How NFT Royalties Work – and Sometimes Don’t

NFT

blockworks.co

04 November 2022 19:43, UTC

Studying time: ~8 m

In an period of artists recouping fractions of a cent on music streams and visible artists missing any income share from the speculative secondary market — NFT royalties had been bandied about as a trump card for artists vying to arrange sustainable enterprise fashions.

Now, with the transfer from X2Y2, Seems to be Uncommon and Magic Eden to make NFT royalties non-obligatory, artists are as soon as once more taking part in protection.

As a result of the sensible contracts underpinning NFT royalties lack authorized enforcement mechanisms or some other exterior accountability, it seems the expertise is barely pretty much as good because the platform’s dedication to uphold it.

And, with ImmutableX’s swift launch of a community-managed NFT market blacklist, scores of skeptical artists and NFT collectors have been asking how the tech really works — and if artist royalties may be saved.

What are NFT royalties?

NFT royalties are crypto payouts designed to proffer creators a minimize of secondary gross sales of their digital collectibles. The proportion of sale designated for royalties is about by the creator on the time of minting — sometimes round 6%. Good contract platforms the place NFTs are minted are, typically, liable for automating the funds.

The important thing to the success of income sharing lies in earlier makes an attempt to institute common baselines for artist resale royalty rights. It explains why NFT royalties matter to the Web3 narrative and the place the system at the moment falls in need of its supposed goal.

Why artists want resale income

Artists have lengthy struggled to search out truthful compensation. Artists equivalent to Harvey Ball, well-known for creating the yellow smiley face in 1963, was solely paid $45 for his iconic picture. The t-shirt firm that used it later bought for $500,000,000 in 2000. And Robert Rauschenberg in 1958 bought his portray “Thaw” for $900. Just some years later it modified palms for $85,000.

As soon as the mental property of each artists left the constructing, they misplaced all rights to downstream funds. That will not be the case if they’d rights to royalty funds from secondary gross sales.

Resale royalty rights are the authorized entitlement to a proportion of proceeds made out of promoting an unique art work. The proper is both granted by the state or a contract between the artist and reseller. And within the US, save for California, artists can solely entry this proper by means of particular person contracts.

In 2013, The US Copyright Workplace reported that visible artists are at a singular drawback in comparison with different creators in terms of income era.

As a result of the worth of their artwork is derived from uniqueness, little cash may be made out of replica. The inherent nature of visible artwork excludes it from the kind of royalty contracts between musicians, document labels and streaming platforms.

The music trade has its personal set of challenges in terms of truthful compensation. The streaming mannequin has minimize artists out of a giant share of royalties. Tasks equivalent to Blocktones have discovered inventive methods to royalties into their music based mostly NFTs.

Artists within the US have tried to institute common baselines for artist resale royalty rights by means of laws, however every try has failed. And whereas a few of these rights exist for Californians — and in some international locations equivalent to France — the necessities are straightforward to evade because of the lack of cross-border enforcement.

The power to supply artists a simple system to gather royalties from NFT resales is what satisfied many artists to enter the NFT market. With out royalties, the expertise lacks a substitute for the artist’s monetization mannequin.

How NFT royalties work

The NFT royalty system can differ between blockchains, however with Ethereum, it’s managed on the discretion of sensible contract platforms.

With Rarible, for instance, the artist can set the share of resale proceeds on the minting stage by way of a wise contract on the blockchain in query. On the time of buy, the platform routinely executes the phrases of the contract. Platforms differ within the specifics of payout schedules.

The phrases don’t signify a authorized contract, although — sometimes in a bid to sidestep litigation.

Living proof: Per Rarible’s phrases of service, creators should conform to grant the platform royalty-free rights to any content material posted on the platform. So, though the platform embeds the phrases of royalties by way of sensible contract, there is no such thing as a authorized obligation.

The legalese transfers the enforcement burden from civil authorities to code. However, as a result of the automation nonetheless requires consent from the market maker, a sequence of thorny enforcement challenges have emerged.

Are you able to switch royalties between marketplaces?

Royalty insurance policies from different platforms don’t routinely switch.

OpenSea, for example, solely helps royalties on collections — not particular person items. So, if an NFT with its personal royalty coverage is bought on Rarible, after which listed on OpenSea, the unique artist wouldn’t see any income from the secondary sale. Moreover, OpenSea’s most royalty is 10% to Rarible’s 50%.

What are non-obligatory royalties?

NFT marketplaces equivalent to LooksRare, Magic Eden and X2Y2 have all moved away from the NFT royalty mannequin. Their new royalty-optional system lets NFT consumers resolve to honor an artist’s royalty coverage for purchases.

How? Nicely, though royalties insurance policies are immutable sensible contracts, the Ethereum blockchain isn’t capable of implement stipulations on token transfers. Any enforcement of the sensible contract is inherently voluntary. The platforms merely handed that choice on to the consumers.

Because of this for all current and new NFT listings, royalty funds are discretionary. Some platforms together with LooksRare have agreed to share 25% of protocol charges with creators in an effort to alleviate the results to the artist income mannequin.

NFT artists like Tyler Hobbs have began including NFT marketplaces that evade royalties to a blacklist.

He added X2Y2 to the blacklist in his QQL assortment following their resolution to axe royalties. The transfer succeeded in blocking the gathering from being listed, however platforms can develop workarounds. Some ecosystems equivalent to ImmutableX are engaged on a community-managed whitelist and blacklist that will implement broad enforcement throughout the Ethereum NFT ecosystem.

Is there proof that NFT royalties supply sustainable income to artists?

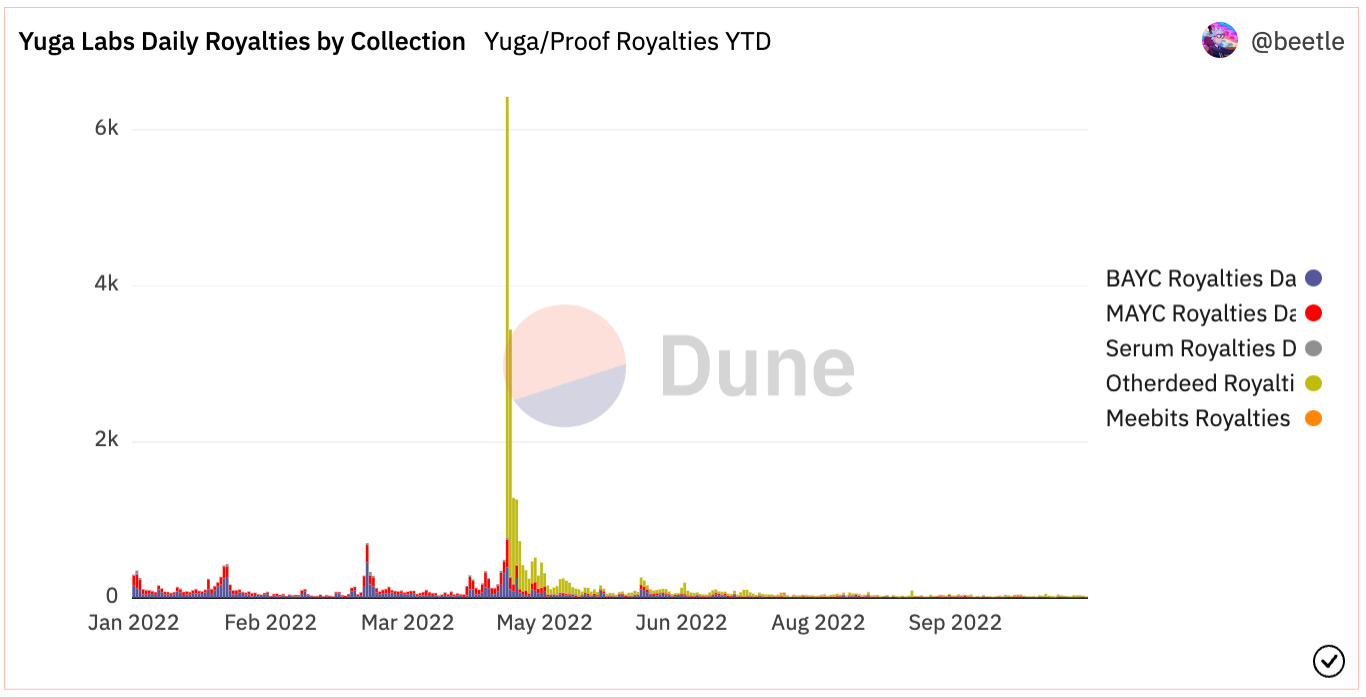

In the course of the early days of NFT launches, many tasks and people generated hundreds of thousands from royalties on the secondary market. At this time, the secondary market shouldn’t be offering the identical.

Bearish market circumstances mixed with a rising variety of platforms abandoning royalties have all contributed to declining income. A take a look at Yuga Labs’ royalty payouts illustrates this decline:

Yuga Labs Every day Royalties by Assortment | Supply: @beetle

Many tasks have shut down. However NFT collections equivalent to DeGods have responded by eradicating royalties outright.

DeGods launched a set of 10,000 Solana NFTs in October 2021. The challenge provides utility past the resale market by giving DeGods and DeadGods NFT holders the flexibility to stake and earn utility tokens.

Whereas massive tasks with exterior income sources can afford royalties, particular person artists can’t. As an instance, the NFT assortment Fidenza by Tyler Hobbs has made a complete of three,999 ETH in royalty income, in keeping with Flips.Finance. The preliminary mint value was solely .17 ETH, which means royalty income exponentially outweighed mint proceeds.

Regardless of enforcement challenges, resale royalties have a significant impression on an artist’s backside line.

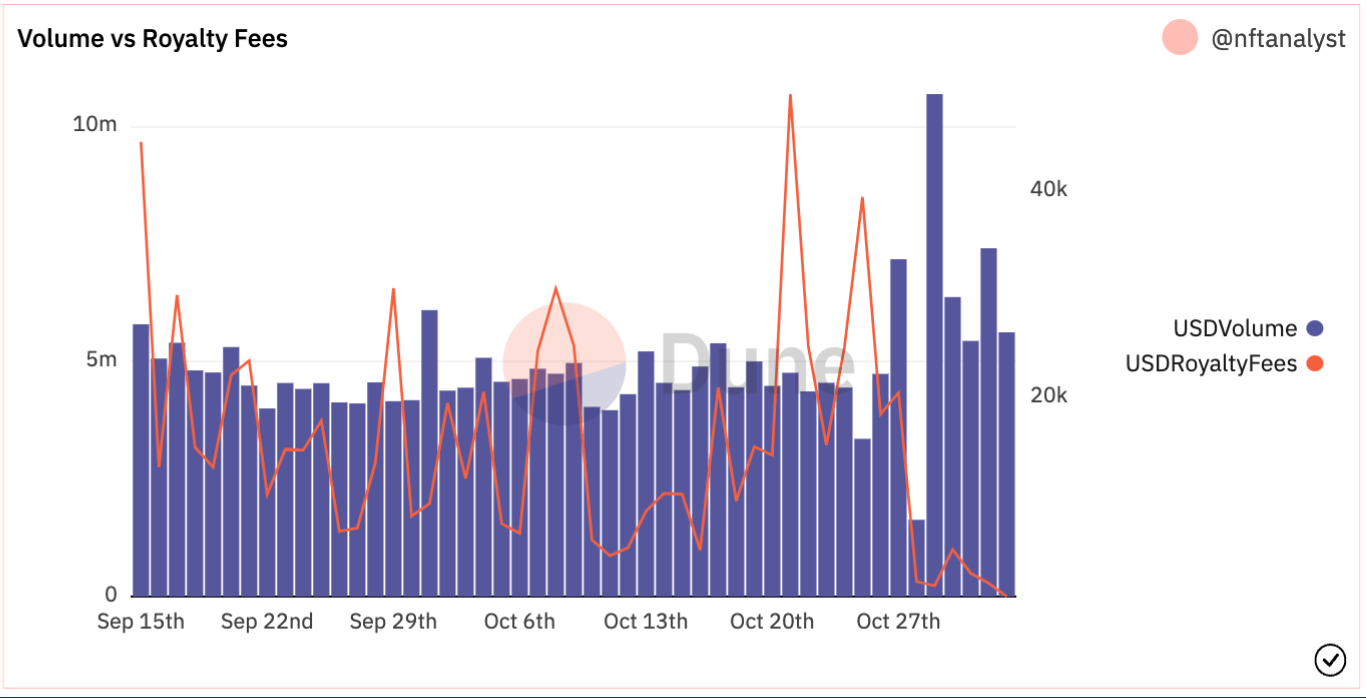

If an NFT transferred from OpenSea to LooksRare, the artists may nonetheless see royalties if the artist registered the gathering. However as quickly as LooksRare made royalty funds non-obligatory, the platform’s complete quantity rose dramatically, and royalty charges dropped near 0.

LooksRare Quantity Versus Royalty Charges | Supply: @nftanalyst

The economics driving NFT marketplaces to drop royalties

The motivation for marketplaces to drop NFT royalties is straightforward. It attracts merchants who need larger revenue margins on NFT resales.

“Proper now, we’re seeing some marketplaces in search of an edge in the course of the present NFT market downturn, and so they’re turning to ways like eliminating necessary royalties,” MakersPlace CEO Craig Palmer stated in an announcement. “MakersPlace has at all times been a agency supporter of creators and whereas this ‘non-obligatory’ strategy the place the client decides whether or not or to not pay royalties could make sense to different marketplaces, it doesn’t match with our imaginative and prescient for the house.”

Along with MakersPlace, NFT marketplaces equivalent to Rarible and OpenSea are persevering with to implement royalties.

In response to Magic Eden and LooksRare transitioning to non-obligatory NFT royalties, Twitter person NFTstatistics.eth defined the economics in motion.

Economics in motion:

In the event you assume you’re getting a aggressive benefit by slicing royalties… you are really simply beginning a race to the underside.

Everybody follows and we’re again the place we began, simply now with out royalties.

— NFTstatistics.eth (@punk9059) October 27, 2022

This has occurred on Solana (MagicEden is again to 90% share now that they’ve minimize royalties) and is occurring on ETH w LooksRare slicing out royalties

It is a notably pronounced course of in NFTs for the reason that charges being minimize do not really go to the corporate doing the fee-cutting

— NFTstatistics.eth (@punk9059) October 27, 2022

Whereas there seems to be a race to the underside, the community results of a single platform’s resolution to make royalties non-obligatory are restricted to the diploma of interoperability between NFT ecosystems.

As a result of Magic Eden helps each Solana- and Ethereum-based NFTs, {the marketplace}’s transfer to drop royalties incentivizes marketplaces in each blockchains to observe swimsuit.

Whereas the development has grown throughout each blockchains, it has not but triggered the same sample throughout NFT economies on the likes of Cardano.

Cardano NFT quantity surpassed Solana’s for the month of October, with some speculating demand for royalties as a big motive why. The idea: The artist-friendly setup attracted a brand new wave of artists and mints.

The long run relationship between artists and NFTs

Based on critics of non-obligatory royalties, this race to the underside is a determined try and hold customers engaged. But, it robs Peter to pay Paul within the sense that advantages to merchants come on the expense of the artist.

The royalty incentive solely works when all main platforms conform to uphold them. If one breaks that disagreement, it’s not lengthy earlier than others observe.

The trade seems to be at a fork within the street. If it finds a method to implement royalties on the protocol stage — or perhaps a authorized stage — then it might succeed the place lawmakers failed.

However most proposal upgrades seem to have loopholes that will permit for related issues to emerge.

The choice is to discover a completely different carrot. If NFTs reach implementing a sustainable enterprise mannequin with out royalties, others could observe.