Here’s the ‘big picture’ story of how the NFT market is really faring

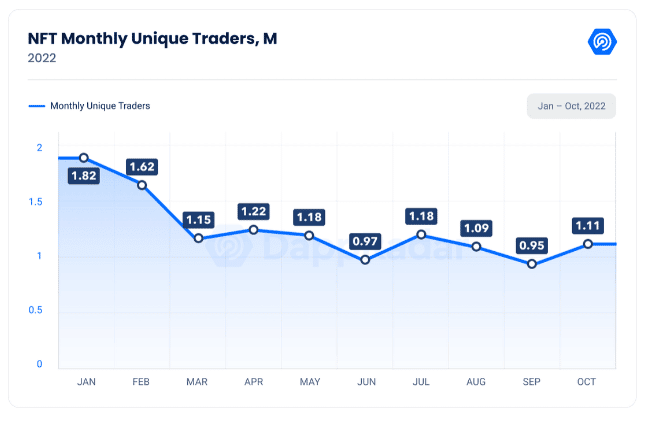

Non-fungible token (NFT) buying and selling volumes and gross sales could have fallen in October. Nevertheless, in keeping with DappRadar’s findings, a rise of 18% in month-to-month distinctive NFT merchants demonstrates that the market remains to be in “excessive demand.”

DappRadar reported that there have been 1.11 million month-to-month distinctive NFT merchants in October, up 18% from the roughly 950,000 merchants there have been in September.

That is true, even if revenues fell by 30% to$ 6.13 million in October whereas commerce volumes fell by 30% to $662 million – The bottom recorded in 2022.

That is true, even if revenues fell by 30% to$ 6.13 million in October whereas commerce volumes fell by 30% to $662 million – The bottom recorded in 2022.

“The rise within the distinctive merchants’ depend signifies that new individuals are getting into the NFT market, and it’s nonetheless in nice demand.”

Busy month for the NFT Market

For the NFT neighborhood, the month was very hectic. A minimum of two different NFT marketplaces, Magic Eden in Solana and LooksRare in Ethereum, switched to an elective royalty association.

The survey additionally famous Yuga Labs’ continued dominance within the NFT business, with CryptoPunks and Bored Ape Yacht Membership accounting for seven of the top-10 gross sales for the month.

The NFT buying and selling quantity rose to $2.71 billion in Q3 – A 67% hike from Q2 ranges. The variety of gross sales additionally elevated from Q2 by 8.3%.

In comparison with August, the NFT buying and selling quantity appreciated by 10.4% in September alone. Moreover, the gross sales depend climbed by 21%, demonstrating the sustained excessive demand for the NFT business. However, the cryptocurrency market’s devaluation could have contributed to the general decline in buying and selling quantity.

The evaluation additionally confirmed that regardless of a 76% decline in NFT buying and selling quantity on Ethereum from Q2, there have been 11% extra NFT trades total. Regardless of a 96% hike from the earlier month, Solana’s NFT buying and selling quantity was nonetheless down 63% from Q2.

The introduction of the y00ts assortment, which gave Ethereum NFTs a run for his or her cash, was what fuelled the enlargement of the latter. Inside a month of its introduction, it surpassed NFT large OpenSea’s quantity charts and generated 435,000 SOL or roughly $15 million in secondary gross sales.

Extra competitors?

Since a couple of months in the past, OpenSea’s rivals have expanded their market share, changing the “monopoly” market into an “oligopoly.” Though Ethereum and Solana-based exchanges X2Y2 and Magic Eden have elevated their market share since 2022, OpenSea nonetheless dominates the sector when it comes to customers and quantity.

When in comparison with August, OpenSea’s market share dropped by 8.3% in October and its month-to-month NFT buying and selling quantity fell by 12.1% ($313 million). Since July 2021, that is the bottom commerce quantity we have now seen.

NFTs and their underlying marketplaces are displaying sturdy indicators of putting up with regardless of fluctuations, although all markets are presently experiencing elevated volatility.

With all of the hoopla, an increasing number of companies are contemplating NFTs as a way of capital elevating. The pliability of NFTs and their capability to switch verified possession of a uncommon product on the blockchain are what makes them so enticing. Nevertheless, companies ought to take into consideration any potential regulatory constraints that will limit the usage of NFTs for fundraising earlier than contemplating an NFT providing.