Old Bitcoin Supply Moves Into Derivatives, Whales Setting Up Long Positions?

On-chain information exhibits Bitcoin provide older than two years has moved into spinoff exchanges not too long ago, suggesting whales could also be positioning themselves on the futures market.

By-product Alternate Influx Of Bitcoin Provide Older Than 2 Years Has Spiked Up

As identified by an analyst in a CryptoQuant post, the latest short-dominant open curiosity has gone down whereas some previous cash have simply been shifted into exchanges.

The related indicator right here is the “spinoff change influx,” which measures the overall quantity of Bitcoin transferring into wallets of all spinoff exchanges.

A modified model of this metric, the “influx spent output age bands,” tells us what the person contribution has been from the varied holder age teams to the overall inflows.

The investor cohorts of curiosity listed here are those that have been holding onto their cash since not less than 2 years with out having bought or moved them (prior to now).

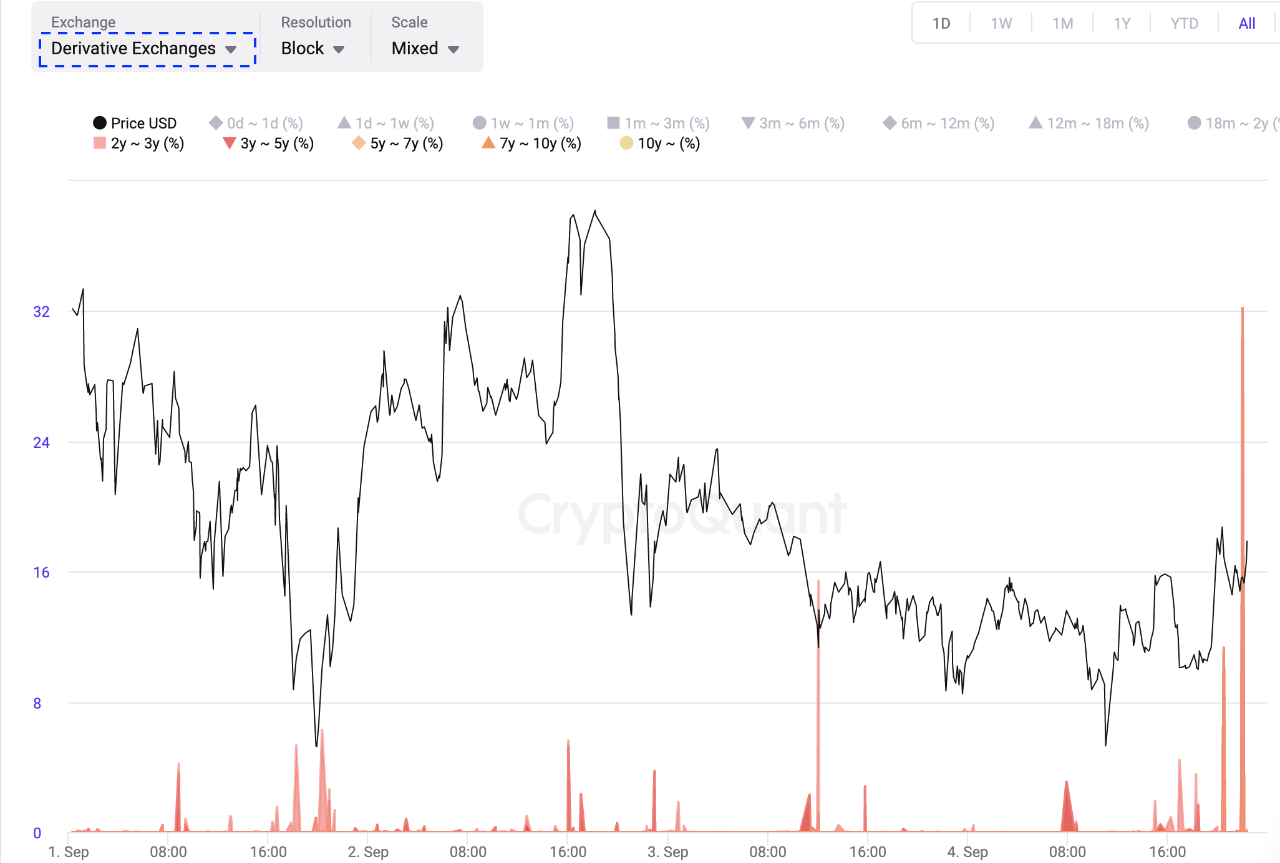

Seems like the worth of the metric has spiked up over the previous day | Supply: CryptoQuant

As you possibly can see within the above graph, the Bitcoin spinoff change influx from the two years+ previous investor group has spiked up not too long ago.

This exhibits that these BTC hodlers are transferring vital quantities to exchanges for establishing positions within the derivatives market.

It’s unclear whether or not this switch is with the intent of opening lengthy positions, or if it’s for hedging spot positions utilizing shorts.

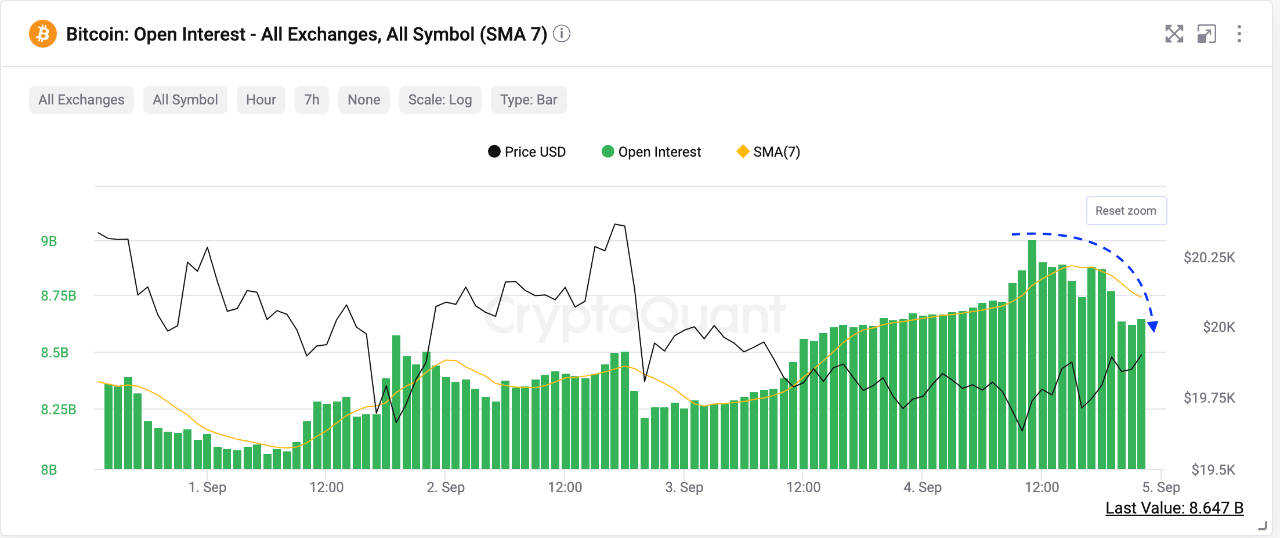

Nonetheless, the pattern in one other indicator, the open curiosity, could maintain hints concerning the vacation spot of those inflows. This metric measures the overall quantity of positions at the moment open on spinoff exchanges.

Lately, the funding charges had been barely adverse, implying that the open curiosity was short-dominant. However because the under chart highlights, this indicator’s worth has gone down through the previous day.

The worth of the indicator appears to have slumped down after rising throughout the previous couple of days | Supply: CryptoQuant

The worth of the Bitcoin open curiosity declining can recommend a number of the brief positions have now been closed down.

It now stays to be seen whether or not the market shifts in the direction of a long-dominant atmosphere or not within the coming days as exchanges obtain recent massive inflows like the latest one.

BTC Value

On the time of writing, Bitcoin’s worth floats round $19.7k, down 2% within the final seven days. Over the previous month, the crypto has misplaced 12% in worth.

Beneath is a chart that exhibits the pattern within the worth of the coin over the past 5 days.

The worth of BTC hasn't confirmed a lot motion throughout the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, CryptoQuant.com