Have Bitcoin and Ethereum Bottomed Out? Top Trader Examines Path Forward for the Two Largest Crypto Assets

A preferred analyst is digging into the charts to set worth targets for six crypto belongings because the markets attempt to finish the week on a shiny be aware.

Pseudonymous crypto dealer Altcoin Sherpa tells his 180,100 Twitter followers he’s trying on the 200-day exponential shifting common (EMA) for Bitcoin (BTC) on four-hour candles to plot out each short-term highs and lows.

The crypto strategist additionally says that whereas Bitcoin has managed to determine a near-term vary, he doesn’t imagine that the bear market backside is in for BTC.

“I feel that the highest of vary is smart at this level, eyeing $21,600 and $22,000 as of now.

Nonetheless uncertain that is the macro backside nevertheless it’s a really robust tradeable occasion. Taking earnings increased the place the 200 EMA four-hour is.”

Bitcoin is presently up by 1.5% during the last 24 hours, altering arms for $20,693.

Shifting on to main sensible contract platform Ethereum (ETH), Altcoin Sherpa once more utilizes the 200-day EMA metric to determine a worth fluctuation zone of $1,013 to $1,283 whereas cautioning that ETH may fall to as little as $850 earlier than the subsequent large rally.

“Concept – [ETH] goes to the highs/hits resistance at 200 EMA four-hour after which again to the lows.

Might even go as little as $850 earlier than springing increased. NOT the underside but although [in my opinion].

Ethereum is up by 2.33% on the day, priced at $1,217.

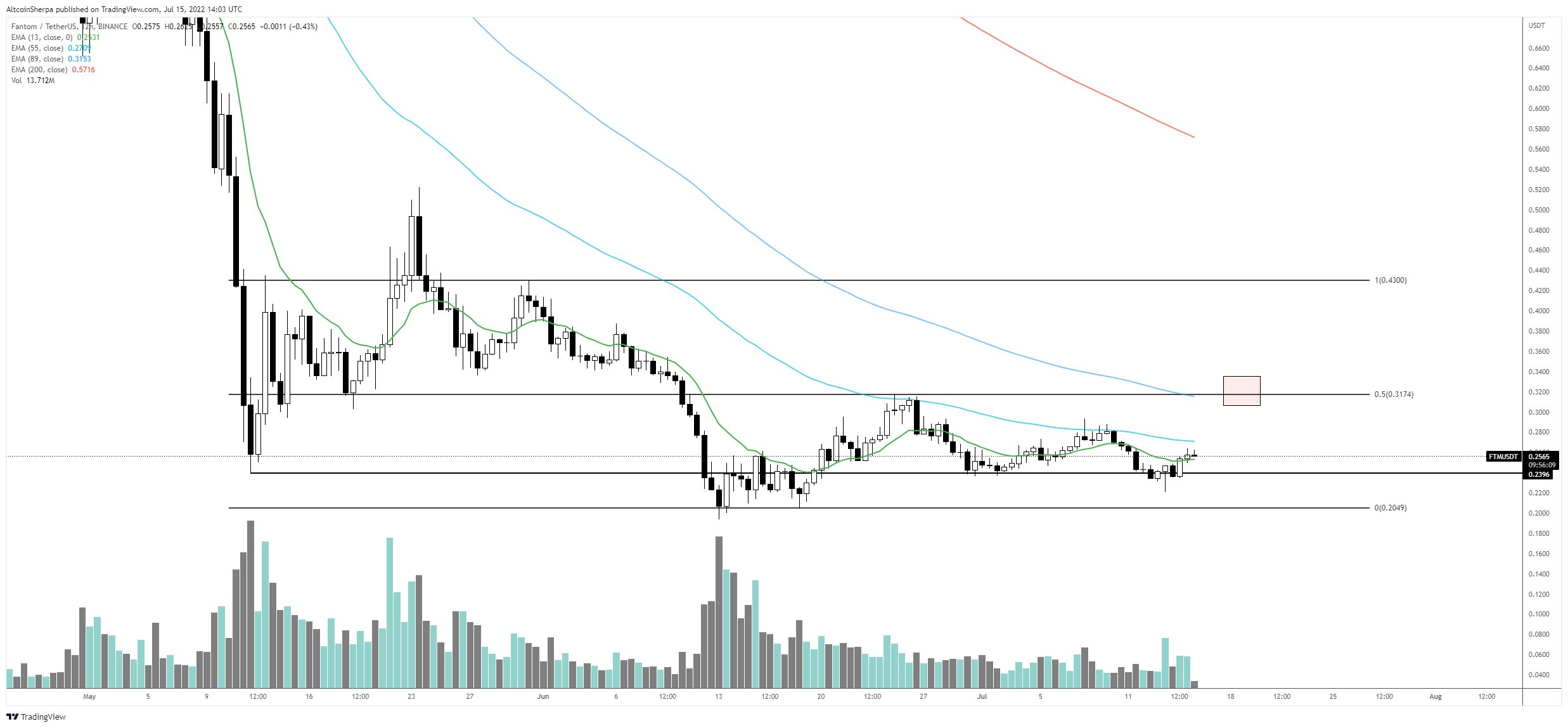

Relating to enterprise-grade blockchain platform Fantom (FTM), the crypto analyst doesn’t have excessive hopes however thinks FTM may at the very least attain the mid-point of its present buying and selling vary.

“I haven’t checked out this shitcoin shortly. I wouldn’t be shocked to see this grind as much as the [equilibrium] of the vary round $0.32.

It’s nonetheless tremendous bearish although total.”

At time of writing, Fantom is valued at $0.25.

Subsequent on the analyst’s radar is Ethereum competitor Solana (SOL). He says he’s planning to completely exit his positions if SOL can work its manner as much as $42.

“I’m 1/third out of this place, took this one and entered at $34.

I feel this will make its approach to the prime quality at $42, the place I’ll be largely all out at the moment.”

Solana is rallying properly off its weekly lows within the $32 vary and is presently buying and selling at $37.01.

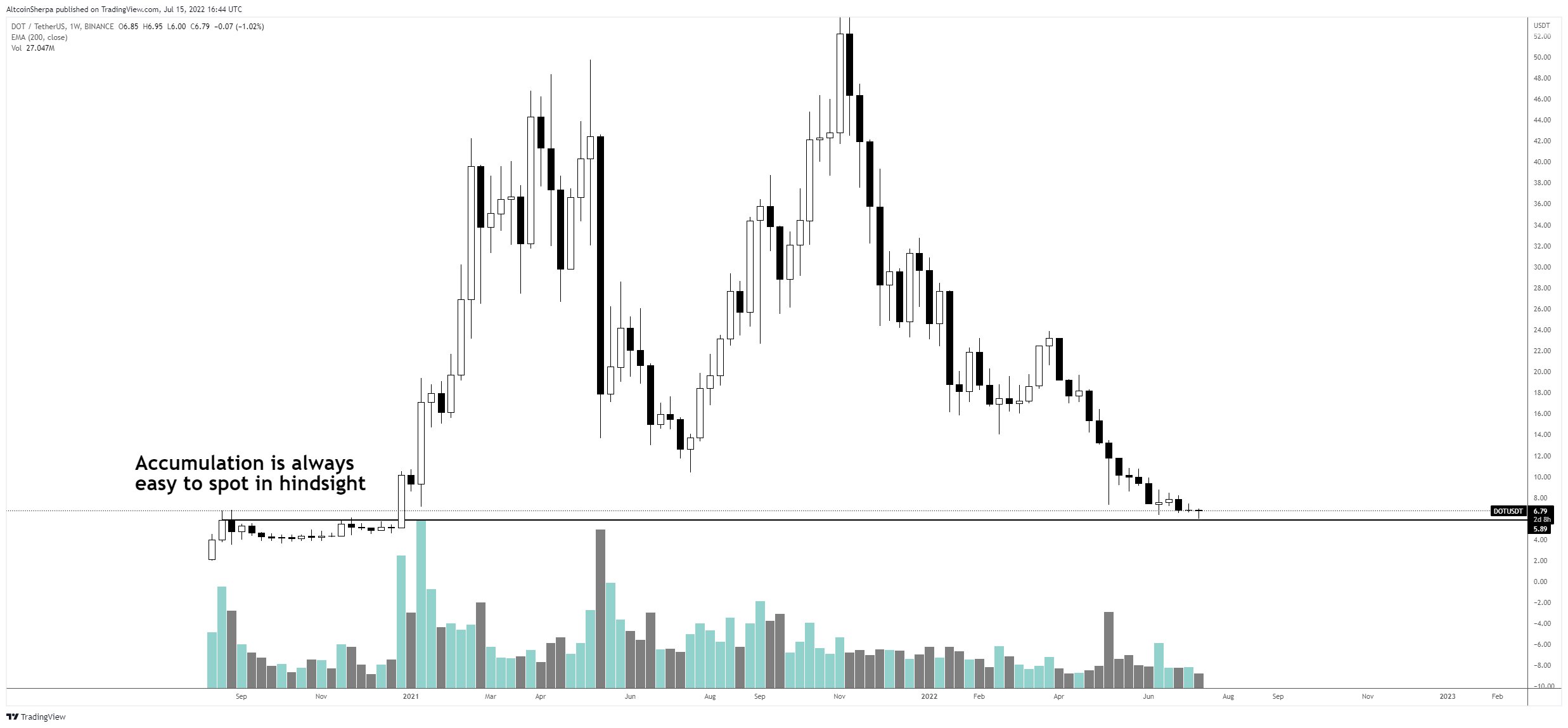

As for cross-chain interoperability protocol Polkadot (DOT), Altcoin Sherpa believes the underside nonetheless isn’t in regardless of DOT pushing steadily downward since April.

“I don’t suppose that is accumulation fairly but however that is all the time actually onerous to see in actual time. Chop round right here one other few weeks and I may perhaps see it being the underside.

Till then, I’m going to imagine $5 is coming.”

Polkadot is presently altering arms for $6.74.

Final on the dealer’s listing is lending and borrowing protocol Aave (AAVE), which he predicts is due for a big leg down earlier than any rally may happen.

“I feel that the cluster of EMAs might be an honest entry across the mid-$70s ($75ish) in case you’re taking part in the decrease timeframes.

It appears to be like bullish on the four-hour however nonetheless fairly bearish on the one-day/increased timeframes.

I’d in all probability look to quick low-$100s if/when it will get there.”

At the moment, Aave is down over 4% on the day with a worth of $88.85.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Featured Picture: Shutterstock/klyaksun