ETH sharks on accumulation spree, but how long will it take for bubble to burst?

- Ethereum sharks accumulate a considerable amount of ETH, and costs surge.

- Information suggests a attainable bubble, short-term holders could promote.

A 12 January tweet by Santiment revealed that sharks had accrued a major quantity of Ethereum [ETH] during the last two months. This led to a surge in ETH’s costs. The development of ETH accumulation by giant holders may additionally affect total market sentiment and costs.

🦈 #Ethereum has jumped above $1,400 for the primary time since November seventh. Over the previous 10 weeks, ~3,000 new shark addresses (holding 100 to 10,000 $ETH) have proven up on the community. 48,556 shark addresses is the best stage recorded since Feb, 2021. https://t.co/yJfTP3QhKI pic.twitter.com/4tzS0nsph9

— Santiment (@santimentfeed) January 12, 2023

What number of are 1,10,100 ETH value in the present day?

Information offered by Glassnode confirmed a rise in curiosity from addresses holding over 10 ETH throughout this era. Furthermore, the variety of addresses in revenue reached a one-month excessive of 49,079,396.702.

📈 #Ethereum $ETH Variety of Addresses in Revenue (7d MA) simply reached a 1-month excessive of 49,079,396.702

View metric:https://t.co/9t2b8JZ83s pic.twitter.com/NtSNbGwJ3m

— glassnode alerts (@glassnodealerts) January 11, 2023

Hassle in paradise?

Nevertheless, this sudden surge in Ethereum costs might be a bubble, based on knowledge by MAC_D on Crypto Quant. Two indicators present that the present state of affairs is overbought. The primary indicator is the Brief Time period Holder SOPR, which measures the sentiment of short-term traders.

A price higher than or equal to at least one signifies that short-term traders are making a revenue when the general development is falling. Thus, giant holders or “whale traders” are in a great place to make a revenue. The present worth for this indicator is 1.007.

The second indicator is the ETH dominance index, which measures the relative energy of Ethereum in comparison with different cryptocurrencies, similar to Bitcoin. An increase within the index of over 20% means that altcoins are rising excessively in comparison with Bitcoin, which might be seen as an indication of a bubble. A slight drop within the worth of Bitcoin may considerably influence the market.

Downward stress will increase on account of overbought

“Extreme rise in $ETH in comparison with $BTC might be analyzed to have shaped a bubble, and even a slight drop in #BTC can shake the market considerably.”

by @MAC_D46035Hyperlink👇https://t.co/edkoaA6HWq pic.twitter.com/B2ftM3bSm9

— CryptoQuant.com (@cryptoquant_com) January 11, 2023

Ethereum merchants go brief

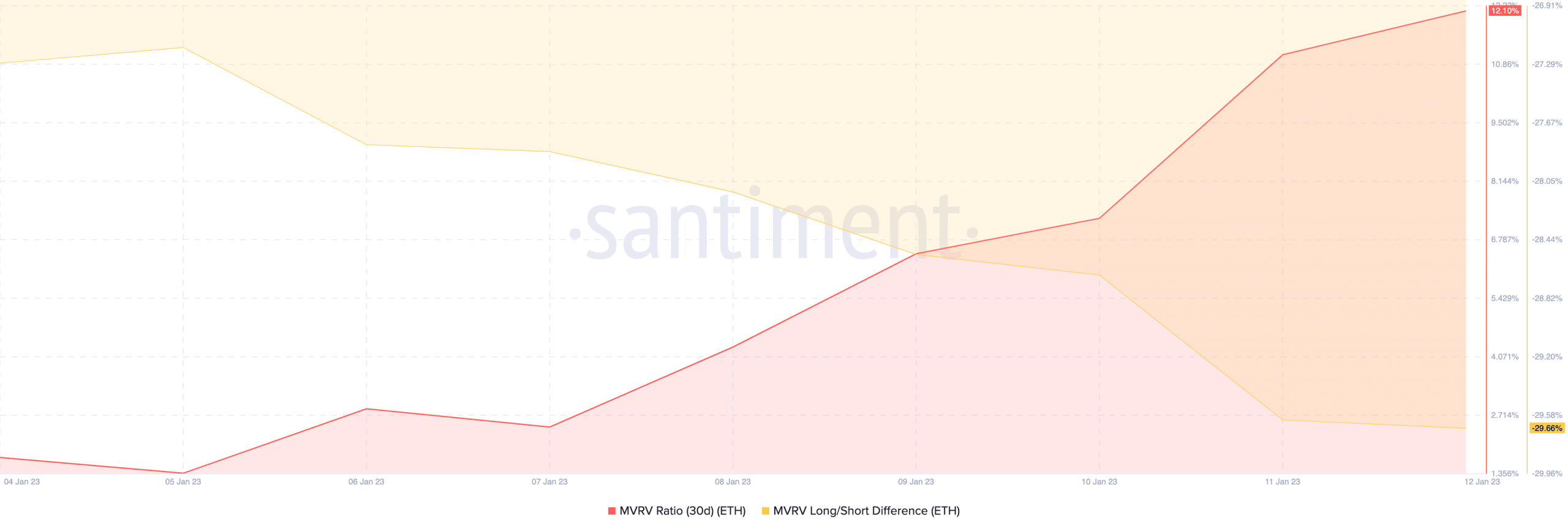

One other indicator of rising promoting sentiment could be the rising MVRV ratio. The rising MVRV ratio coupled with the rising lengthy/brief distinction implied that many short-term Ethereum holders may revenue from promoting their ETH. This might improve promoting stress on Ethereum.

Supply: Santiment

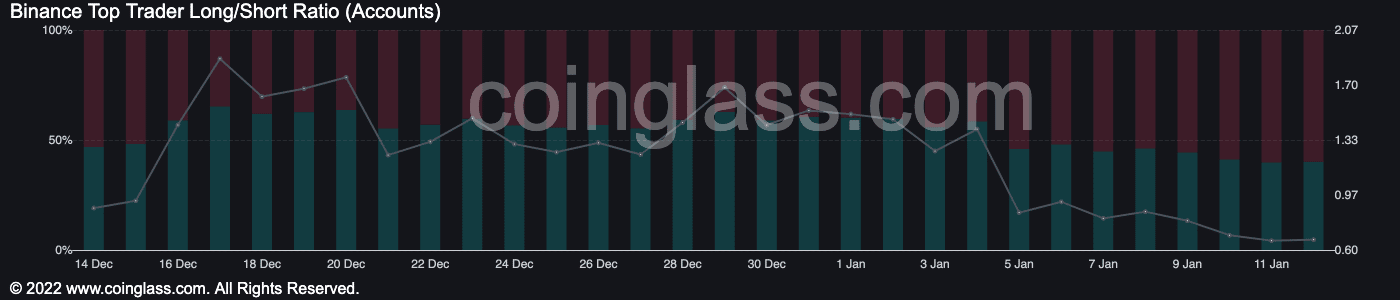

This rising promoting stress might be one cause why merchants took brief positions towards ETH. Information offered by Coinglass confirmed that the variety of brief positions taken towards Ethereum grew significantly over the previous few days, with 60.16% of merchants shorting Ethereum on the time of writing.

Is your portfolio inexperienced? Try the Solana Revenue Calculator

Supply: Coinglass

At press time, the worth of Ethereum was $1,399.74. ETH grew by 4.80% within the final 24 hours, based on CoinMarketCap.