MicroStrategy Bitcoin (BTC) Losses At $1 Billion, MSTR Stock Plummets 25%

Enterprise Intelligence agency MicroStrategy (NASDAQ: MSTR) which has constructed an enormous Bitcoin place on its steadiness sheet has seen the valuation of its holdings eroding by 25%. As of its newest submitting with the U.S. SEC, MicroStrategy has amassed 130,000 Bitcoins for an aggregated funding of $3.97 billion.

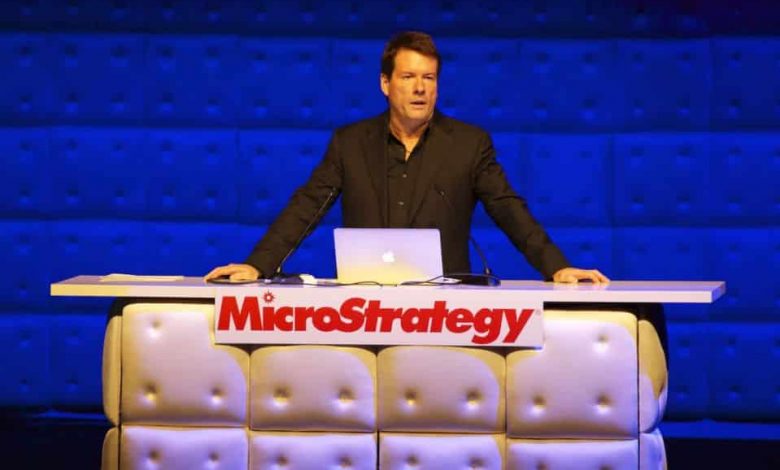

The agency led by CEO Michael Saylor has been aggregating BTC since August 2020 with its present common value at $30,700 as of March 31. Amid a brutal market correction over the past 4 days, the BTC value has crashed to $22,000.

Thus, the mixture worth of its Bitcoin holdings is at the moment at $3 billion with losses surmounting $1 billion. Nevertheless, regardless of all of the market turmoil, firm CRO Michael Saylor is totally unfazed.

Throughout his latest interview, mentioned that his firm would by no means promote Bitcoins and would even proceed to purchase on the high. Moreover, he additionally has a really sturdy conviction that the Bitcoin value goes to one million over the subsequent decade.

MicroStrategy Leads Lethal Promote-off In Crypto-Associated Shares

Crypto-based firms confronted a extreme beating on Monday’s buying and selling session on Wall Avenue. Main the whole crypto shares rout was MicroStrategy because the MSTR inventory collapsed by a staggering 25% ending Monday’s buying and selling session at $152.

The MSTR inventory has tanked greater than 72% year-to-date. Different public-listed blockchain and crypto corporations noticed their inventory costs plummet by 15% every. Susannah Streeter, senior funding and markets analyst at Hargreaves Lansdown told Bloomberg:

“Crypto followers have grow to be used to risky rides, however these rollercoaster descents are more and more laborious to abdomen. With the period of low cost cash coming quickly to an finish, merchants have gotten far more danger averse and turning their backs on crypto property.”

Cryptocurrency shares have been below extreme stress amid the latest crash on Wall Avenue. The CoinShares Blockchain International Fairness Index, which tracks 49 crypto-related firms worldwide, is down by 38% to date this yr registering its worst annual efficiency on file.