The Sandbox: What should investors expect after SAND’s latest stunt in the market

Because the crypto market shook off its week-long rally, the Sandbox [SAND] defied the pattern because it surged 14.14%, hitting its thirty-day excessive. The metaverse token had adopted the market sentiment earlier, registering greens for a lot of the recently-ended week.

Nonetheless, the newest 24-hour rally was approach higher than no matter surge SAND recorded within the final seven-days. With The Sandbox clearly not slowing down its momentum, buyers expectations within the short-term would possibly align with the token’s persistence.

Right here is AMBCrypto’s Worth Prediction for The Sandbox [SAND] 2023-2024

Unfold the message in each nook and cranny

A lot of components might need performed a job in SAND’s rise to $0.908. Nonetheless, an simple half can be The Sandbox having a notable style large key into its metaverse plans.

Based on Forbes, fashion-power home, Gucci, formally went stay with its first Sandbox expertise. Apparently, the online 3.0 occasion which began on 27 October would run till 9 November. The implication of this could be that SAND might stay related whilst its 24-hour buying and selling quantity surged over 170%.

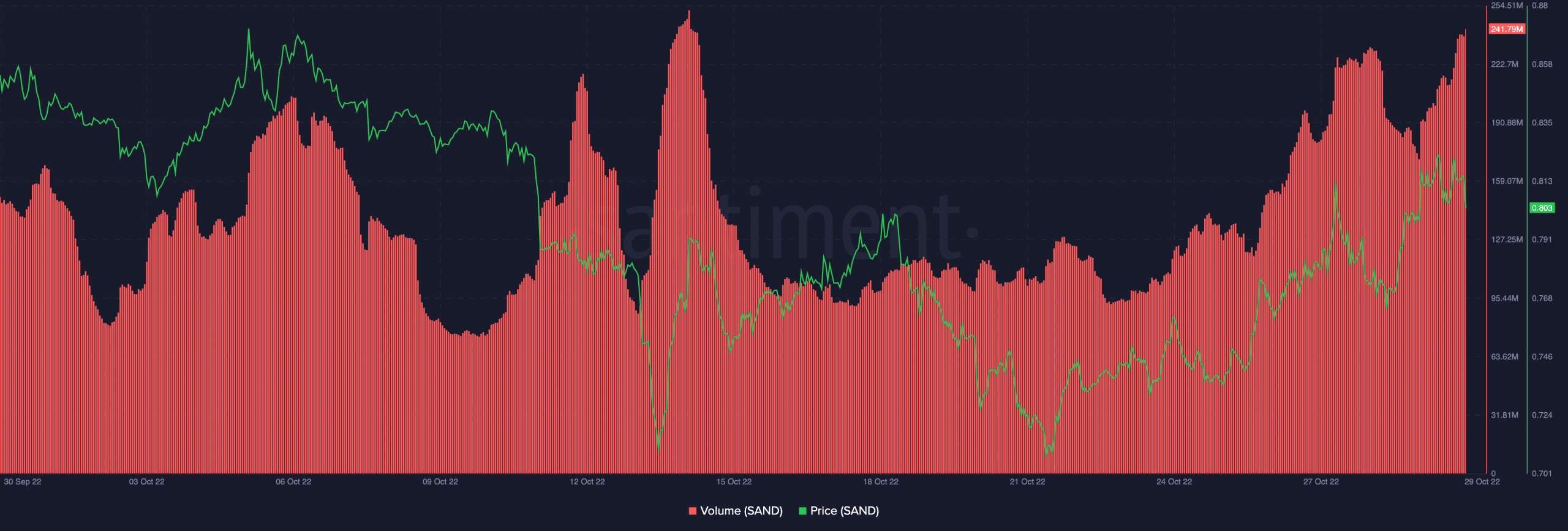

Supply: Santiment

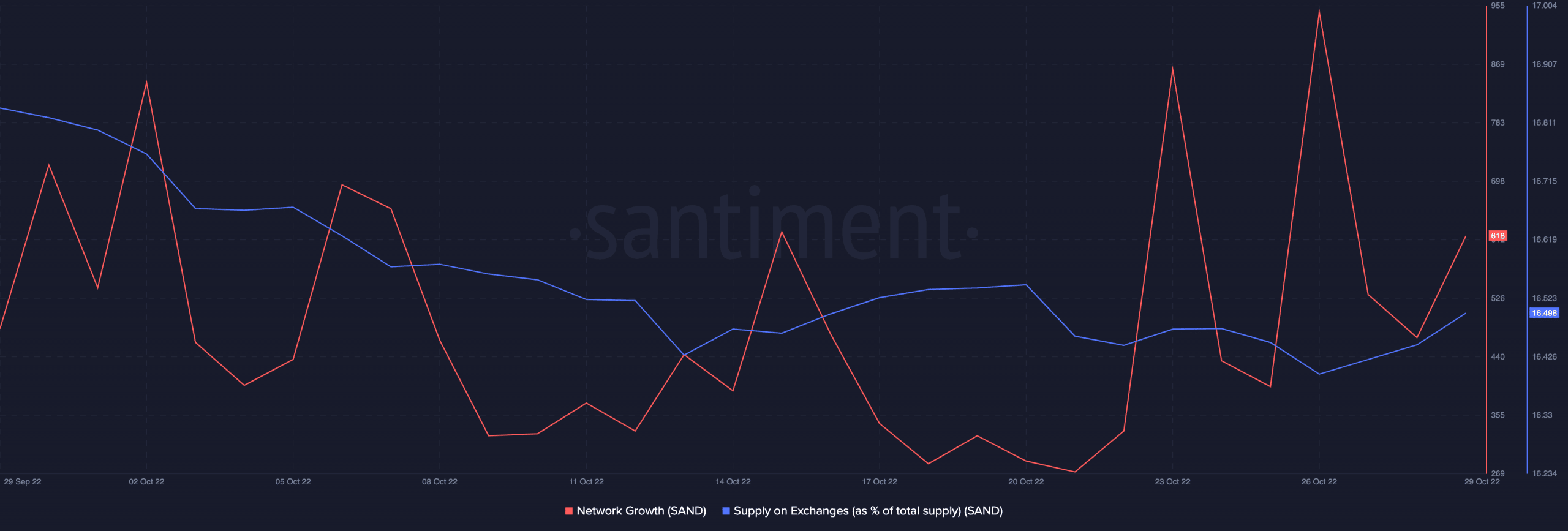

Apart from the quantity, SAND appeared to have attracted new buyers. This was evident from the community development enhance. With the uptick in community involvement, SAND was more likely to proceed gaining traction from the crypto group. Nonetheless, it was needed to think about the state of the alternate provide.

At press time, Santiment revealed that whole alternate provide had risen to 16.49%. This enhance meant that buyers may very well be directing earnings constructed from the previous few days into the exchanges. As such, there was a excessive probability of promoting strain. So, buyers would possibly should be further cautious in anticipating one other collection of upticks within the coming days.

Supply: Santiment

Have merchants taken benefit?

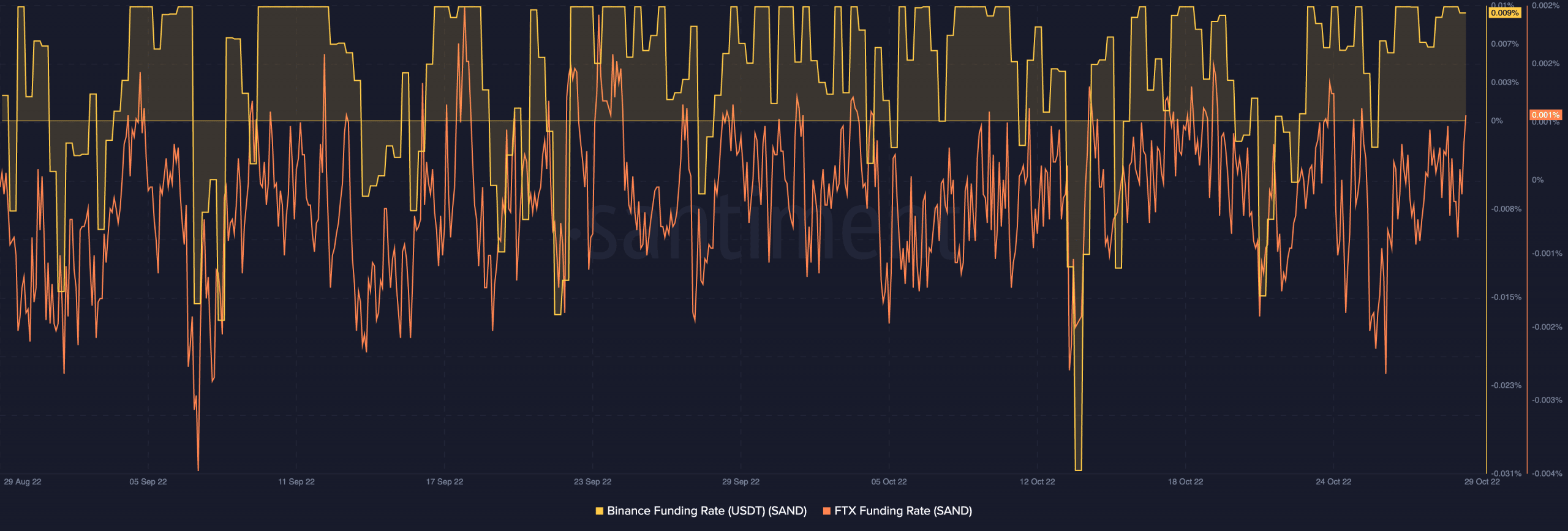

Contemplating the momentum displayed by SAND, one would anticipate that merchants would have key into the “alternative”. Apparently, that was the case as Santiment confirmed that the Binance and FTX funding rates for SAND had been in a optimistic state. This implied that futures merchants had been enthusiastic about benefiting from the worth swings to make earnings.

Supply: Santiment

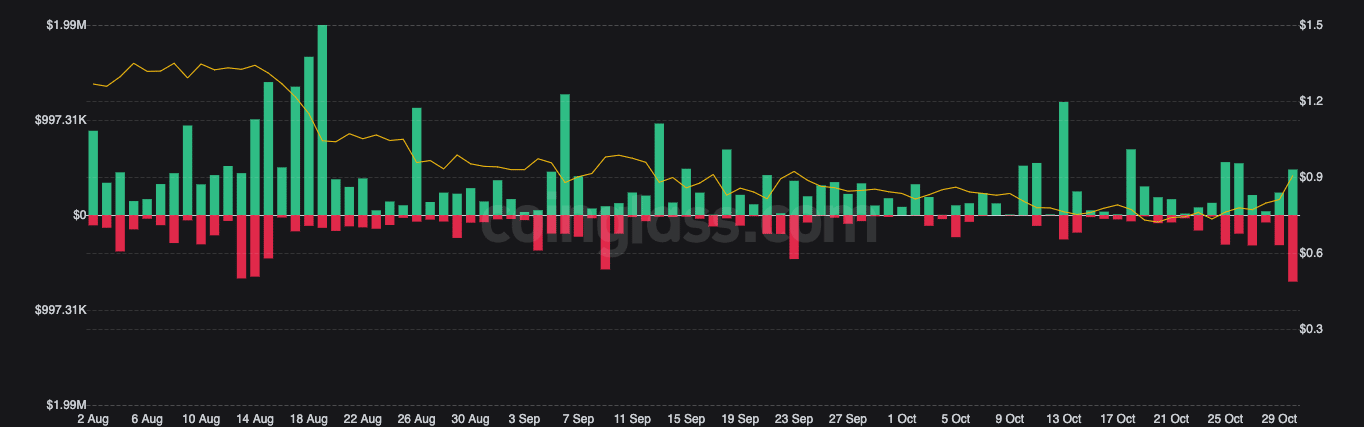

Regardless of the uptick recorded, it appeared that liquidations had been virtually at par with each shorts and longs. Based on Coinglass, about $1.4 million price of SAND had been liquidated within the final 24 hours. Nonetheless, the distinction between each these reverse ends wasn’t a lot surprisingly.

At press time, shorts had been liquidated at slightly over $698,000. For long-position merchants, it was $477,050. With this information, it could be necessary for buyers trying to revenue extra to observe their steps.

Supply: Coinglass

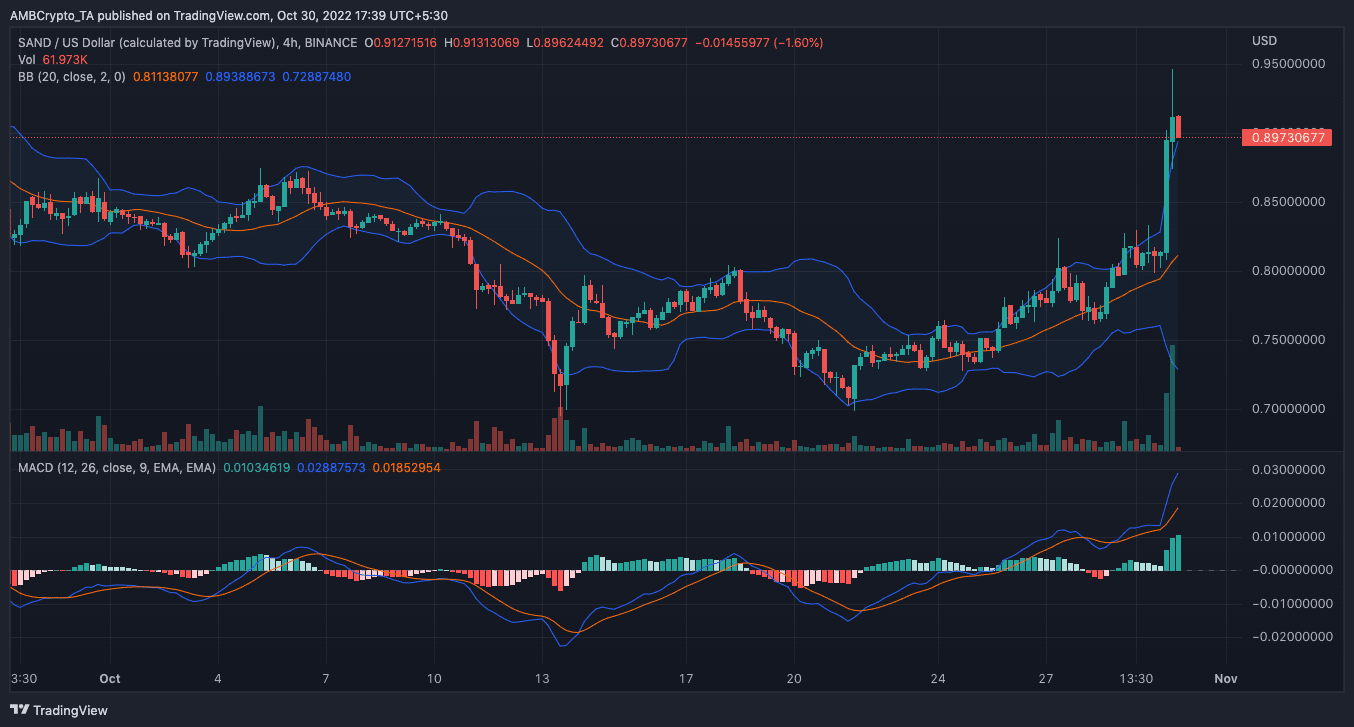

On the four-hour chart, SAND was displaying excessive indicators of volatility. Primarily based on indications from the Bollinger Bands (BB), the extremely unstable state exploded past its average state within the early hours of 30 October.

Whereas this contributed to the worth hike, it might additionally lead SAND down the charts. As well as, the Shifting Common Convergence (MACD) revealed that the sellers (orange) had been near catching up with the consumers. Within the case of assembly up or overtaking, SAND would possibly halt its rally.

Supply: TradingView