OTC Trading Explained – What does OTC mean

superior

OTC buying and selling is a technique of buying and selling monetary property, together with cryptocurrencies, that takes place instantly between two events with out the oversight of an change. This decentralized type of buying and selling is especially favored by massive gamers, akin to hedge funds, on the lookout for a non-public and environment friendly option to conduct massive transactions with out impacting the market value. Naturally, its format additionally attracts many crypto traders.

Nevertheless, OTC buying and selling comes with its personal set of challenges. Attributable to much less regulatory oversight, it might undergo from an absence of investor curiosity, affecting its liquidity. On this article, I’ll define each the advantages and dangers that you would be able to encounter whenever you commerce OTC shares or crypto. Let’s dive in!

Over-the-Counter (OTC) Buying and selling Definition

Over-the-Counter (OTC) buying and selling refers to a way of buying and selling that happens instantly between two events with out the supervision of an change. This buying and selling occurs by way of a decentralized market fairly than on a centralized change. In OTC markets, buying and selling can contain a broad vary of property — from commodities to monetary devices like shares and cryptos. The important thing level right here is that OTC buying and selling bypasses the normal mediums of inventory market exchanges.

What Is an OTC Market?

An over-the-counter market is a decentralized market the place the buying and selling of economic devices, akin to shares, commodities, currencies, or derivatives, takes place. This contrasts with public sale markets (such because the New York Inventory Trade or Nasdaq), that are characterised by a bodily location.

The OTC Markets Group, a vital participant on this area, categorizes OTC-traded corporations into three tiers primarily based on numerous elements, together with monetary requirements, company governance, and disclosure practices. These tiers are OTCQX (the highest tier), OTCQB (the enterprise market), and OTC Pink (the pink market).

Whereas market individuals can commerce blue-chip shares, most OTC securities are from smaller corporations. These could embrace penny shares from early-stage or development corporations or securities from shell corporations and bigger overseas corporations that don’t meet the eligibility necessities to be listed on a significant change within the U.S.

Can You Commerce Crypto in OTC Markets?

Sure, cryptocurrencies can certainly be traded in OTC markets. In actual fact, OTC buying and selling desks have change into a notable a part of the cryptocurrency world, particularly for bigger trades. Crypto OTC trades can happen via e mail, personal messages, or devoted digital platform buying and selling programs.

OTC buying and selling helps you to bypass third events and change crypto in a extra direct means.

Similar to the way in which market makers facilitate the shopping for and promoting of conventional OTC securities, in addition they play a essential function within the crypto OTC market, offering liquidity and setting the share value of the crypto cash. The market makers guarantee there may be sufficient buying and selling quantity to permit market individuals to purchase or promote a major quantity of a particular cryptocurrency with out considerably shifting the market value.

Sorts of OTC Securities

OTC markets facilitate the buying and selling of a wide range of securities, together with:

- Equities – these usually contain penny shares or shares of smaller corporations, in addition to shares of bigger overseas corporations that don’t qualify for itemizing on a significant change.

- Derivatives – these are complicated monetary devices whose worth is derived from underlying property like shares, bonds, commodities, or cryptocurrencies.

- Bonds – company bonds, municipal bonds, and authorities bonds could be traded OTC.

- Cryptocurrencies – given the comparatively decentralized nature of cryptocurrencies, OTC markets are a preferred venue for buying and selling these digital property, particularly for high-volume trades.

- Financial institution Certificates – financial institution certificates of deposit (CDs) will also be traded in OTC markets.

The Professionals and Cons of OTC Buying and selling

Professionals:

- Flexibility and Comfort. OTC markets function 24/7, enabling market individuals to commerce at any time. That is useful for cryptos, which additionally commerce around the clock.

- Privateness. Since OTC trades don’t must be publicly reported instantly, they provide higher privateness to merchants.

- Much less Market Affect. Excessive-volume trades in OTC markets are much less prone to have an effect on the market value of a safety, making them supreme for big trades.

Cons:

- Further Threat. OTC buying and selling carries extra threat because of the lack of regulatory oversight. This threat could be particularly pronounced with penny shares and cryptocurrencies, which are sometimes topic to cost manipulation.

- Lack of Transparency. OTC markets lack the transparency of exchanges, making it tougher for merchants to establish a good market value.

- Regulatory Compliance. Particularly for overseas corporations, assembly regulatory compliance in OTC buying and selling can generally be complicated and time-consuming.

- Liquidity Threat. Some OTC securities could also be much less liquid than these traded on exchanges, probably making it tougher for merchants to purchase or promote them with out impacting the market value.

In conclusion, whereas OTC markets supply an alternate buying and selling venue for a variety of securities, together with cryptocurrencies, in addition they carry their very own distinctive dangers and challenges. Subsequently, potential merchants ought to rigorously contemplate these elements and probably search skilled recommendation earlier than diving into OTC buying and selling.

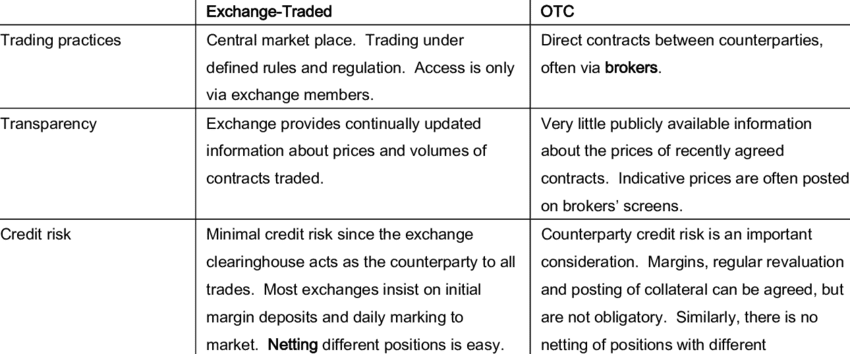

OTC vs. Trade

OTC and change buying and selling differ basically in how transactions are carried out. Within the OTC (Over-the-Counter) market, buying and selling occurs instantly between two events with out the oversight of an change. It’s basically a decentralized market with no bodily location.

Then again, change buying and selling, which occurs on inventory exchanges such because the NYSE and Nasdaq, is centralized. All trades are carried out and cleared by way of the change platform, making certain transparency and regulatory compliance. In OTC markets, nonetheless, a broker-dealer community is accountable for conducting transactions.

The reporting requirements additionally differ. OTC markets usually have extra lenient reporting necessities in comparison with exchanges. For instance, whereas some OTC securities do report back to the SEC (the US Securities and Trade Fee), many others don’t. This flexibility could be useful to smaller corporations that may’t meet the stringent capital necessities of main exchanges.

Methods to Purchase OTC Shares and Crypto

Shopping for OTC shares and cryptocurrencies isn’t really totally different from buying different forms of securities. You’ll must comply with these basic steps:

- Discover a Dealer: Select a dealer that has entry to the OTC market. Be sure it’s registered with the Monetary Business Regulatory Authority (FINRA). Should you’re seeking to get OTC crypto, choose a platform that has nice critiques and has confirmed to be dependable — and don’t overlook to take a look at their safety measures.

- Do Your Analysis: Analysis the funding deserves of the OTC inventory or crypto you need to purchase. For shares, this might contain reviewing the pink sheet listings.

- Place an Order: When you’ve selected an funding, place your order in your chosen platform. Remember to specify the ticker image of the inventory or the cryptocurrency.

Keep in mind, OTC trades are much less regulated than trades made on main exchanges. So, it’s important to train due diligence earlier than making funding choices.

FAQ

What are OTC derivatives?

OTC derivatives are contracts which are traded (and privately negotiated) instantly between two events with out going via an change or different middleman. These derivatives transactions can contain numerous monetary devices like currencies, rates of interest, commodities, or indices.

Not like standardized exchange-traded derivatives, OTC derivatives are custom-made to suit the wants of the counterparty. The phrases of those derivatives could be adjusted to accommodate future funds, notional quantities, and different particular wants of the events concerned.

OTC derivatives gained notoriety through the monetary disaster of 2008, as they have been a major contributor to the monetary system’s instability. Consequently, the European Union and different jurisdictions have carried out rules to extend transparency and restrict dangers associated to OTC derivatives transactions.

What does OTC imply?

OTC stands for over-the-counter. In monetary markets, OTC refers back to the technique of how securities are traded for corporations not listed on an change. Securities traded over-the-counter are traded by way of a broker-dealer community fairly than on a centralized change. These securities could embrace shares, bonds, derivatives, or cryptocurrencies.

Are OTC shares secure?

It’s vital to do not forget that whereas OTC shares can current massive alternatives for good points, in addition they include dangers. Thus, it’s essential for traders to completely analysis any OTC inventory earlier than investing and contemplate searching for recommendation from a monetary advisor or dealer acquainted with the OTC market.

As the security of OTC shares relies upon closely on particular property, it will probably range extensively. There are professional, well-run corporations whose shares commerce over-the-counter. Don’t overlook to DYOR earlier than investing in any OTC shares.

Disclaimer: Please notice that the contents of this text are usually not monetary or investing recommendation. The knowledge offered on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native rules earlier than committing to an funding.