Uniswap [UNI] buyers must identify these signs of reversal before going long

Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought of funding recommendation.

- Uniswap bears re-entered the market whereas the crypto gravitated beneath its EMA ribbons.

- The crypto’s funding charges witnessed a slight enchancment over the previous couple of days.

Following its newest bearish pull, Uniswap [UNI] slipped beneath its EMA ribbons whereas revealing a heightened promoting edge. The sellers renewed their strain and propelled a streak of purple candles because the alt reversed from the day by day 200 EMA (inexperienced).

Learn Uniswap’s worth prediction 2023-24

If the sellers insist on defending the $6.4 resistance, UNI might see a near-term pullback earlier than any bullish rebuttal. At press time, UNI was buying and selling at $6.07.

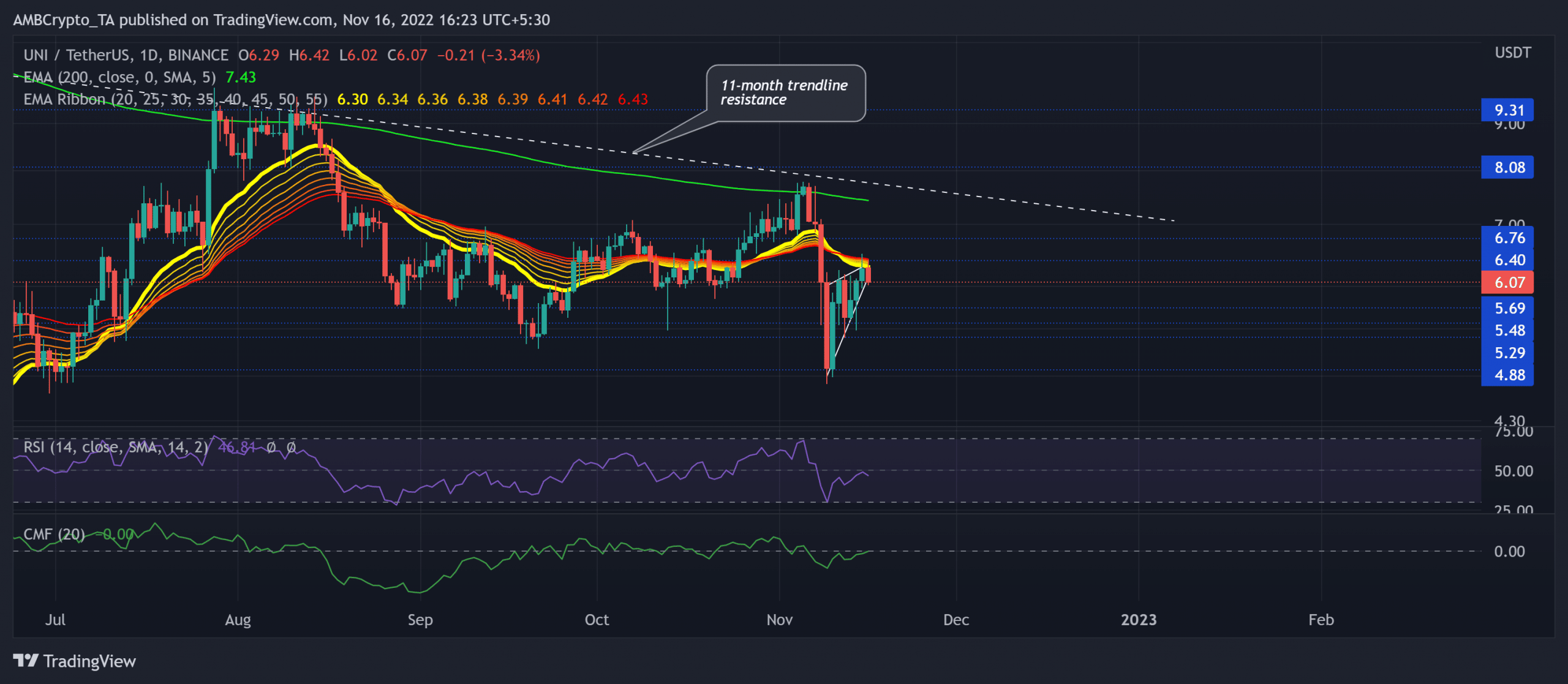

UNI noticed a bearish pull from its long-term trendline resistance

Supply: TradingView, UNI/USDT

UNI’s long-term trendline resistance traditionally propelled bearish pulls over the past 11 months. Consequently, the current rebound from this stage close to the 200 EMA induced a strong pulldown.

The altcoin’s prolonged bearish run discovered help round $4.8 help. Whereas the patrons exhibited their intentions to forestall any additional harm, UNI crawled again towards its EMA ribbons.

In the meantime, UNI noticed a bearish crossover on its EMA ribbons whereas forming a bearish pennant-like construction. A convincing shut beneath the present sample might heighten the continued bearish strain within the coming classes.

On this case, the sellers would look to check the $5.2-$5.4 vary. Any ensuing revival can deliver forth shopping for alternatives. Any shut above the EMA ribbons might place UNI for a retest of its long-trendline resistance within the coming time.

The Relative Energy Index (RSI) continued its sway within the bearish zone whereas depicting slight ease in promoting strain. Any reversals from the midline would reinforce the bearish edge. Furthermore, the Chaikin Cash Movement (CMF) hovered close to the midline to depict a impartial place.

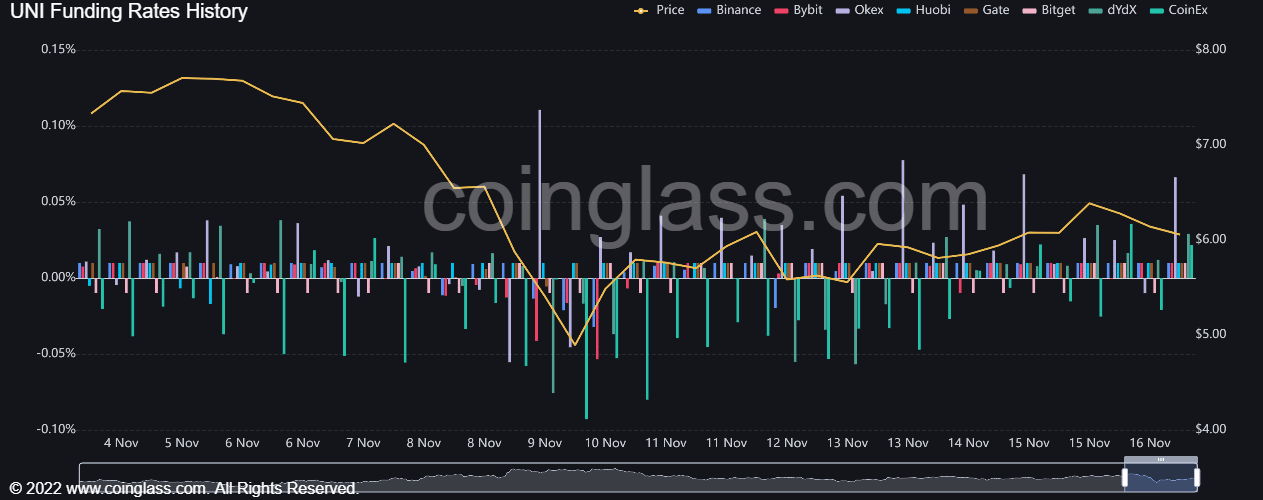

Improved funding charges

Supply: Coinglass

An evaluation of the funding charges revealed a comparatively favorable place for the patrons. UNI’s funding charges throughout all exchanges marked an uptrend over the previous couple of days.

Consequently, these charges hovered within the optimistic zone over the past day after this upturn. The patrons might maintain a watch out for a possible change of pattern on this entrance to gauge the sentiment within the futures market. Lastly, general market sentiment and on-chain evaluation could be very important for making a worthwhile wager.