Litecoin: Why relying solely on NFT growth could spell disaster for LTC investors

Excellent news got here for the Litecoin [LTC] NFT ecosystem because it witnessed progress over the previous few days. Santiment’s data revealed that not solely did LTC’s complete NFT commerce rely register an uptick, however it’s NFT commerce quantity in USD additionally elevated.

This growth was legitimate as LiteVerse, Litecoin’s first NFT market, introduced a partnership with Antpool. The LiteVerse is an NFT market makes use of OmniLite to mint NFTs with low charges.

Partnership announcement with ltcLABS

(@AntPoolofficial x @LTCFoundation) is official!🔥#Litecoin #LTC #LTCFAM #Crypto #NFT #NFTs #NFTCommunity #dogecoin #doge #ElonMusk #SolanaNFT #OpenSeaNFT #ltcLabs $LTC pic.twitter.com/Dmkfht2uBh— LiteVerse: NFT Market (@theliteverse) November 1, 2022

______________________________________________________________________________________

Right here’s AMBCrypto’s Value Prediction for Litecoin [LTC] for 2023-2024

______________________________________________________________________________________

Regardless of rising within the NFT area, issues didn’t look so good on LTC’s day by day chart. This was as a result of LTC, after witnessing an extended worth surge, dropped by greater than 2% within the final seven days. Moreover, at press time, LTC was trading at $55.05 with a market capitalization of over $3.94 billion.

Traders might need to cross their fingers and hope for the very best as a number of of LTC’s on-chain metrics revealed the opportunity of a worth downfall.

Warning is really useful

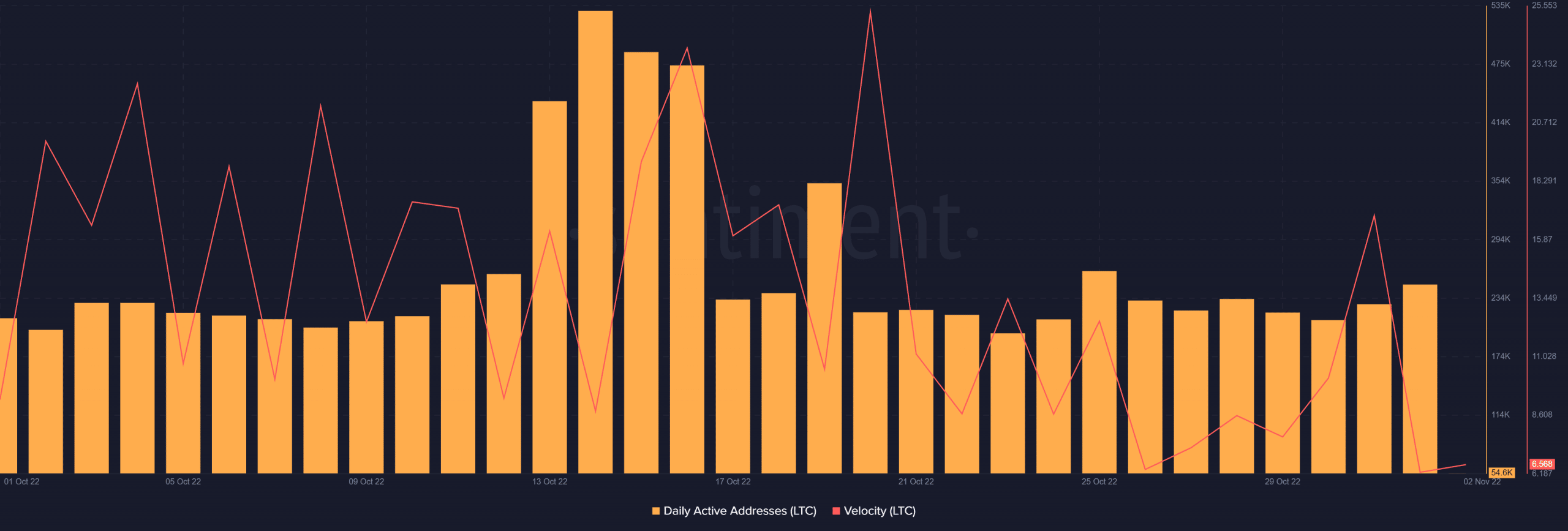

Litecoin’s velocity, after registering a spike, decreased significantly on 31 October. This was a bearish sign because it indicated that the coin was utilized in transactions much less typically inside a set timeframe. Moreover, LTC’s day by day energetic addresses additionally went down in October, which advised a decrease variety of customers energetic on the community.

Supply: Santiment

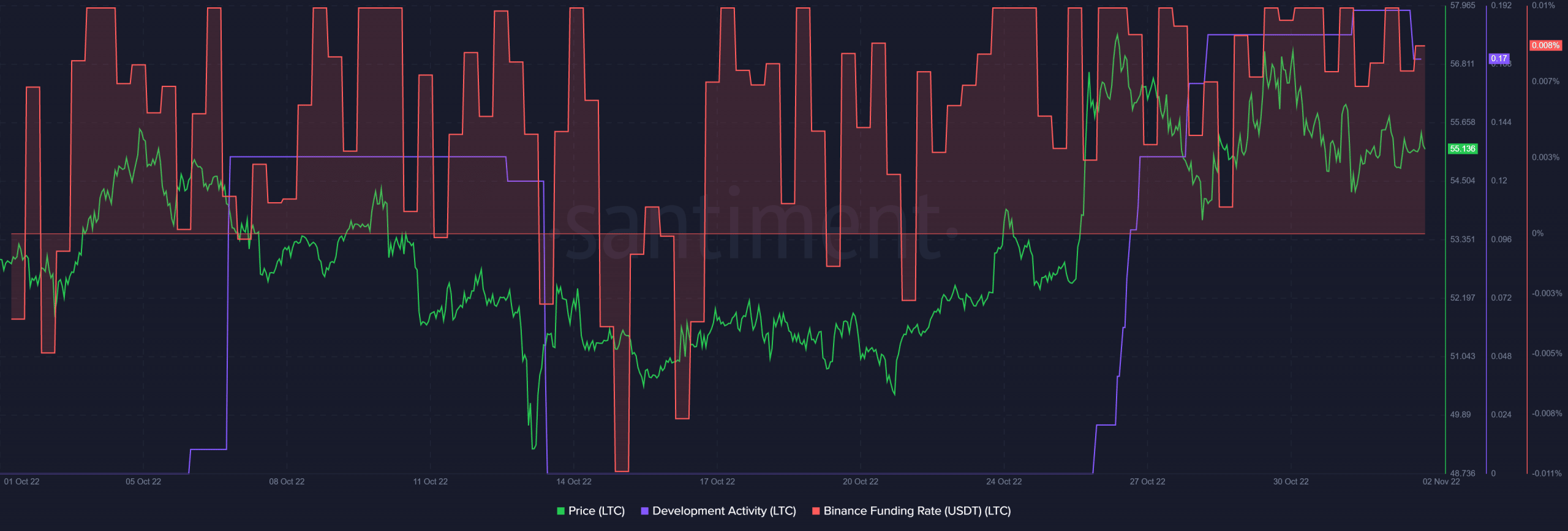

Nonetheless, a couple of issues have been working in LTC’s favor. For example, LTC’s growth exercise elevated. This was a constructive signal for a blockchain. Furthermore, LTC continued to realize curiosity from the derivatives market as its Binance funding price was persistently excessive.

Supply: Santiment

The bears are again in motion

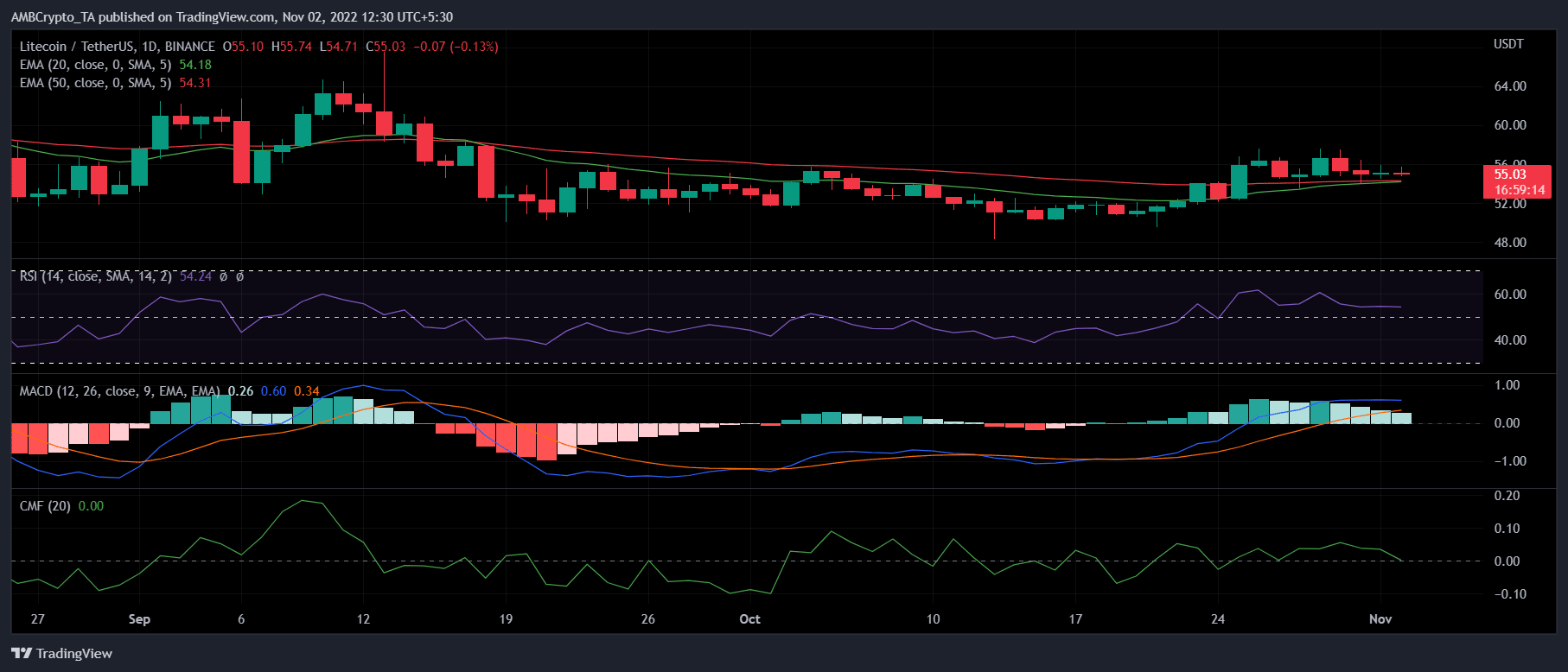

A have a look at LTC’s day by day chart advised that consumers witnessed an edge out there for per week. Nonetheless, sellers had buckled up as a number of market indicators revealed the probabilities of a downtick.

LTC’s Relative Energy Index (RSI) was resting simply above the impartial place. The Chaikin Cash Move (CMF) registered a downtick and went under the impartial mark, which was a bearish sign. Furthermore, the Shifting Common Convergence Divergence (MAC) displayed the opportunity of a bearish crossover quickly.

Apparently, the 20-day Exponential Shifting Common (EMA) was in a tussle with the 50-day EMA, which gave some hope for a worth surge.

Supply: TradingView