Ethereum: Will the tides change for ETH amid this recent accumulation

Ethereum [ETH] high ten buyers holding their belongings off exchanges added about 6.7% extra of the primary altcoin, in accordance with a current replace from Santiment.

The on-chain analytic platform reported that the highest ten non-exchange addresses, at press time, held 23.7 million ETH. This was a transparent distinction of the standing of the highest ten addresses on exchanges which held about 8.7 million.

Right here’s AMBCrypto’s Worth Prediction for Ethereum for 2023-2034

Recall that the Merge didn’t include a constructive worth response a lot to the frustration of buyers. Nonetheless, each alternate and non-exchange holders performed important roles that resulted in complacent worth motion.

🐳 #Ethereum‘s high 10 largest non-exchange addresses have been accumulating belongings after their huge drop-off main as much as September’s merge. They’ve added 6.7% extra $ETH. In the meantime, the highest 10 exchanges are standing pat with simply an 0.2% rise. https://t.co/h5CxDwOphX pic.twitter.com/msrrzvhB4P

— Santiment (@santimentfeed) November 1, 2022

Now, it appeared that non-exchange holders have been attempting to make up for his or her actions. Regardless of the change of thoughts, there was no certainty that it might lead ETH into extra inexperienced after it registered an 18% uptick within the final seven days.

Alternatively, the current motion ensured that there was some shopping for stress, however was it true?

Nearly nothing to show

On evaluating the provision outdoors of exchanges, Santiment showed that different ETH holders may need slackened the amount. At press time, the non-exchange provide was 103.65 million.

This determine was a slight lower from the value on 28 October. This implied that the buildup by the highest ten addresses had little influence on the general ecosystem. Therefore, there was much less probability of an enormous shopping for stress considerably impacting the ETH worth.

Supply: Santiment

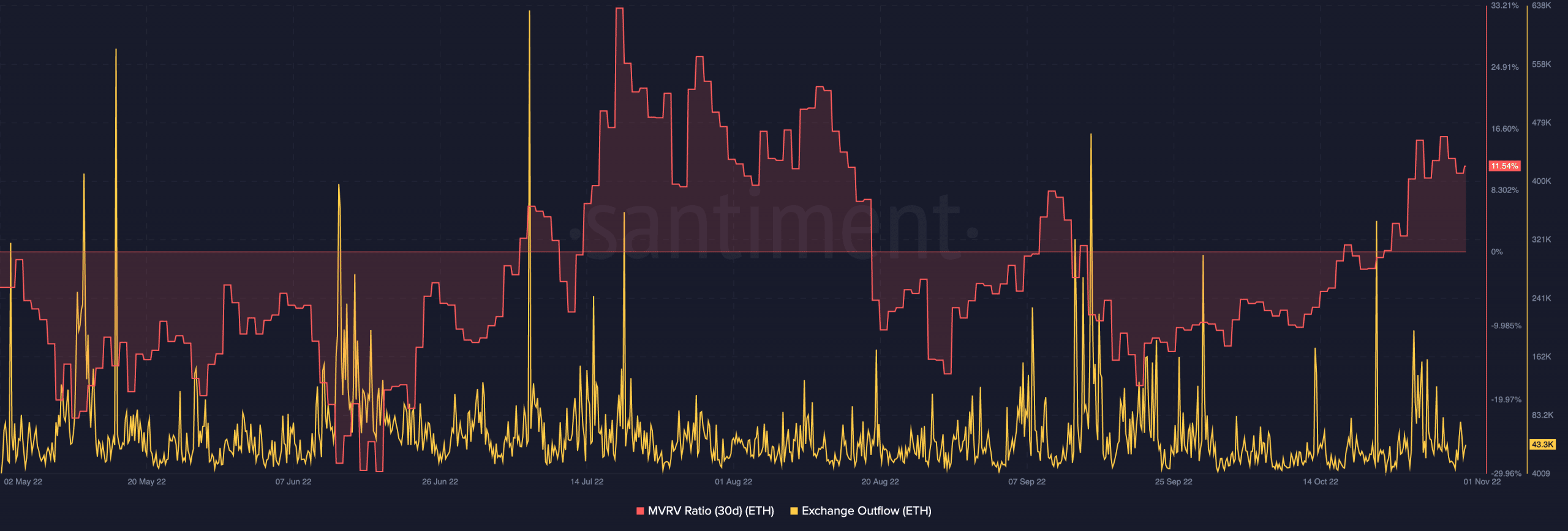

Moreover, the Market Worth to Realized Worth (MVRV) ratio proved that the impact on the ETH worth was virtually irrelevant. As of this writing, the MVRV ratio was 11.54%. Earlier than press time, it had risen as excessive as 15.77%. This implied that buyers who had amassed income from the current uptick have been now setting for some take-outs from these beneficial properties.

An evaluation of the alternate outflow indicated that there was much less stress from consumers. With the worth already lowering to 43,300, ETH short-term buyers would possibly have to dampen their expectations of one other double-digit uptick quickly.

Supply: Santiment

The place will ETH go from right here?

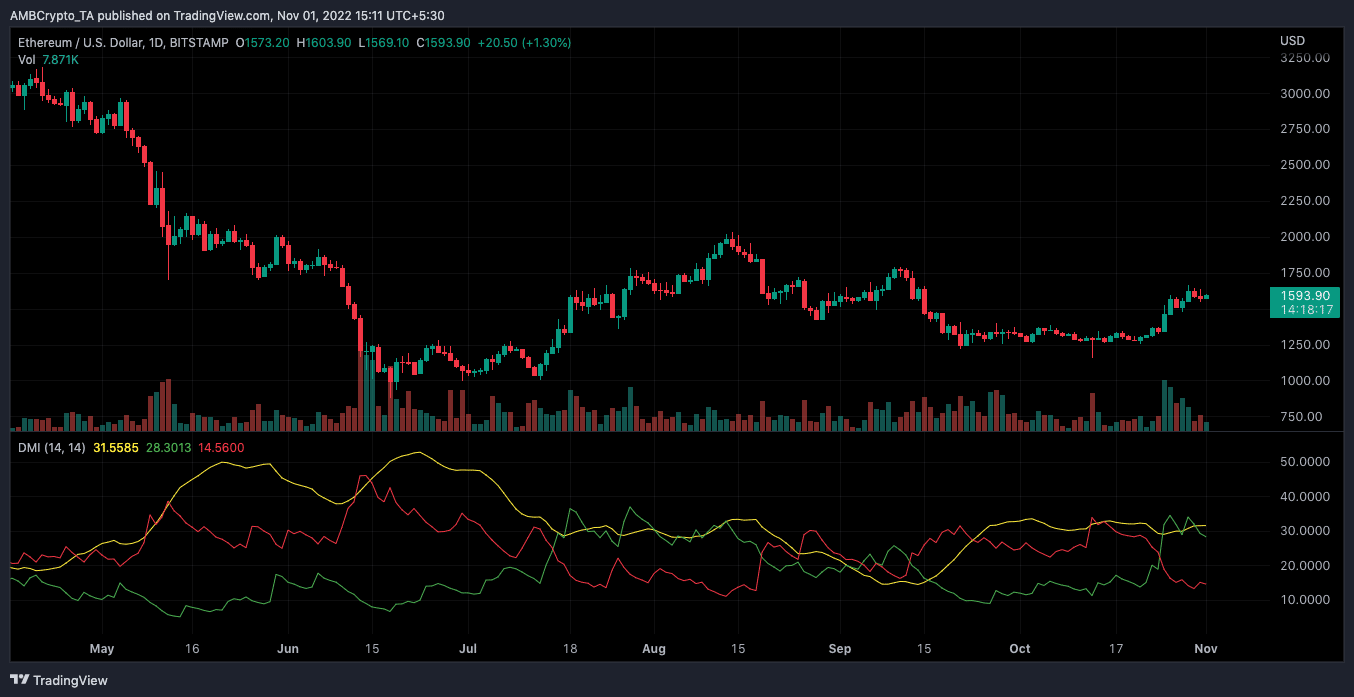

Surprisingly, ETH seems to be poised for the sustenance of its current enhance. Based on the four-hour chart, the Directional Motion Index (DMI) was in favor of the consumers.

Indications from the DMI confirmed that the shopping for energy (inexperienced) at 28.30 was properly in management over the sellers (purple). Moreover, the Common Directional Index (ADX) was in assist of an improved ETH worth. With the ADX (yellow) At 31.55, ETH had a robust motion within the upward path.

Nonetheless, with indicators and metrics on opposing sides, ETH may need to accept minimal will increase within the brief time period. Though, the altcoin’s quantity was rising at press time. Within the meantime, the momentum might favor extra of a worth enhance.

Supply: TradingView