Cosmos: Risk-averse traders have reason to overlook ATOM’s bullish crossover

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion

- Cosmos [ATOM] witnessed a bullish MACD crossover – a purchase sign

- ATOM noticed improved growth exercise and funding charges, however the sentiment continues to be unfavorable

Cosmos [ATOM] rebounded after Bitcoin [BTC] reached $16.19K on 22 November. Notably, BTC’s decline from $16.60K between 27 and 28 November led to the value correction of ATOM.

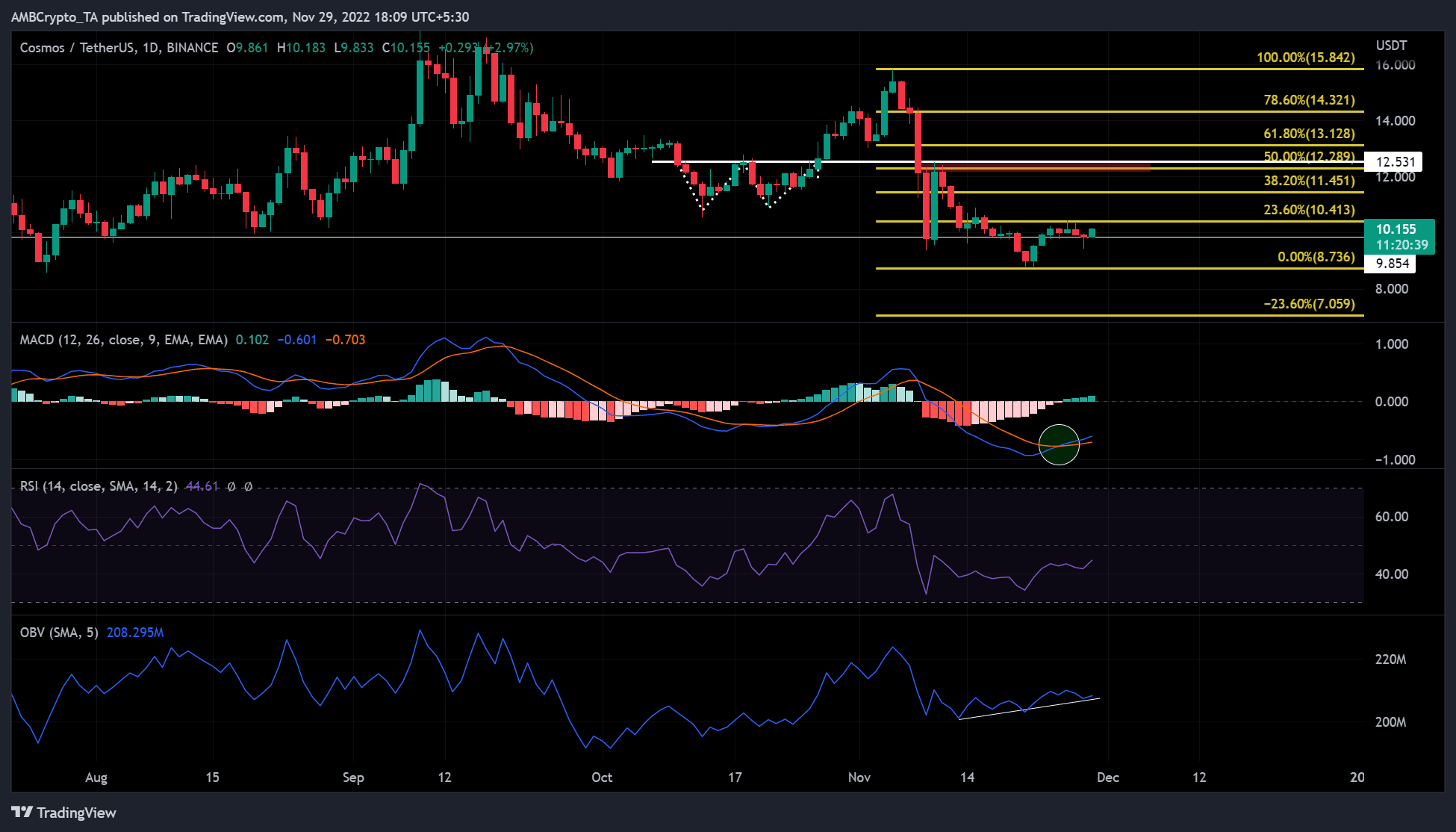

On the time of writing, ATOM was buying and selling at $10.155, up 4% within the final 24 hours. Following a confirmed bullish Shifting Common Convergence Divergence (MACD) crossover on 25 November, ATOM traders noticed a shopping for alternative forward of them.

Learn Cosmos’ [ATOM] value prediction 2023-2024

Nonetheless, ATOM’s market construction was nonetheless bearish at press time. Subsequently, risk-averse merchants could possibly be searching for shopping for alternatives after a breakout and retest of this Fib stage in a day or two.

A bullish MACD crossover: can the bulls maintain the upside momentum?

Supply: TradingView

The bullish MACD crossover could possibly be thought-about because the purchase sign that coincided with a growing uptrend. Nonetheless, the plotting of the Fibonacci retracement software between the best and lowest ATOM value factors in November led to outcomes that weren’t convincing.

ATOM didn’t break above the 23.6% Fib stage ($10.413) – a major resistance. If the bulls break the 23.6% Fib stage and retest this stage or affirm it as assist, traders can take positions for an extended commerce as assist at $9.854 may be thought-about as steady.

On this case, the goal for an extended place can be the bearish order block on the 50% Fib stage ($12.289). Key technical indicators level towards this inclination.

The Relative Energy Index (RSI) retreated from the decrease ranges bordering the oversold territory. It confirmed that the promoting strain was easing. This additionally meant that the bulls have been slowly gaining affect.

Accordingly, the On-Stability Quantity (OBV) reached some new highs since mid-November. It confirmed that buying and selling volumes have been growing, which might improve shopping for strain and assist the bulls to interrupt by means of resistance targets.

Nonetheless, an intraday shut beneath $8.736 would invalidate the above inclination. On this case, one other downtrend might discover new assist at $7.059 or beneath.

Improved growth exercise, however the sentiment stays unfavorable

Supply: Santiment

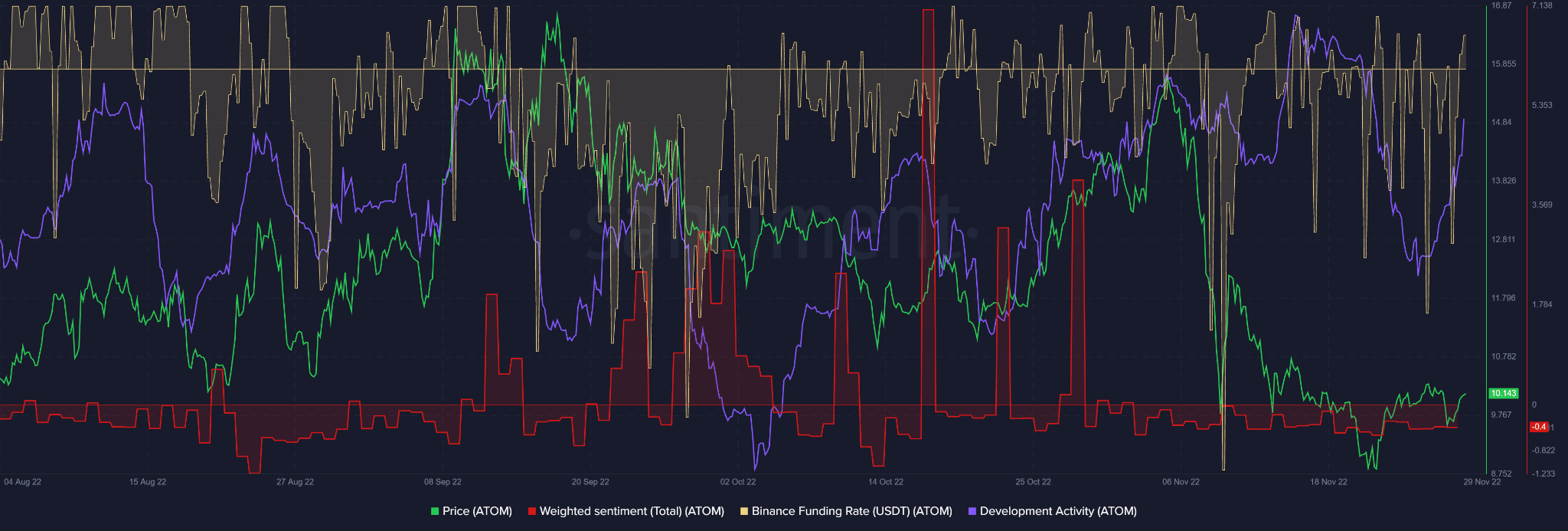

Based on Santiment’s data, ATOM noticed a gradual improve in growth exercise from October. Nonetheless, growth exercise fell in mid-November, solely to rise steadily once more thereafter.

Curiously, ATOM’s growth exercise correlated positively with its value efficiency. Subsequently, the rise in growth exercise on the time of the press launch might point out a possible improve in ATOM’s value.

Nonetheless, the weighted sentiment of ATOM remained worryingly unfavorable all through November. Because it additionally straight impacts the value of ATOM, this might complicate ATOM’s ongoing value restoration.

Subsequently, risk-averse merchants shouldn’t rush to purchase the bullish MACD crossover. Ready for a break of the 23.6% Fib resistance stage and a retest can be a certain signal to provoke a transfer. Nonetheless, ready for a retest might result in a missed alternative if the uptrend continues with out retesting the extent.

Thus, cautious merchants ought to watch for a convincing breakout above the 23.6% Fib stage. As well as, it is best to monitor BTC’s efficiency and sentiment on ATOM.