Curve Finance: What should CRV holders expect of the token in 2023

- CRV ended 2022 in a decrease TVL place than it began the 12 months.

- Technical indicators confirmed that CRV might end 2023’s first quarter in consolidation.

In occasions previous, Decentralized Finance (DeFi) would have been incomplete with out the point out of Curve Finance [CRV]. However in 2022, the automated market maker was a shadow of its former self.

Threatened by the affect of Lido Finance [LDO] and Maker DAO [DAO], Curve was unable to keep up remaining within the high two positions per its Complete Worth Locked [TVL]. Nonetheless, DeFi Llama had reported that CRV nonetheless shaped part of the 42% DeFi market dominance as of 1 January 2023.

What number of CRVs are you able to get for $1?

Whales rise to the event however…

Whereas doubts rose in regards to the longevity of the protocols, Ethereum [ETH] whales determined that CRV nonetheless remained helpful. In keeping with Whale Stats, CRV was a part of the highest 10 tokens used most by the whales within the final 24 hours.

JUST IN: $CRV @curvefinance one of many MOST USED good contracts amongst high 100 #ETH whales within the final 24hrs🐳

Verify the highest 100 whales right here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see information for the highest 5000!)#CRV #whalestats #babywhale #BBW pic.twitter.com/rmv1ffFI9y

— WhaleStats (monitoring crypto whales) (@WhaleStats) January 1, 2023

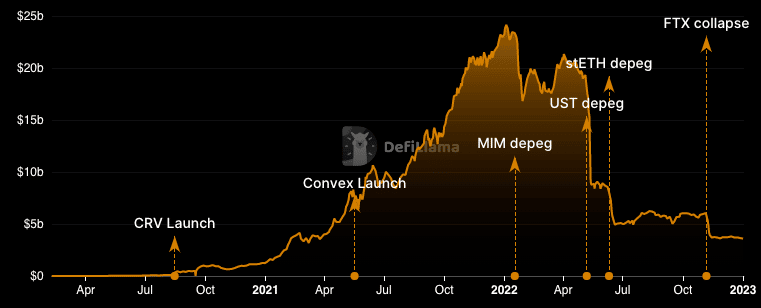

When it comes to its TVL, DeFi Llama information showed that CRV misplaced plenty of worth since its yearly peak in April 2022. At press time, the TVL was price $3.63 billion. This implied that the protocol’s well being was liable to jeopardy. Moreso, buyers’ curiosity in depositing liquid property within the Curve pool didn’t heighten.

Supply: DeFi Llama

CRV’s value efficiency in 2022 was additionally not one thing that holders desired. On the time of writing, the token’s 365-day efficiency was a 91.51% lower.

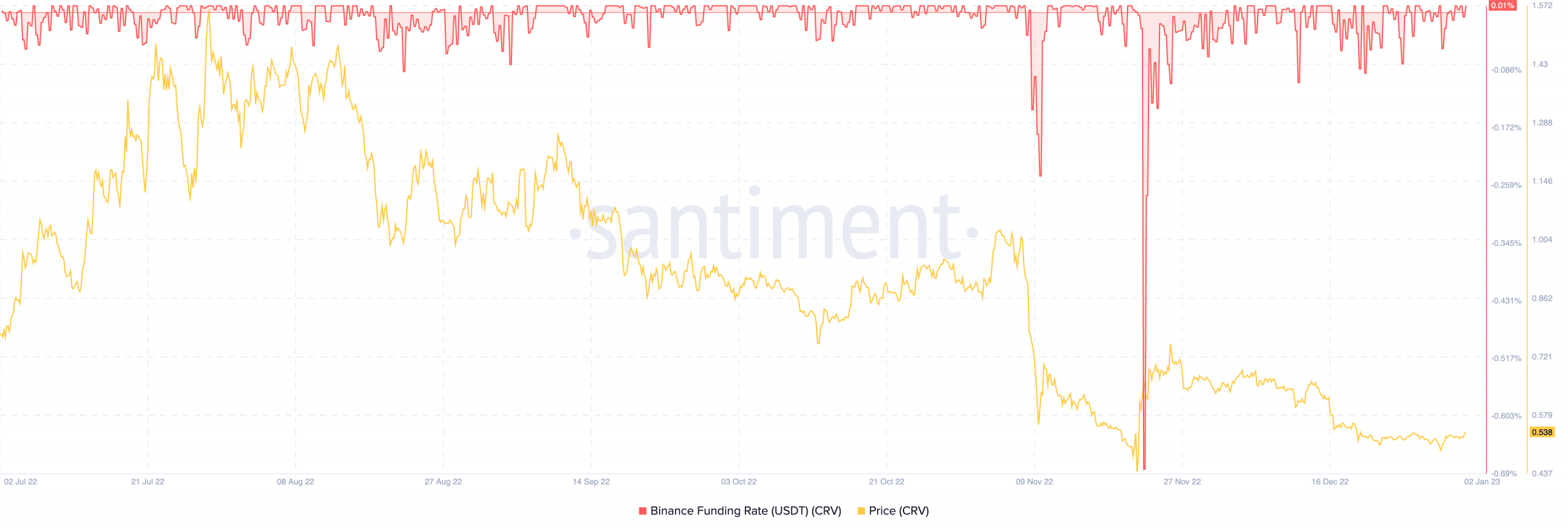

Whatever the disappointing state, merchants nonetheless seemed in CRV’s path. In keeping with Sanitment, the Binance funding fee was 0.01%. Whereas these merchants continued with periodic funds within the derivatives market, additionally they sustained the futures open curiosity.

Supply: Santiment

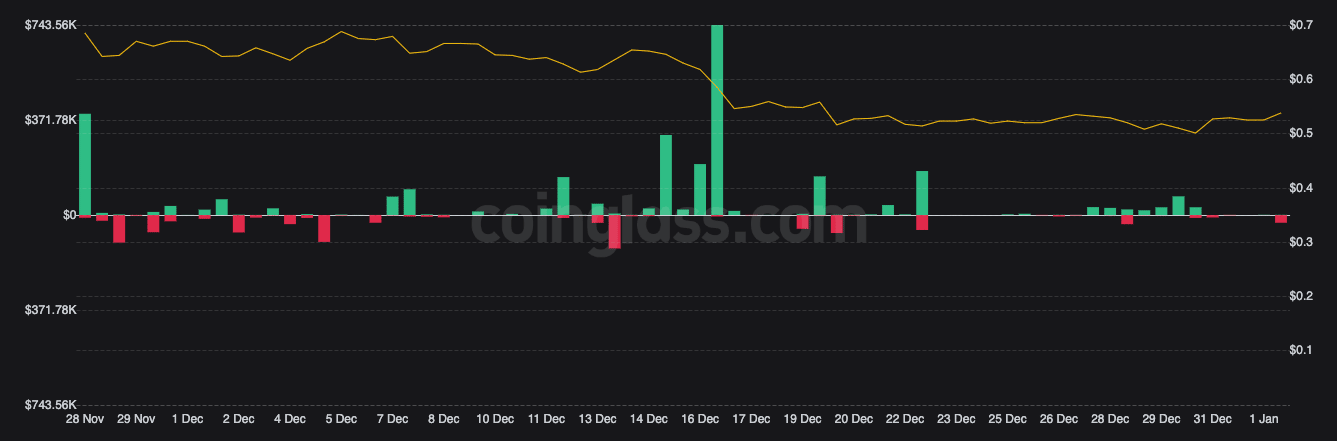

Coinglass information revealed that merchants threw in spectacular quantity in opening quick or lengthy CRV contracts throughout a number of exchanges. Regardless of that, liquidations had been minimal, all amounting to $32,680 within the final 24 hours.

With CRV trending upward from the day gone by, short-positioned merchants suffered a lot of the market wipeout.

Supply: Coinglass

Are your CRV holdings flashing inexperienced? Verify the Revenue Calculator

CRV: Right here’s what 2023 might supply

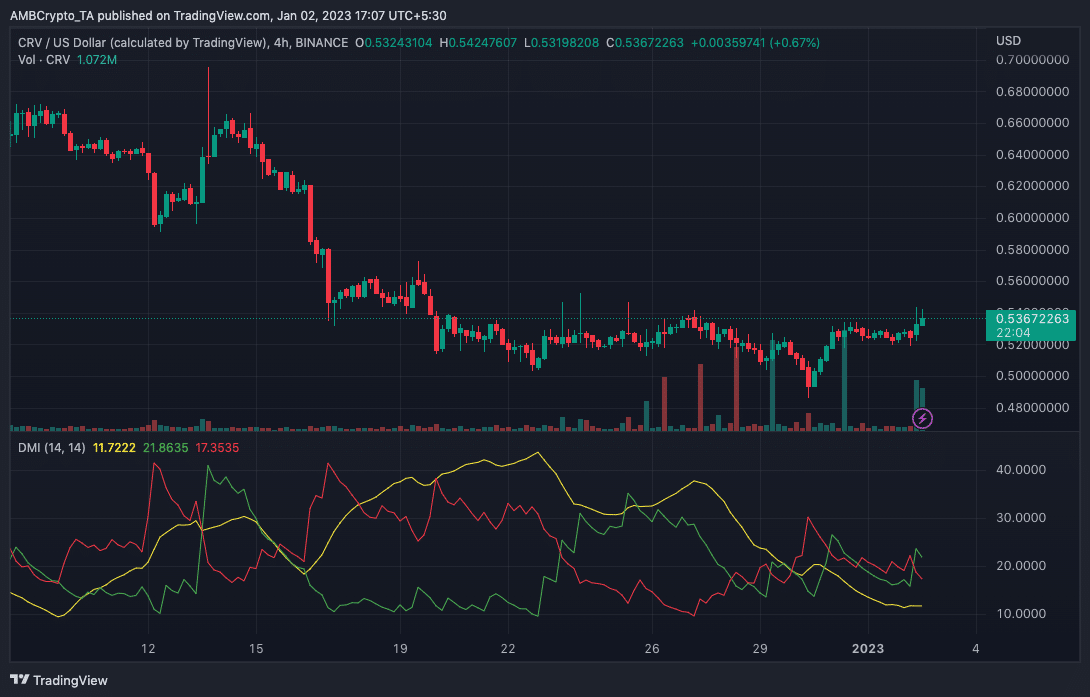

Indicators from the four-hour chart confirmed that CRV may encounter some hurdles in sustaining greens. This was as a result of the Directional Motion Index (DMI) confirmed a wrestle between the +DMI (inexperienced) and -DMI (crimson). At press time, the adverse DMI was barely above the optimistic DMI.

Nonetheless, the Common Directional Index (ADX) moved in a weak path at 11.72. So, it’s possible that the CRV value consolidates within the quick time period. Therefore CRV’s first quarter in 2023 might finish in a not-so-different situation from the way it led to 2022.

Supply: TradingView