Ethereum’s latest update could get ETH holders excited for 2023 because…

- The full worth of ETH staked and validators on the community witnessed substantial progress

- Whales present curiosity in ETH because the variety of transactions witnessed a surge

Ethereum’s [ETH] staking exercise continued its upward swing as the full worth staked in ETH 2.0. deposit contract reached one more ATH, data from Glassnode revealed.

📈 #Ethereum $ETH Whole Worth within the ETH 2.0 Deposit Contract simply reached an ATH of 16,042,407 ETH

Earlier ATH of 16,042,391 ETH was noticed on 14 January 2023

View metric:https://t.co/SzbMPqvhlb pic.twitter.com/QRT9ANf6dr

— glassnode alerts (@glassnodealerts) January 15, 2023

What number of are 1,10,100 ETHs value right now?

A drill down of the chart additional indicated that this worth noticed a considerable improve since 6 January. This was when builders introduced that the Shanghai Improve, which can allow the withdrawal of staked ETH, will go reside in March 2023.

However the 1.3% drop noticed in ETH’s value on the time of writing, the king of altcoins made a outstanding restoration because the FTX contagion hit the crypto market. The bullish cycle additionally witnessed ETH dash in the direction of its pre-FTX market cap ranges.

Staking will get scorching

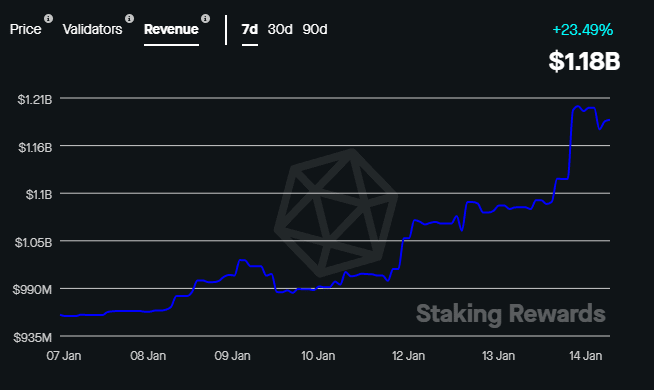

The variety of validators on ETH community steadily elevated by 0.61% over the seven-day interval, per data from Staking Rewards. The income from transaction charges additionally shot up by nearly 24% which lent credence to the lucrativeness of ETH staking.

The annualized reward charge or the reward that validators can count on to earn per yr was estimated at 3.8%.

Supply: Staking Rewards

Apparently, the proportion of eligible tokens that had been being staked stood at 13.87%, considerably decrease than different in style chains like Cardano [ADA] and Solana [SOL] which had as staking ratio of over 70%.

Whales’ transactions surge

On-chain indicators corroborated the rising attraction of the community. Whale transactions registered a pointy uptick to hit their highest worth in additional than two months. As of 14 January, the transactions hit 5646, a bounce of just about 30% during the last month.

The brand new contributors getting into the community rose steadily indicating that Ethereum’s adoption was on the rise.

Supply: Santiment

The elevated exercise was additionally highlighted by the rate indicator which steeply elevated to three.99 on 14 January. This steered that ETH moved extra often throughout wallets.

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

Nevertheless, ETH traders are cautious of the truth that the Shanghai Improve might intensify promoting stress out there. Information analytics agency Bitwise challenged the declare and stated that mass gross sales shall be unimaginable as the quantity of ETH that might be unstaked shall be restricted at any level of time.

Bitwise additionally predicted that ETH will flip deflationary in 2023 and its whole circulating provide will drop by 1% or extra, bringing extra aid to traders.