Ethereum’s future hinges on validators amidst declining interest and market trends

- Ethereum community’s validator numbers remained regular regardless of bear market.

- Decreased whale curiosity, community progress, velocity, and dealer sentiment raised issues.

Validators on Ethereum [ETH] may play a major function within the community’s future. New information on 6 February instructed that the variety of new validators added to the community remained fixed in 2022, even in the course of the bear market.

Do you know that there have been 218,068 new Ethereum validators (nearly 7 million ETH value) that have been spun up in 2022 alone?

This was roughly the identical variety of validators that have been spun up in 2021.

Bull or bear, the demand for ETH staking is insatiable. pic.twitter.com/4gIthHw6KP

— sassal.eth 🦇🔊 (@sassal0x) February 6, 2023

Is your portfolio inexperienced? Try the Ethereum Revenue Calculator

Thus, there was curiosity amongst stakers, even in a unstable market. The upcoming Shanghai Improve was anticipated to additional incentivize new validators to hitch the community.

Current validator curiosity could possibly be pushed by the optimistic developments surrounding Ethereum.

Trying on the positives

A optimistic indicator for Ethereum was the declining variety of addresses in loss, reaching a five-month low in response to Glassnode.

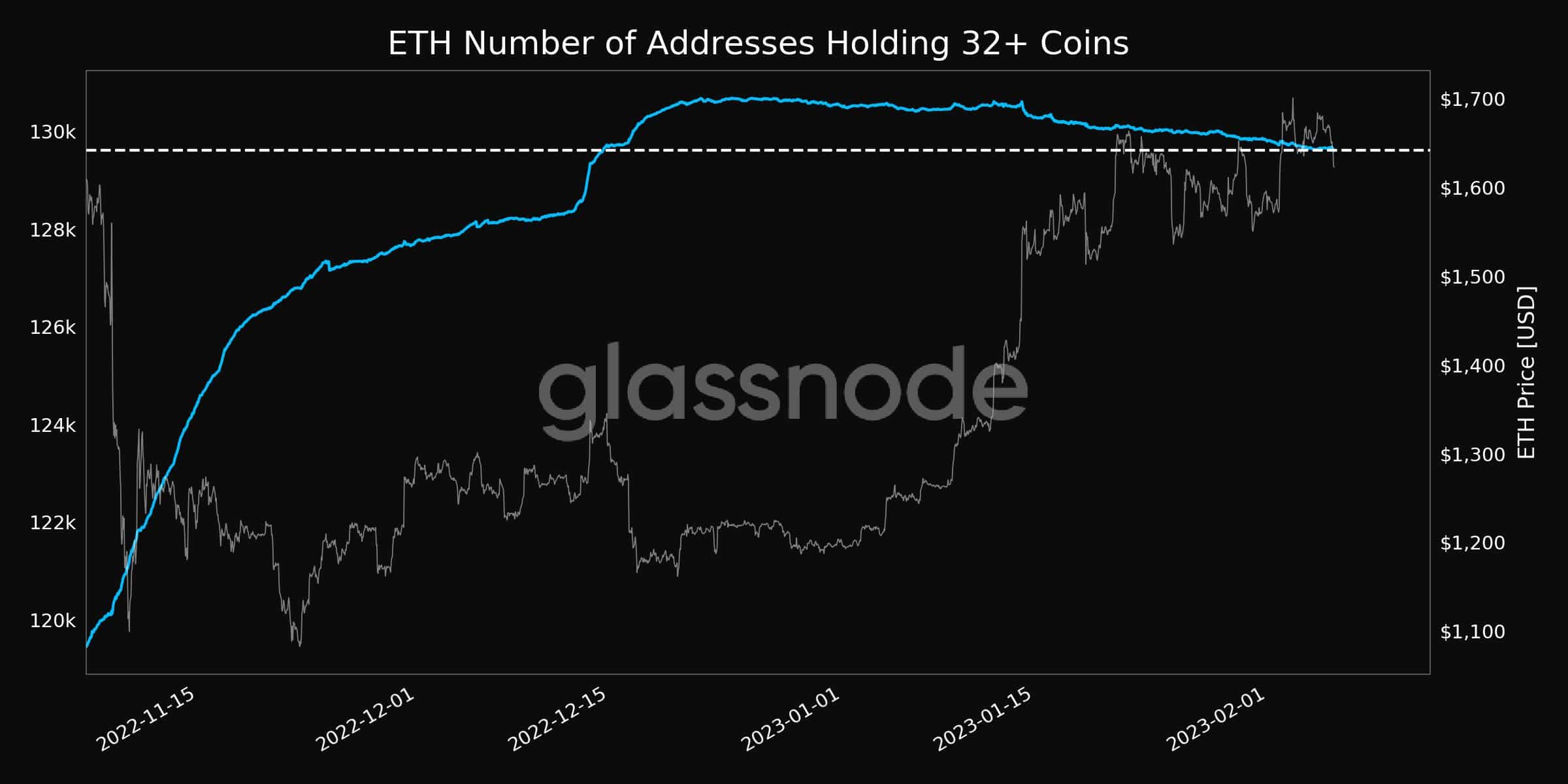

Nonetheless, regardless of this optimistic information, whale curiosity decreased over the past month. If giant addresses determined to promote their investments, it may negatively influence retail traders.

Supply: glassnode

Taking a look at Ethereum, on-chain

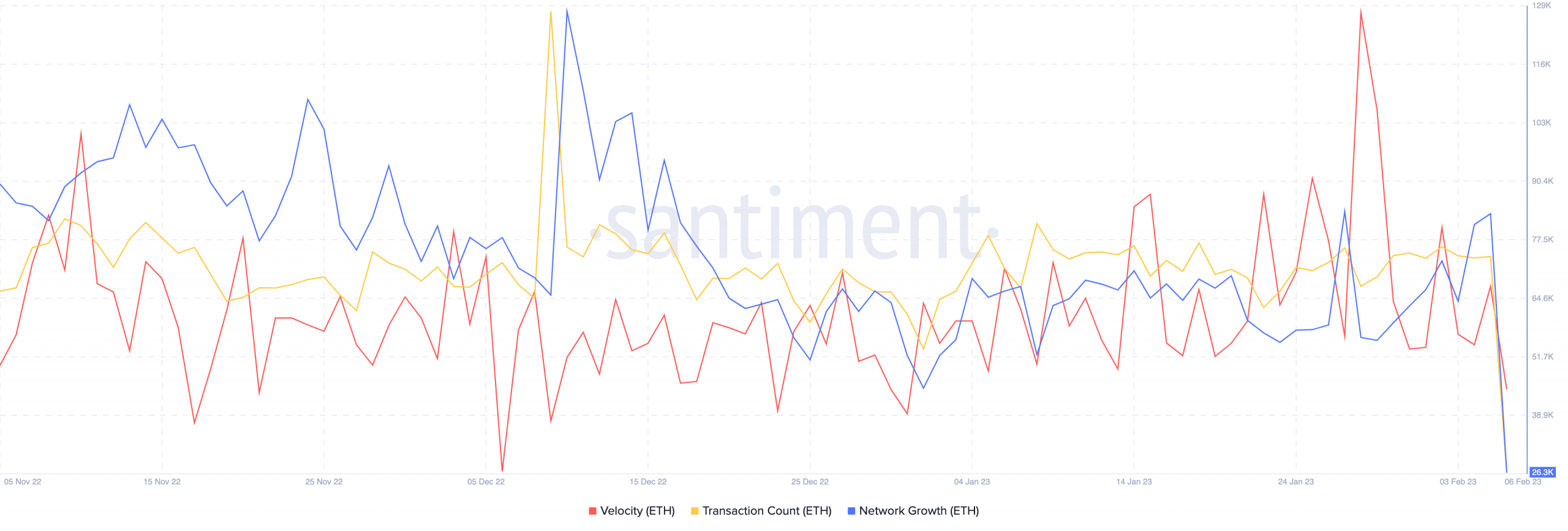

Ethereum’s declining community progress could possibly be one purpose for the lower in whale curiosity, as there was a cutback in new addresses transferring ETH for the primary time. This instructed that new addresses weren’t displaying curiosity within the community.

Supply: Santiment

Another excuse for the dearth of whale curiosity could possibly be the decline in Ethereum’s velocity, which means that the frequency of ETH trades decreased.

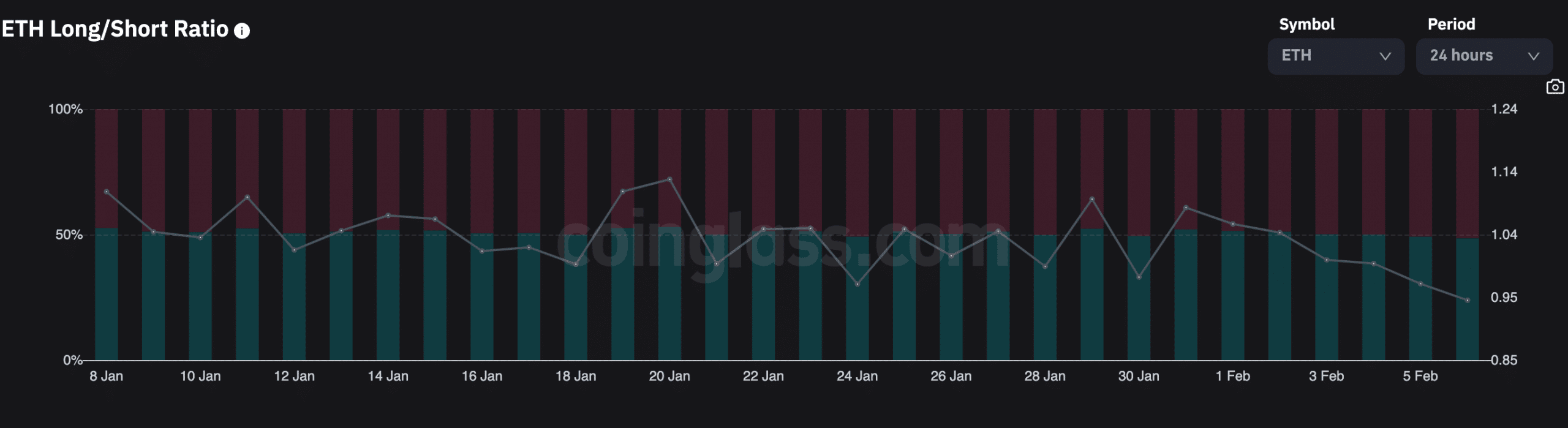

Moreover, dealer sentiment additionally turned unfavourable throughout this era. Brief positions towards Ethereum elevated, in response to Coinglass. This surge briefly positions elevated after 1 February. At press time, the proportion of quick positions towards ETH was 51.57%.

Supply: Coinglass

Though merchants have been pessimistic about Ethereum, a brand new growth with Visa may enhance the community’s odds of success. As per a 6 February tweet, Visa was utilizing the Ethereum community to check USDT transactions.

VISA: We have been testing learn how to really settle for settlement funds from issuers in USDC beginning on Ethereum and paying out in USDC on Ethereum. And these are giant worth settlement funds. https://t.co/M2PkeQDNBL

— Wu Blockchain (@WuBlockchain) February 6, 2023

Learn Ethereum’s [ETH] Value Prediction 2023-2024

The aforementioned partnership may assist improve Ethereum adoption and enhance sentiment amongst merchants and whales.

General, the variety of validators on the community and their continued progress, regardless of market volatility, instructed a promising future. The Shanghai Improve and Visa’s partnership are key indicators to be careful for, as they’ve the potential to positively influence the king altcoin’s adoption and its general future.