MakerDAO [MKR]: Will DAI adoption improve with new protocol?

- MakerDAO’s new protocol might assist enhance DAI adoption.

- Promoting strain on MKR elevated as MVRV ratio rose.

Messari, in a 22 February tweet, introduced the launch of MakerDAO’s new vertically built-in market, known as Sparks Lend. The market will primarily be geared toward enhancing DAI adoption.

1/ The success of @MakerDAO‘s stablecoin $DAI has largely been depending on its acceptance throughout markets.

In an effort to incentivize and management $DAI‘s success and utilization, the protocol is launching Spark Lend, the primary vertically built-in marketplace for $DAI.🧵 pic.twitter.com/TaucLnof5R

— Messari (@MessariCrypto) February 22, 2023

Learn Maker’s [MKR] Value Prediction 2023-2024

Spark Lend’s affiliation with Maker would allow customers to borrow DAI on the DSR variable fee of 1%. Spark Lend faucets into Maker’s DAI Direct Deposit Module (D3M) and PSM to straight regulate the provision of DAI in its market.

The subsequent step for this protocol could be integrating its providers with L2 options, which might assist make DAI extra mainstream.

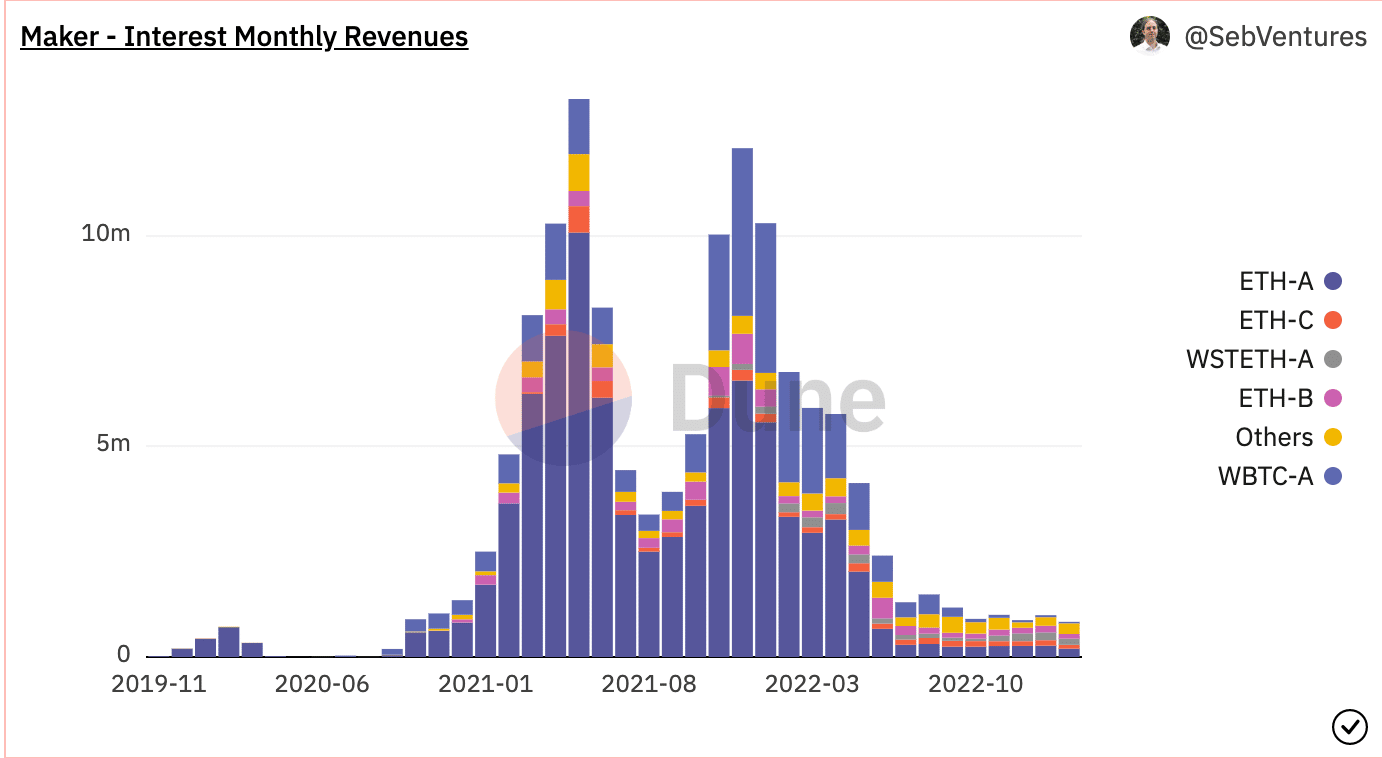

If DAI adoption will increase, it might enhance the income generated by MakerDAO. On the time of writing, the income generated by MakerDAO, particularly by means of curiosity generated from stablecoins, was lowering. Many of the income generated by the protocol trusted its investments in real-world belongings (RWA).

Supply: Dune Analytics

Whales meet their MKR

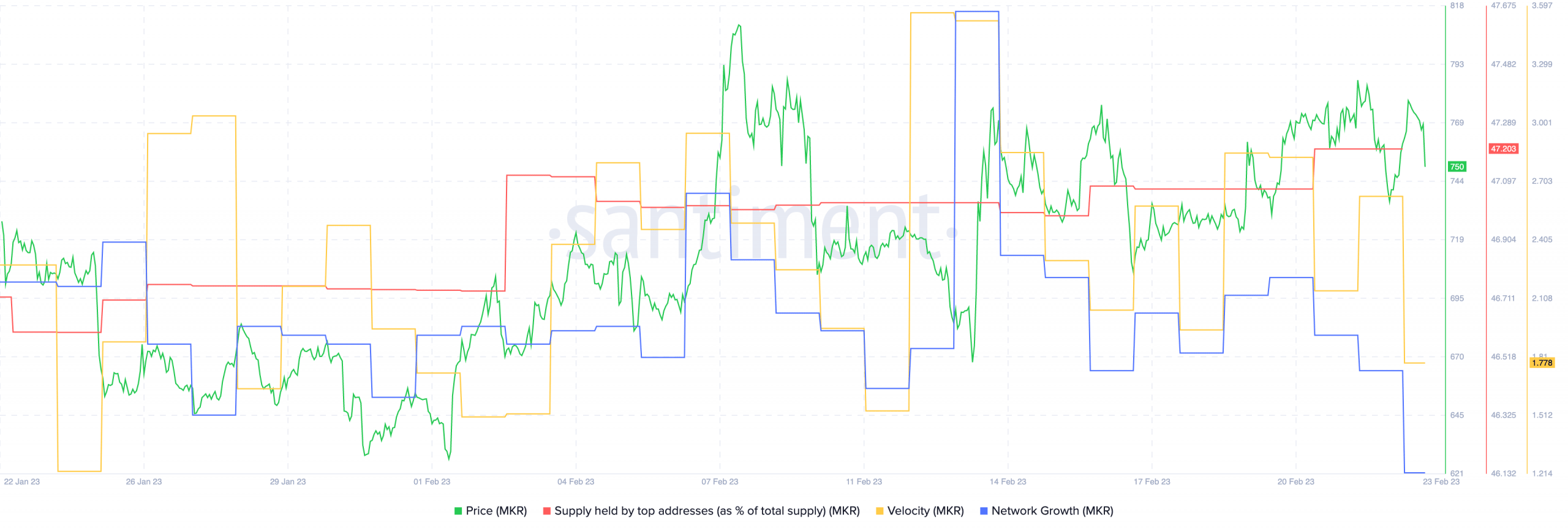

This new replace may be one motive why whale curiosity in MKR elevated, as the share of enormous addresses holding MKR grew over the past month, in keeping with Santiment.

Nevertheless, its velocity continued to say no, implying that the frequency with which MKR was being traded fell. Coupled with that, the general community progress of MKR additionally declined. This instructed that new addresses weren’t significantly inquisitive about shopping for MKR.

Supply: Santiment

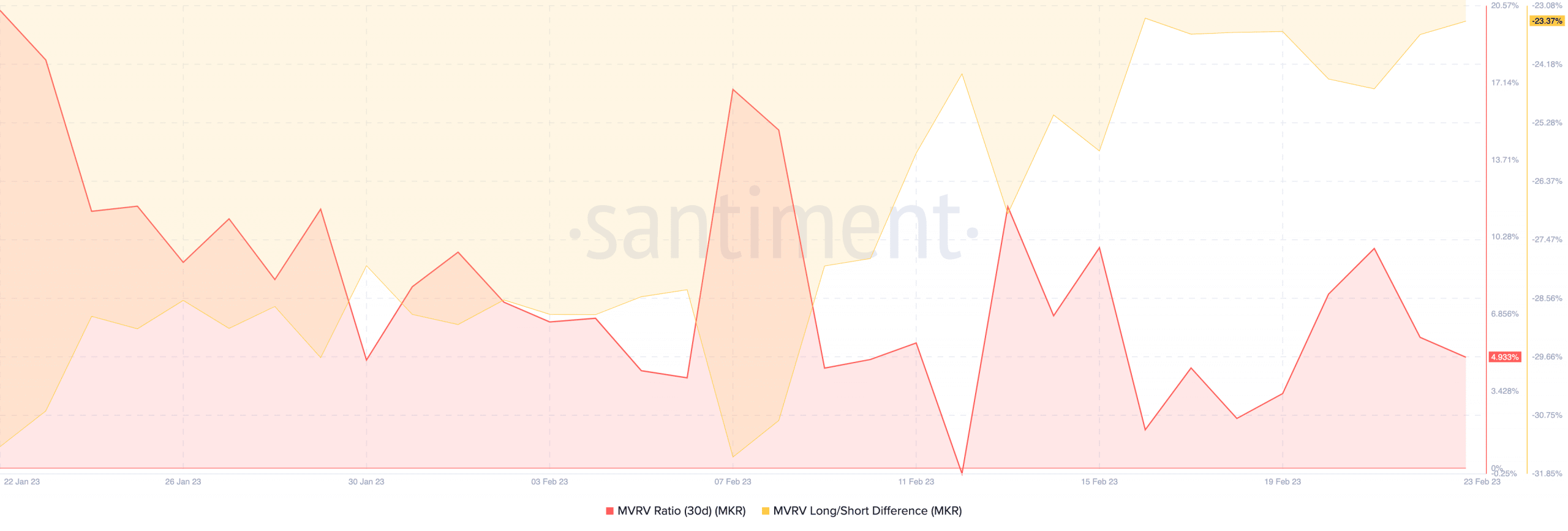

One motive for a similar may very well be MKR’s excessive MVRV ratio, which implied that holders would flip income in the event that they bought on the time of writing. Because the lengthy/brief ratio was adverse at press time, it implied that almost all MKR holders had been short-term.

Supply: Santiment

Lifelike or not, right here’s MKR market cap in BTC’s phrases

Nevertheless, if these short-term addresses ended up promoting MKR at press time, it will drive MKR’s worth down significantly.

Over the previous few years, Tether [USDT] and USD Coin [USDC] have been the go-to stablecoins for customers coping with DeFi. These stablecoins captured a big majority of the market and have left behind different stablecoins, equivalent to DAI, behind.