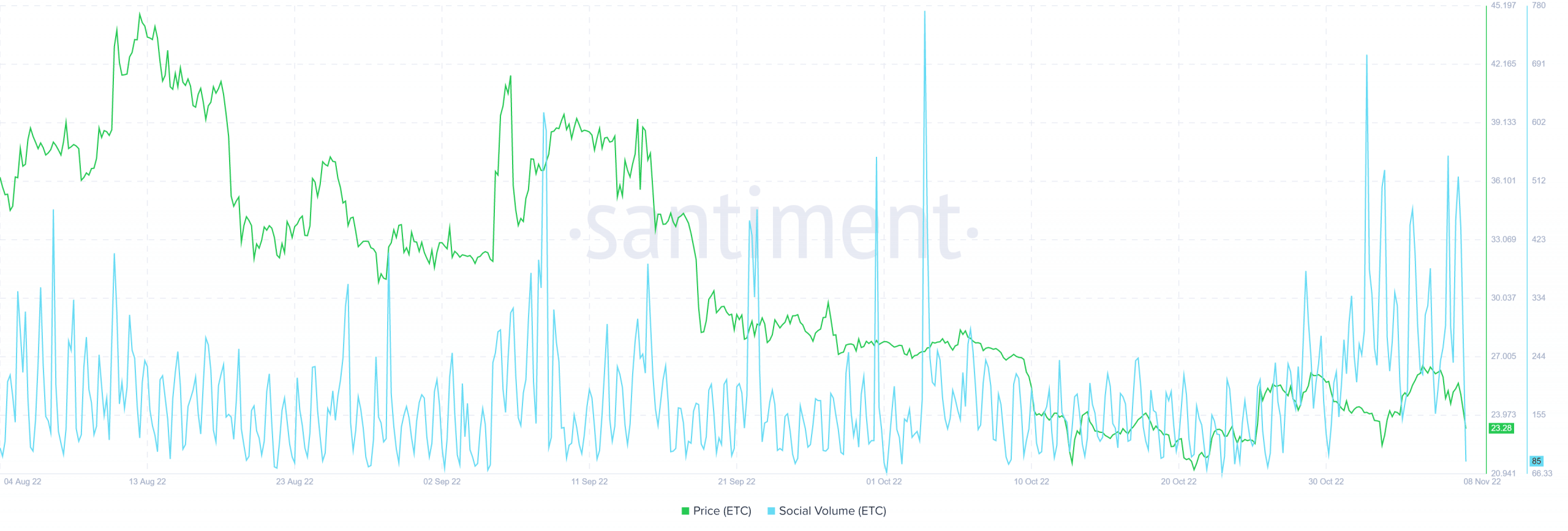

Supply: Santiment

Over the previous month, ETC registered an uptick in its social volumes. Correspondingly the value motion marked its uptrend by chalking out the up-channel on the four-hour chart. Continued development on this finish might assist the consumers in defending the quick assist zone.

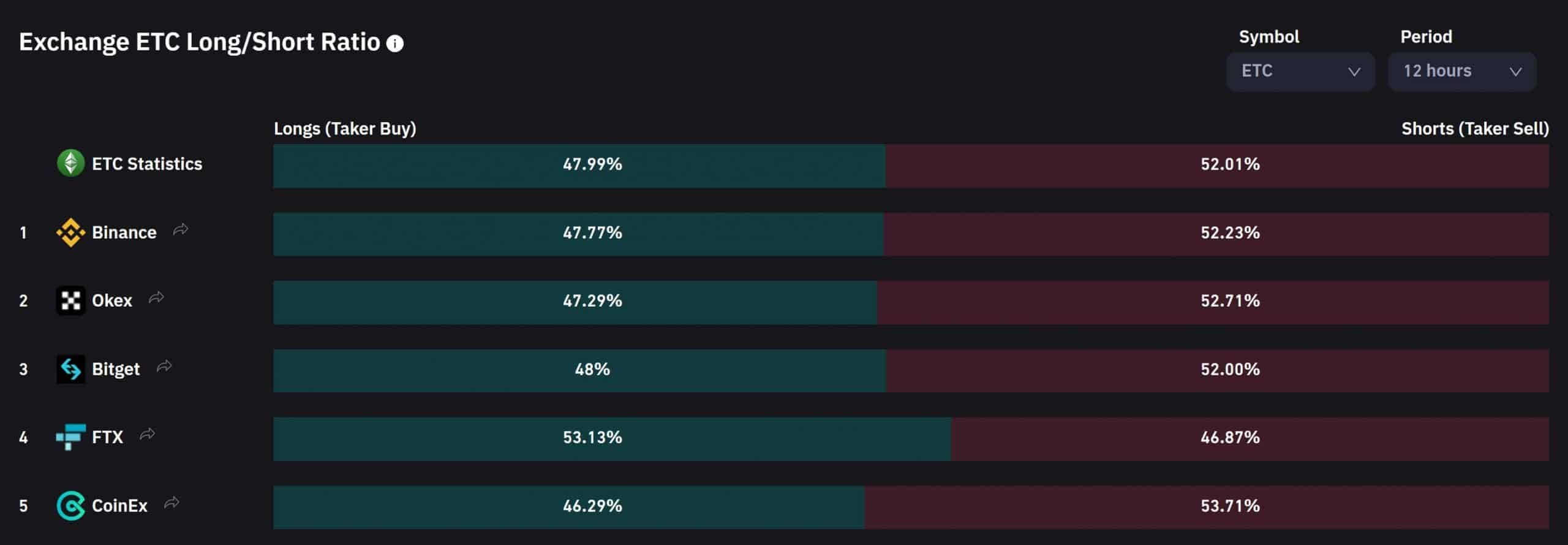

Supply: Coinglass

Nonetheless, an evaluation of the lengthy/quick ratio over the past 12 hours revealed an edge for the sellers. However the targets would stay the identical as mentioned.

Lastly, broader market sentiment and different on-chain developments may very well be important in influencing future actions.