DYDX retraces into an HTF support, can we expect another surge upward?

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.

- Two necessary ranges of help stay unbroken for DYDX.

- Larger timeframe bias stays bullish regardless of the decrease timeframe downward momentum.

DYDX made monumental positive factors in January. Like the remainder of the altcoin market, the start of the brand new yr introduced a rally that has lasted shut to 6 weeks. Durations of consolidation and pullback have been witnessed throughout this run, and the token was going by one other deep pullback.

Learn DYDX’s Value Prediction 2023-24

If Bitcoin can regain its bullishness, DYDX could possibly be one of many tokens which returns strongly to its earlier bullish pattern. This concept can be invalidated if the token fell beneath the next timeframe help zone.

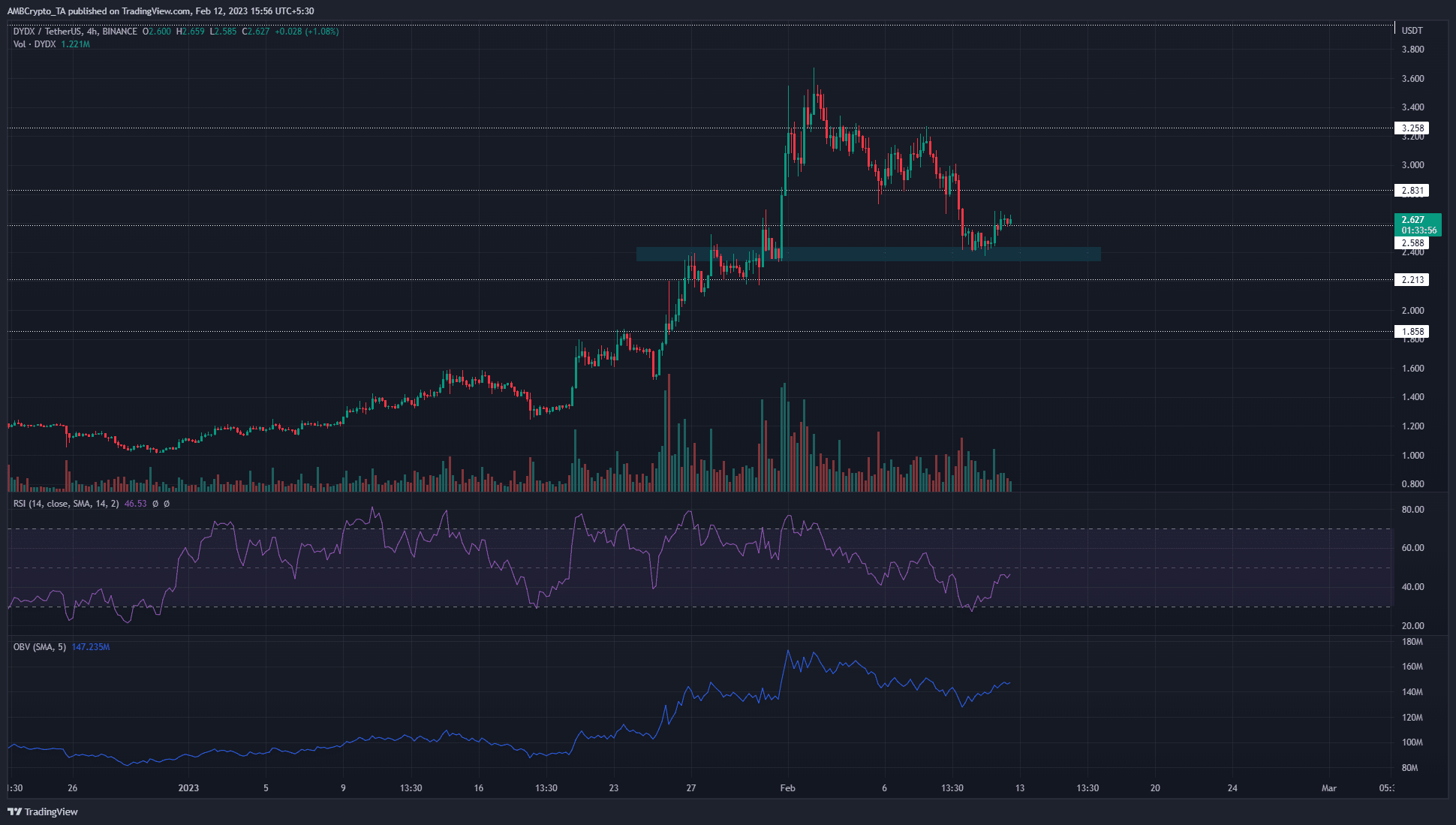

The $2.4 zone has seen consolidation within the past- and a bounce in latest days

Supply: DYDX/USDT on TradingView

On the 4-hour worth chart, it may be seen that the $2.4 area just isn’t solely an H4 bullish order block but in addition a zone beneath which the asset consolidated in late January. Following this part of consolidation, a violent transfer upward occurred on 31 January.

Subsequently, it’s probably that this area will curiosity a lot of consumers.

The 4-hour RSI has not but recovered to push above the impartial 50 mark, regardless of the close to 10% bounce throughout the previous three days.

In the meantime, the OBV made decrease highs, despite the fact that DYDX burst above the $2.8 resistance with vehemence.

Is your portfolio inexperienced? Examine the dYdX Revenue Calculator

Though the indications didn’t present a pointy bullish disposition, the value motion was promising.

Threat should be fastidiously managed, as Bitcoin sat at a important help zone of round $21.6k.

Consumers might discover some earnings by shopping for the transfer again above the $2.6 stage of help. To the north, $3.25 and $4 will be take-profit ranges. Invalidation of this purchase can be a drop beneath $2.2 on the each day timeframe, and $2.6 and $2.4 on decrease timeframes.

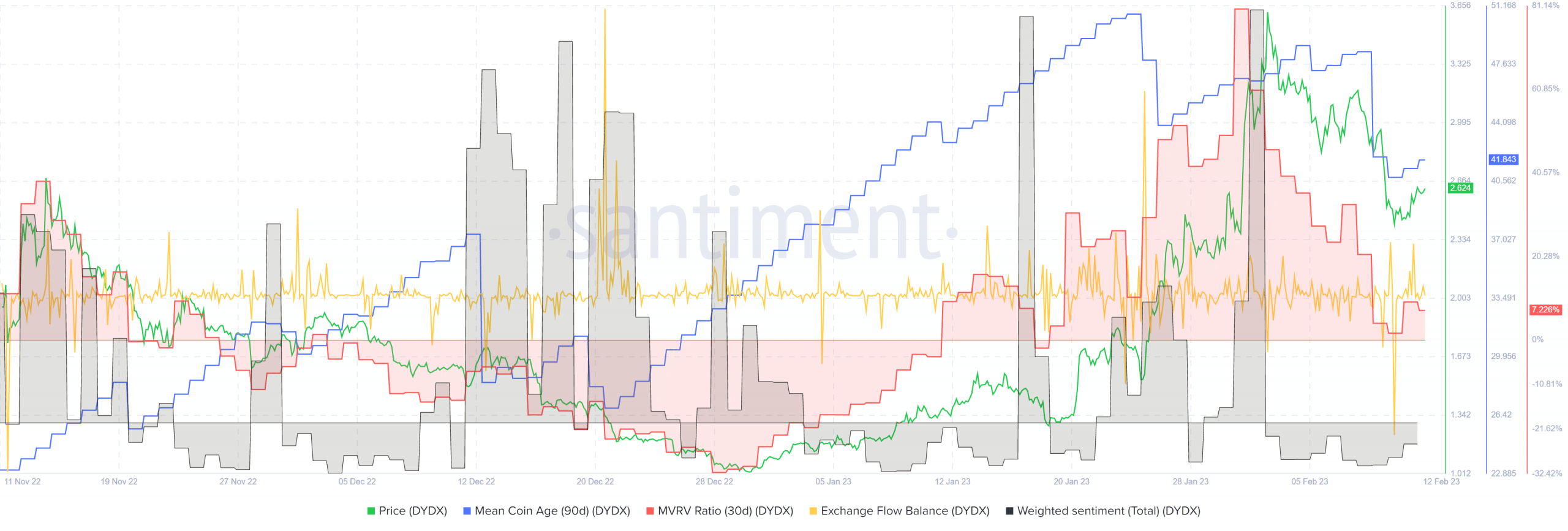

Supply: Santiment

In the meantime, the 30-day MVRV ratio fell towards the zero mark to point short-term holders had taken earnings.

This was not an indication of bullishness, however it pointed towards the likelihood that the promoting stress might quickly abate. Weighted sentiment remained detrimental.

The imply coin age, which had been rising since late December, noticed sharp drops within the latter half of January.

This signaled a spike in promoting stress. As issues stand, this metric doesn’t present a network-wide accumulation pattern.

The change stream steadiness noticed a big outflow in latest days. This hinted at accumulation however just isn’t conclusive by itself.