Ethereum: Decoding if ETH would lose sight of $1,600 and its dominance over this…

As October nears its finish, Ethereum [ETH] has been in a position to maintain its value dominance over Bitcoin [BTC] with indicators to even command higher. An outline of the final thirty days confirmed that ETH elevated 21.52% whereas buying and selling at $1,628 at press time. In response to CoinMarketCap, BTC’s rise throughout the similar interval was a minimal 6.55%.

Right here’s AMBCrypto’s Value Prediction for Ethereum for 2022-2023

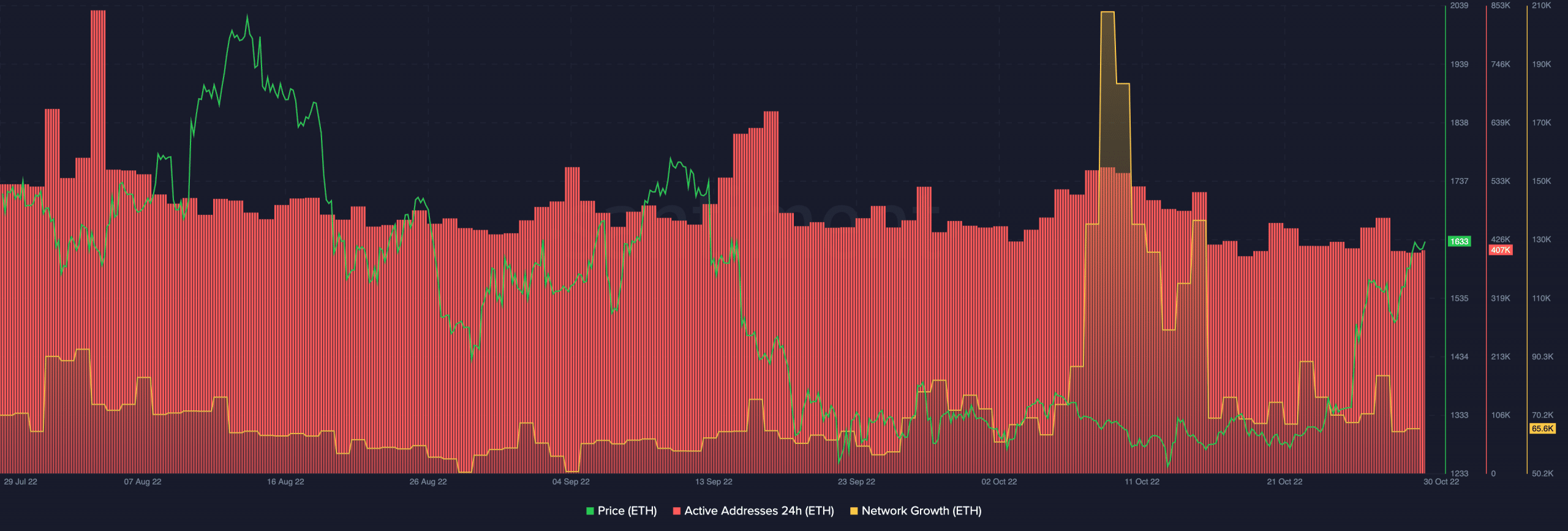

In response to Santiment, BTC was much less prone to win the “battle” anytime quickly. The on-chain analytic platform reported that the ETH had gained new addresses significantly better than that of the king coin. Nonetheless, the increase had not impacted a lot on the community progress which decreased to 65,600.

Usually, a rise in lively addresses ought to result in an increase within the community progress. In flip, this could impression the value barring some other exterior elements.

Supply: Santiment

Time to do extra or else…

The on-chain analytic platform famous that ETH may want greater than the present lively addresses momentum to take care of the value rise. If not, the primary altcoin may lose its grip on the $1,600 area, and probably squander the dominance it held for months. So, is there an opportunity that different elements of the Ethereum chain are making up for the minimal tackle improve?

In response to Glassnode, it appeared that retail buyers fashioned a big a part of the brand new addresses gained. This was as a result of the addresses with 1,000 to 10,000 ETH had decreased. At press time, addresses with 10,000 ETH had been 1,160— a discount from 1,165 on 28 October.

As compared with the addresses with 0.1 ETH and 1 ETH, the deep-pocket buyers had been accumulating actually low. As of this writing, the retail distinctive addresses rely had massively elevated. The implications of this development was that ETH had potential to surpass the $1,600 zone contemplating that addresses proceed to spike. Furthermore, the coin may want a greater impression from institutional buyers to maintain the present momentum.

Supply: Glassnode

ETH may require extra motion

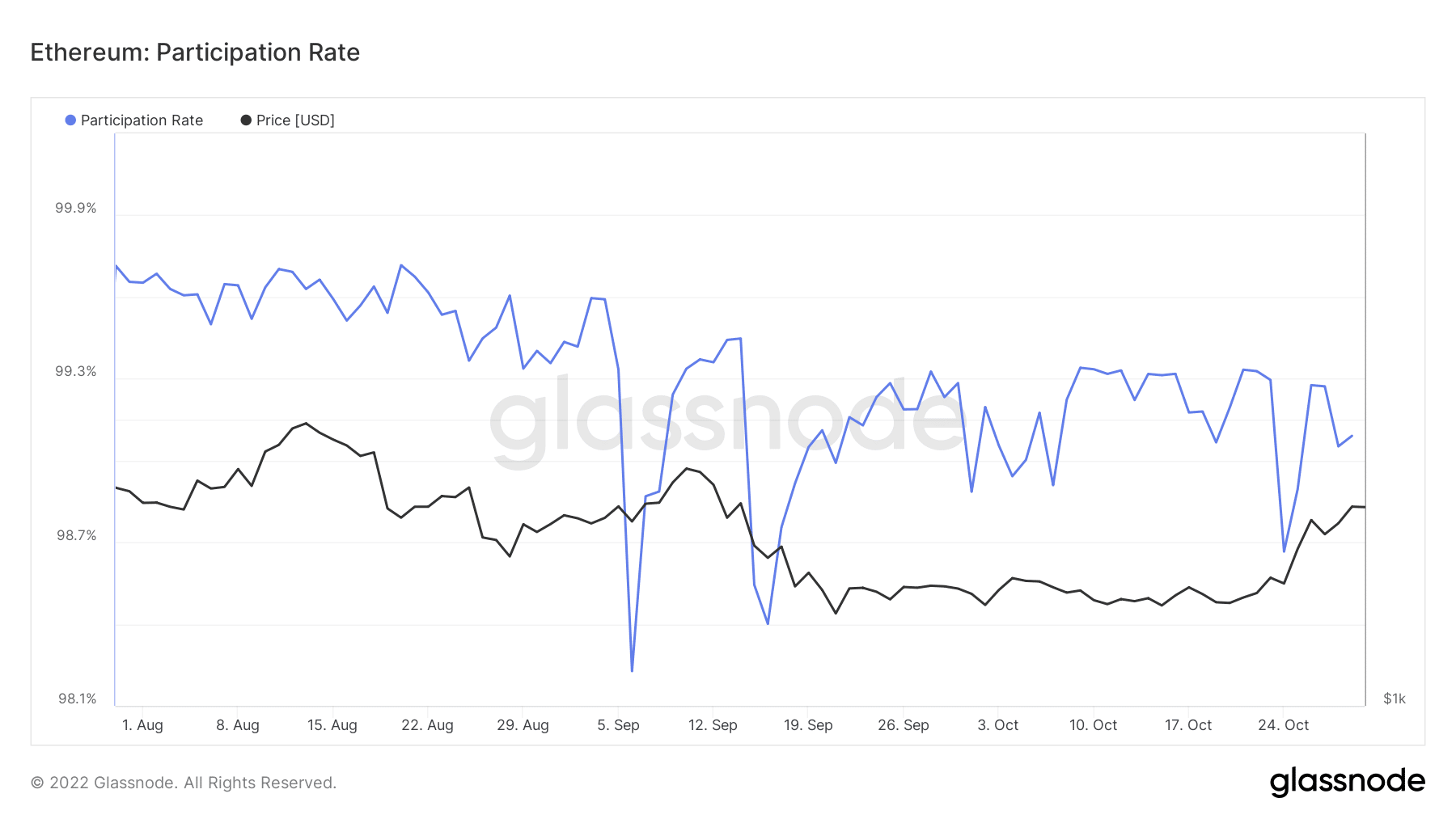

Whereas ETH might need achieved nicely with its sensible contracts provide, sustaining its dominance may require greater than investor exercise. For context, the community responsiveness may must play a serious function. Nonetheless, the ETH participation charge had not been in a position to match up the validator impact on 26 October. At press time, Glassnode information confirmed that the participation charge was 99.09%. At this charge, slots missed by community validators had been minimal. Nonetheless, it had the potential to be higher.

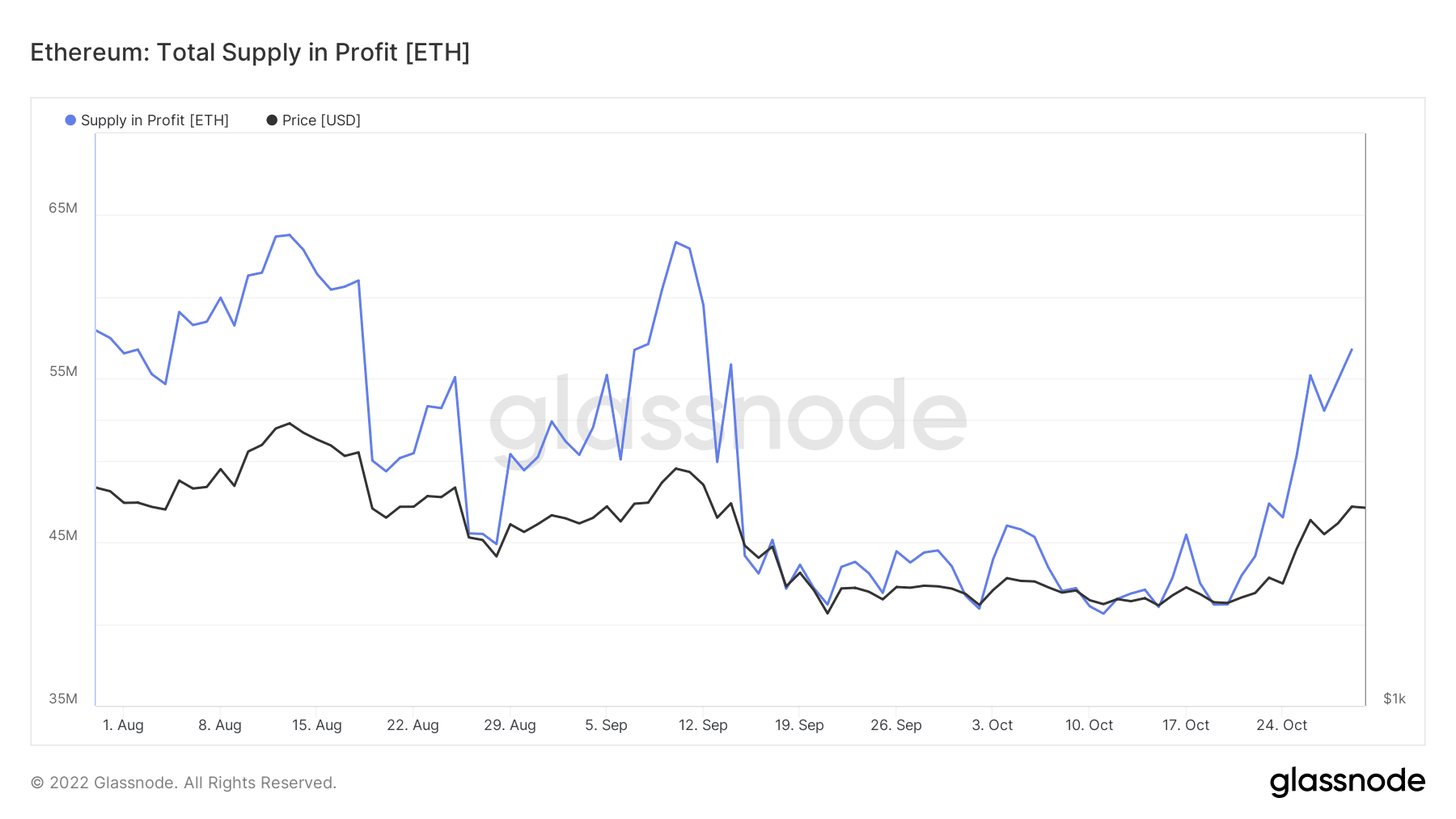

Apparently, the present ETH value stood extra worthwhile for buyers. As revealed by Glassnode, the ETH supply in profit was 56.78 million. With the efficiency of those metrics, it was extremely probably that ETH would see the BTC dominance until 12 months finish.

Supply: Glassnode