Polygon (MATIC) Price Prediction 2025-2030: Should you go long on MATIC in 2023?

Disclaimer: The datasets shared within the following article have been compiled from a set of on-line assets and don’t replicate AMBCrypto’s personal analysis on the topic

Polygon, the preferred scaling answer of Ethereum, has witnessed quite a few partnerships this 12 months. Every partnership brings web3 a step nearer to the mainstream enterprise world.

The newest one was a partnership with Warner Music to launch music NFTs in January of subsequent 12 months. These developments affect the worth of its native token MATIC to some extent.

Learn Worth Prediction for MATIC for 2023-24

The Polygon community helps plenty of initiatives and DeFi exchanges. The community boasts over 1.45 million lively customers per week who make greater than 3 million transactions daily.

Decentralized exchanges have been thriving on the community. SushiSwap’s consumer base has gone up by a whopping 68% since final week. In the meantime, KyberSwap and QuickSwap have expanded their consumer base by 46% and 53% respectively.

On-chain analytics agency Messari reported lately that Polygon’s NFT market has fared comparatively properly amid the market downturn. The report revealed that Polygon noticed a whopping 191% improve in NFT gross sales because the finish of September, due to web2 corporations which can be turning in direction of the combination of NFTs into their platforms.

On 21 November, Polygon co-founder Sandeep Nailwal took to Twitter to share some key stats concerning the undertaking’s zero data Ethereum Digital Machine (zkEVM) testnet. He revealed that greater than 14,000 transactions had been carried out. Moreover, nearly 6000 addresses in addition to 1622 good contracts had been deployed.

A brand new report printed by Blockchain analytics agency Messari reveals that the third quarter of 2022 noticed a 180% improve within the variety of lively addresses Q0Q, with whole transactions for the quarter coming in at 2 billion.

Moreover, Polygon’s partnership with Warren Buffet-backed Nubank, which was introduced final week, is being seen as a optimistic improvement for the community.

Common TV Community SHOWTIME lately announced a collaboration with Polygon and Spotify.

In different information, Polygon informed customers that Ethereum’s Merge had dramatically lowered its carbon dioxide emissions.

Polygon Community reached a brand new milestone on 15 November after the variety of distinctive addresses reached 191.2 million. Information from polygonscan reveals that the every day transactions on the Polygon chain took a big hit following the information of FTX’s chapter. As of 15 November, the overall transactions stood at 3.26 million.

Polygon announced a partnership with Nike earlier this week. This three way partnership will see the sportswear attire model bild it’s web3 experiences solely on Polygon.

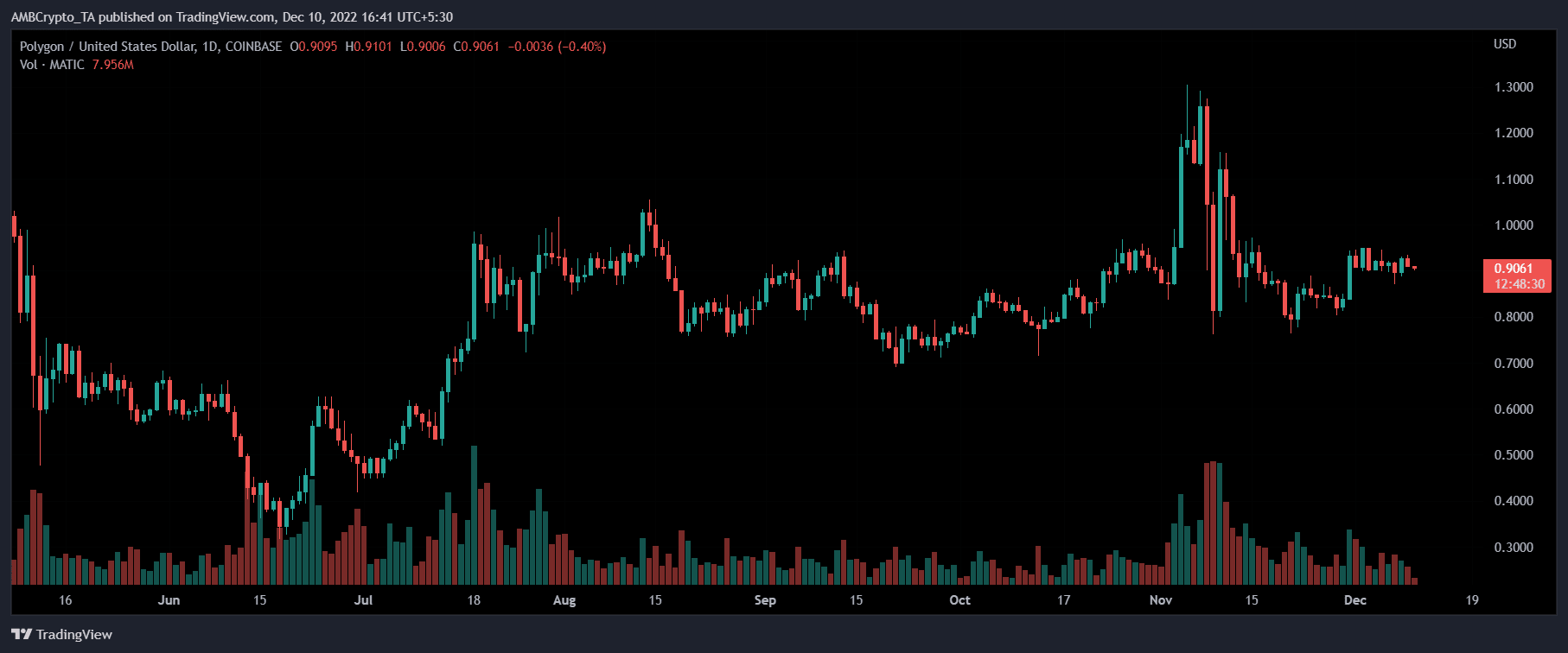

MATIC’s YTD chart might recommend a purchase sign, on condition that the crypto is presently properly above $1, in comparison with $2.58 in direction of the start of the 12 months. Whereas this will likely appear to be a ripe alternative to beef up MATIC holdings at a reduced value, it is very important have a look at different elements whereas investing choice.

Numbers from the buying and selling quantity, nonetheless, are fairly worrisome. Ethereum’s hottest layer 2 scaling answer has misplaced greater than 62% of its every day buying and selling quantity during the last seven days. $361 million value of MATIC was traded over the previous 24 hours, in comparison with $525 million two weeks in the past.

One doable cause for the sharp decline within the every day quantity of MATIC is the Ethereum Merge that befell on 15 September. The crypto has taken successful following the Merge occasion, with each market cap and every day quantity on a downtrend.

Polygon lately published an analytical perception into its bridge move between January and August 2022. A better have a look at the numbers revealed that in these 8 months, greater than $11 billion entered the Polygon ecosystem from a number of chains. Ethereum and Fantom Opera contributed essentially the most with an influx of $8.2 billion and $1.06 billion, respectively, which additionally places it on the prime by way of internet quantity.

So far as bridges are involved, Ethereum’s PoS bridge and Plasma bridge accounted for a internet quantity of $1 billion and $250 million inside this time interval. In the meantime, Ethereum’s PoS and Fantom Opera’s Multichain bridge accounted for a mixed outflow quantity of greater than $7.2 billion. Contemplating all 43 bridge chain pairs, the common quantity comes out to be $48 million.

At press time, MATIC was buying and selling at $0.9061.

Supply: TradingView

In February 2021, Matic rebranded to Polygon in a bid to supply a scalable model of Ethereum’s infrastructure and introduce overlay rollups to mix one other layer 2 platforms for immediate transactions, amongst different issues. Polygon retained the title of its native token MATIC. The token proceeded to achieve by over 200% over the following 30 days. Polygon runs on the proof-of-stake consensus protocol and may be described as an Ethereum layer 2 scaling answer with the perfect of each worlds.

In 2021, MATIC’s value went hovering due to the growing recognition of Ethereum and surging exercise in NFTs and play-to-earn video games like Axie Infinity. MATIC started the 12 months at a humble $0.018 and a market cap of $81 million. By the top of the 12 months, MATIC’s market cap hit a whopping $20 billion, with the altcoin touching its all-time excessive of $2.92 on 27 December.

On 12 Could 2021, Ethereum co-founder Vitalik Buterin donated crypto value $1 billion to the India Covid-19 reduction fund arrange by Nailwal. This seemingly unrelated occasion precipitated MATIC to surge by 145% inside the subsequent 48 hours. By 18 Could, the token had gone from $1.01 all the best way as much as $2.45, gaining 240%.

In Could 2021, Polygon was within the information after it acquired backing from billionaire investor Mark Cuban, who revealed plans to combine his NFT platform Lazy.com with Polygon. Following his funding in Polygon, Cuban claimed that the Polygon Community was “destroying everyone else” on the Defi Summit Digital Convention in June 2021.

For the reason that starting of 2022, Polygon has secured varied partnerships, most notably with Adobe’s Behance, Draftkings, and billionaire hedge fund supervisor Alan Howard for the event of Web3 initiatives. Polygon boasts partnerships throughout varied industries. Instagram and Polygon have collaborated on NFTs too.

Stripe has launched international crypto pay-outs with Polygon. Style manufacturers like Adidas Originals and Prada have launched NFT collections on polygon

Based mostly on gathered adoption metrics, Alchemy has described Polygon to be the best-positioned protocol to drive the booming Web3 ecosystem. Information from Alchemy additionally confirmed that at press time, Polygon hosted greater than 19,000 decentralized functions (dApps) on its community.

On 27 Could 2022, Tether (USDT), the biggest stablecoin by market capitalization, announced that it was launching on the Polygon Community. MATIC rose by greater than 10% following information of the launch.

Citigroup launched a report in April 2022, one during which it described Polygon because the AWS of Web3. The report went on to say that the Metaverse economic system is estimated to be value a whopping $13 trillion by 2030, with most of it being developed on the Polygon Community. Citigroup additionally believes that Polygon will see widespread adoption due to its low transaction charges and developer-friendly ecosystem.

The Terra community’s collapse in Could 2022 triggered an exodus of builders and initiatives. Polygon quickly introduced a multi-million greenback, Terra Builders Fund, in a bid to assist the migration of anybody seeking to swap networks. On 8 July, Polygon Studios CEO Ryan Wyatt tweeted that over 48 Terra initiatives had migrated to Polygon.

Crypto change Coinbase printed a report on 8 August 2022 that claimed that the way forward for Layer 2 scaling options might very properly be a zero-sum recreation, hinting that layer 2 options like Polygon might overtake Ethereum by way of financial exercise.

On 8 August 2022, blockchain safety type PeckShield reported a rug pull by the Polygon-based play-to-earn recreation Dragoma, following a pointy decline within the worth of its native token DMA. The identical has been corroborated by information from Polygonscan which reveals a transparent surge in token transfers and switch quantity on the day of the alleged rug pull which led to a lack of over $1 million.

Within the week following Polygon’s announcement of the Gnosis bridge, MATIC surged greater than 18% breaking the essential resistance at $1 for a quick interval. This characteristic paves the best way for Web3 groups like DeFi protocols and DAOs to switch property between Ethereum and Polygon, for significantly fewer gasoline charges with out compromising on safety.

Numbers from the thirty second version of PolygonInsights, a weekly report printed by Polygon outlining key community metrics, indicated that despite dropping down from the $1 mark that MATIC had reclaimed barely per week earlier than, not all was misplaced. Weekly NFT quantity stood at $902 million, a whopping 800% improve from the earlier week. In the meantime, lively wallets grew by 75% to 280,000.

In an trade that’s typically bashed for being power intensive and dangerous to the setting, Polygon has distinguished itself by attaining community carbon neutrality after offloading $400,000 in carbon credit. This nullified the carbon debt accrued by the community. As per the ‘Inexperienced Manifesto’ published by Polygon, they now plan to attain the standing of being carbon-negative by the top of 2022. In actual fact, they’ve pledged $20 million in direction of that milestone.

Cercle X, the world’s first decentralized software for waste administration options, introduced on 15 August that it had built-in with Polygon to leverage Web3 to digitize the rubbish disposal course of by creating a waste administration dashboard.

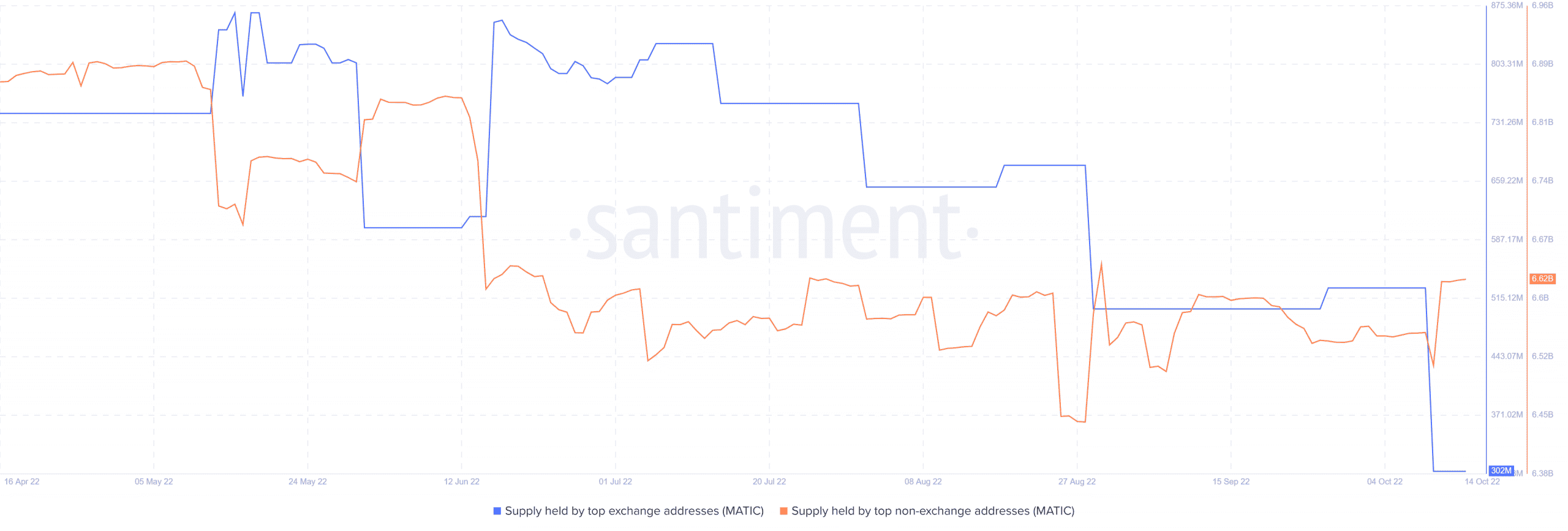

Whale Motion

Supply: Santiment

Information from blockchain analytics agency Santiment confirmed that following the market-wide sell-off triggered by the collapse of Terra, nearly 30% of the availability held by prime change addresses (whales) was taken off of exchanges, the identical is corroborated by the seen spike in provide held by non-exchange addresses which point out that offer held by non-exchange addresses soared all the best way to 806 million MATIC.

Nevertheless, come mid-June, this switch was reversed, with buyers speeding their MATIC holdings into exchanges and non-exchange holdings dropping by 240 million MATIC.

It might be secure to imagine that these holdings got here from non-exchange addresses as a pointy decline in provide held by them is seen. For over a month the holdings had been reasonably dormant of their respective locations, however by the top of July, provide held by prime change addresses was slashed once more, this time by 120 million MATIC. On the identical time, non-exchange addresses held a whopping 6.6 billion MATIC.

Newest Stats

On August 30, Polygon released the 34th version of PolygonInsights, a weekly analytics report the place key metrics concerning the community, dApps and NFTs are printed.

With 817,000 weekly lively customers, the community registered a 14% progress, in comparison with the 805,000 lively customers within the earlier week. Whereas every day transactions fell by 3%, the general transactions had been 12% cheaper than the week earlier than. The typical every day income got here out to be $45,100.

Numbers within the NFT division had been much more optimistic. The weekly NFT grew by a whopping 400%, reaching $656 million. The variety of new NFT wallets surged by nearly 60% with 60,000 new customers registering with the community. Mint occasions and whole NFT transactions had been the 2 areas that didn’t see progress, with each numbers declining by 12% and 9% respectively.

dApp stats revealed that Arc8 and SushiSwap had been the highest two movers within the prime 25 protocols. Arc8 registered greater than 30,000 new customers, a 51% improve from the earlier week. SushiSwap then again registered 8200 new customers, reflecting an enormous 88% improve over the earlier week.

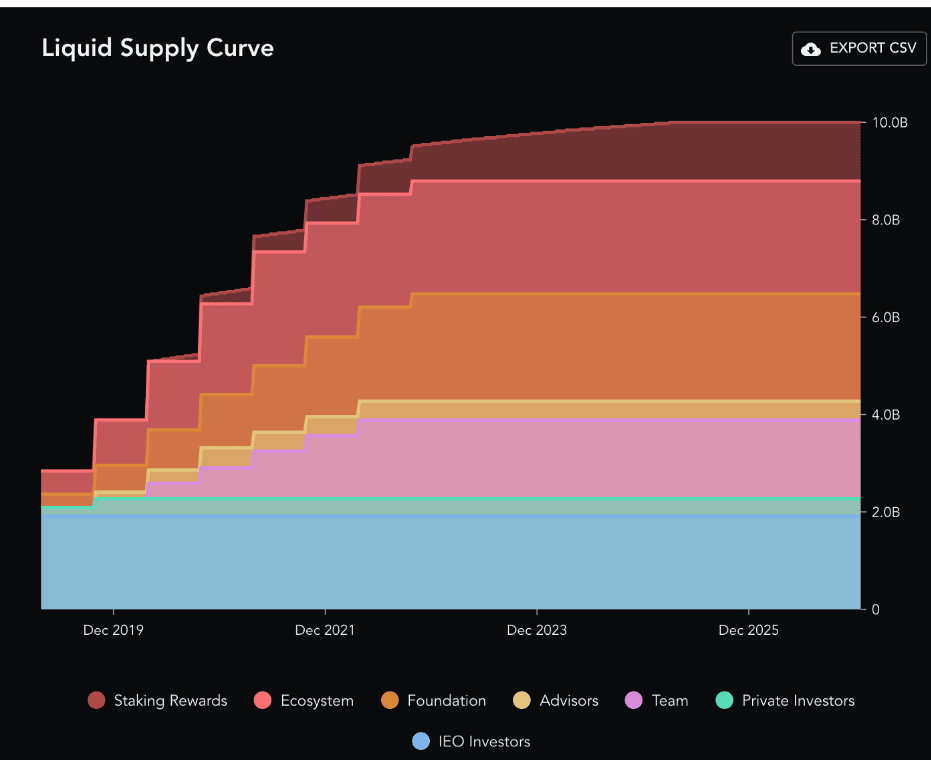

Polygon Tokenomics

Polygon has a most whole provide of 10 billion tokens, out of which 8 billion are presently in circulation. The remaining 2 billion tokens can be unlocked periodically over the following 4 years and can primarily be disbursed by staking rewards. The preliminary change providing was held on Binance by the Binance Launch Pad to facilitate the sale of 19% of the tokens.

Supply: Polygon Forum

Following is the breakdown of the present provide –

- Polygon Workforce – 1.6 billion

- Polygon Basis – 2.19 billion

- Binance Launchpad – 1.9 billion

- Advisors – 400 million

- Non-public sale – 380 million

- Ecosystem – 2.33 billion

- Staking Rewards – 1.2 billion

Understandably, there are various who’re very bullish on MATIC’s future. Some YouTubers, as an example, believe MATIC will quickly be value $10 on the charts. In actual fact, he claimed {that a} “wonderful” double-digit valuation for the token is inevitable.

“We’ve seen Polygon actually selecting up within the variety of NFTs offered. We will see from July, once we had 50,000 Polygon-based NFTs offered, to now the place we’ve… 1.99 million NFTs offered within the month of December on Polygon on OpenSea. That’s completely large, large progress for the Polygon ecosystem.”

MATIC Worth Prediction 2025

After analyzing the altcoin’s value motion, crypto-experts at Changelly concluded that MATIC must be value at the least $3.39 in 2025. They forecasted a most value of $3.97 for that 12 months.

In keeping with Telegaon, MATIC must be value at the least $6.93 by 2025, with a median value of $7.18. The utmost value projected by the platform is $9.36.

MATIC Worth Prediction for 2030

Changelly’s crypto-experts consider that by the 12 months 2030, MATIC can be buying and selling between $22.74 and $27.07, with a median value of $23.36.

Right here, it’s value declaring that 2030 continues to be a great distance away. 8 years down the road, the crypto market could possibly be affected by a bunch of various occasions and updates, every of which is troublesome to determine. Ergo, it’s greatest that predictions like these are taken with a pinch of salt.

On the intense facet, nonetheless, MATIC’s technicals flashed a BUY sign on the time of writing. It’s no surprise then that the majority are optimistic concerning the fortunes of the altcoin.

Conclusion

MATIC’s restoration because the market-wide sell-off in Could has been spectacular, however it’s doable that the pattern reverses if buyers select to e-book their income. Particularly on condition that a variety of them have seen their holdings diminish because of the ongoing crypto-winter and the prospect of leaving within the inexperienced can be tempting.

Talking on the Korea Blockchain Week 2022, co-founder Sandeep Nailwal advised that bearish situations akin to the continued crypto winter present a ‘noise-free’ setting appropriate for expertise acquisition and advertising. This might imply that Polygon comes out forward as soon as the pattern reverses and the bulls are again answerable for the market.

Crypto consultants appear to be divided over the aftermath of the much-anticipated Ethereum merge which is scheduled for subsequent month. Some consider that when ETH 2.0 arrives, it might make scaling options redundant – or at the least much less essential.

The opposite facet of consultants has argued that the merge will make Ethereum extra eco-friendly by lowering power consumption, and by extension will profit layer 2 scaling options like Polygon by growing its attraction to buyers as environment-friendly crypto. Along with this, MATIC would even be poised for a surge in worth since Ethereum’s merge can have no impact on its controversially excessive gasoline charges, successfully promoting Polygon’s use case.

In a blog submit on 23 August, The Polygon crew addressed the neighborhood’s issues relating to the merge and its affect on the community.

The crew assured customers that the merge is sweet information and nothing to fret about. The crew went on to elucidate that whereas the merge will cut back Ethereum’s power consumption considerably, it won’t have any impact on the gasoline charges or transaction pace, which is a significant drawback for the community. “the community depends upon Polygon and different Layer 2 options to unravel for this. “ the crew added.

The crew reiterated that the expansion of Ethereum will result in the expansion of Polygon and that the way forward for each networks is symbiotic.

This statement from the Ethereum Basis will come as a reduction to these frightened concerning the affect of the merge on the polygon community, “The Ethereum ecosystem is firmly aligned that layer 2 scaling is the one technique to resolve the scalability trilemma whereas remaining decentralized and safe.”

When ETH 2.0 comes, it might make scaling options redundant – or at the least much less essential. The counter to that’s Polygon plans to broaden to different blockchains and the interoperability capabilities sooner or later will offset any menace that Ethereum’s Merge presents.

The key elements that can affect MATIC’s value within the coming years are –

- Profitable rollout of zero-knowledge EVMs

- Growth to new blockchains

- Development in dApps hosted on the community

Predictions should not proof against altering circumstances and can be up to date with new developments. Do be aware, nonetheless, that predictions should not an alternative choice to analysis and due diligence.

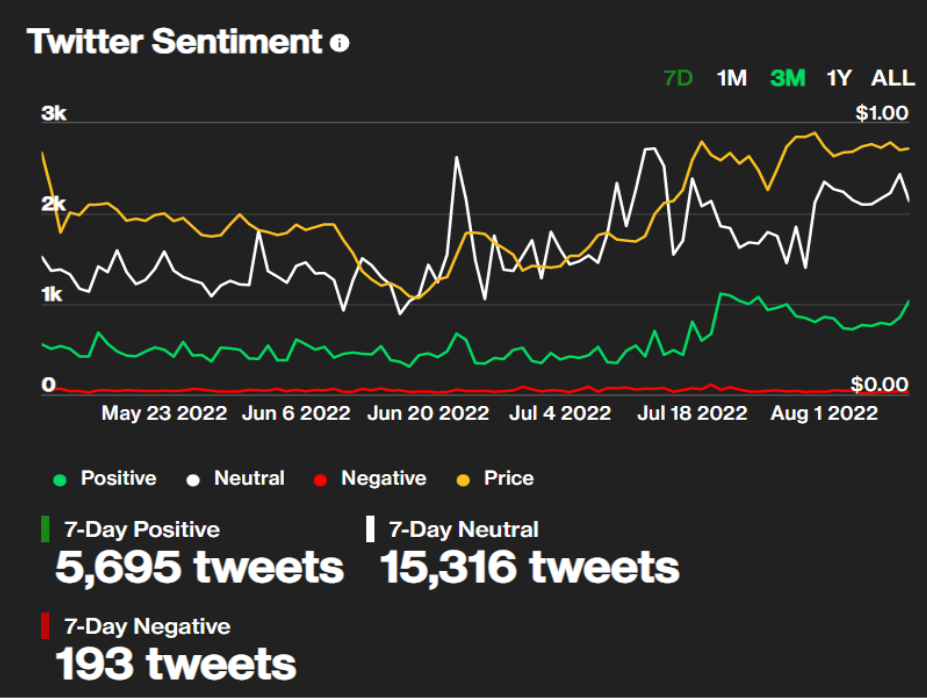

It’s value declaring right here that so far as social sentiment is worried, all are on the optimistic facet for Polygon.

Supply: CoinDesk

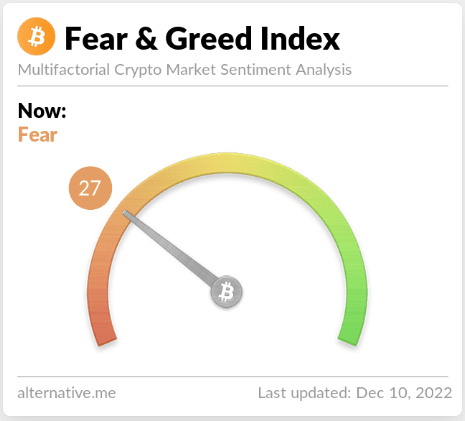

The Concern and Greed Index has degraded over the previous week.

Supply: Various