Gamers Rejoice as Crypto Winter Tanks GPU Prices

Key Takeaways

- Excessive-end graphics processing models (GPUs) have tanked in worth on the secondary market over the previous six months.

- The falling value of Ethereum and its upcoming swap away from Proof-of-Work have contributed to the decreased demand.

- Rising vitality prices have additionally harm miner profitability, leading to many miners promoting their graphics playing cards to recoup prices.

Share this text

The declining crypto market has precipitated costs for graphics playing cards on the secondary market to plummet.

GPUs Come Again Right down to Earth

Graphics playing cards have gotten extra reasonably priced for his or her meant goal.

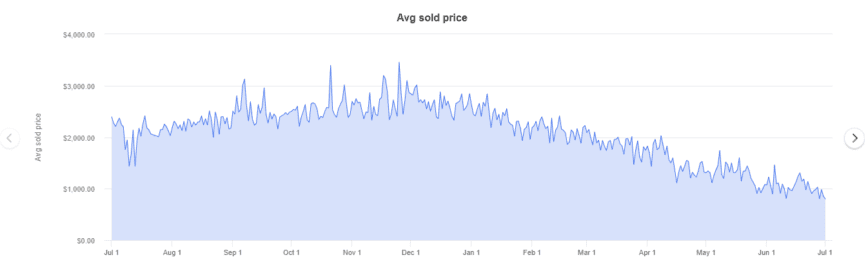

Excessive-end graphics processing models (GPUs), popularly used for mining Proof-of-Work cryptocurrencies equivalent to Ethereum, have plummeted in worth on the secondary market over the previous six months.

In accordance with accomplished listings information compiled from eBay, the newest fashions from Nvidia’s RTX 3000 sequence and AMD’s 6000 sequence have seen their costs drop 50% for the reason that begin of the 12 months. In January, an RTX 3060ti, one of the environment friendly consumer-grade playing cards for mining Ethereum, sometimes set consumers again upwards of $1,000. Now, the identical card trades arms on eBay for round $492.

Secondary gross sales of different playing cards present comparable developments. Nvidia RTX 3070s and AMD RX 6800 XTs have additionally registered over 50% declines in latest months. Moreover, extra highly effective playing cards, such because the RTX 3080 and 3090 fashions, present bigger reductions in comparison with their extra mining-efficient counterparts. The RTX 3090, till lately probably the most highly effective card within the RTX sequence, has seen probably the most vital value drop, beforehand promoting for as much as $2,788 in January, right down to a mean of $1,106 right this moment.

The upper decline within the costs of the RTX 3080 and 3090 fashions suggests these playing cards could have been promoting at an extra premium unconnected to their use in crypto mining. Whereas demand from crypto miners has contributed to graphics card value rises over the previous two years, scalpers making the most of semiconductor provide points attributable to COVID-19 lockdowns are additionally chargeable for much less mining-efficient graphics playing cards buying and selling at exorbitant costs.

Graphics playing cards are a vital part in private computer systems that convert code into photographs that may be displayed on a monitor. Whereas high-end GPUs let players play well-liked titles in excessive element with superior results, the processors that render these prime quality graphics are additionally efficient in fixing the advanced equations wanted to mine some cryptocurrencies. Because the crypto market roared to new highs in late 2020, demand for graphics card soared. On the top of mining profitability in 2021, playing cards purchased at essential sale retail value could possibly be paid off after round three months of Ethereum mining.

Now, falling crypto costs, and thus mining profitability, has supplied aid to the GPU market. Ethereum, the second-largest cryptocurrency behind Bitcoin, has persistently been the most well-liked coin to mine utilizing consumer-grade GPUs. For the reason that begin of the 12 months, Ethereum has nosedived from over $3,600 to simply over $1,000, representing a drop in worth of greater than 70%.

Ethereum Merge Slashes GPU Demand

Moreover, Ethereum will quickly swap from a Proof-of-Work to a Proof-of-Stake consensus mechanism in a long-awaited improve dubbed “the Merge.” It will carry an finish to utilizing GPUs to validate the community, changing energy-hungry computations with a greener coin staking mechanism. The swap to staking is estimated to scale back Ethereum’s carbon footprint 100-fold whereas lowering coin emissions by round 90%.

With the Merge anticipated to happen later this 12 months, many Ethereum miners are slowing down their operations in preparation. Whereas some miners have announced plans to modify to different cryptocurrencies equivalent to Ethereum Traditional or use their GPUs for on-demand video rendering post-Merge, there’s no assure these actions can be as worthwhile as mining Ethereum—if in any respect. These mining right this moment will doubtless be apprehensive about shopping for extra graphics playing cards with an unsure future forward.

One closing concern contributing to falling GPU costs is the rising value of vitality globally. The World Financial institution Group’s energy price index reveals a 26.3% value improve between January and April 2022, including to a 50% improve between January 2020 and December 2021. With vitality costs surging, extra miners will battle to eke out a revenue—particularly smaller residence miners who pay home electrical energy charges. A mixture of rising vitality prices and plummeting crypto costs has doubtless made it uneconomical for a lot of hobbyists to proceed mining. As those that determine to unplug their rigs promote their playing cards to recoup prices, pushing lower as a result of improve in provide.

Whereas GPU costs have dropped from the jacked-up costs customers have come to count on over the previous two years, there could possibly be scope for them to drop additional. Semiconductor shortages mixed with extreme demand precipitated GPU makers to up their retail costs to fall extra in step with secondary market gross sales. Nonetheless, the latest inflow of used playing cards on marketplaces like eBay has introduced the going price down properly under essential sale retail costs. If producers like Nvidia and AMD need to proceed promoting new models, they face adjusting their costs to compensate for secondary market provide. This isn’t the primary time producers have been hit—in 2019, Nvidia reported disappointing gross sales of its then-new 2000 sequence playing cards, which the corporate blamed on second-hand GPUs flooding the market after the mining increase throughout the 2017 crypto bull run.

With Ethereum transferring away from Proof-of-Work mining and crypto costs settling right into a bear market, graphics card costs are lastly returning to regular. Nonetheless, if one other Proof-of-Work coin takes off sooner or later, GPUs may as soon as once more turn out to be a scorching commodity.

Disclosure: On the time of scripting this piece, the writer owned ETH and several other different cryptocurrencies.