NEAR is still far from its pre-FTX level, but don’t lose hope because…

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion

- NEAR should overcome two obstacles to achieve its pre-FTX ranges.

- NEAR’s Funding Fee stagnated for the previous week.

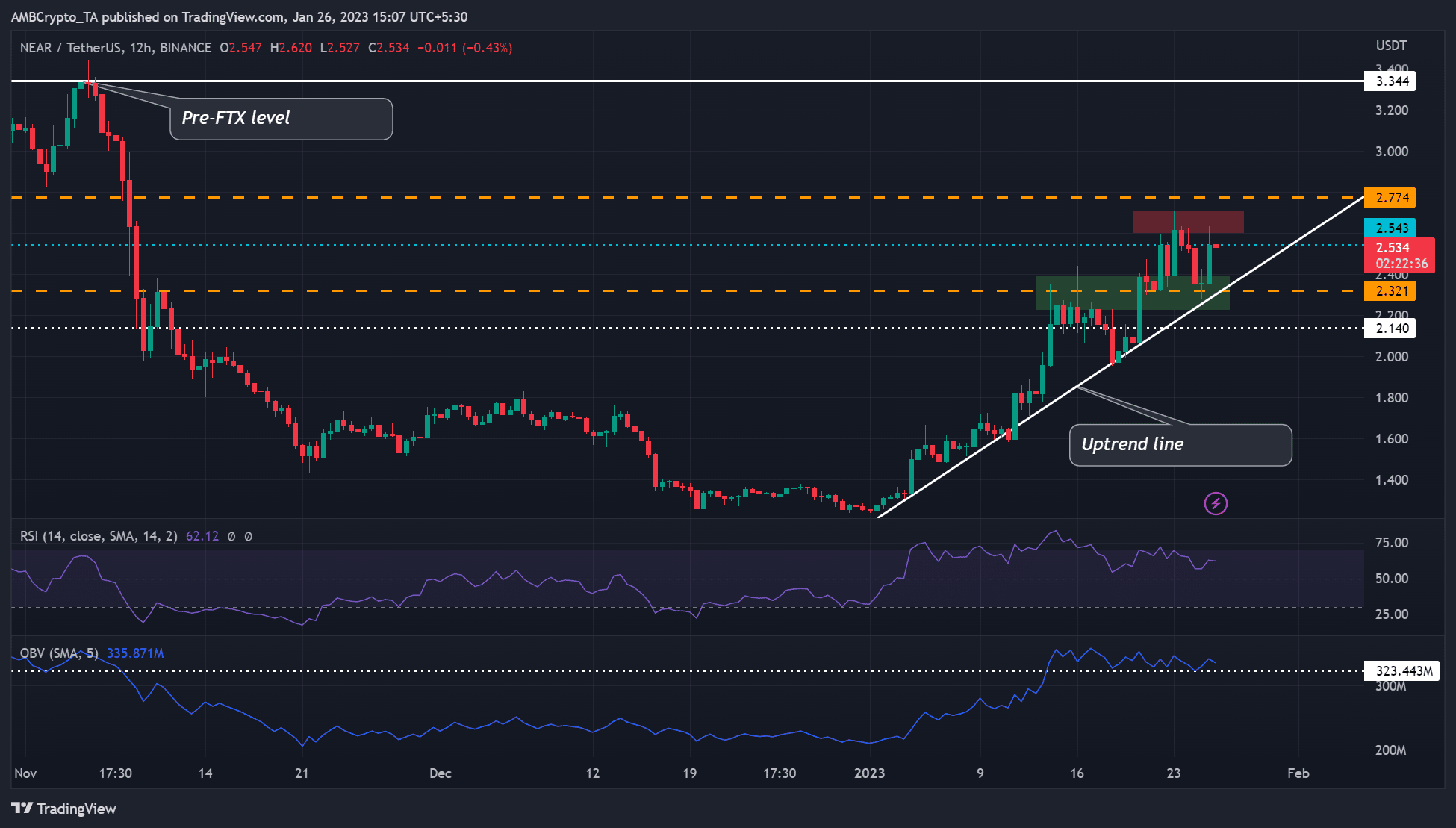

NEAR Protocol [NEAR] posted 118% good points after rising from $1.240 to $2.710. However the uptrend hasn’t been fully easy. NEAR skilled an prolonged worth consolidation in mid-January however continued with its uptrend.

At press time, NEAR’s worth was $2.534, means under the pre-FTX ranges of $3.344. Nonetheless, if subsequent week’s FOMC announcement is dovish (a 0.25 price hike), NEAR may try and reclaim its pre-FTX ranges. Nevertheless it should clear these obstacles.

Learn NEAR Value Prediction 2023-24

Can NEAR Protocol bulls goal the pre-FTX ranges?

Supply: NEAR/USDT on TradingView

On the 12-hour chart, NEAR’s Relative Energy Index (RSI) was 62, thus bullish. The RSI has been hovering across the overbought zone all through January. Due to this fact, NEAR Protocol bulls may try to focus on the pre-FTX degree of $3.344.

However NEAR bulls should clear the obstacles on the short-term promoting strain round $2.630 (purple zone) and the $2.774 degree. With the On Stability Quantity (OBV) transferring sideways since mid-January, NEAR may fluctuate between $2.321 and $2.630 within the few hours earlier than trying a breakout above the promoting strain zone within the subsequent few days.

Nonetheless, a break under the $2.321 and the uptrend line would invalidate the bullish forecast. The $2.140 help degree may maintain the drop.

Due to this fact, buyers ought to monitor BTC efficiency, particularly after subsequent week’s FOMC announcement. Any upswing on BTC will tip NEAR bulls to smash the obstacles and goal pre-FTX ranges.

How a lot are 1,10,100 NEARs value as we speak?

Investor sentiment was optimistic regardless of a stagnant Funding Fee

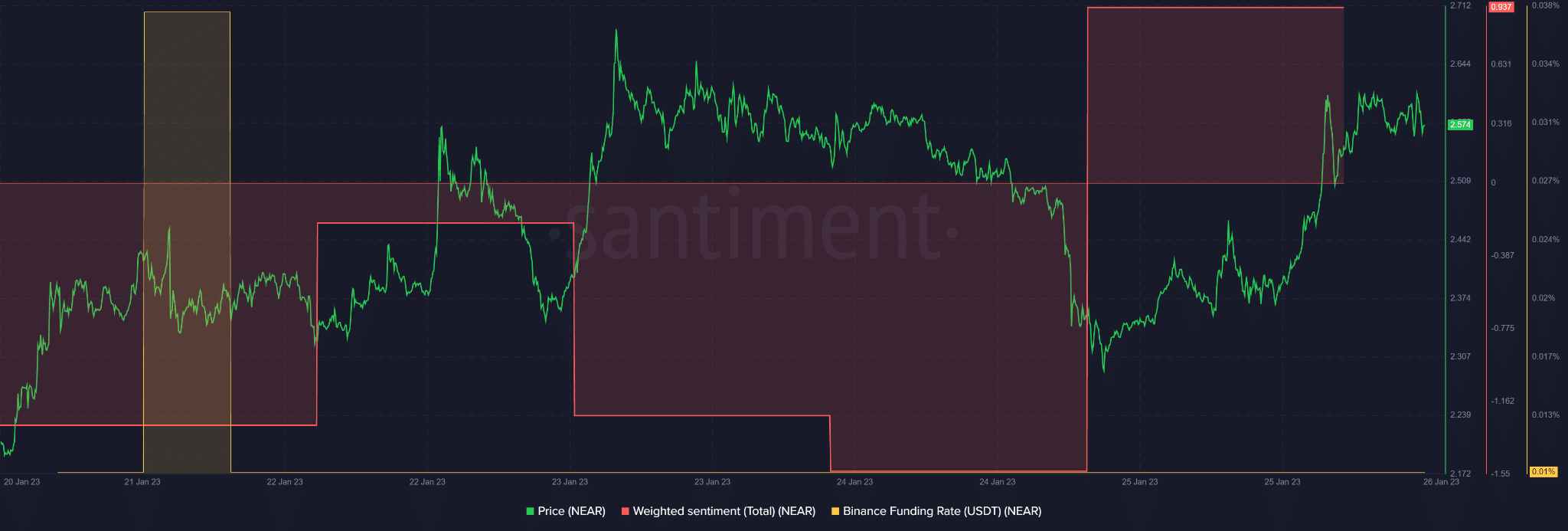

Supply: Santiment

In accordance with Santiment, the current worth surge noticed NEAR’s weighted sentiment flip to the optimistic facet. Nonetheless, sentiment knowledge was unavailable at press time.

However, NEAR’s Funding Fee within the Binance trade has remained unchanged since 22 January. It rested on the impartial line, exhibiting demand for NEAR within the by-product market stagnated prior to now week.

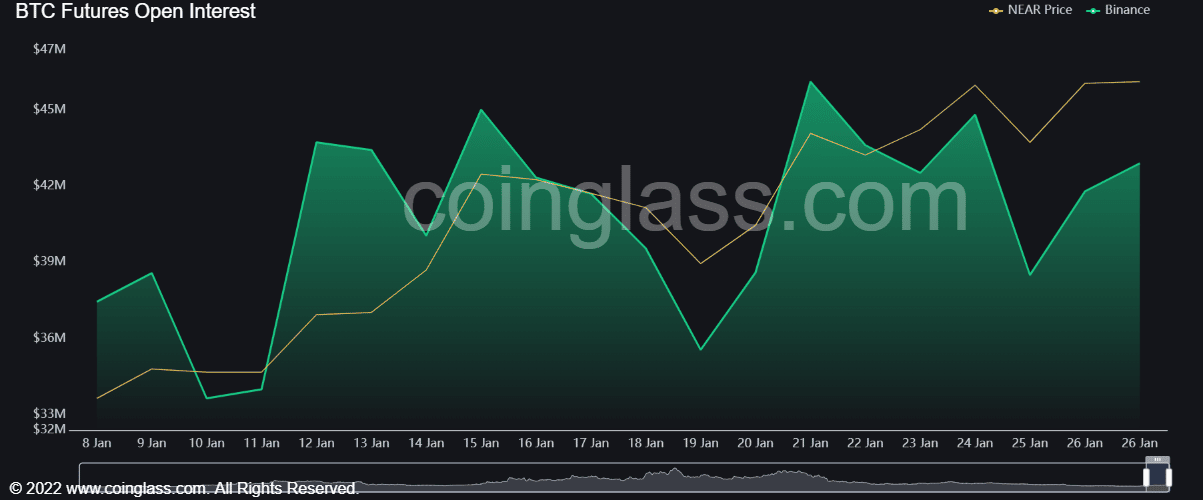

The above development can also be captured by NEAR’s open rate of interest fluctuations regardless of rising costs. NEAR made increased lows from 19 January, however the OI recorded some decrease lows in the identical interval, indicating a hidden divergence.

Though the above development may have delayed a a lot stronger uptrend momentum, the OI elevated proportionately, on the time of writing. If the development continues and extra money flows into NEAR’s futures market, its uptrend momentum may get a lift to bypass its obstacles.

Supply: Coinglass