On-Chain Metrics Indicate Potential Correction In Bitcoin, Ethereum Price

The U.S. Federal Reserve is predicted to boost the fed funds price by 25bps to 4.75%-5% throughout the FOMC assembly on Wednesday. It is going to be the second consecutive 25bps price hike, pushing borrowing prices to new highs since 2007. Merchants anticipate an extra improve in Bitcoin and Ethereum costs as a result of banking disaster.

Billionaires Elon Musk and Invoice Ackman, economists, and traders consider the central financial institution ought to pause the financial tightening to carry monetary stability after the collapse of three US banks and the takeover of Credit score Suisse. Traders should hold an in depth watch on new financial forecasts and dot plot attainable additional price hikes this 12 months.

On-Chain Information Indicating Potential Correction in Bitcoin Worth

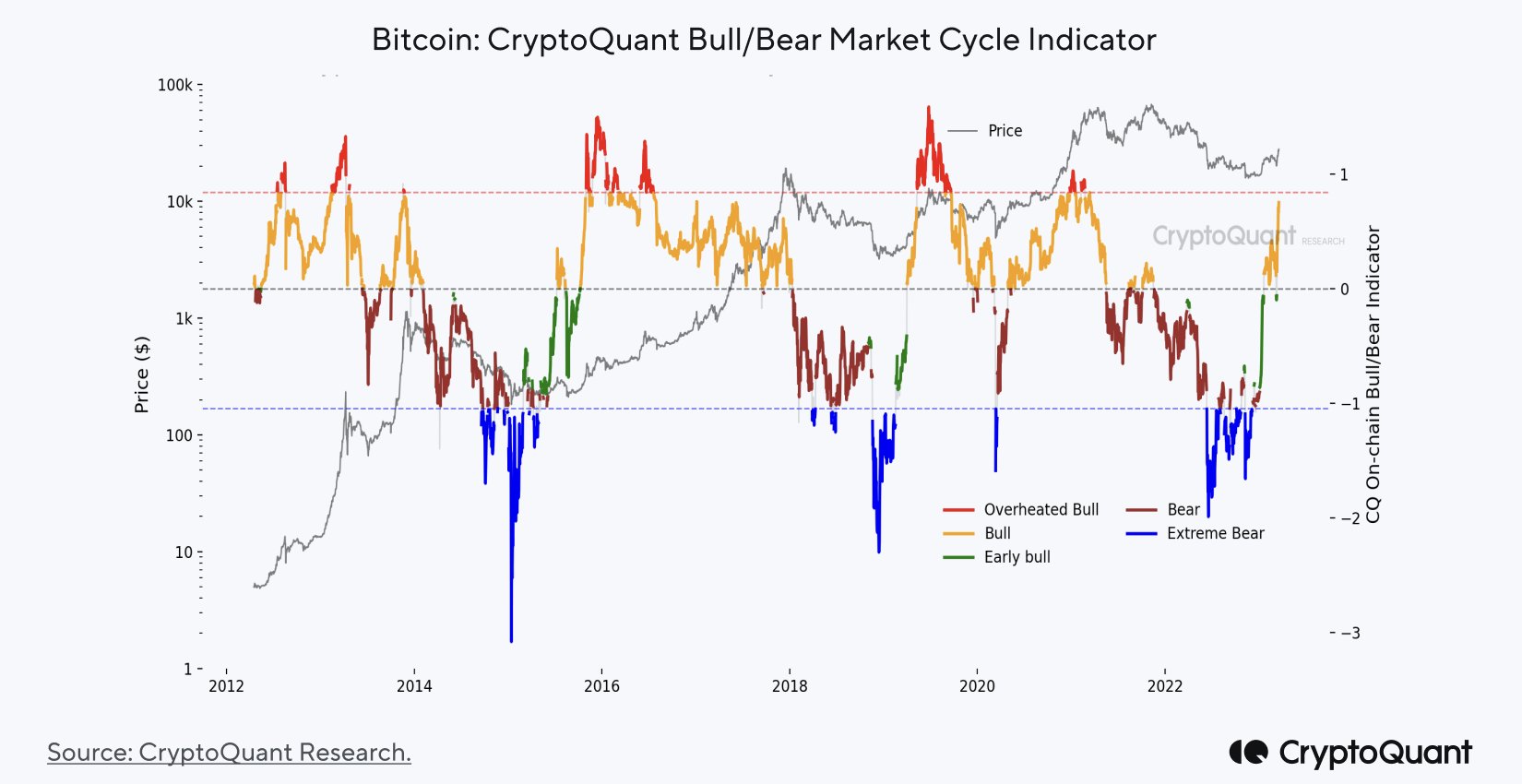

Bitcoin is within the early bull market cycle and the latest rally above $28,000 clearly proves it. Furthermore, on-chain indicators corresponding to CryptoQuant’s On-chain P&L Index and inter-exchange flows indicated a bullish Bitcoin narrative.

The Bitcoin Bull/Bear Market Cycle metric signifies a risk of a worth correction because it reaches close to the Overheated Bull space. Thus, traders should train warning as a result of sudden improve in Bitcoin worth in a significantly quick interval.

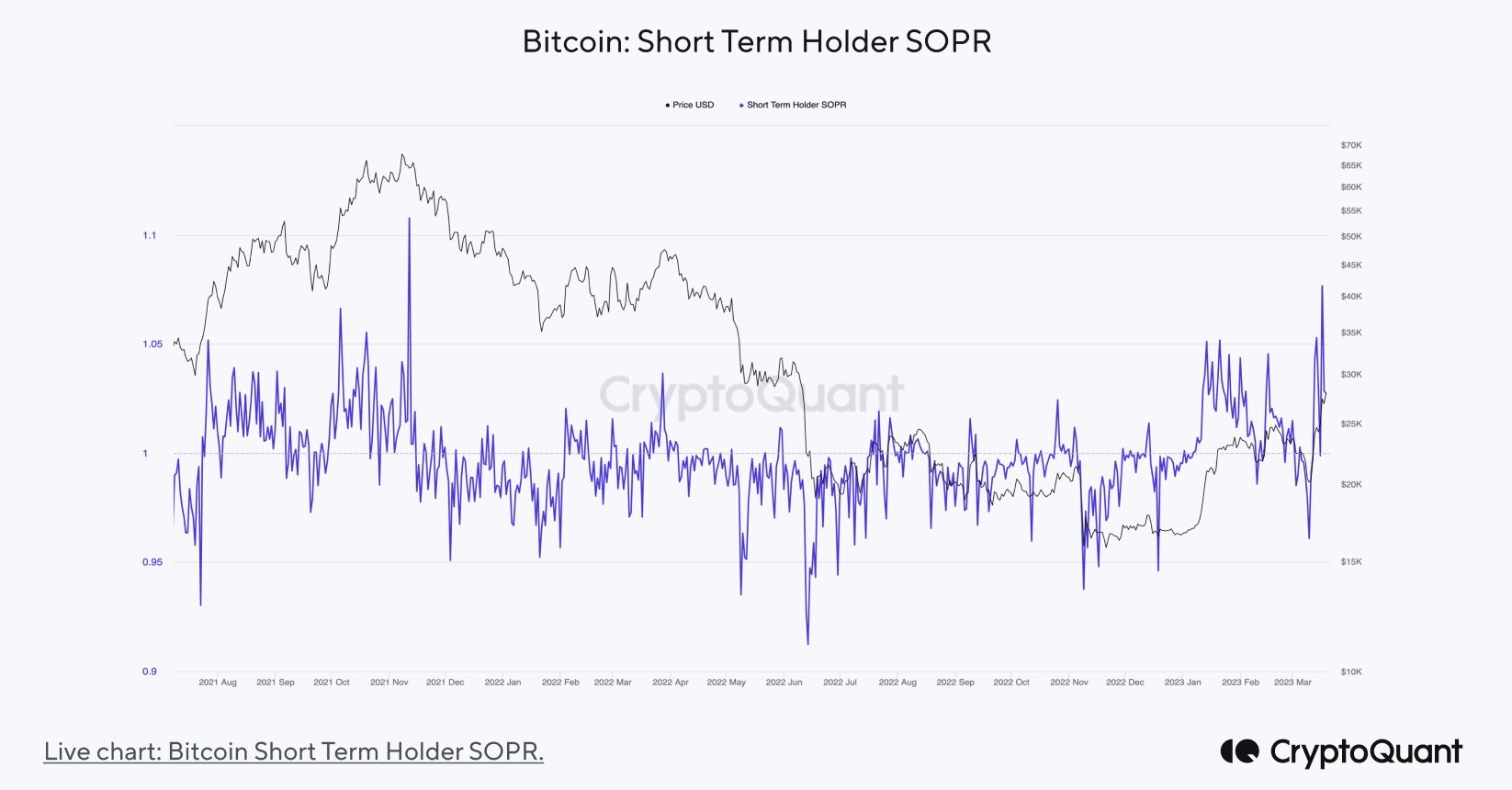

The Bitcoin Quick-Time period Holders SOPR metric has jumped above 1.5. It signifies traders are reserving income at a outstanding revenue margin of seven.6%. It’s the highest since November 2021, when Bitcoin was buying and selling at $64K. Sometimes, values over ‘1’ point out extra short-term traders are promoting at a revenue.

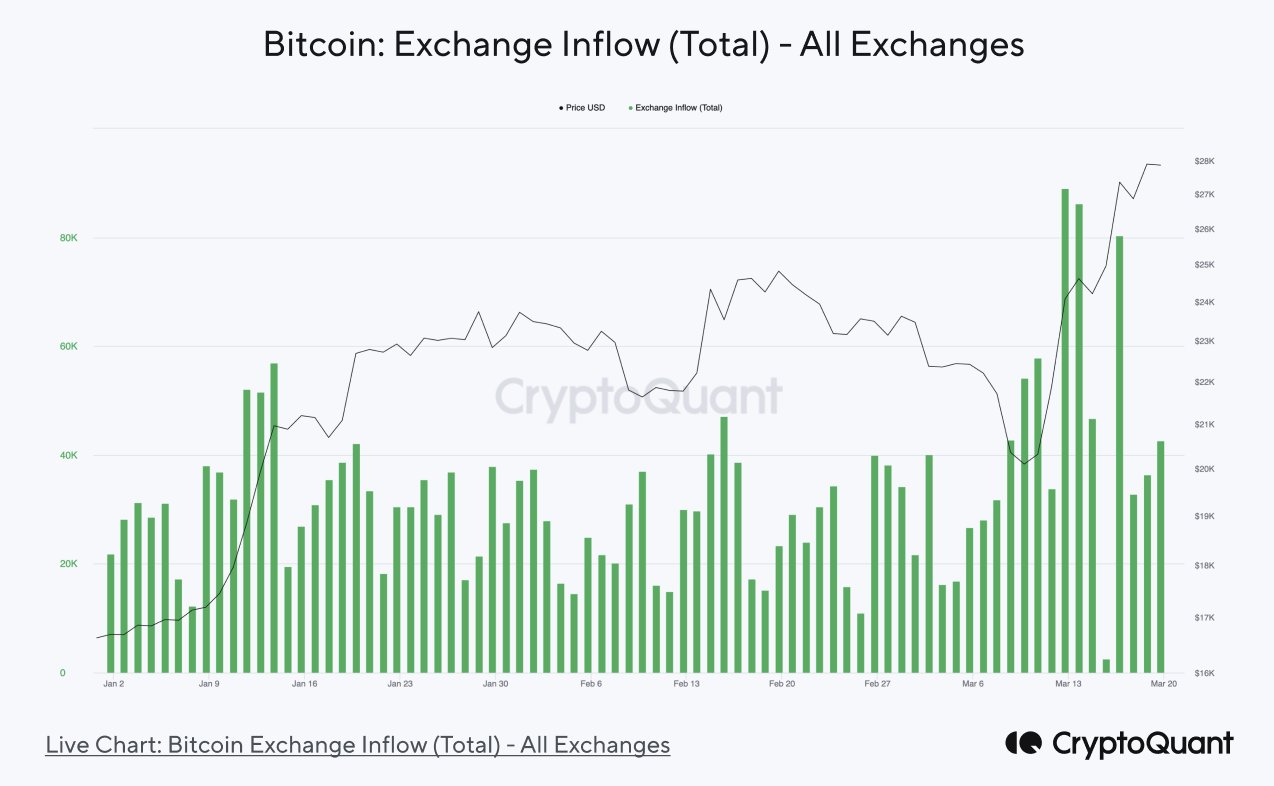

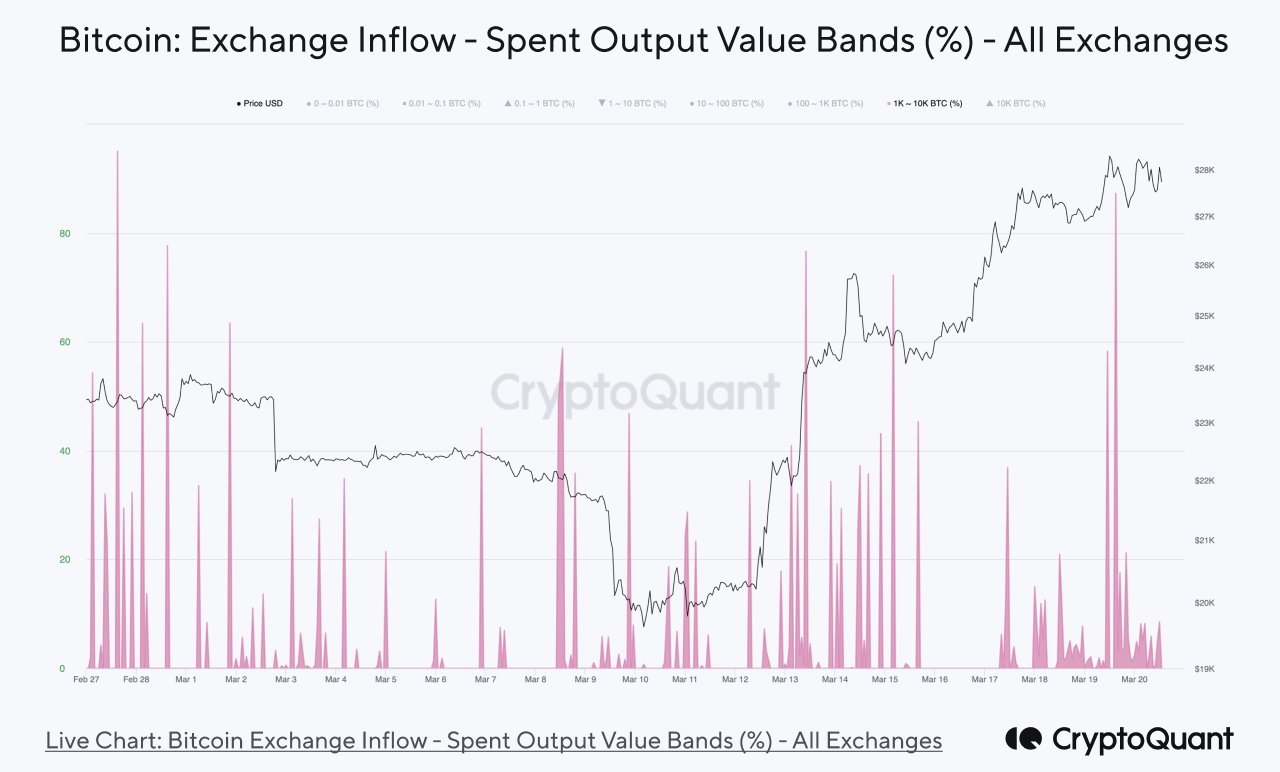

Bitcoin Trade Influx metric signifies a major improve in Bitcoin inflows into crypto exchanges because the BTC worth rallied above $28,000, reaching the best ranges in 2023. Usually, a excessive worth signifies increased promoting strain within the spot change. Thus, a correction in Bitcoin worth is predicted.

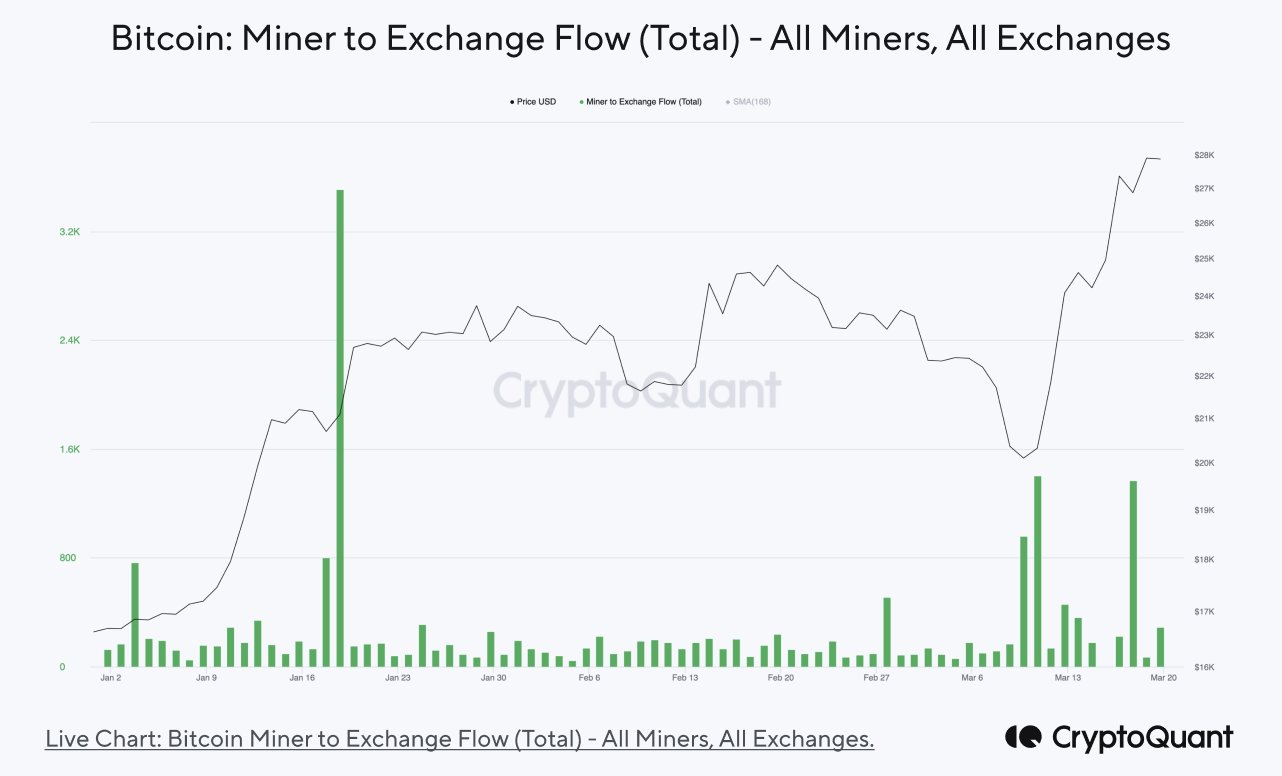

The Bitcoin Miner to Trade Circulation metric reveals that miners have been contributing to those inflows amid the banking disaster, particularly after the shut down of crypto-friendly Silicon Valley Financial institution. The miner reserves have fallen once more in March after selloff in January.

Bitcoin Trade Influx – Spent Output Worth Bands (%) metric signifies large whale exercise. A substantial proportion (33%) of Bitcoin flowing into exchanges has been from whales. This implies that whales have been dominating change inflows just lately.

Ethereum Worth Correction

In the meantime, Ethereum Trade Influx signifies attainable ETH worth correction and different on-chain metrics stay blended. ETH worth is predicted to witness promoting strain amid the Shanghai improve and Bitcoin downfall.

Some analysts predicted a transfer towards $2000 within the short-term, however will proceed to face resistance close to the psychological degree.

Additionally Learn: Bitcoin Worth Set For $35,000 After US Fed Charge Hike Determination: Bloomberg