Ethereum: Everything you need to know about Shapella mainnet upgrade

- ETH accumulation is on the rise- The variety of addresses holding 0.01+ cash elevated.

- Demand from the derivatives market additionally noticed an uptick.

Ethereum [ETH] not too long ago revealed in a blog that the Shapella (Shanghai+Capella) mainnet improve was getting into the ultimate pre-launch part after intensive testing and improvement.

The brand new improve will embrace a number of new options, probably the most notable of which will likely be withdrawals for stakeholders and the consensus layer.

Exiting validators will likely be eligible for full withdrawals, whereas energetic validators with balances over 32 ETH will likely be certified for partial withdrawals.

Because the hype across the Shapella improve rose, buyers’ expectations of ETH additionally elevated. ETH accumulation was on the rise because the variety of addresses holding 0.01+ cash reached a 6-month excessive of twenty-two,907,244.

Moreover, demand for ETH within the futures market was additionally going uphill as ETH’s open curiosity in perpetual futures contracts reached a 1-month high of $290,732,090 on Deribit.

Can this elevated curiosity and accumulation be hinting towards a brand new bull run?

📈 #Ethereum $ETH Variety of Addresses Holding 0.01+ Cash simply reached a 6-month excessive of twenty-two,907,244

Earlier 6-month excessive of twenty-two,906,541 was noticed on 10 February 2023

View metric:https://t.co/XXb0u19ouH pic.twitter.com/4bZlt6PMD1

— glassnode alerts (@glassnodealerts) February 11, 2023

Learn Ethereum’s [ETH] Value Prediction 2023-24

Market’s response

ETH’s value motion has not been in buyers’ favor these days, as its weekly chart registered a decline. As per CoinMarketCap, ETH was down by over 8% within the final seven days, and on the time of writing, it was buying and selling at $1,519.80 with a market capitalization of greater than $186 billion.

Nevertheless, as we get nearer to the launch of Shapella, the opportunity of a bull run can’t be dominated out. Curiously, Messari additionally revealed the identical as Ethereum’s transferring averages materialized into golden crosses.

Has the Subsequent Bull Cycle Begun for #Bitcoin and #Ethereum?

+$BTC and $ETH transferring averages materialized into golden crosses

+Prep work begins within the UK for digital pound

+@WisdomTreeFunds positions itself as a number one digital asset supervisorFull macro/crypto recap ⬇️ pic.twitter.com/bG9iQLbzfw

— Messari (@MessariCrypto) February 10, 2023

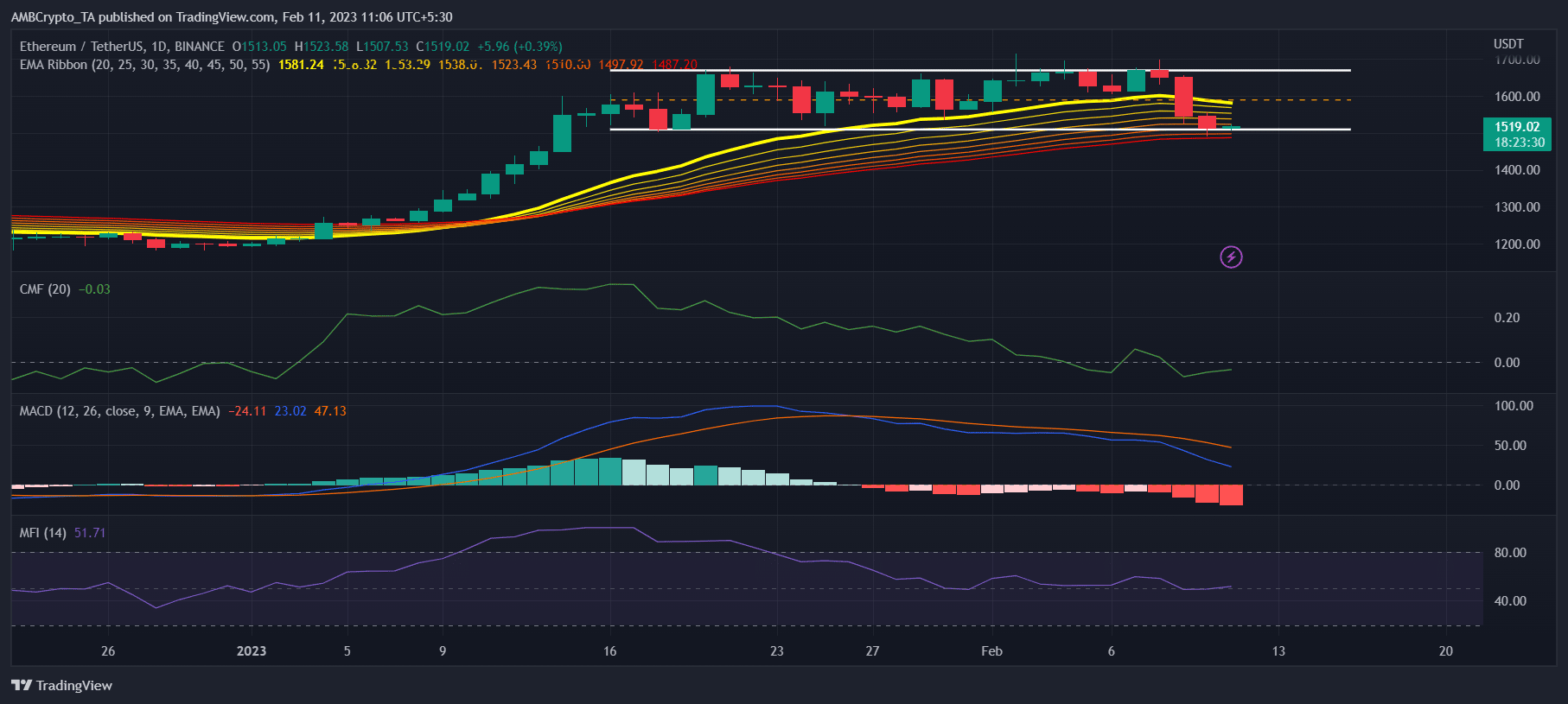

Moreover, ETH’s each day chart revealed that the bulls had the higher hand available in the market because the 20-day Exponential Transferring Common (EMA) was above the 55-day EMA.

The Chaikin Cash Circulate (CMF), after registering a downtick, went up barely in the direction of the impartial mark, which was constructive information. Ethereum’s Cash Circulate Index (MFI) was resting close to the impartial mark, suggesting that the market may head in any path. Nevertheless, ETH’s MACD was regarding because it displayed a bearish crossover.

Supply: TradingView

Is your portfolio inexperienced? Examine the Ethereum Revenue Calculator

Can the metrics save ETH?

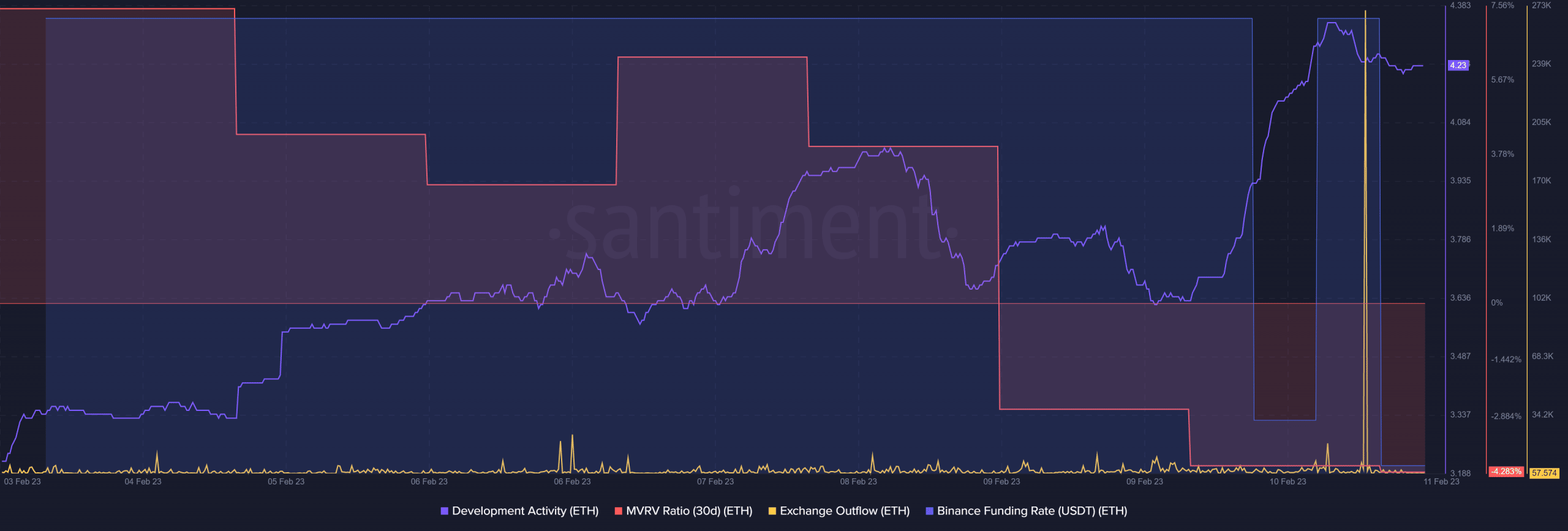

Much like Glassnode’s information, a number of of the opposite metrics aligned with buyers’ pursuits as they appeared in ETH’s favor. As an illustration, ETH’s change outflow spiked significantly, which may be thought of a bullish signal.

Furthermore, ETH’s change reserve was decreasing, suggesting decrease promoting stress. Aside from open curiosity, ETH’s Binance funding fee additionally remained excessive, which mirrored its demand within the derivatives market.

Because of the deliberate improve, ETH’s improvement exercise was up. Nonetheless, ETH’s MVRV Ratio registered a decline, which might carry bother within the days to come back.

Supply: Santiment