NFTs accounted for 28% of the ETH gas usage in January

NFT

cryptoslate.com

26 January 2023 19:26, UTC

Studying time: ~3 m

Crypto analysts examined the gasoline utilization shares of various transaction classes on the Ethereum (ETH) community and located that the NFTs class accounted for 28% within the first month of the 12 months.

The evaluation divides all transactions on the ETH community into eight classes as Vanilla, ERC20, Stablecoins, DeFi, Bridges, NFTs, MEV Bots, and others.

The second, third, and fourth classes that occupied probably the most important gasoline utilization by share appeared as Defi, ERC20, and stablecoins, with 8% for Defi and ERC20 and 6% for stablecoins.

The classes

The vanilla class contains pure ETH transfers between Externally Owned Accounts (EOAs) issued with out calling any contracts. The ERC20 class counts all transactions that decision ERC20 contracts, excluding stablecoin transactions.

The stablecoins class represents all fungible tokens which have their worth pegged to an off-chain asset both by the issuer or by an algorithm. This class contains over 150 stablecoins, with Tether (USDT), USD Coin (USDC), Binance USD (BUSD), and DAI (DAI) being probably the most outstanding ones.

The Defi class covers all on-chain monetary devices and protocols applied as good contracts. Decentralized exchanges (DEXs) additionally fall below this class. Greater than 90 Defi protocols are represented below this part, together with Uniswap (UNI), Etherdelta, 1 inch (1INCH), Sushiswap (SUSHI), and Aave (AAVE).

Bridges characterize all contracts that permit the switch of tokens between totally different blockchains and contains over 50 bridges comparable to Ronin, Polygon (MATIC), Optimism (OP), and Arbitrum (ARBI).

All transactions interacting with non-fungible tokens fall below the NFTs class. This part contains each ERC721 and ERC1155 token contract requirements and NFT marketplaces for buying and selling them.

MEV bots, or Miner Extractable Worth bots, characterize bots that routinely execute transactions for revenue by reordering, inserting, and censoring transactions inside blocks.

All remaining ETH transactions are gathered below the Different class.

Fuel utilization by class

The chart under represents the relative quantity of gasoline consumed by every class within the ETH community. The chat begins from January 2020 and represents the gasoline utilization share of every class with a distinct colour.

” />At first look, the NFTs, Defi, ERC20, Stablecoins, and Vanilla classes stand out as they’ve probably the most seen shares in whole gasoline charges.

In accordance with the info, the NFTs class presently accounts for 28% of the entire gasoline charges on the ETH community, which is represented with the orange zone. This class’s share was solely round 4% in early Might earlier than the pandemic began.

The Defi takes up the second largest share with 8%, represented by the sunshine inexperienced space. Each the NFTs and the Defi class recorded a rise in gasoline charge shares because the pandemic began. The ERC20 class accounts for 8% of the entire gasoline share. Represented by the darkish inexperienced space, the class’s share halved from 16% in October 2022.

Within the meantime, stablecoins’ proportion remained flat, round 5-6%, as could be seen from the darkish blue zone as nicely. Lastly, the vanilla class continued to account for round 5% of whole gasoline charges.

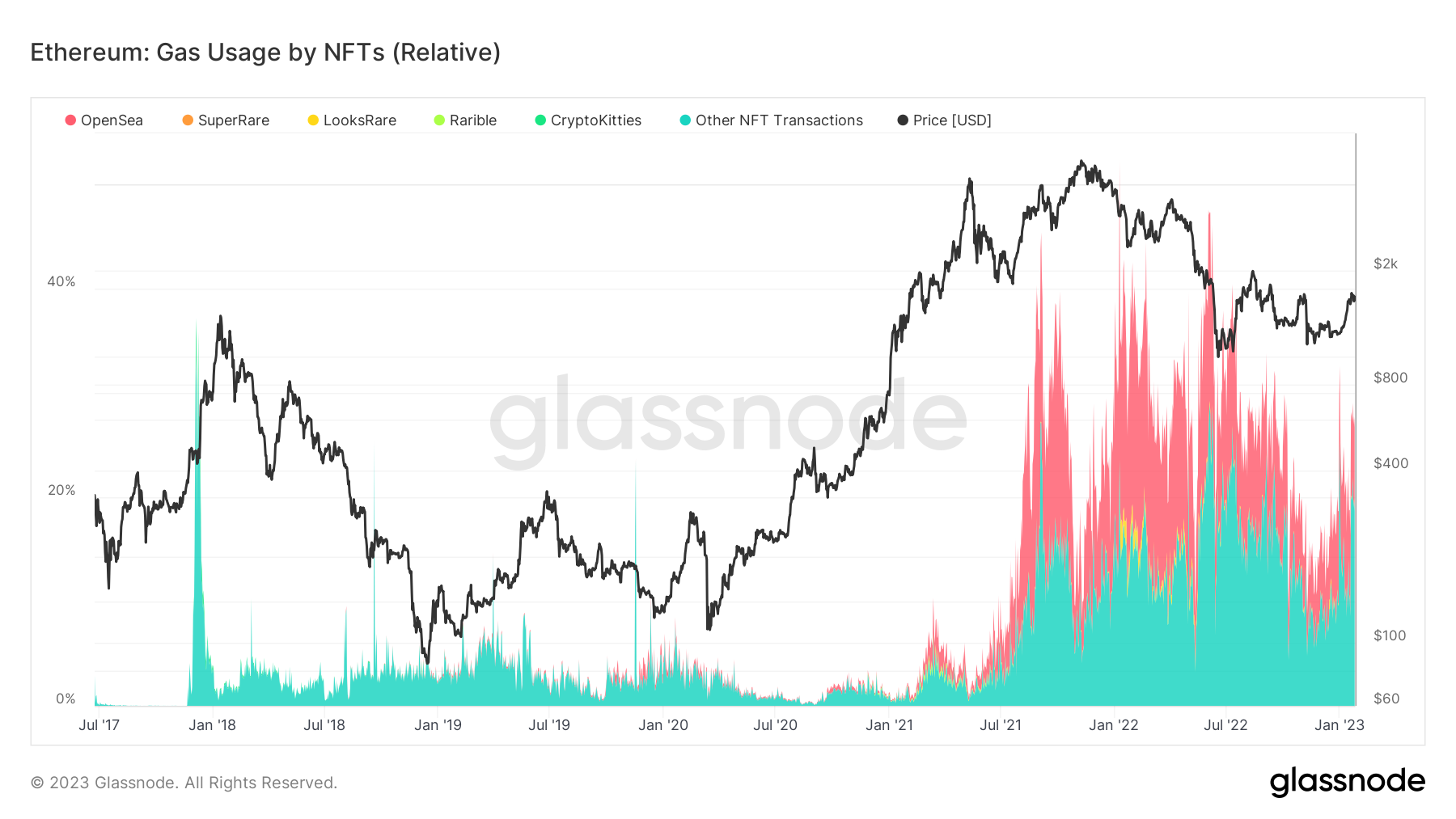

Fuel utilization by NFTs

Wanting on the gasoline utilization of the NFTs class intimately, OpenSea seems as dominant. The chart under represents the NFT marketplaces’ share in gasoline utilization because the starting of 2018.

OpenSea appeared in early 2020 and considerably elevated its share in gasoline utilization after mid-2021. It stays the dominant NFT market that occupies sufficient gasoline utilization to depart a mark on the general chart, apart from a brief interval in January 2022, the place LooksRare accounted for sufficient gasoline utilization to look briefly subsequent to OpenSea.

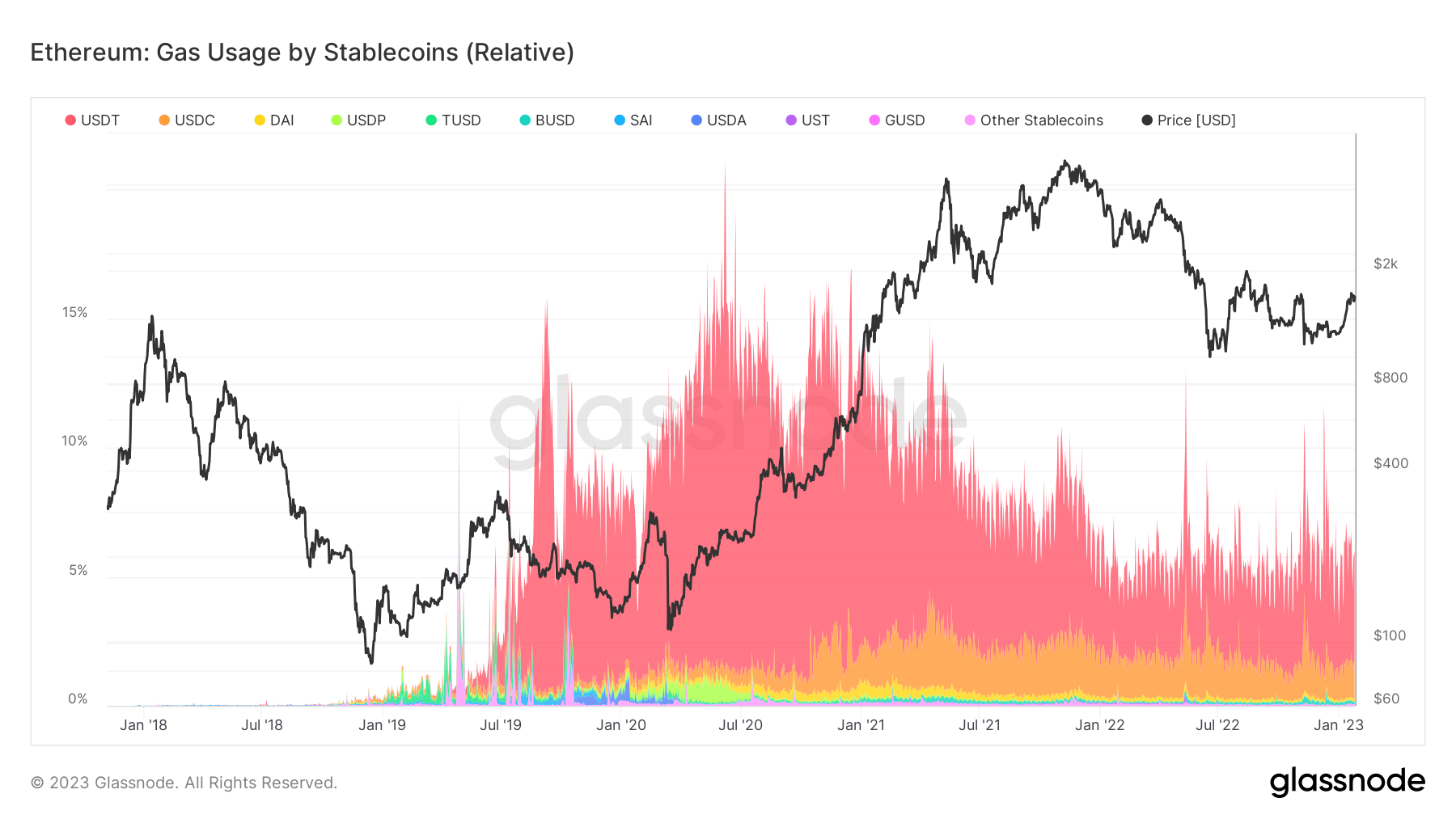

Fuel utilization by stablecoins

The breakdown of the gasoline utilization share of stablecoins additionally emphasizes USDT’s dominance. The chart under represents main stablecoins’ gasoline utilization shares from the start of 2018.

Despite the fact that USDT stays the dominant stablecoin, its share nonetheless recorded a big lower from 11% to 4%. However, USDC grew to become seen on the chart in early 2020 and has been rising its share in gasoline utilization slowly however steadily since then.