Optimism: Analyzing the chances of OP maintaining its bullish trajectory

- Optimism’s income has been growing since its launch.

- On-chain metrics and market indicators had been bullish.

Optimism [OP] made a daring announcement on 23 February, because it revealed its plans to turn out to be a “Superchain.” In accordance with the official announcement, moderately than constructing a number of L2 chains, Optimism would as an alternative deal with unifying them because it deliberate to turn out to be a platform for chains.

It’s time for Optimism to arrange for the subsequent wave of adoption.

It’s time to construct a unified community of chains—not only one.

It’s time to construct collectively, not aside.https://t.co/3BvJqD5pPe pic.twitter.com/OSKe5FDs8J

— Optimism (✨🔴_🔴✨) (@optimismFND) February 23, 2023

The Superchain aimed to mix numerous siloed L2s into one cohesive and interoperable system. Furthermore, Optimism said that it wanted to work towards a future when launching an L2 was so simple as deploying a sensible contract on Ethereum [ETH].

Whereas Optimism continued to step up its sport, the community’s efficiency on the income entrance additionally appeared promising. Token Terminal’s data identified that Optimism’s income has been growing consistently since its launch in 2021, which was a constructive pattern.

Real looking or not, right here’s OP market cap in BTC’s phrases

Aside from this, Coinbase introduced that it was growing Base on Optimism’s OP Stack with the purpose of growing an ordinary, modular, rollup agnostic Superchain powered by Optimism with a view to facilitate the trail towards decentralization.

0/ 🔵 Howdy world.

Meet Base, an Ethereum L2 that provides a safe, low-cost, developer-friendly manner for anybody, anyplace, to construct decentralized apps.

Our purpose with Base is to make onchain the subsequent on-line and onboard 1B+ customers into the cryptoeconomy.https://t.co/Znuu3o3pJw

— Base (@BuildOnBase) February 23, 2023

OP’s response is apt!

OP’s worth responded to those developments by portray its every day and weekly charts inexperienced. In accordance with CoinMarketCap, OP’s worth elevated by over 8% within the final 24 hours, and at press time, it was buying and selling at $3.09 with a market capitalization of over $725 million.

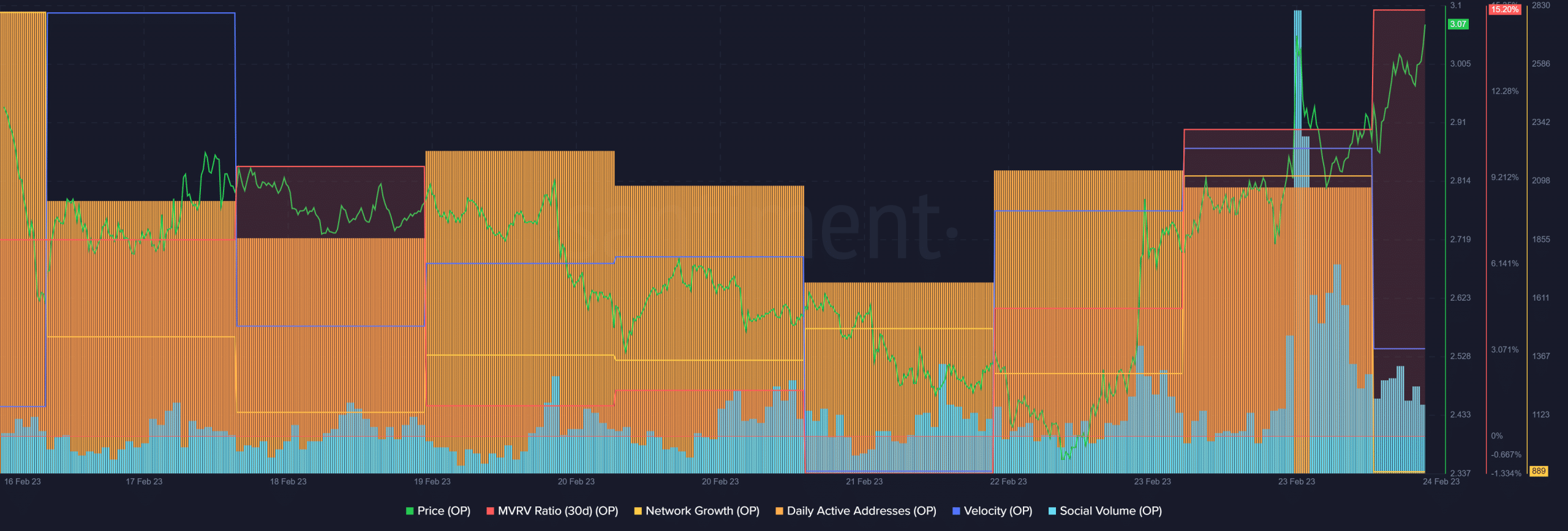

Furthermore, OP’s on-chain efficiency supported this surge in worth, growing the possibilities of registering extra beneficial properties within the coming days. As an example, the token’s MVRV Ratio went up significantly, which was a bullish sign.

OP’s community progress and velocity each registered upticks in the previous couple of days, one more constructive improvement. The social quantity has additionally spiked these days. Nonetheless, OP’s every day lively addresses declined during the last week, which indicated fewer customers within the community.

Supply: Santiment

How a lot are 1,10,100 OPs value immediately?

Buyers can sit again and chill out

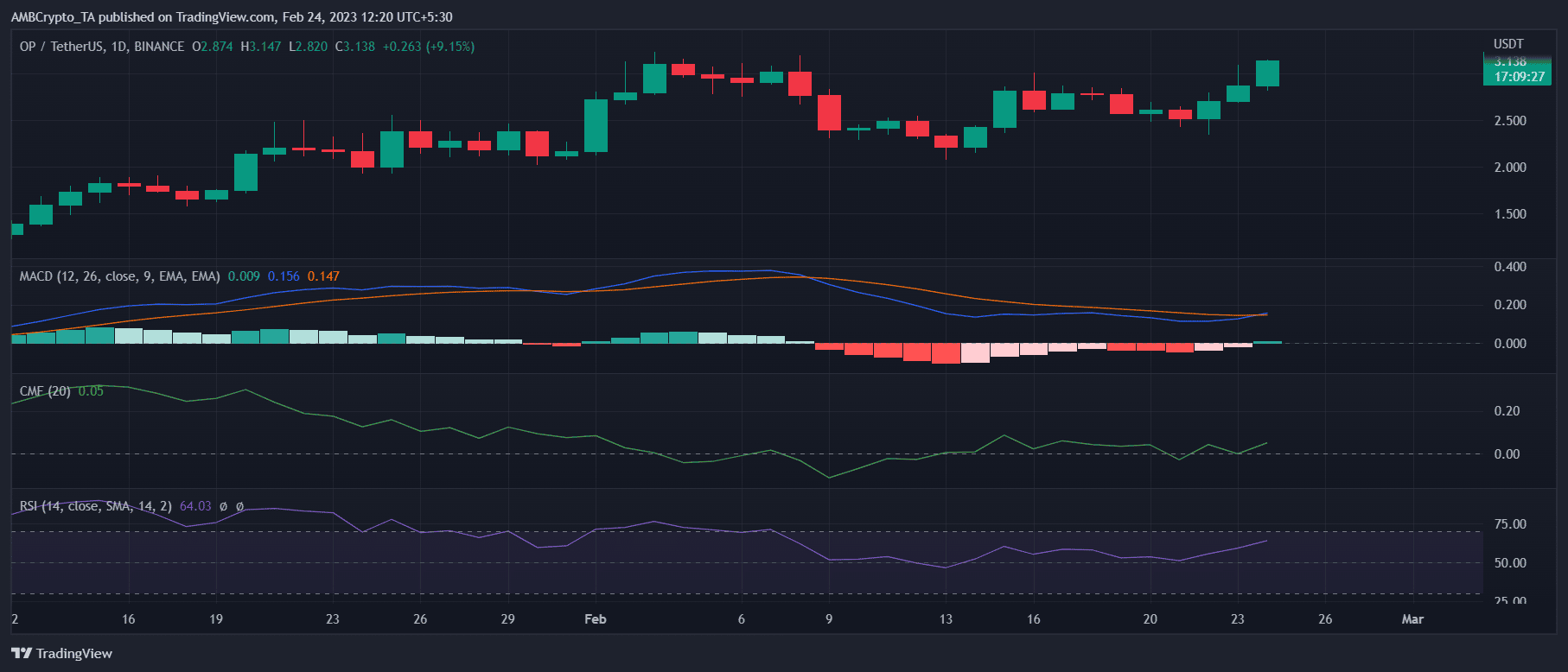

Just like the on-chain metrics, a number of of the market indicators had been additionally in favor of the buyers. OP’s MACD displayed a bullish crossover, suggesting an extra worth hike. The Relative Power Index (RSI) and Chaikin Cash Move (CMF) each registered upticks, which was additionally a improvement within the patrons’ favor.

Moreover, the Exponential Shifting Common (EMA) Ribbon painted a bullish image because the 20-day EMA was properly above the 55-day EMA.

Supply: TradingView