Ethereum [ETH]: These metrics look bullish – Is a rally around the corner

- Ethereum led the market at press time, because it remained the biggest L1 by way of TVL and charges.

- ETH’s on-chain efficiency appeared bullish.

Ethereum [ETH] registered huge positive factors throughout this yr’s bull market. Nonetheless, since peaking on 7 February, ETH’s worth dropped by 13%. On the time of writing, it was trading at $1,501.74, with a market capitalization of greater than $183 billion.

Learn Ethereum’s [ETH] Worth Prediction 2023-24

Apparently, not the whole lot appeared dangerous for Ethereum, as Santiment’s information revealed that regardless of the worth decline, the quantity of accessible ETH sitting on exchanges continued to fall, which appeared bullish. To be extra particular, there have been 37% fewer cash by way of greenback valuation on exchanges for the reason that merge.

📉 #Ethereum has dropped -13% since peaking at $1,688 again on February seventh. Nonetheless, the excellent news is that the quantity of accessible $ETH sitting on exchanges (and out there to promote) continues to fall. Because the #merge, there are 37% much less cash on exchanges. https://t.co/HOnHO6iLpJ pic.twitter.com/YpReloS8iT

— Santiment (@santimentfeed) February 13, 2023

ETH nonetheless the market main on this facet

Ethereum continued to dominate the market at press time, because it remained the biggest L1 by way of TVL and charges. With practically $28 billion in TVL, ETH’s TVL was 5.6 occasions increased than that of the subsequent largest L1, which was Binance [BNB].

Ethereum nonetheless the biggest L1 by TVL and charges

– At ~$28B TVL, ETH is 5.6x that of the subsequent largest L1 in BNB

– At $3.4m each day charges, ETH is nearly 3x that of BNBObserve that ETH is #3 in energetic handle (behind BNB and BTC) and #5 in transactions. pic.twitter.com/xGOND2Ow9a

— Artemis 🏹 (@Artemis__xyz) February 13, 2023

Ethereum’s efficiency on the social entrance additionally appeared promising. LunarCrush’s data revealed that Ethereum’s social mentions and social dominance just lately hit three-month highs. All these updates appeared favorable for Ethereum. Due to this fact, let’s take a look on the king of altcoins’ on-chain metrics to seek out out whether or not a brand new bull rally is across the nook.

Is ETH preparing for a bull run?

In line with CryptoQuant’s data, Ethereum’s alternate reserve was reducing, which was a bullish sign because it indicated much less promoting stress. One more constructive sign was that Ethereum’s complete variety of transactions was on the rise. As per Glassnode, ETH’s open curiosity in perpetual future contracts reached a three-month excessive of $296,148,748 on Deribit.

📈 #Ethereum $ETH Open Curiosity in Perpetual Futures Contracts simply reached a 3-month excessive of $296,148,748 on #Deribit

View metric:https://t.co/5MhXAkWLAZ pic.twitter.com/HDQV1d9gcA

— glassnode alerts (@glassnodealerts) February 14, 2023

Sensible or not, right here’s ETH market cap in BTC’s phrases

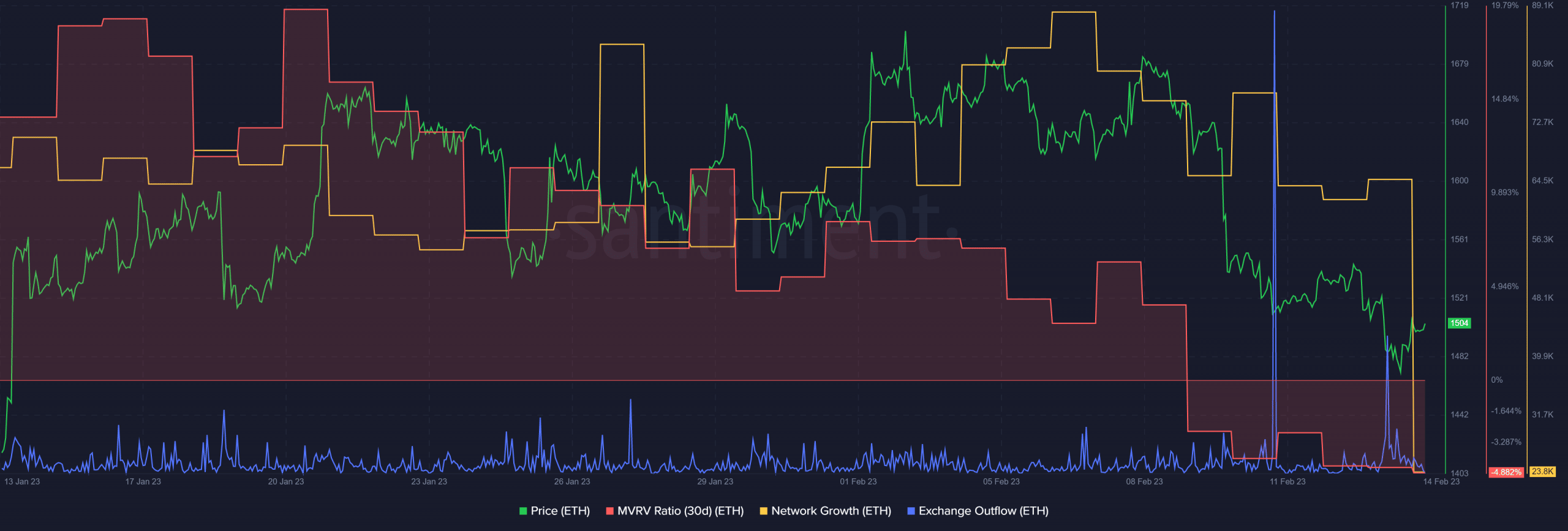

This was excellent news, because it mirrored increased demand for ETH within the derivatives market. The identical was additional confirmed by the taker purchase/promote ratio, which revealed that purchasing sentiment was dominant within the derivatives market. Santiment’s chart revealed that ETH’s community progress remained excessive all through the week.

Moreover, ETH’s alternate outflow spiked twice in the previous couple of days, which was bullish. Nonetheless, ETH’s MVRV Ratio was down significantly, which could limit ETH from initiating a bull run within the coming days.

Supply: Santiment